Candlestick Charts Crypto

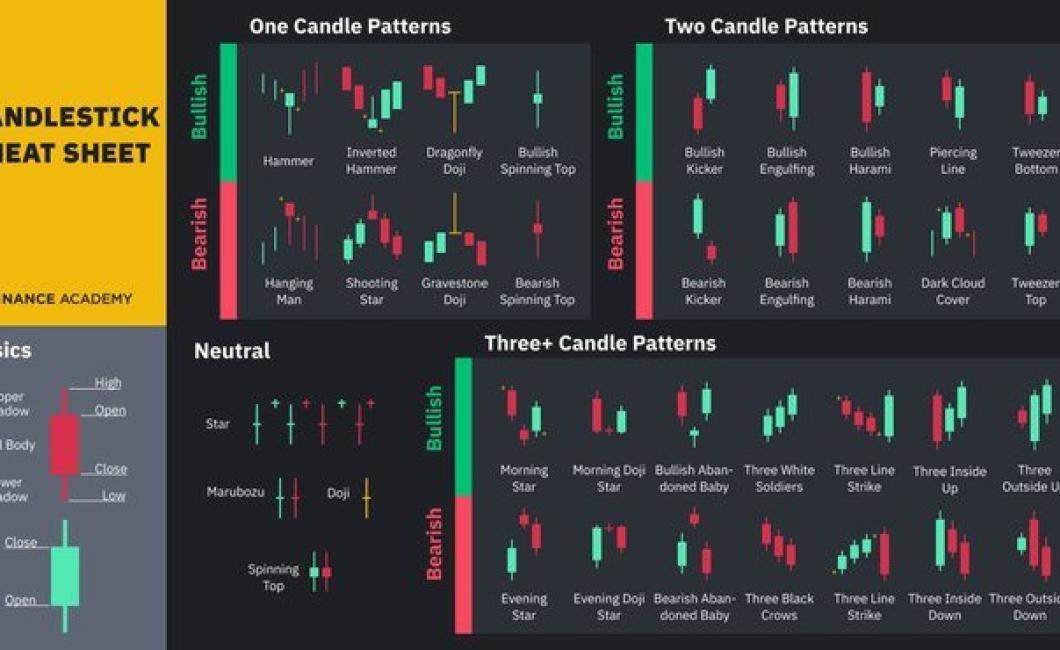

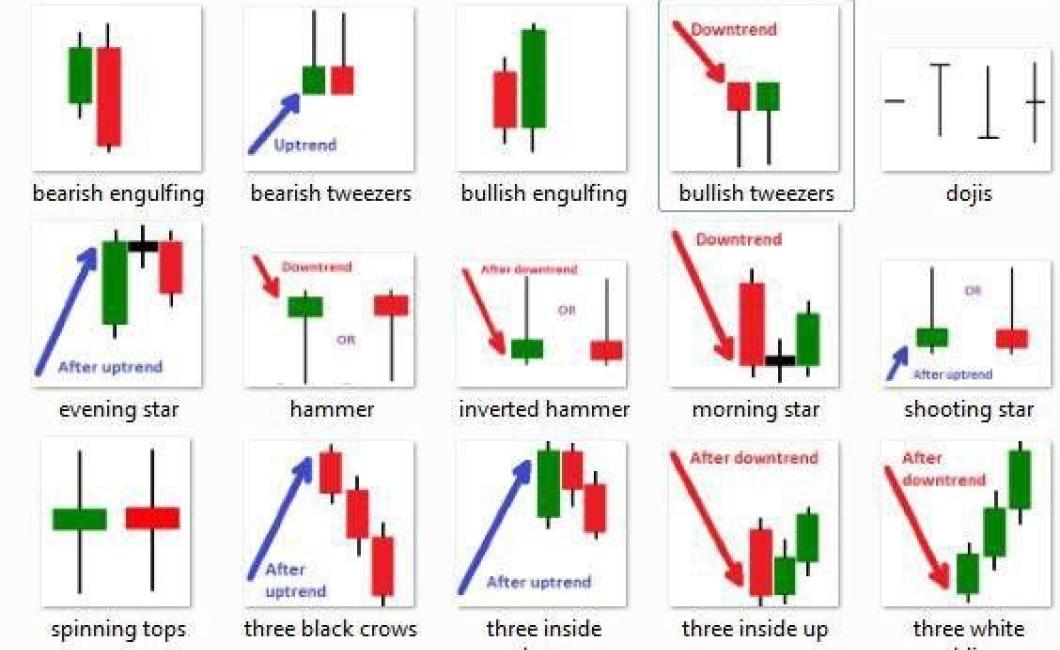

Candlestick charts are a popular tool among cryptocurrency traders and investors. The charts provide a visual representation of price action and can be used to spot trends and identify potential trading opportunities. Candlestick patterns can also give clues about the market sentiment and investor psychology.

Decoding Candlestick Charts for Crypto Trading Success

Candlestick charts are a popular way to visualize price movements in the stock and cryptocurrency markets.

Candlestick charts are made up of three parts: the body, the shadow, and the highlight.

The body is the largest part of the candlestick chart and it usually shows the actual price at that moment.

The shadow is the smaller, darker portion of the candlestick chart and it shows the previous day's price movements.

The highlight is the smallest part of the candlestick chart and it shows the current day's price movements.

3 Tips for Understanding Candlestick Charts in Crypto Trading

1. Identify the various types of candlesticks used in crypto trading.

There are three main types of candlesticks used in crypto trading: open, high, and low.

2. Understand how to read candlestick charts.

Candlestick charts are designed to help traders identify changes in the market. The most important thing to remember is that candlesticks are only one tool that traders use to analyze the market.

3. Use candlestick charts to predict future price movements.

Candlestick charts can be used to predict future price movements by identifying patterns such as support and resistance levels.

How to Use Candlestick Charts to Trade Cryptocurrencies

Candlestick charts are a type of technical analysis that traders often use to make informed decisions about trading cryptocurrencies. Candlestick charts are designed to show the movement of a cryptocurrency over time, and can be used to identify patterns in price movement.

To use candlestick charts to trade cryptocurrencies, first open a chart of a chosen cryptocurrency. Next, identify any important candles on the chart. For example, if you are trading Bitcoin, important candles might include the opening and closing prices for the day, as well as the 50-day and 200-day moving averages.

Next, look for any patterns that may exist in the candle movements. For example, if you are looking for signs that the price of Bitcoin is about to rise, you might look for candles that move higher relatively quickly. Conversely, if you are looking for signs that the price of Bitcoin is about to fall, you might look for candles that move lower relatively quickly.

Finally, based on what you have found, make an informed decision about whether or not to buy or sell cryptocurrencies based on the patterns that you have identified.

Candlestick Charting for Crypto: What You Need to Know

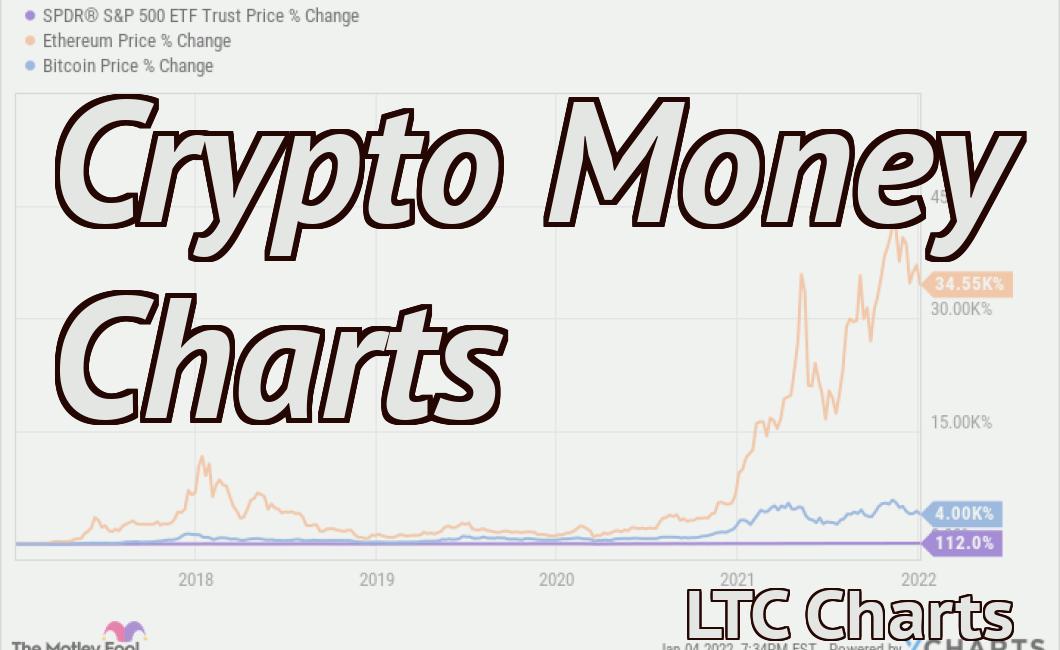

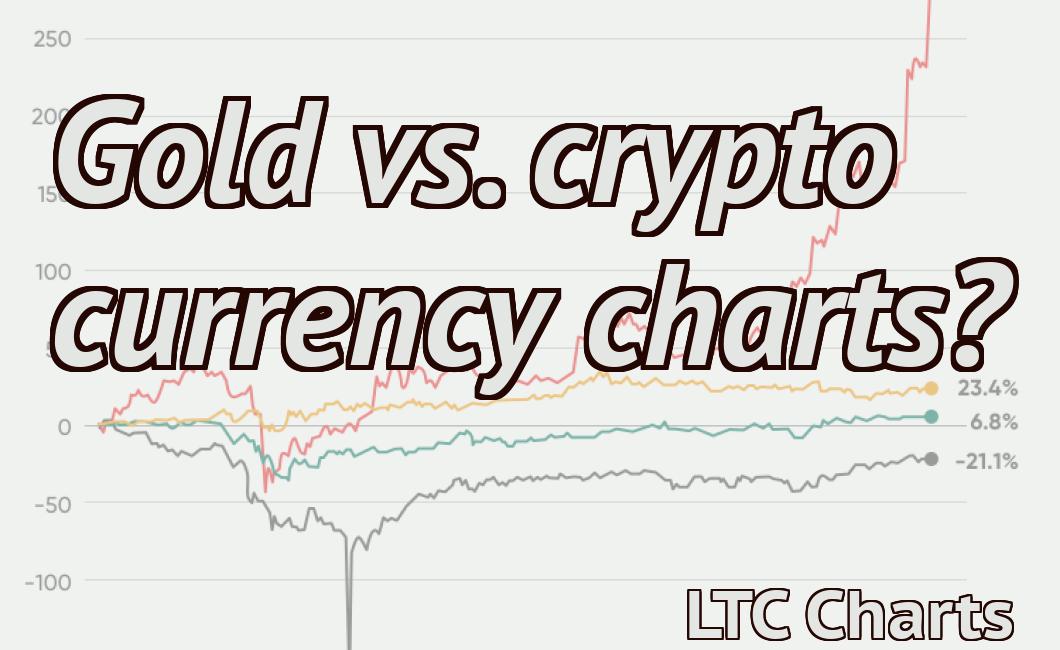

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most famous cryptocurrency, was created in 2009. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Bitcoin, Ethereum, and other cryptocurrencies are traded on decentralized exchanges and can also be used to purchase goods and services. Cryptocurrencies are often regarded as high-risk investments, and their prices can fluctuate rapidly.

Getting Started with Candlestick Charts in Crypto Trading

Candlestick charts are a popular way to visualize price movements over time. Candlestick charts are made up of a series of bars, and each bar is divided into two parts: the upper and lower. The color of the candlestick indicates whether the price moved higher (green) or lower (red).

To create a candlestick chart in Crypto Trading, first open your trading platform and create a new chart. Select the type of chart you want to create (candlestick, line, or bar), and then click on the "Add Chart" button.

To create a candlestick chart, first select the type of chart you want to create.

Next, click on the "Add Chart" button.

You will then be prompted to select the type of data you want to include in your chart. To create a candlestick chart, select "Candlestick."

You will now be prompted to select your timeframe. To create a candlestick chart, select "1 day."

You will now be prompted to select your market. To create a candlestick chart, select "Crypto."

You will now be prompted to select your asset. To create a candlestick chart, select "Bitcoin."

Next, you will be prompted to select your candlestick type. To create a candlestick chart, select "Green-Up."

You will now be prompted to select your open and high prices. To create a candlestick chart, select "Open Price" and "High Price."

Next, you will be prompted to select your close and low prices. To create a candlestick chart, select "Close Price" and "Low Price."

Finally, you will be prompted to select your color scheme. To create a candlestick chart, select "Auto."

How to Read Candlestick Charts for Crypto Trading

To read candlestick charts for crypto trading, one must understand how to read candlestick charts. Candlestick charts are used to analyze price movements of assets. Candlestick charts are divided into two parts: the body and the shadows.

The body is made up of bars that represent actual trading activity. The shadows are created by the lines that connect the bars. The height of a candlestick represents the value of the asset at the time of the bar. The color of the candle shows whether the price was higher, lower, or unchanged during that particular bar.

When looking at a candlestick chart for crypto trading, it is important to focus on the shadows. These indicate whether the price was higher, lower, or unchanged compared to the previous candle. If the shadows are long and thin, this indicates that the price was higher during that particular bar. If the shadows are short and thick, this indicates that the price was lower during that particular bar. Finally, if the shadows are both long and thin, this indicates that the price was unchanged during that particular bar.

What do Candlestick Charts Mean for Crypto Traders?

Candlestick charts are a type of technical analysis used in the finance world to help spot trends and predict future price movements. They are typically used by cryptocurrency traders to identify potential buying and selling opportunities.

Candlestick charts are composed of two types of lines: the open and the close. The open is the first point on the chart where prices began trading, and the close is the last point where prices closed out the trading session. Candlestick charts are designed to show how prices have moved over time. Each candlestick represents a single transaction, and the height of the candlestick indicates the volume of that transaction.

Candlestick charts can be helpful for identifying patterns in price movement. For example, if you see a pattern where prices move higher and lower over time but never cross the open or close price, this could be an indicator that there is a buying or selling opportunity waiting to be taken advantage of.