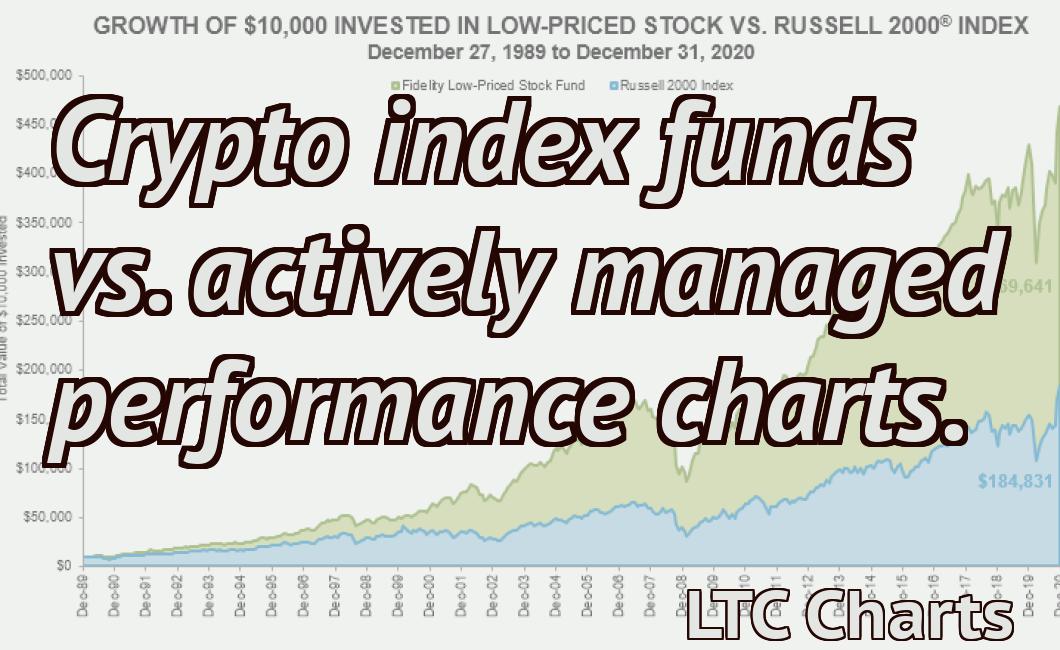

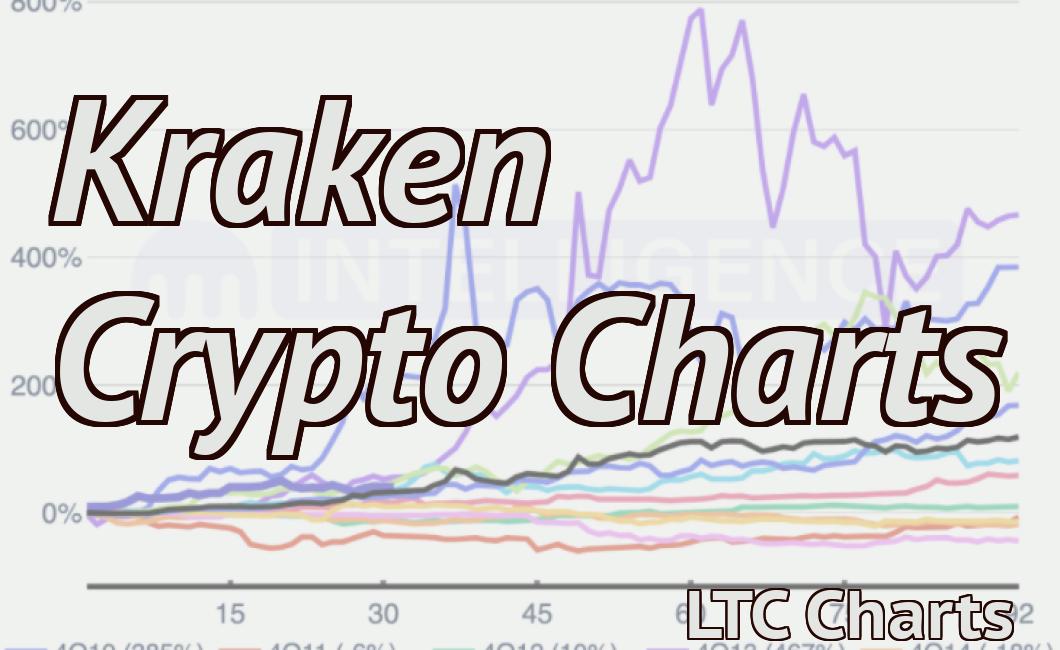

Why do all the crypto charts look the same?

The article discusses how many crypto charts tend to look very similar, with a few key exceptions. This is likely due to the fact that most cryptocurrencies are based on the same underlying technology, which leads to similar patterns in their price movements. However, there are a few key factors that can lead to significant differences in the way that different cryptocurrencies behave.

Why do all the crypto charts look the same?

There are a few reasons why crypto charts look the same. The most common reason is because exchanges use the same algorithms to display prices. This means that all charting platforms will show the same prices for a given cryptocurrency.

The Importance of Diversification in Crypto portfolios

A cryptocurrency portfolio should be diversified in order to reduce risk. In order to diversify, you should invest in a variety of cryptocurrencies and tokens. A well-diversified cryptocurrency portfolio will have a mix of different coins and tokens, with a majority of the holdings in lower-risk assets.

A cryptocurrency portfolio should also be diversified geographically. This means holding a variety of cryptocurrencies and tokens from different countries. The reason for this is that different countries have different regulations and tax treatments for cryptocurrencies. By investing in a variety of cryptocurrencies and tokens from different countries, you reduce your overall risk and exposure to any one country or region.

Diversification also reduces the risk of losing money if one cryptocurrency or token falls in value. For example, if you invested all of your money in Bitcoin, then if Bitcoin falls in value, you would lose all of your money. Diversifying your investments reduces this risk.

The Benefits of a Diversified Crypto Portfolio

There are many benefits to investing in a diversified crypto portfolio.

1. Increased Returns

If you invest in a single cryptocurrency, your returns are going to be lower than if you invest in a portfolio of different cryptocurrencies. A diversified crypto portfolio will give you the potential for higher returns, as the prices of the different cryptocurrencies will move independently of one another.

2. Reduced Risk

If you invest in a single cryptocurrency, your risk is high. If the price of that cryptocurrency falls, your investment is worth less. A diversified crypto portfolio reduces your risk by giving you exposure to a number of different cryptocurrencies. If one of those cryptocurrencies falls in value, it won’t have a big impact on the value of your other cryptocurrencies.

3. Greater Flexibility

If you want to trade one cryptocurrency for another, a diversified portfolio gives you more flexibility. If you invest in a single cryptocurrency, you may not be able to trade it for another cryptocurrency for some time. With a diversified portfolio, you can trade different cryptocurrencies easily.

4. Increased Liquidity

A diversified crypto portfolio has more liquidity than a single-cryptocurrency portfolio. This means that you can easily sell your cryptocurrencies and get your money back. Single-cryptocurrency portfolios may not have as much liquidity, so it may be difficult to sell them.

The Risks of Not Diversifying Your Crypto Portfolio

The biggest risk of not diversifying your crypto portfolio is that you could lose all of your money. If the value of your holdings falls below your original investment, you will lose money. Additionally, if the value of your holdings falls below the price of your initial investment, you will also lose money. Finally, if the value of your holdings falls below the price at which you can sell them, you will also lose money.

The perils of putting all your eggs in one basket

There are a few reasons why it's important to diversify your investments. For one, if a company you invest in goes bankrupt, you won't lose all your money. Additionally, if you have a lot of money invested in one company, it's more likely that that company will experience a dip in stock prices, which could lead to a loss. Finally, if the stock prices of all the companies you invest in go down, it's more difficult to make money since your portfolio's overall value will be lower.

Why you shouldn't put all your faith in one crypto

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

However, cryptocurrencies are not immune to security risks. They can be stolen, lost, or hacked. Additionally, crypto markets are volatile and can be subject to wide swings in price. If you invest money you cannot afford to lose, you should do your own research and consult with a financial advisor before making any decisions.

How to protect yourself from crypto volatility

There is no one-size-fits-all answer to this question, as the best way to protect yourself from crypto volatility will vary depending on your individual circumstances. However, some tips to keep in mind include:

1. Stay informed about current market conditions.

2. Consider investing in a cryptocurrency that is well-tracked and has a stable coin.

3. Do not invest money that you cannot afford to lose.

The importance of having a well-rounded crypto portfolio

A well-rounded crypto portfolio is essential to mitigating risk and maximizing returns. A well-rounded portfolio includes a variety of cryptocurrencies, tokens, and assets, so that you can find the best investments for your needs.

A well-rounded crypto portfolio will help you:

Mitigate risk. A well-rounded crypto portfolio will include a variety of cryptocurrencies, tokens, and assets, so that you can reduce the chances of losing money in case of a downturn in the market.

Maximize returns. A well-rounded crypto portfolio will include a variety of cryptocurrencies, tokens, and assets, so that you can earn the highest possible returns.

Stay up-to-date. A well-rounded crypto portfolio will include a variety of cryptocurrencies, tokens, and assets, so that you can stay informed of the latest trends and developments in the space.

Some tips for building a well-rounded crypto portfolio

To build a well-rounded crypto portfolio, start by doing your research. research the different types of cryptocurrencies, tokens, and assets available and find ones that fit your investment goals and risk tolerance.

Then, invest in a mix of cryptocurrencies, tokens, and assets that gives you exposure to a range of different markets and technologies. For example, invest in cryptocurrencies, tokens, and assets related to finance, technology, and other sectors.

Finally, stay up-to-date with the latest trends and developments in the space by regularly reading cryptocurrency news and investing resources.

Why you shouldn't put all your money in one crypto

There is no guarantee that any one cryptocurrency will outperform all the others over the long term. Putting all your money into one coin could be risky.