I understand crypto charts.

This article provides a basic overview of how to read cryptocurrency charts. It explains the different types of charts and how to interpret them.

How to read crypto charts

Crypto charts are designed to help traders and investors understand the current state of the cryptocurrency market. By analyzing the data, investors can make informed decisions about whether or not to invest in a particular coin or token.

Cryptocurrency exchanges offer a variety of different charting tools, so it’s important to familiarize yourself with the different types of charts before you start trading.

Here are three types of crypto charts that you may encounter:

1. Technical indicators

Technical indicators are used to identify the current trend in a cryptocurrency market. These indicators include:

The Bollinger Bands

The MACD

The RSI

These indicators are used to determine whether the market is bullish or bearish, and can help you make informed decisions about whether or not to invest in a particular coin or token.

2. Social media analysis

Social media analysis is a popular way to monitor the sentiment of the cryptocurrency community. By looking at the number of tweets, Facebook posts, and Reddit submissions about a particular coin or token, you can determine whether or not the community is excited about that coin or token.

3. Volume analysis

Volume analysis is used to measure the amount of trading activity in a particular cryptocurrency market. By looking at the number of transactions and the dollar value of those transactions, you can determine whether or not the market is growing or shrinking.

The basics of crypto charting

Crypto charting is the process of creating visual representations of cryptocurrency prices and trends. The goal is to help you make informed decisions about where to invest and trade cryptocurrencies.

There are a variety of different crypto charting platforms available, and each has its own features and advantages. Some of the most popular platforms include CoinMarketCap, CoinGecko, and Cryptonator.

To create a crypto chart, you first need to gather the relevant data. This can be done by scanning through cryptocurrency exchanges and monitoring the prices of specific cryptocurrencies. You can also use a crypto charting platform to track this data automatically.

Once you have the data, you can start creating your charts. Crypto charting platforms offer a variety of different graph types, including candlesticks, line charts, and bar charts.

Once you have created your charts, you can use them to analyze cryptocurrency trends and market conditions. This can help you make informed decisions about where to invest and trade cryptocurrencies.

The most popular crypto chart types

There are three main types of crypto charts:

1. Price charts

2. Volume charts

3. Crypto exchange charts

The benefits of crypto charting

Crypto charting is a great way to get a quick overview of the current price and performance of a cryptocurrency. This can help you make informed decisions about whether or not to buy or sell a coin.

Cryptocurrencies are complex and volatile, so it's important to have access to reliable information in order to make sound investment decisions. Crypto charting can help you stay informed about the market conditions and make informed decisions about when to buy and sell.

The key features of crypto charts

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

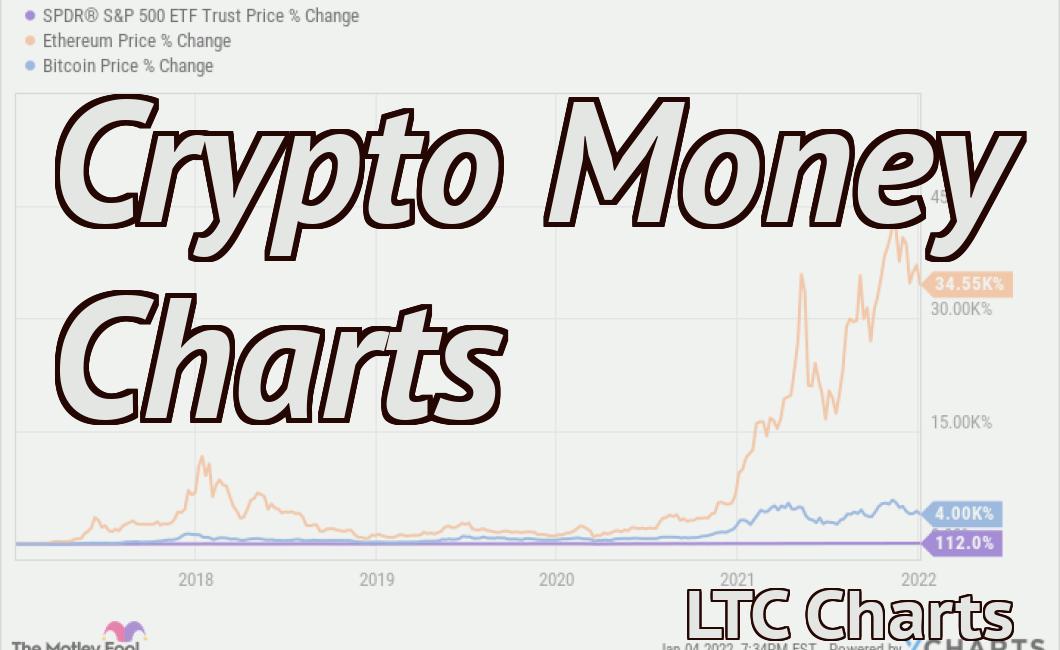

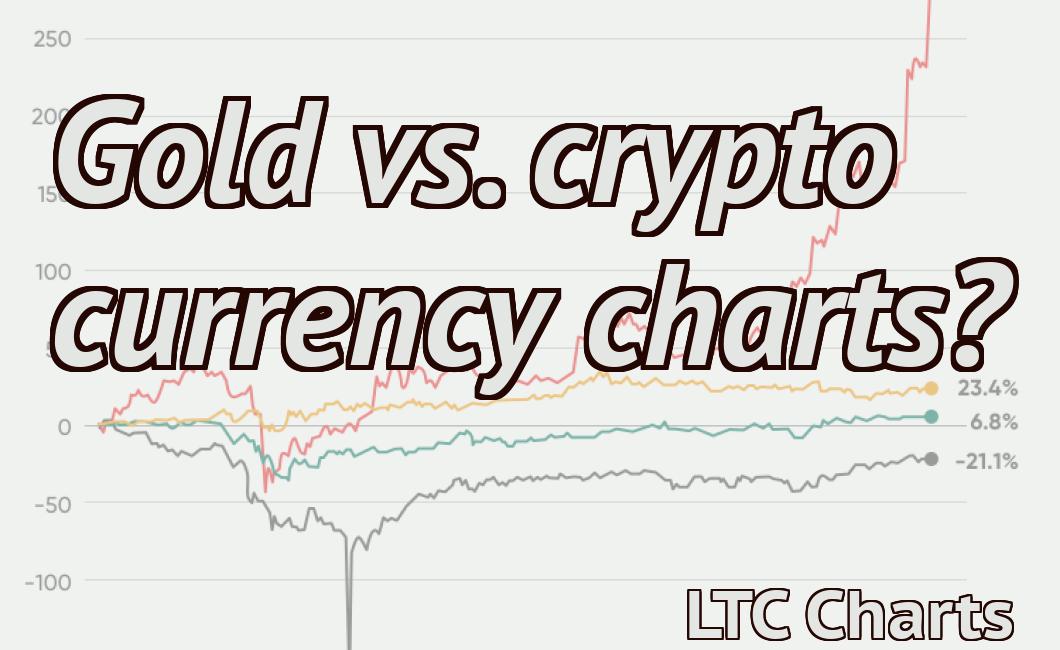

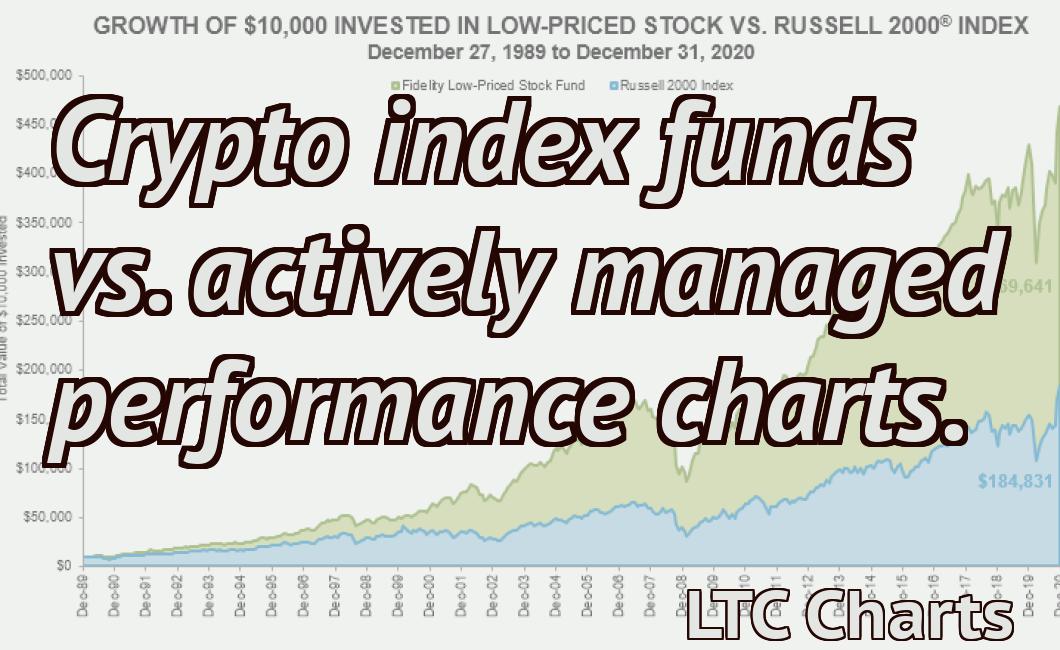

The difference between crypto charts and traditional markets charts

Cryptocurrency charts are a unique way to view and track the market performance of digital assets. Cryptocurrencies are often traded on decentralized exchanges, which makes it difficult to correlate price movements across different exchanges. Crypto charts provide a single view of the market, making it easier to see trends and make informed trading decisions.

Traditional markets charts are used to track the performance of stocks, commodities, and other assets. They are generally divided into two types: time-based and volume-based. Time-based charts show the price movement over a specific period of time, while volume-based charts show the number of transactions that have taken place over a given period of time.

How to use crypto charts to your advantage

Crypto charts provide an excellent way to monitor the market activity. By understanding the different indicators, you can make informed decisions regarding your investments.

Here are some tips for using crypto charts:

1. Compare the prices of different cryptocurrencies.

2. Watch for trends in the prices of different cryptocurrencies.

3. Compare the prices of different cryptocurrencies over time.

The top 5 things you need to know about crypto charts

1. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units.

2. Bitcoin was the first decentralized cryptocurrency and still dominates the market.

3. Other popular cryptocurrencies include Ethereum, Litecoin, and Ripple.

4. Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services.

5. Cryptocurrencies are not regulated by governments and are vulnerable to technical and financial risks.

What do all those lines and squiggles on crypto charts mean?

Cryptocurrencies are traded on digital exchanges and are typically divided into two categories: digital currencies and tokens.

Digital currencies are a type of cryptocurrency that uses cryptography to secure its transactions and to control the creation of new units. Bitcoin, the first and most well-known digital currency, was created in 2009.

Tokens are a type of digital currency that uses a blockchain technology to secure its transactions and to control the creation of new units. Ethereum is a popular token based on the blockchain technology.

How to make sense of the madness – a beginner’s guide to reading crypto charts

Crypto charts are a complex and often confusing way to track the performance of digital assets. Here is a beginner’s guide to making sense of crypto charts:

1. Don’t worry about the price.

The price of a digital asset is not the most important thing to look at when trying to make sense of a crypto chart. Instead, focus on the various indicators (such as the percentage change) to get a better idea of how a particular digital asset is performing.

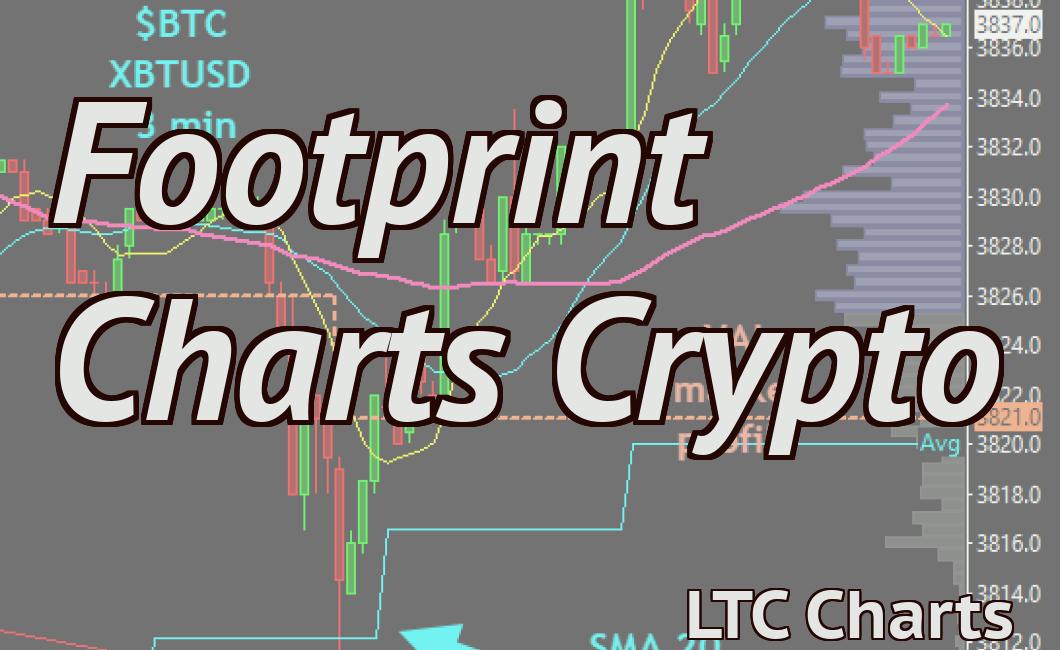

2. Understand how to read a candle stick chart.

Candles stick charts are one of the most common types of crypto charts. They show the price movement of a particular digital asset over a specific period of time.

To make sense of a candle stick chart, first identify the black and white candles. The black candles indicate periods of low price movement, while the white candles indicate periods of high price movement.

Next, focus on the longer-term trends shown by the candles. For example, if you see that the white candles are consistently landing lower than the black candles, this might be an indicator that the price of the digital asset is headed downwards. Conversely, if the white candles are consistently landing higher than the black candles, this might be an indicator that the price of the digital asset is headed upwards.

3. Understand how to read a bar chart.

Bar charts are another common type of crypto chart. They show the price movement of a particular digital asset over a specific period of time on a single horizontal axis.

To make sense of a bar chart, first identify the bars. The taller the bar, the more active the market for the digital asset has been over that period of time.

Next, focus on the different indicators (such as the percentage change) to get a better idea of how a particular digital asset is performing.

4. Understand how to read a histogram.

Histograms are one of the most effective ways to visualise data. They show the distribution of a particular data set over a range of values.

To make sense of a histogram, first identify the bars. The taller the bar, the more active the market for the digital asset has been over that period of time.

Next, focus on the different values shown by the bars. The most active values will be shown in the centre of the graph, while less active values will be shown on either side of the centre point.

5. Understand how to read a candlestick chart.

Candlestick charts are one of the oldest types of crypto charts. They show the price movement of a particular digital asset over a specific period of time on a single vertical axis.

To make sense of a candlestick chart, first identify the candlesticks. The taller the candlestick, the more active the market for the digital asset has been over that period of time.

Next, focus on the different indicators (such as the percentage change) to get a better idea of how a particular digital asset is performing.

So you want to get into cryptocurrency trading? Start with understanding these charts

Cryptocurrency charts are a great way to understand how the market is performing and to get an understanding of what factors are influencing prices.

There are many different types of cryptocurrency charts, but the most common are:

1. candle stick chart

2. line chart

3. moving average chart

4. fractal analysis

5. trend analysis

6. volume analysis

Candle Stick Chart

A candle stick chart is a type of chart that shows the price of a cryptocurrency over time. It works by displaying the price of a cryptocurrency as a candlestick (a small, coloured bar) on the chart.

The size and colour of the candlestick indicates how much the price has changed over that time period. The longer the candlestick, the more significant the change in price.

Line Chart

A line chart is a type of chart that shows the price of a cryptocurrency over time. It works by plotting the price of a cryptocurrency against time, on a horizontal axis, and displaying the data as a series of lines.

The length of the line shows how strong the trend is – the longer the line, the stronger the trend. The direction of the line shows which way the price is moving – up means that the price is increasing, down means that the price is decreasing, and neutral means that the price is staying the same.

Moving Average Chart

A moving average chart is a type of chart that shows the average price of a cryptocurrency over time. It works by plotting the average price of a cryptocurrency against time, on a horizontal axis, and displaying the data as a series of lines.

The moving average helps to smooth out the peaks and valleys in the data, making it easier to see trends. The length of the line shows how strong the trend is – the longer the line, the stronger the trend. The direction of the line shows which way the price is moving – up means that the price is increasing, down means that the price is decreasing, and neutral means that the price is staying the same.

Fractal Analysis

Fractal analysis is a technique that can be used to identify patterns in data. It works by analysing patterns in data that repeat themselves over and over again. This can help you to identify trends (and reversals in those trends) in the data.

Trend Analysis

Trend analysis is a technique that can be used to identify whether a cryptocurrency is going up or down. It works by looking at how often the price of a cryptocurrency is increasing or decreasing over time, and using that information to estimate how long it will take for the trend to reach its final destination.

Volume Analysis

Volume analysis is a technique that can be used to identify whether there is high demand for a cryptocurrency. It works by looking at how many transactions are being made involving a cryptocurrency over time, and using that information to estimate how valuable the cryptocurrency is.