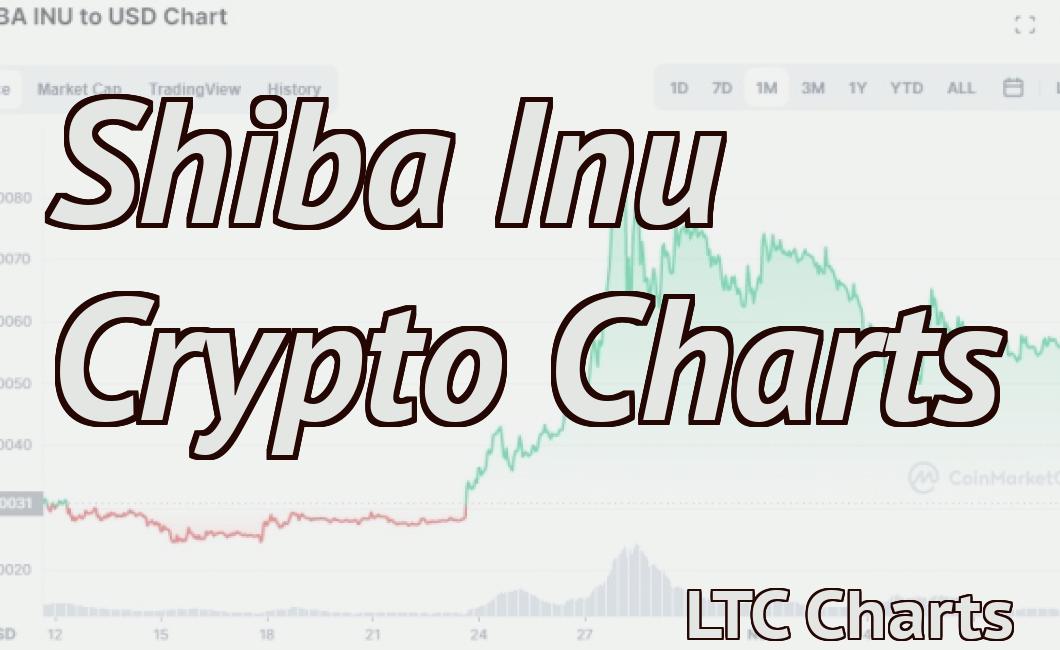

Free Crypto Charts With Indicators

If you're looking for a comprehensive and free crypto charting tool, look no further than CryptoCharts. With CryptoCharts, you can view charts for all major cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and more. Plus, you can view indicators for each currency to help you make informed investment decisions.

Best Crypto Charts with Indicators

Cryptocurrencies are notoriously volatile, with prices swinging on a daily basis. This makes it difficult to identify trends and make informed investment decisions.

That’s where cryptocurrency indicators come in! These tools can help you track the performance of specific cryptocurrencies, and help you make more informed investment decisions.

Here are four of the most popular cryptocurrency indicators:

1. Price Index

The price index measures the average price of a cryptocurrency over a certain period of time. This allows you to see how the value of a particular cryptocurrency is changing over time.

2. Volume Index

The volume index measures the total number of transactions executed on a given cryptocurrency over a certain period of time. This allows you to see how active the market is.

3. Circulating Supply

The circulating supply measures the number of coins that are currently in circulation. This helps you to determine how valuable a cryptocurrency is.

4. Altcoin Index

The altcoin index measures the performance of all cryptocurrencies other than Bitcoin. This allows you to see how the market is performing overall.

The Top 5 Sites for tracking Crypto Prices

1. CoinMarketCap

2. CoinGecko

3. CoinMarketCap (again)

4. Coincheck

5. TradingView

How to read & interpret crypto charts

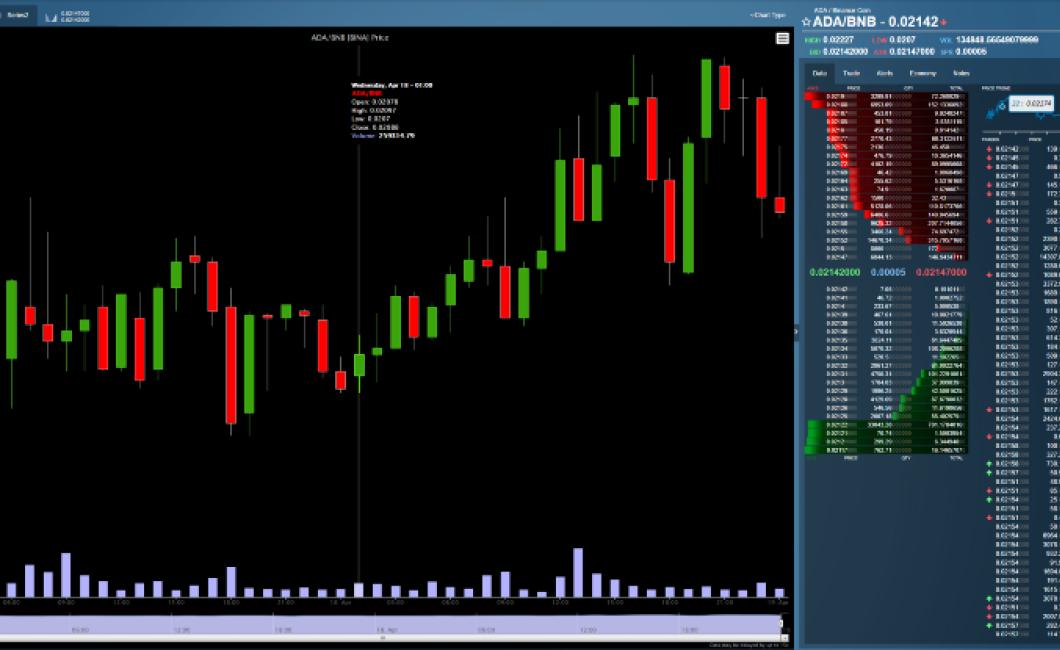

Cryptocurrency charts are used to track the performance of a digital asset over time. The data displayed on a crypto chart is expressed in terms of candles, which indicate the closing prices of individual transactions.

When analyzing crypto charts, it is important to understand how traders use them. Traders will look at a chart to determine if the price of a digital asset is trending up or down. They will also use charts to spot possible buying and selling opportunities.

The following guide will teach you how to read and interpret crypto charts.

How to read a crypto chart

To begin, locate the cryptocurrency you want to analyze on the chart. You can find cryptocurrencies by searching for their name or by scanning the list of assets displayed on CoinMarketCap.

Once you have located the cryptocurrency on the chart, you will need to understand the different types of charts available.

candlestick chart

A candlestick chart is the most basic type of chart available and it displays the latest prices for a cryptocurrency over a given period of time. Candles are represented by small circles and each circle shows the closing price of an individual transaction.

The color of a candle indicates the direction in which the price of the cryptocurrency is trending. For example, a green candle indicates that the price is rising and a red candle indicates that the price is falling.

When analyzing a candlestick chart, it is important to note the following points:

The width of the candles indicates how many days have passed since the last transaction was made.

The height of the candles indicates how much money was traded during that period of time.

The open, high, and low prices of a candle indicate the price at which the transaction was made and at which it was closed, respectively.

bar chart

A bar chart is similar to a candlestick chart, but it displays the latest prices for a cryptocurrency over a given period of time. Bars are represented by short horizontal lines and each line shows the closing price of an individual transaction.

The color of a bar indicates the direction in which the price of the cryptocurrency is trending. For example, a green bar indicates that the price is rising and a red bar indicates that the price is falling.

When analyzing a bar chart, it is important to note the following points:

The width of a bar indicates how many transactions have been made during that period of time.

The height of a bar indicates how much money has been traded during that period of time.

The open, high, and low prices of a bar indicate the price at which the transaction was made and at which it was closed, respectively.

line chart

A line chart is similar to a bar chart, but it displays the latest prices for a cryptocurrency over a given period of time. Lines are represented by long horizontal lines and each line shows the closing price of an individual transaction.

The color of a line indicates the direction in which the price of the cryptocurrency is trending. For example, a green line indicates that the price is rising and a red line indicates that the price is falling.

When analyzing a line chart, it is important to note the following points:

The width of a line indicates how many transactions have been made during that period of time.

The height of a line indicates how much money has been traded during that period of time.

The open, high, and low prices of a line indicate the price at which the transaction was made and at which it was closed, respectively.

3 must-have crypto indicators for technical analysis

1. Price trend – This is one of the most important indicators for technical analysis, as it tells you how the price of a cryptocurrency is moving over time. Look for a consistent upward or downward trend in prices, and try to identify any possible signals that may indicate a potential trend reversal.

2. Volume – Another important indicator for technical analysis is volume. Look for large daily or weekly volumes in order to identify potential trends and reversals. Additionally, monitor volume levels around key support and resistance levels, as these can provide clues about future price movements.

3. Technical indicators – Several technical indicators can help you analyze cryptocurrency prices and trends. Some of the most popular indicators include the Relative Strength Index (RSI), the Ichimoku Cloud, and the Commodity Channel Index (CCI). Use these indicators to help identify potential support and resistance levels, and to track overall market sentiment.

5 popular indicators every crypto trader should know

1. Supply and Demand

This is one of the most fundamental concepts in trading. When there is a high demand for a cryptocurrency, the price will be higher. Conversely, when there is a low demand for a cryptocurrency, the price will be lower.

2. Volatility

Volatility is the measure of how much a cryptocurrency’s price changes over a given period of time. Cryptocurrencies with high volatility tend to be more volatile than those with low volatility.

3. News and Events

Cryptocurrencies are highly sensitive to news and events. If there is news that affects the value of a cryptocurrency, the price will move up or down accordingly.

4. Technical Analysis

Technical analysis is the use of charts and indicators to predict the future direction of a cryptocurrency’s price. Technical analysts often use charts to identify patterns in the price movement and use that information to make trading decisions.

5. The Crypto Market

The cryptocurrency market is a worldwide collection of different cryptocurrencies. It is constantly changing, and new cryptocurrencies are being created all the time.

The difference between lagging & leading indicators

Leading indicators are those that suggest future performance, whereas lagging indicators are those that reflect past performance. For example, a company's stock price might be considered a leading indicator of future performance, as it reflects changes in investor sentiment. Conversely, a company's sales figures might be considered a lagging indicator, as they do not necessarily reflect future demand.

MACD, RSI, Stochastic: which is the best indicator for trading crypto?

There is no definitive answer to this question as different traders may prefer different indicators for trading cryptocurrency. Some traders may prefer the Moving Average Convergence Divergence (MACD) indicator while others may prefer the Relative Strength Index (RSI) indicator. Other traders may prefer a combination of the three indicators.

How to use Bollinger Bands to trade cryptocurrency

Bollinger Bands are a technical analysis tool that can be used to trade cryptocurrency. To use Bollinger Bands, you first need to create an account on an exchange that offers Bollinger Bands trading. Once you have an account, you can deposit your desired cryptocurrency into your account and start trading.

To use Bollinger Bands, you first need to find the appropriate Bollinger Bandwidth (BB). This BB is the width of the Bollinger band, which represents the range of prices over which the price will fluctuate. For example, if the Bollinger Bandwidth is 0.5, then the price will fluctuate between 0.5 and 1.0.

Once you have found the appropriate BB, you can start trading by placing buy and sell orders at the appropriate BBs. The goal is to buy cryptocurrency when the price is below the lower BB and sell when the price is above the upper BB.

Using Fibonacci retracements in crypto trading

There is a well-known Fibonacci retracement tool in technical analysis that traders and investors can use to analyze price movements.

When using Fibonacci retracements, traders look for patterns that correspond with Fibonacci ratios. For example, if a cryptocurrency is trading at $50.00 and has a Fibonacci retracement of 50% from the previous high to the current low, a trader might look for opportunities to buy or sell the cryptocurrency at $43.50 or $48.75.

This type of analysis can help traders identify potential support and resistance levels, and can help them make informed decisions about when to buy or sell cryptocurrencies.

Ichimoku Cloud indicator: what is it and how to use it in crypto trading

The Ichimoku Cloud is a technical indicator used in stock and cryptocurrency trading. It was developed by Japanese charting specialist, Ichimoku Kinko Hyo.

The Ichimoku Cloud is a graphical representation of the current price trend. The five colors that make up the cloud indicate the trend direction:

Green: The trend is up

Red: The trend is down

Blue: The trend is stable

Brown: The trend is moving sideways

The Cloud is updated every 5 minutes.

Trading cryptocurrencies with Pivot Points

When you trade cryptocurrencies, it is important to keep in mind the Pivot Points. Pivot Points are technical indicators that can help you predict the direction of a cryptocurrency’s price.

Pivot Points are based on a simple principle: If the price of a security moves from one price point to another, there is usually a reason for the movement. The reason for the movement can be determined by looking at the charts and studying the patterns that have developed over time.

The following are four Pivot Points that are most relevant to trading cryptocurrencies:

1. $6,000 – This is the point where the majority of Bitcoin price movement takes place. When the price is below $6,000, there is a tendency for it to rise, and when the price is above $6,000, there is a tendency for it to fall.

2. $7,500 – This is the point where Ethereum prices tend to move. When the price is below $7,500, there is a tendency for it to rise, and when the price is above $7,500, there is a tendency for it to fall.

3. $8,000 – This is the point where Litecoin prices tend to move. When the price is below $8,000, there is a tendency for it to rise, and when the price is above $8,000, there is a tendency for it to fall.

4. $9,000 – This is the point where Bitcoin Cash prices tend to move. When the price is below $9,000, there is a tendency for it to rise, and when the price is above $9,000, there is a tendency for it to fall.

Head and shoulders pattern in cryptocurrency trading

A head and shoulders pattern is a technical analysis pattern that can be found in the price charts of many different assets. The pattern looks like a U-shaped formation, with the bottom of the pattern around the price point where the head of the pattern is located, and the top of the pattern around the price point where the shoulders of the pattern are located.

The head and shoulders pattern is most commonly found in the prices of stocks, but it can also be found in the prices of commodities, currencies, and even digital assets.

The idea behind the head and shoulders pattern is that it is a sign that the price of an asset is about to go up or down. If you see a head and shoulders pattern in the price charts of an asset, it is usually a good time to buy or sell the asset accordingly.