What To Look For In Crypto Charts

When looking at cryptocurrency charts, there are a few things you should keep in mind. First, look at the volume. This will give you an idea of how much activity is happening with a particular coin. Second, look at the price action. This will tell you if the market is bullish or bearish on a particular coin. Finally, look at the technical indicators. These will help you identify potential entry and exit points.

How to Read Crypto Charts

Cryptocurrency charts are important to understand in order to make informed investment decisions.

The first thing to do is to identify the coin or token you are interested in.

Once you have identified the coin or token, you will need to find the right cryptocurrency chart.

There are a number of different types of cryptocurrency charts available, so it is important to find the type that best suits your needs.

Some common types of cryptocurrency charts are:

candle charts

line charts

area charts

volume charts

trend charts

Each type of cryptocurrency chart has its own strengths and weaknesses, so it is important to select the type of chart that best suits your needs.

Once you have selected the type of cryptocurrency chart, you will need to find the right cryptocurrency trading platform.

Cryptocurrency trading platforms are important in order to trade cryptocurrencies.

Some common cryptocurrency trading platforms include:

BitMEX

Coinbase

Binance

Gemini

Kraken

What do the Different Lines Mean on a Crypto Chart?

A crypto chart is a graphical representation of the price movement of a cryptocurrency. Each line on the graph represents a buy or sell order placed by a trader. The height of the line corresponds to the price at which that order was executed.

Crypto Charting Basics: Understanding Support and Resistance

Crypto charting is the process of visualizing prices and trends over time on a digital chart. Crypto charts can be used to identify support and resistance levels, and to spot price reversals.

Crypto charts use a series of horizontal lines to display price data. The first line, known as the support level, indicates the lowest price at which a cryptocurrency has been trading in recent history. The next line, known as the resistance level, indicates the highest price at which a cryptocurrency has been trading in recent history.

When a cryptocurrency moves below the support level, it is considered to be in a downtrend. When a cryptocurrency moves above the resistance level, it is considered to be in a uptrend.

It is important to note that support and resistance levels are not set in stone. They can change over time, depending on the sentiment of the market. If a cryptocurrency moves significantly below or above the support or resistance level, it is often indicative of a fresh trend or reversal.

In order to identify price reversals, it is important to look for patterns such as the following:

A cryptocurrency will move below the support level and then rebound.

A cryptocurrency will move above the resistance level and then rebound.

A cryptocurrency will move below the support level and then stay there for an extended period of time.

A cryptocurrency will move above the resistance level and then stay there for an extended period of time.

Trading Cryptocurrencies Using Technical Analysis

Technical analysis is a trading technique that uses charts and indicators to anticipate trends in the stock or cryptocurrency markets. Technical analysis can help traders make informed decisions about when to buy or sell cryptocurrencies.

One common technical analysis tool is the Bollinger Band. The Bollinger Band represents the range of prices over a given period of time and can be used to identify potential trend changes. When prices are within the Bollinger Band, this is often seen as a bullish sign, indicating that the market is likely to continue rising. When prices break out of the Bollinger Band, this is often seen as a bearish signal, indicating that the market is likely to decline.

Other common technical analysis tools include the moving average, the Fibonacci retracement, and the volume indicator. Moving averages help identify long-term trends in the market and can be used to predict when a stock or cryptocurrency is likely to reach a certain price point. Fibonacci retracements help identify short-term trends and can be used to predict when a stock or cryptocurrency is likely to reach a certain price point. The volume indicator measures how active the market is and can be used to determine whether the market is likely to rise or fall.

5 Tips For Reading Crypto Charts Like a Pro

Cryptocurrency charts are a great way to get an overview of the market and track your investments. Here are five tips for reading crypto charts like a pro:

1. Use a Tradingview charting platform

Tradingview is one of the most popular cryptocurrency charting platforms. It provides detailed information on the price, market cap, and other metrics for each coin.

2. Use a technical analysis tool

Technical analysis is a method for analyzing the price movement of a security over time. There are many different tools available, so find one that suits your needs.

3. Look for trends

One of the most important things to do when reading cryptocurrency charts is to look for trends. Trends can indicate future price movements, so be sure to pay attention!

4. Compare prices across different exchanges

It can be helpful to compare prices across different exchanges to get an idea of where the market is headed.

5. Don't panic!

While reading cryptocurrency charts can be exciting, it's important not to panic if the prices go down. Instead, simply wait for the prices to stabilize before making any more investments.

How to Use Technical Analysis to Trade Cryptocurrency

Technical analysis is a technique used to help traders make informed investment decisions. Technical analysis looks at chart patterns, indicators, and other factors to try and predict future price movements.

When trading cryptocurrencies, technical analysis can be used to help identify trends and forecast future prices. By understanding the technical indicators and chart patterns, traders can make more informed decisions about when to buy or sell.

Some common technical analysis tools used to trade cryptocurrencies include:

1. Chart Patterns

Chart patterns are a form of technical analysis that can help identify trends in the market. When looking for chart patterns, traders should consider things such as price action, volume, and Bollinger Bands.

2. Indicators

Indicators are technical measures that can help traders predict future price movements. Common indicators used to trade cryptocurrencies include the moving averages and Bollinger Bands.

3. Technical Analysis Tools

There are a variety of technical analysis tools available online, including TradingView and Coinigy. These tools allow traders to track various indicators and chart patterns, and make trading decisions based on the information.

3 Essential Tips for Understanding Cryptocurrency Charts

1. Always consult a qualified financial advisor before investing in cryptocurrency.

2. Verify the authenticity of any cryptocurrency chart before making any investment decisions.

3. Remember that cryptocurrency is still a very new and volatile market, so always do your own research before investing.

4. Always be aware of the risks associated with cryptocurrency trading, and only invest what you are willing to lose.

A Beginner's Guide to Reading Cryptocurrency Charts

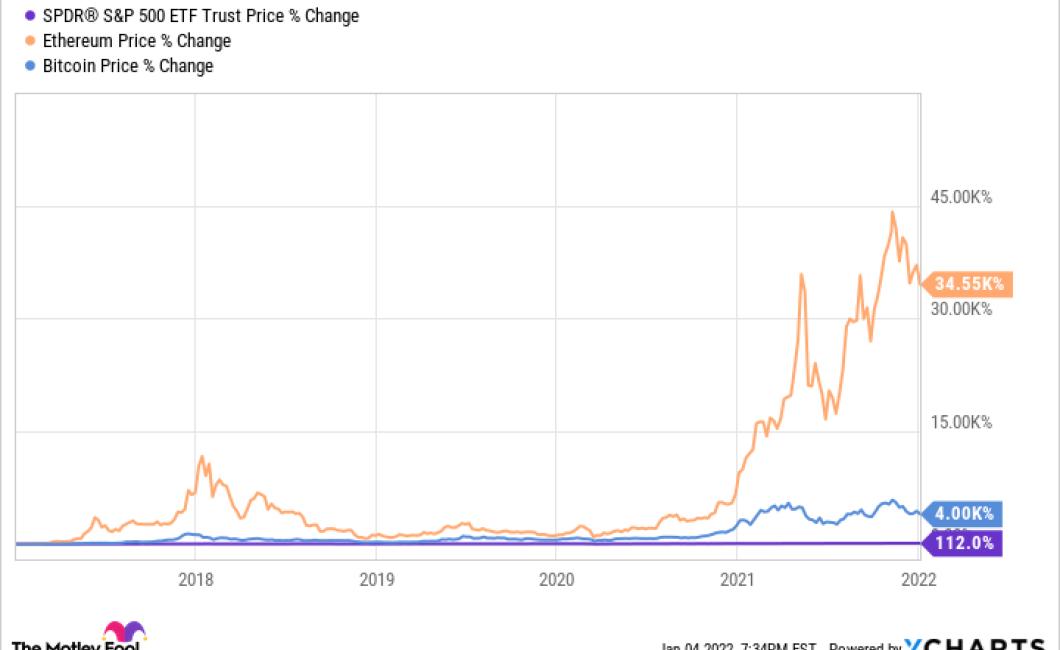

Cryptocurrency charts are a great way to get a quick overview of the current price of a coin or token. They can be used to identify trends, monitor price movement, and make informed investment decisions.

To start using cryptocurrency charts, first find a reputable cryptocurrency tracker website. There are many to choose from, but some of the most popular include CoinMarketCap and CoinDesk. Once you've found a tracker, open it up and search for the cryptocurrency you want to study.

Next, locate the relevant cryptocurrency chart. For example, if you're looking at the price of Bitcoin, you would click on the "Bitcoin Price" chart on CoinMarketCap or CoinDesk.

Once you've located the chart, you'll need to understand a few key concepts before you can use it effectively. First, understand what each column on the chart represents. Each column shows different information about the price of the coin or token over a specific time period.

Second, understand how to read the chart. The most important thing to remember is that the chart is constantly changing, so pay close attention to the data in each column.

Finally, use the chart to make informed investment decisions. For example, if you're interested in buying a particular cryptocurrency, you can use the chart to see how its price has been changing over time. This will help you decide whether or not it's a good investment.