Crypto Charts With Dmi

The DMI (Directional Movement Index) is a technical indicator that measures the strength of a price trend. It can be used to identify whether a market is in an upward or downward trend, and whether the trend is strong or weak. The DMI is calculated using the highest high and lowest low prices from a given period, and the resulting value is compared to a moving average. A reading above 50 indicates an upward trend, while a reading below 50 indicates a downward trend.

How to Read a Crypto Chart with the DMI Indicator

The DMI indicator is used to identify oversold and overbought positions in a crypto chart. The DMI indicator is composed of three lines: the red line, the green line, and the blue line.

The red line is the oversold line, and it shows when a crypto chart is trading below the lower Bollinger Band. The green line is the overbought line, and it shows when a crypto chart is trading above the upper Bollinger Band. The blue line is the neutral line, and it shows when the price is trading between the lower Bollinger Band and the upper Bollinger Band.

To use the DMI indicator, you first need to figure out where the lower Bollinger Band is located. To do this, you need to find the lower Bollinger Band indicator on your crypto chart. The lower Bollinger Band indicator will be located on the bottom of your crypto chart, next to the price bars.

Next, you need to find the upper Bollinger Band indicator. The upper Bollinger Band indicator will be located on the top of your crypto chart, next to the price bars.

Finally, you need to determine where the DMI indicator is located. The DMI indicator is located in the middle of the red line, the green line, and the blue line.

The Best Crypto Charts with the DMI Indicator

The DMI indicator is a technical analysis tool that is used to identify oversold and overbought conditions in a market. The indicator is based on the relative price movement of the five major crypto currencies: Bitcoin, Ethereum, Bitcoin Cash, Litecoin, and Ripple.

The DMI indicator has two main components: the DMI Trendline and the DMI Volume Index.

The DMI Trendline is a line that shows the trend in the prices of the five major crypto currencies over time. The slope of the trendline indicates whether the market is trending higher or lower.

The DMI Volume Index is a technical indicator that measures the daily volume of the five major crypto currencies. A rising volume index indicates that the market is trending higher, while a falling volume index indicates that the market is trending lower.

How to Use the DMI Indicator on Crypto Charts

The DMI indicator is used on cryptocurrency charts to help identify overbought and oversold levels. The indicator is a line that is drawn across the price chart and indicates whether the price is trading above or below the average price over the past 30 days.

To use the DMI indicator on a cryptocurrency chart, first find the 30-day moving average on the chart. To do this, look for the line that crosses the price data at regular intervals and indicates where the price has been over the past month. Once you have found the moving average, draw a line through it to create the DMI indicator.

The DMI indicator will tell you whether the price is overbought or oversold. If the DMI indicator is above the line, then the price is overbought and likely to fall soon; conversely, if the DMI indicator is below the line, then the price is oversold and likely to rise soon.

The Most Useful Indicator for Crypto Charts - The DMI

Cryptocurrency charts can be divided into technical and fundamental analysis. Technical analysis looks at the price movement of a cryptocurrency, while fundamental analysis looks at the underlying technology and its potential.

The most useful indicator for crypto charts is the DMI. The DMI is a technical analysis indicator that measures the trend of a cryptocurrency’s price over a given period of time. It uses a variety of indicators to measure the trend, including the MACD, the RSI, and the SMA.

A Beginner's Guide to Reading Crypto Charts with the DMI Indicator

Cryptocurrencies are a digital asset class that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services.

Cryptocurrencies are volatile, which means their prices can change rapidly. To make sure you are making informed decisions when trading cryptocurrencies, it is important to understand how they are analyzed and traded.

To read cryptocurrency charts with the DMI indicator, follow these steps:

1. Open a chart of a cryptocurrency you are interested in.

2. Click on the "DMI" indicator in the upper left corner of the chart.

3. The DMI indicator will display the current price of the cryptocurrency as well as the Bollinger Bands (BB). The BB show the range of prices that the cryptocurrency has been trading within over the past three days.

4. Use the "High" and "Low" buttons to toggle between the current price and the lowest and highest prices within the past three days.

5. The "MA" button will display the Moving Average (MA) for the cryptocurrency. The MA shows the average price over the past number of days.

How to Analyze Crypto Charts with the Directional Movement Index

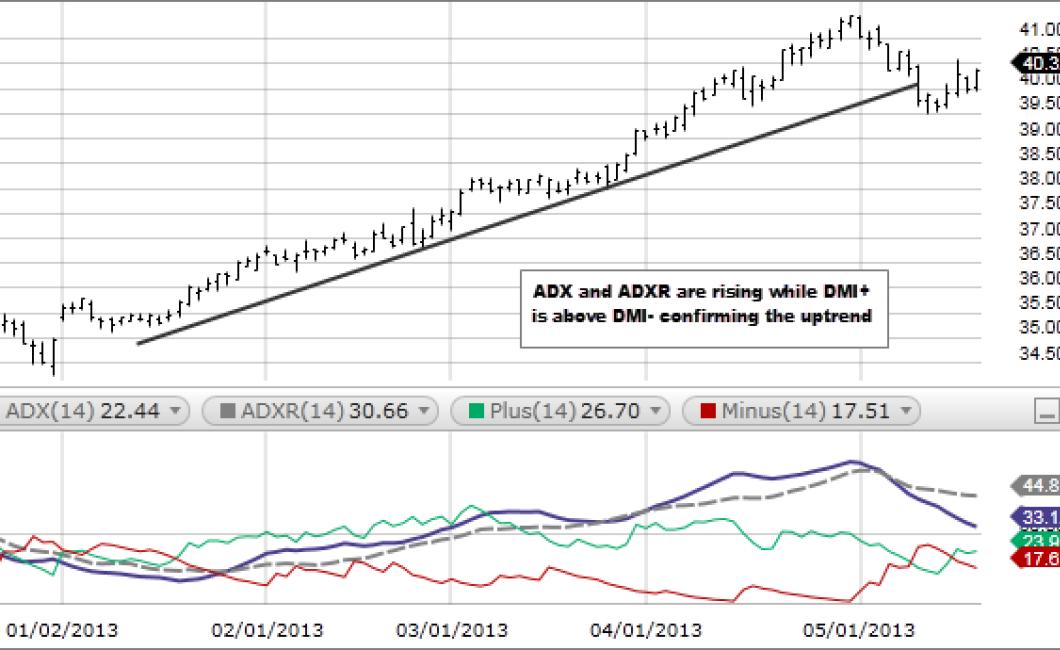

The directional movement index (DMI) is a technical indicator developed in the early 1980s that can be used to measure the trend of a cryptocurrency's price over time. The DMI is a simple calculation that uses the average change in price over a given period of time to determine whether the price is moving up or down.

To calculate the DMI, you first need to find the average price over the given period of time. To do this, you can use a tools like CoinMarketCap or Livecoin. Once you have the average price, you can use this value to calculate the change in price over the given period of time. To calculate the change in price, you can use a tool like CoinMarketCap or Livecoin.

Once you have the change in price, you can use this value to calculate the DMI. To do this, you divide the change in price by the average price over the given period of time. This calculation will give you a value between 0 and 1. A value of 1 indicates that the price is moving up, and a value of 0 indicates that the price is moving down.

The DMI can be used to assess the trend of a cryptocurrency's price over time. If the DMI is positive (meaning that the price is moving up), this suggests that the market is bullish and that the cryptocurrency may have potential for future growth. If the DMI is negative (meaning that the price is moving down), this suggests that the market is bearish and that the cryptocurrency may have potential for future decline.