Crypto index funds vs. actively managed performance charts.

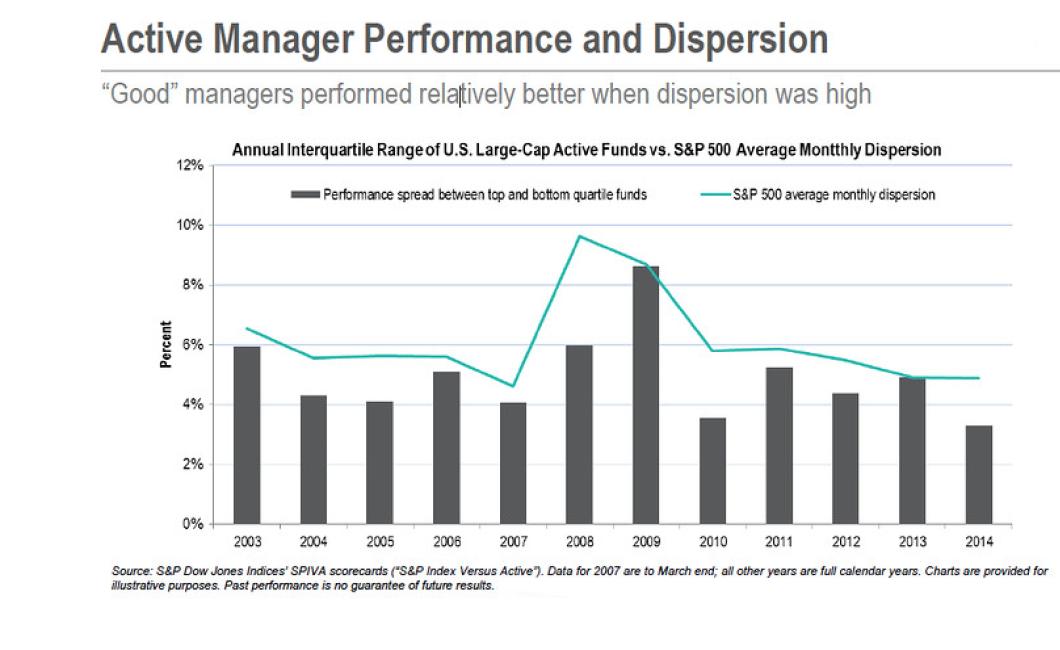

Crypto index funds have outperformed actively managed performance charts over the past year. This is likely due to the fact that index funds offer a more diversified portfolio, which helps to mitigate risk. Additionally, index funds are passive investment vehicles, meaning that they do not require active management. This can help to keep costs low, which is another advantage that index funds have over actively managed performance charts.

Actively Managed Crypto Index Funds Outperform Traditional Indexes

A recent study found that actively managed crypto index funds outperform traditional indexes by a significant margin. The study, conducted by Algorithm Labs and CoinShares, looked at data from 889 cryptoassets across three indices: the CoinMarketCap All-Crypto Index, the CoinShares Bitcoin Index Fund, and the CoinShares Ethereum Index Fund.

The study found that the actively managed crypto index funds outperformed the indexes by an average of 2.4% per year. The study also found that the average return for the cryptoassets in the CoinMarketCap All-Crypto Index was 3.3%, while the CoinShares Bitcoin Index Fund returned 6.4% and the CoinShares Ethereum Index Fund returned 13.2%.

The study’s authors believe that the results of the study “suggest that investors would be well served by investing in a professionally managed crypto index fund rather than trying to trade each individual asset.”

Crypto Index Funds vs Actively Managed Performance Charts

Crypto index funds vs actively managed performance charts often come up when people are trying to make a decision about which type of investment to make. There are a few things to consider when comparing the two types of charts.

The first thing to consider is how each type of chart is constructed. Active management charts typically use a combination of price-based and performance-based indicators to measure a fund’s success. Crypto index funds, on the other hand, typically use only price-based measures. This means that the performance of a crypto index fund will not vary as much as the performance of an actively managed fund that uses performance-based indices.

The second thing to consider is the risk associated with each investment option. Active management funds tend to have higher risk profiles than crypto index funds, since they are typically more volatile. This means that they can lose a greater percentage of their value over time. Crypto index funds, on the other hand, are typically less volatile than actively managed funds, which means that they will not lose as much of their value over time.

The final thing to consider is the overall return that each investment option will provide. Active management funds tend to provide higher returns than crypto index funds, but this is not always the case. It depends on the specific investment options that are chosen.

Why Actively Managed Crypto Index Funds outperform traditional indexes

?

Crypto index funds are actively managed, meaning they are actively trying to beat the market. This can be done through a variety of means, including buying and selling cryptocurrencies, investing in other blockchain-based assets, and trading on margin. By doing this, crypto index funds are able to outperform traditional indexes, which rely on passive investment techniques.

How do Crypto Index Funds work?

Crypto Index Funds are investment vehicles that track a specific cryptocurrency index. Their objective is to provide investors with exposure to a basket of cryptocurrencies while providing diversification benefits. They typically charge fees and aggregated data is not always readily available.

What are the benefits of a Crypto Index Fund?

Crypto Index Funds have a number of benefits, including:

1) They provide exposure to a wide range of cryptocurrencies and blockchain-based assets, which can help investors diversify their portfolio and gain exposure to new and emerging technologies.

2) They are typically managed by professional investment teams, which can offer investors stability and security.

3) They can offer lower fees than traditional funds, which can help investors save on costs.

4) They can help investors track the performance of a variety of cryptocurrencies and blockchain-based assets, which can provide valuable insights into the market.

Why you should consider investing in a Crypto Index Fund

There are many reasons you may want to invest in a crypto index fund. These funds track a basket of cryptocurrencies, which means that they will give you exposure to a wide range of digital assets. Additionally, crypto index funds are regulated and licensed, meaning that they are subject to the same standards as traditional financial institutions. This means that you can trust them to provide you with a safe and reliable investment.

The advantages of an actively managed Crypto Index Fund

There are a number of advantages to investing in an actively managed Crypto Index Fund. These include:

– The fund manager will have a deep understanding of the cryptocurrency markets, allowing them to make informed investment decisions.

– The fund will be able to track the performance of a variety of cryptocurrency indexes, ensuring that your investment is diversified and ensuring that you are getting the most out of your investment.

– The fund will be able to provide you with regular updates on the latest news and developments in the cryptocurrency markets, ensuring that you are kept up to date with the latest developments.

How to choose the right Crypto Index Fund for you

When choosing a crypto index fund, you should consider your investment goals, investment horizon, and risk tolerance.

Investment Goals

Consider your investment goals when selecting a crypto index fund. Do you want to invest in a diversified portfolio of cryptocurrencies? Or are you looking for a specific type of cryptocurrency, such as Bitcoin or Ethereum?

Investment Horizon

Your investment horizon will also affect your choice of crypto index fund. If you plan to hold your crypto index fund for a short period of time, a diversified cryptocurrency index fund is likely the best option. If you want to hold your crypto index fund for a longer period of time, a focused cryptocurrency index fund may be a better choice.

Risk Tolerance

Another factor to consider when choosing a crypto index fund is your risk tolerance. Some crypto index funds are more volatile than others, so if you're uncomfortable with increased risk, choose a fund with lower volatility.

10 things you need to know about Crypto Index Funds

Crypto Index Funds are a new type of investment vehicle that allow investors to track the performance of a basket of cryptocurrencies. These funds are unregulated and offer high returns, but they are also risky and can be subject to volatility. Here are 10 things to know about crypto index funds:

1. Crypto index funds are unregulated investment vehicles that allow investors to track the performance of a basket of cryptocurrencies.

2. These funds are typically offered by brokerage firms and offer high returns, but they are also riskier and can be subject to volatility.

3. Crypto index funds are not endorsed by any financial institution and are not subject to the same regulatory requirements as traditional investments.

4. Because crypto index funds are not regulated, they are not subject to investor protections such as FDIC insurance.

5. Crypto index funds are often marketed as a way to get exposure to a diverse range of cryptocurrencies without having to invest in individual coins or tokens.

6. Crypto index funds are available in a variety of flavors, including those that track the performance of Bitcoin, Ethereum, and other major cryptocurrencies.

7. Because these funds are not regulated, they are not subject to the same investor protections as traditional investments.

8. Like all investments, crypto index funds carry risk, and investors should carefully consider the risks and rewards associated with these funds before investing.

9. Because crypto index funds are not endorsed by any financial institution, they may not be subject to the same regulatory requirements as traditional investments.

10. Cryptocurrency investment is still in its early stages, and there is a risk that these funds will not be able to provide consistent returns over time. For this reason, it is important to carefully consider the risks and rewards associated with these funds before investing.

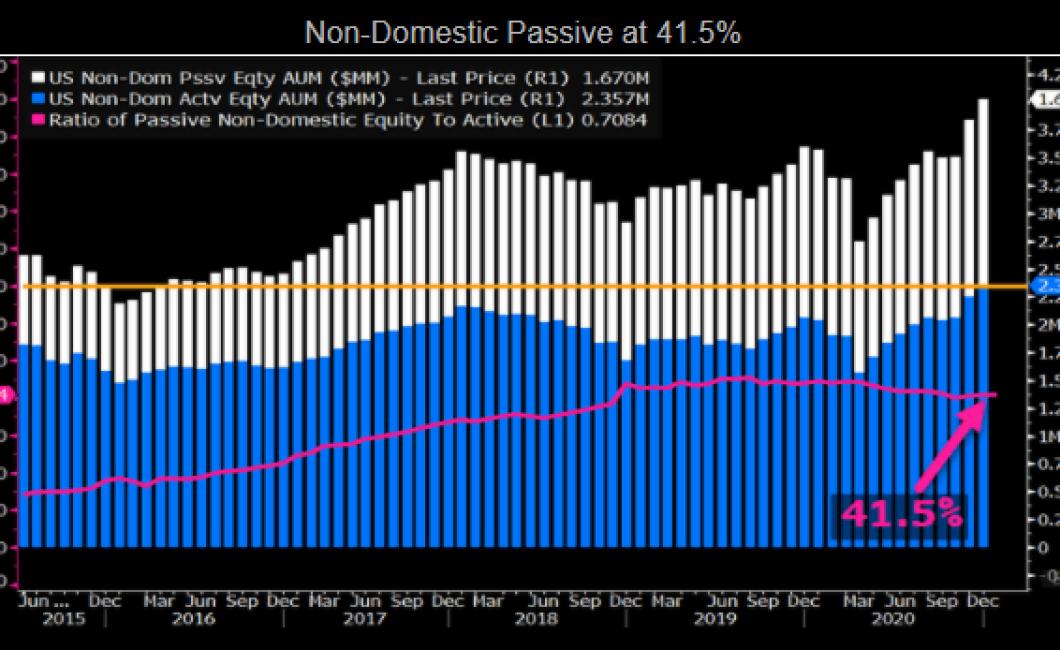

The difference between traditional index funds and Crypto Index Funds

Traditional index funds are designed to track the performance of a specific benchmark, such as the S&P 500. Crypto index funds, on the other hand, are designed to track the performance of a specific cryptocurrency. This means that they will hold a diverse range of cryptocurrencies, instead of following a specific benchmark.

Crypto index funds are still relatively new, and there is still much research that needs to be done in order to find the best ones. As a result, they may not always offer the same returns as traditional index funds. However, they are likely to be more volatile, which could make them more risky.

Why more investors are turning to Crypto Index Funds

Crypto Index Funds are becoming increasingly popular among investors because they provide a way to access a diversified range of digital assets without having to manage them individually. These funds track the performance of a specific index, such as the Bitcoin or Ethereum indices, and allow investors to gain exposure to a wide range of cryptocurrencies without having to worry about the individual risks.