Crypto Charts Meaning

Crypto charts can be a little overwhelming at first glance. All those lines and squiggles can appear to be random, but they're actually telling you a story about the price movements of a cryptocurrency. By understanding what the various elements of a chart represent, you can start to see patterns and make better-informed trading decisions.

How to read crypto charts and what they mean

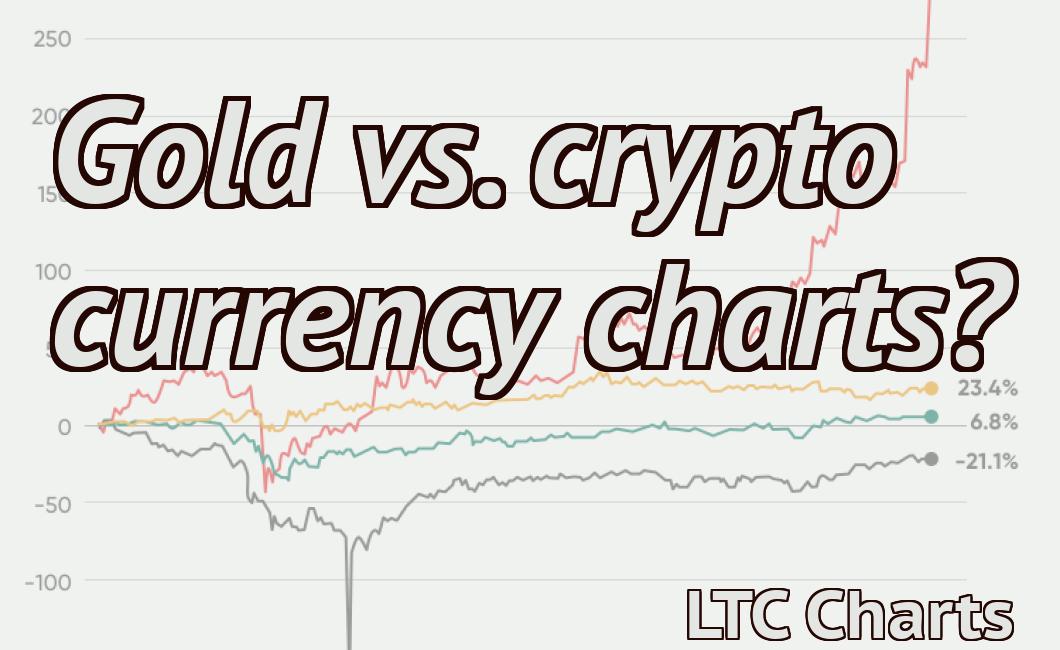

Crypto charts are used to measure the price and performance of cryptocurrencies.

The vertical axis of a crypto chart measures price, while the horizontal axis shows time.

Cryptocurrencies move up and down in price based on how much demand there is for them.

The red lines on a crypto chart show the highest and lowest prices that the cryptocurrency has ever been at.

The green lines show where the price is currently.

Cryptocurrencies can also be traded on exchanges, and the prices of these exchanges will be shown on the crypto charts.

The different types of crypto charts and their meanings

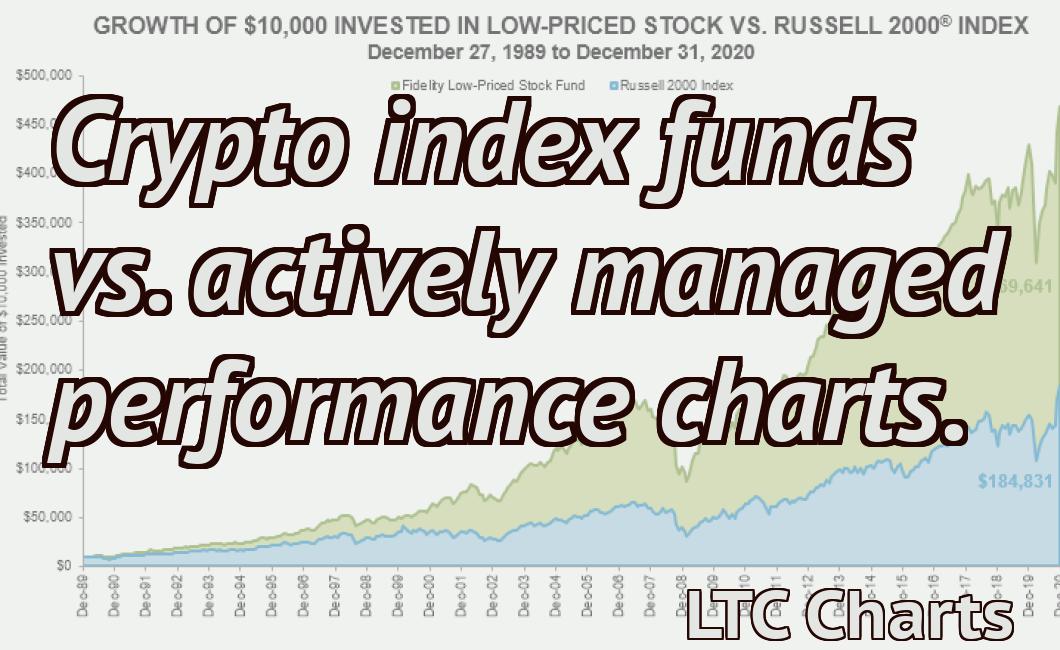

Crypto charts are a great way to stay up to date on the latest movements in the cryptocurrency market. They can give you a visual representation of how the market is performing, and help you to make informed decisions about whether or not to invest in cryptocurrencies.

Here are the different types of crypto charts and their meanings:

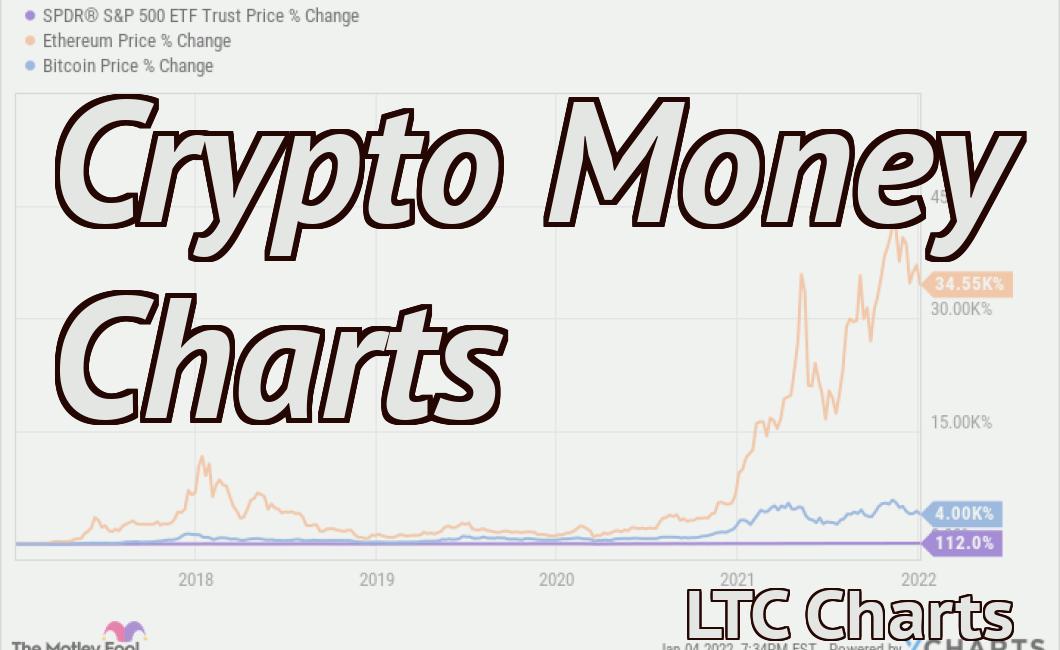

1. Bitcoin price chart

The bitcoin price chart is the most popular type of crypto chart, and it shows the price of a single bitcoin over time. This chart is useful for tracking the price of bitcoin, as well as other cryptocurrencies that are based on bitcoin technology.

2. Ethereum price chart

The ethereum price chart is similar to the bitcoin price chart, but it shows the price of ether (the cryptocurrency associated with ethereum) over time. Ethereum is a popular cryptocurrency, and its price has been increasing over time.

3. Litecoin price chart

The litecoin price chart is similar to the ethereum price chart, but it shows the price of litecoin over time. Litecoin is a popular cryptocurrency, and its price has been increasing over time.

4. Ripple price chart

The ripple price chart is similar to the litecoin price chart, but it shows the price of ripple over time. Ripple is a popular cryptocurrency, and its price has been increasing over time.

5. Bitcoin cash price chart

The bitcoin cash price chart is similar to the bitcoin price chart, but it shows the price of bitcoin cash over time. Bitcoin cash is a new cryptocurrency, and its price has been increasing over time.

How to interpret crypto chart patterns

Crypto chart patterns are a way to predict future price movements in the cryptocurrency market.

There are many different crypto chart patterns, and it can be difficult to know which one to look for.

Some common crypto chart patterns include:

Head-and-shoulders

Double top

Double bottom

Triple top

Triple bottom

Fibonacci retracement

These patterns can be used to predict future price movements, but it is important to be aware that they are not 100% accurate.

It is also important to remember that crypto charts are often volatile, and so it is possible to see large price movements in a short amount of time.

The most important crypto chart patterns to know

The most important crypto chart patterns to know are the head and shoulders, triangle, and Elliott wave.

The head and shoulders pattern is a bullish reversal pattern that consists of two peaks that are higher than the previous peak. The triangle pattern is a bearish reversal pattern that consists of two peaks that are lower than the previous peak. The Elliott wave pattern is a bullish wave pattern that consists of five waves.

Trading signals from crypto charts

Cryptocurrencies are famously volatile, making it difficult to predict future price movements. However, there are a few indicators that can help traders predict where a cryptocurrency is likely to go.

1. Support and resistance levels

When a cryptocurrency starts to fall, it will often encounter resistances at certain price points. If the price falls below this level, it is likely that more buyers will enter the market and support the price, leading to a rise in prices.

Similarly, when a cryptocurrency is on the rise, it will often encounter resistances at certain price points. If the price rises above this level, it is likely that more sellers will enter the market and push the price down, leading to a fall in prices.

2. Volume

When a large number of traders are buying or selling a cryptocurrency, it is likely to go up or down, respectively.

3. Technical indicators

Some technical indicators, such as the RSI (Relative Strength Index), can help traders detect whether a cryptocurrency is oversold or overvalued.

How to use crypto charts to make better trading decisions

Crypto charts can be used to help traders make better trading decisions. Crypto charts show the price of a cryptocurrency over time, and can be used to identify patterns in the price of a cryptocurrency. Patterns in the price of a cryptocurrency can indicate changes in demand for that cryptocurrency, and can help traders make better trading decisions.