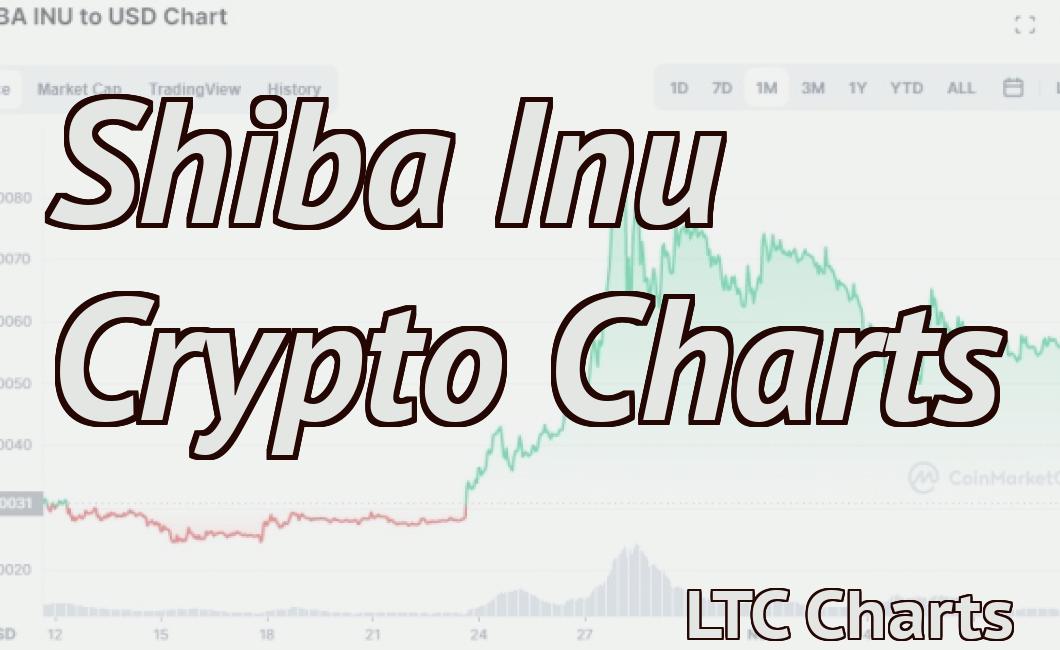

Heikin Ashi Crypto Charts

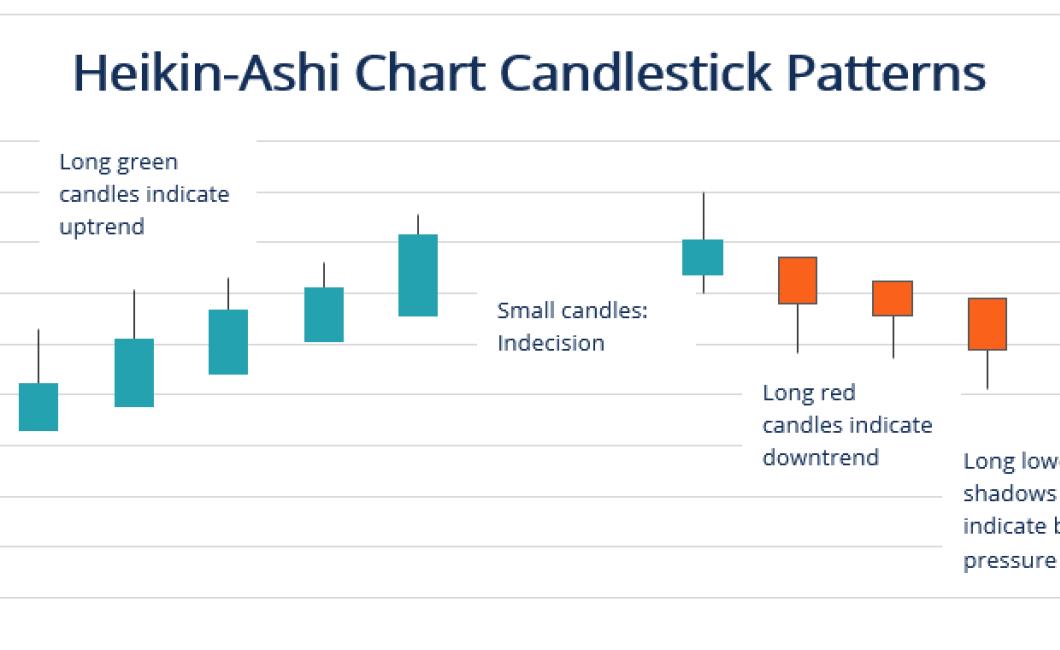

Heikin Ashi charts are a type of Japanese candlestick chart that are used by traders to identify potential trends in the market. These charts are different from traditional candlestick charts because they use a weighted average of the open, close, high, and low prices to create each candlestick. This makes Heikin Ashi charts more responsive to changes in the market and can help traders to spot potential trends earlier than they would with other types of charts.

Heikin Ashi Crypto Charts: The Basics

Heikin Ashi Crypto Charts are a great way to track the performance of a cryptocurrency over time. They provide real-time data on prices, volumes, and other important metrics.

Heikin Ashi Crypto Charts were created by Heiken Ashi Co., Ltd., a Japanese financial information company. They are widely used by cryptocurrency traders and investors.

Heikin Ashi Crypto Charts: How to Use Them

Heikin Ashi Crypto Charts are a great way to track the prices of cryptocurrencies.

To use them, first open a new tab in your browser and go to CoinMarketCap.com.

Scroll down to the "Cryptocurrencies" section and click on the "Heikin Ashi Crypto Chart" link.

This will open the Heikin Ashi Crypto Chart in your browser.

You will see different cryptocurrencies represented by different colors.

The blue line represents the price of Bitcoin, the green line represents the price of Ethereum, and the yellow line represents the price of Litecoin.

To change the color of a cryptocurrency, just click on the color of the line that represents that cryptocurrency.

You can also hover your cursor over a cryptocurrency's color to see more information about that cryptocurrency, such as its market cap and 24-hour trading volume.

If you want to zoom in or out on the Heikin Ashi Crypto Chart, just click and drag your cursor around the screen.

You can also use the buttons at the top of the chart to switch between different time frames (day, week, month, and year).

Heikin Ashi Crypto Charts: Tips and Tricks

Heikin Ashi Crypto Charts are an indispensable tool for anyone trading cryptocurrencies. Here we offer some tips and tricks to help you get the most out of Heikin Ashi Crypto Charts.

1. Use Heikin Ashi Crypto Charts to Stay Ahead of the Curve

Heikin Ashi Crypto Charts are an essential tool for anyone trading cryptocurrencies. By using Heikin Ashi Crypto Charts, you can stay ahead of the curve and make informed decisions about your investments.

2. Use Heikin Ashi Crypto Charts to Analyze the Market

Heikin Ashi Crypto Charts can be used to analyze the market and make informed investment decisions. By using Heikin Ashi Crypto Charts, you can quickly and easily see how the market is performing.

3. Use Heikin Ashi Crypto Charts to Stay Focused on Your Investment Strategy

Heikin Ashi Crypto Charts can help you stay focused on your investment strategy. By using Heikin Ashi Crypto Charts, you can quickly and easily see how the market is performing. This will help you stay focused on your goals and objectives.

4. Use Heikin Ashi Crypto Charts to Stayabreast of Regulatory Developments

Heikin Ashi Crypto Charts are an essential tool for anyone trading cryptocurrencies. By using Heikin Ashi Crypto Charts, you can stay abreast of regulatory developments and make informed decisions about your investments.

Heikin Ashi Crypto Charts: The Pros and Cons

The Heikin Ashi Crypto charts are a great way to get an overview of the current state of the crypto market.

Pros

The Heikin Ashi Crypto charts are very user-friendly and easy to use.

They provide a detailed overview of the current state of the crypto market.

They are updated regularly, so you can always be up-to-date with the latest trends.

Cons

The Heikin Ashi Crypto charts may not be so useful if you are not familiar with the basics of cryptocurrency trading.

They may not be as accurate as some other more specialized crypto charts.

Heikin Ashi Crypto Charts: What to Look For

Heikin Ashi Crypto Charts are a great way to track the performance of different cryptocurrencies.

The Heikin Ashi Crypto Charts provide a graphical representation of crypto prices over time.

The first thing to look for on the Heikin Ashi Crypto Charts is the price of the cryptocurrency.

Next, you'll want to look at the volume of the cryptocurrency. This will give you an idea of how popular the cryptocurrency is.

Another thing to look for on the Heikin Ashi Crypto Charts is the volatility of the cryptocurrency. This will give you an idea of how risky it is to invest in the cryptocurrency.

Heikin Ashi Crypto Charts: How to Interpret Them

Heikin Ashi Crypto Charts are used to analyze the performance of a cryptocurrency over a given period of time.

The Heikin Ashi Crypto Charts are composed of two lines, one indicating the price of a cryptocurrency over a given period of time, and the other indicating the average volume of that cryptocurrency over that period of time.

The Heikin Ashi Crypto Chart is used to identify trends in the performance of a cryptocurrency.

The Heikin Ashi Crypto Chart is composed of two lines, one indicating the price of a cryptocurrency over a given period of time, and the other indicating the average volume of that cryptocurrency over that period of time.

The Heikin Ashi Crypto Chart can be used to identify trends in the performance of a cryptocurrency.

If the price of a cryptocurrency rises above the first line, this indicates that the demand for that cryptocurrency is increasing. Conversely, if the price falls below the first line, this indicates that the demand for that cryptocurrency is decreasing.

Similarly, if the volume of a cryptocurrency rises above the second line, this indicates that more people are trading that cryptocurrency than usual. Conversely, if the volume of a cryptocurrency falls below the second line, this indicates that fewer people are trading that cryptocurrency than usual.

Heikin Ashi Crypto Charts: Making the Most of Them

Heikin Ashi Crypto Charts are an important resource for traders and investors. They provide real-time information on the price of cryptocurrencies, as well as important technical indicators.

Understanding the Heikin Ashi Crypto Chart

The Heikin Ashi Crypto Chart is a graphical representation of the price of cryptocurrency. It shows the value of a cryptocurrency over time, and includes detailed information on the current price and volume.

The Heikin Ashi Crypto Chart is a valuable resource for traders and investors. It provides real-time information on the price of cryptocurrencies, as well as important technical indicators.

How to Use the Heikin Ashi Crypto Chart

To use the Heikin Ashi Crypto Chart, first find the cryptocurrency you are interested in. You can find this information on the Heikin Ashi Crypto Chart, or on other cryptocurrency exchanges. Once you have found the cryptocurrency, you can use the chart to find the current price and volume.

The Heikin Ashi Crypto Chart is a valuable resource for traders and investors. It provides real-time information on the price of cryptocurrencies, as well as important technical indicators.

Heikin Ashi Crypto Charts: Avoiding Common Pitfalls

There are a few common crypto trading pitfalls that you should avoid if you want to succeed in the cryptocurrency markets.

1. Focusing on the Wrong Factors

One of the biggest mistakes that new crypto traders make is focusing too much on technical indicators and price charts instead of analyzing the overall market conditions.

If you're only looking at charts that show the price of cryptocurrencies, you may be missing important information that could help you make better trading decisions.

2. Trading Toooften

Another common mistake made by crypto traders is over-trading.

If you're constantly buying and selling cryptocurrencies, you're likely going to lose a lot of money in the short term.

Instead, try to stick to a fixed trading strategy and only invest in cryptocurrencies that you believe will continue to rise in value over the long term.

3. Not Understanding Volatility

Another common mistake made by crypto traders is not understanding the volatility of the markets.

Volatility is a measure of how much a stock or cryptocurrency price changes over a given period of time.

It's important to remember that high levels of volatility can be a sign of an unstable market, so it's important to stay calm and make informed decisions.

Heikin Ashi Crypto Charts: Getting the Most Out of Them

Heikin Ashi Crypto charts are a great way to get an overview of the market trends and understand the behavior of the different coins in the market. They provide a visual representation of price and volume information, making it easy to see which coins are doing well and which ones are struggling.

However, Heikin Ashi crypto charts are only as good as the data that is used to create them. If you are not familiar with how to read Heikin Ashi crypto charts, there are a few tips that can help you get the most out of them.

First, always keep in mind that the charts show the price and volume information for a given day, so be sure to look at the date at the bottom of the chart.

Next, pay attention to the trend lines. These lines show how the prices have been moving over the past few days, and can help you better understand what is happening in the market.

Finally, use the indicators to help you make better decisions about which coins to invest in. The most common indicators are the MACD (Moving Average Convergence/Divergence) indicator and the RSI (Relative Strength Index) indicator.