Charts for shorts on crypto.

If you're looking for a quick and easy way to get started with cryptocurrency trading, then look no further than charts for shorts on crypto. This type of trading involves using charts to predict the future direction of prices, and then making trades accordingly. Charting is a vital tool for all types of traders, and it's especially important for those who trade cryptocurrencies. The markets for these digital assets are often highly volatile, making it essential to have a clear understanding of what the charts are saying before making any moves. With charts for shorts on crypto, you can get a birds-eye view of the market and make informed decisions about your trades. So if you're ready to start profiting from the world of cryptocurrencies, then make sure you check out charts for shorts on crypto today.

Best Crypto Charts for Short-Term Traders

Crypto charts are a great way to track a cryptocurrency’s price movement over time.

Here are some of the most popular crypto charts for short-term traders:

Cryptocurrency Price Charts

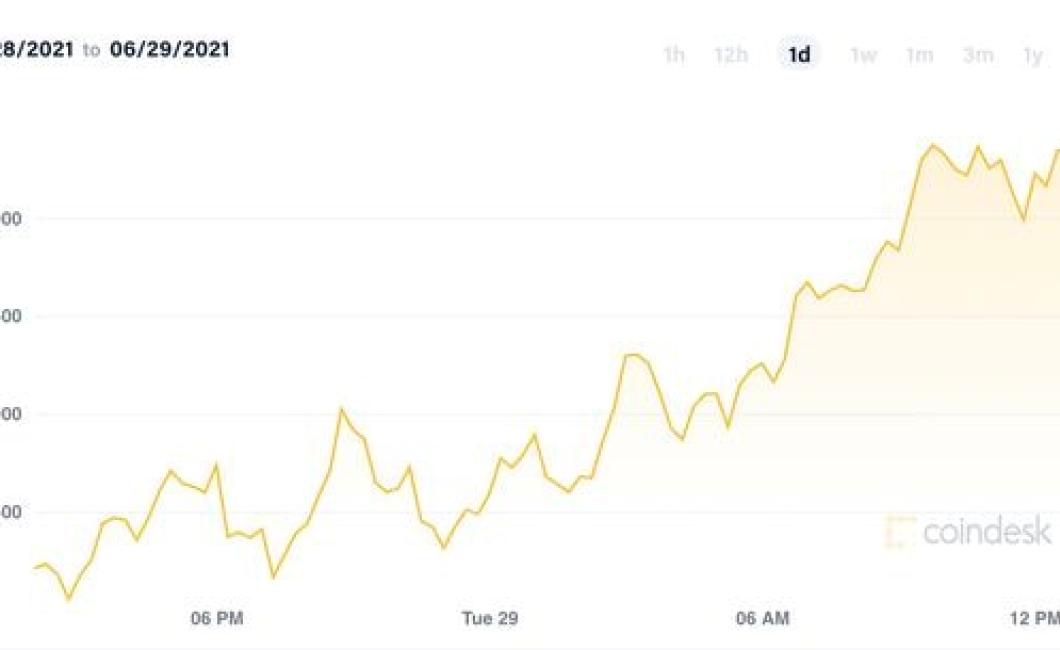

Cryptocurrency prices are displayed on various charts, including the 24-hour, 7-day, and 1-month charts.

Cryptocurrency Volume Charts

Volume is another important metric to watch when trading cryptocurrencies. Volume charts display the number of coins traded over a given period of time.

Cryptocurrency News Charts

News can often drive prices up or down in the cryptocurrency market. So, it’s important to keep an eye on news charts to see if any important events are happening.

Technical Analysis for Short-Term Cryptocurrency Trading

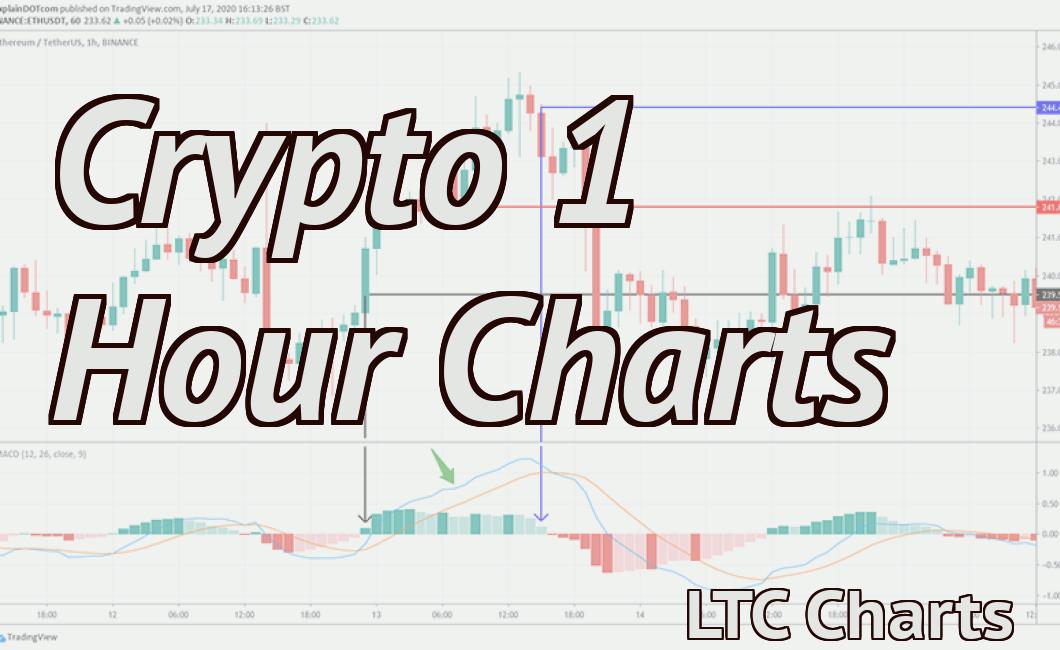

The cryptocurrency market is highly volatile and can be extremely unpredictable. This means that short-term traders should always be prepared for potential price changes, and should use technical analysis to help them understand how the market is behaving.

One of the most important aspects of technical analysis is studying charts. By looking at a chart, traders can see how prices have been moving over time, and can also identify patterns. For example, if prices are moving up rapidly, this may be an indication that the market is in a bull market. On the other hand, if prices are moving slowly and erratically, this may be a sign that the market is in a bear market.

Another important aspect of technical analysis is studying indicators. Indicators help traders track various aspects of the market, such as volume and price trends. Many traders use indicators to help them make buy or sell decisions.

Overall, technical analysis is a valuable tool for short-term cryptocurrency trading. By using it, traders can better understand how the market is behaving and can make informed decisions about where to invest their money.

How to Use Charts when Trading Cryptocurrencies

When trading cryptocurrencies, charts can be used to help make informed decisions. This is because charts provide a visual representation of price action and can help identify patterns in the market.

When trading cryptocurrencies, it is important to keep in mind that charts are not 100% accurate. Instead, they should be used as a guide to help make informed decisions.

Below are some tips for using charts when trading cryptocurrencies:

1. Use charts to identify trends.

Charts can be used to identify trends in the market. For example, if you are looking to buy a cryptocurrency, you may want to focus on charts that display a upward trend. Conversely, if you are looking to sell a cryptocurrency, you may want to focus on charts that display a downward trend.

2. Use charts to time your trades.

Charts can also be used to time your trades. For example, if you are looking to buy a cryptocurrency, you may want to wait for the price to reach a certain level before making your purchase. Conversely, if you are looking to sell a cryptocurrency, you may want to sell right away when the price reaches a certain level.

3. Use charts to monitor your portfolio.

Charts can also be used to monitor your portfolio. For example, you may want to track the performance of individual cryptocurrencies over time. Alternatively, you may want to track the performance of your entire portfolio over time.

3 Popular Charting Techniques for Short-Term Crypto Trading

1. Moving averages: A moving average is a technical indicator that predicts future prices by tracking the average price of a security or commodity over a specific period of time. Moving averages can be used to identify trends and signals in the market.

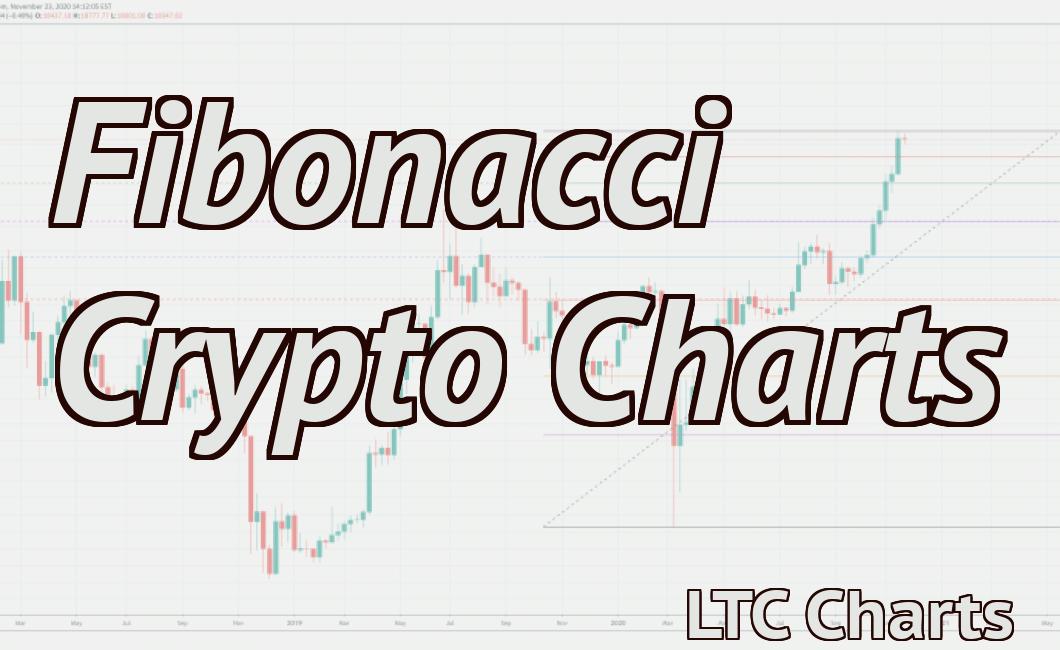

2. Fibonacci retracement: A Fibonacci retracement is a technical analysis tool that uses levels of support and resistance as landmarks to predict future price movements. It is most commonly used to identify potential reversals in trend.

3. Bollinger Bands: Bollinger Bands are a type of technical indicator used to measure volatility and price fluctuations. They are plotted on a graph and allow traders to identify areas of high and low volatility.

Identifying Key Support and Resistance Levels in Crypto Charts

The support and resistance levels in crypto charts are used to help identify where the price is likely to move in the near future.

Cryptocurrencies are often traded on exchanges, which means that prices can change quickly and unpredictably. As such, it is important to be aware of the support and resistance levels in order to make informed trading decisions.

Support levels are areas where the price of a cryptocurrency is expected to stay above the lower boundary of the chart. Resistance levels are areas where the price of a cryptocurrency is expected to stay above the upper boundary of the chart.

The most important thing to remember when trading cryptocurrencies is to always consult a professional. Cryptocurrencies are complex and highly volatile instruments, and without the correct tools and knowledge, you could lose a lot of money.

Using Fibonacci Retracements in Crypto Charting

In crypto trading, Fibonacci retracements are a popular tool to help identify potential support and resistance levels.

A Fibonacci retracement is simply a technical analysis tool that uses the Fibonacci sequence to identify areas of support and resistance in a stock or cryptocurrency chart.

When using a Fibonacci retracement, traders should keep in mind the following key points:

The first step is to identify the “base” or “0” point on the chart. The base point is the point at which the retracement begins.

The second step is to identify the “high” or “1” point on the chart. The high point is the point at which the retracement ends.

The third step is to identify the “crossover” point. The crossover point is the point at which the price moves from one trend to another.

Once you have identified the base, high, and crossover points, you can use the Fibonacci retracement tool to plot the corresponding candlestick charts.

For example, let’s say you are looking to trade stocks and you want to find support and resistance levels around the $50 mark. To do this, you would start by identifying the base point (the $45 mark on the chart), the high point (the $50 mark), and the crossover point (the $55 mark).

Then, you would plot each candlestick around these points using the Fibonacci retracement tool. This would give you charts showing support and resistance levels for the $50 mark.

Tips for Reading and Interpreting Cryptocurrency Charts

Cryptocurrency charts can be a great way to track the performance of cryptocurrencies over time. However, before you can use them to make informed investment decisions, you need to understand some key concepts.

Some key concepts to keep in mind when interpreting cryptocurrency charts include:

1. Cryptocurrencies are decentralized and therefore not subject to government or financial institution control. As such, their prices are often subject to greater volatility than those of more traditional assets.

2. Cryptocurrencies are often traded on decentralized exchanges, which make it difficult to track individual prices. This can make it difficult to determine the accurate value of a given cryptocurrency at any given point in time.

3. Many cryptocurrencies are designed to be deflationary, meaning that their supply will slowly decrease over time. This can make them attractive investments for those seeking long-term capital gains.

4. Cryptocurrencies are often associated with illicit activities, which can lead to their prices being volatile and hard to trust. As such, it is important to do your research before investing in any cryptocurrency.