Footprint Charts Crypto

Footprint charts are a type of chart that is used to track the price movements of a particular cryptocurrency. These charts can be used to identify trends and patterns in the market, and can be used to make predictions about future price movements.

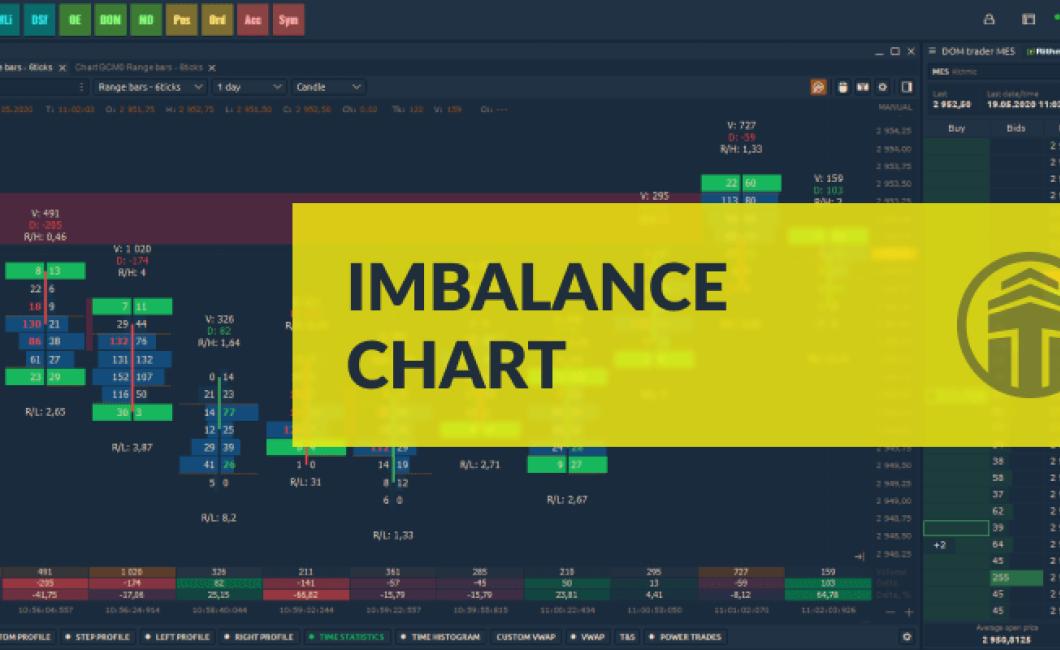

How to read a footprint chart for crypto trading

Cryptocurrencies are traded on a variety of exchanges, and footprints can be used to help traders understand the liquidity and volume of a particular cryptocurrency. The following is a footprint chart for Bitcoin trading on Coinbase.com.

How to use footprint charts to predict market movements

There are many different types of footprint charts that can be used to predict market movements. Some types of footprints charts use histograms to plot data points, while others use line charts.

When using a histogram, the chart will show the distribution of data points, with the majority at the center and the fewest at the edges. The shape of the histogram will indicate the likelihood of a particular event occurring. For example, a histogram with a wide distribution indicates that there is a lot of potential for an event to happen, while a histogram with a narrow distribution indicates that there is less potential for an event to happen.

Line charts are used to plot data points on a graph, and can be used to show trends over time. Line charts can also be used to identify signals, or events that may cause a change in the market. By looking at the slope and shape of the line, traders can determine whether the market is moving up or down, and whether there is potential for a further move.

The benefits of using footprint charts for crypto trading

There are many benefits to using footprint charts in crypto trading. For one, they can help you identify potential buying and selling opportunities. They can also help you identify trends in the market. Finally, they can help you make informed decisions when trading crypto.

The top 10 footprint chart patterns for crypto trading

Crypto trading is a high-risk and high-reward activity. To ensure a successful trading experience, it is important to track and avoid common footprint chart patterns.

1. Ichimoku Cloud

Ichimoku Cloud is a technical analysis tool that uses four lines to show price action. The first line is the current price, the second line is the high price, the third line is the low price, and the fourth line is the Ichimoku cloud.

When the cloud is in the center, it shows that the market is stable. When the cloud is outside of the center, it indicates that there is a trend. When the cloud is close to the center, it shows that the market is volatile.

2. Double Bottom

A double bottom is a technical analysis pattern that indicates that the market is about to go up. It consists of two lows in a row. The first low is lower than the second low, and the second low is lower than the first low.

3. Head and Shoulders

Head and shoulders is a technical analysis pattern that indicates that the market is about to go down. It consists of two peaks in a row. The first peak is higher than the second peak, and the second peak is higher than the first peak.

4. Bullish Engulfing Pattern

A bullish engulfing pattern is a technical analysis pattern that indicates that the market is about to go up. It consists of three peaks in a row. The first peak is higher than the second peak, and the second peak is higher than the third peak.

5. Bearish Engulfing Pattern

A bearish engulfing pattern is a technical analysis pattern that indicates that the market is about to go down. It consists of three peaks in a row. The first peak is lower than the second peak, and the second peak is lower than the third peak.

6. Crab Pattern

A crab pattern is a technical analysis pattern that indicates that the market is about to go down. It consists of four waves in a row. The first wave is smaller than the second wave, the second wave is smaller than the third wave, and the third wave is larger than the fourth wave.

7. Head and Shoulders Top Pattern

Head and shoulders top pattern is a technical analysis pattern that indicates that the market is about to go down. It consists of two peaks in a row. The first peak is higher than the second peak, and the second peak is higher than the first peak.

8. Senkou Span

Senkou span is a technical analysis tool that uses two lines to show price action. The first line is the current price, and the second line is the high price.

How to trade withfootprint charts

There are a few ways to trade with Footprint charts. One way is to use a Footprint chart to help identify oversold and overbought areas of the market. Another way is to use Footprint charts to help identify when a market is about to reach a bottom or top.

How to find support and resistance using footprint charts

There are a few ways you can find support and resistance using a footprint chart:

1. Look for areas of the chart that have high or low volumes. These are likely to be areas of support and resistance.

2. Compare the prices of the assets in an area to see if they are moving in tandem. If they are, this may be an indication that there is resistance to movement.

3. Compare the prices of assets in different areas of the chart to see if there is any divergence. This could be an indication that there is support to movement.

What is order flow trading and how can footprint charts help?

Order flow trading is a type of trading that uses technical indicators to predict the direction of the market. Footprint charts are a type of technical analysis tool that can help traders understand the flow of orders in the market.

How to use volume profile analysis to improve your crypto trading

Volume profile analysis is a technique that can be used to improve your crypto trading. Volume profile analysis can help you identify patterns in the volume of cryptocurrency trades and help you make better trading decisions.

To use volume profile analysis, you first need to collect data on the volume of cryptocurrency trades. You can collect this data using a variety of methods, including market data providers, CoinMarketCap, or cryptocurrency exchanges.

After you have collected the data, you can use volume profile analysis to identify patterns in the volume of cryptocurrency trades. This information can help you make better trading decisions.

Some common uses for volume profile analysis include:

Identifying trends in the volume of cryptocurrency trades

Determining which cryptocurrencies are most popular

Providing insights into the price dynamics of different cryptocurrencies

Identifying which cryptocurrencies are most likely to experience price volatility

Using volume profile analysis to make better trading decisions can help you improve your overall crypto trading strategy. By using volume profile analysis, you can identify potential opportunities and risks in the market and make better trading decisions.

How to time your trades using footprint chart signals

There is no one definitive answer to this question, as each trader has their own method for timing their trades. However, some methods that may be helpful include using trendlines, Fibonacci retracements, and support and resistance levels.

How to use footprint charts in conjunction with other technical indicators

Footprint charts can be used in conjunction with other technical indicators to help determine the health of a company. For example, if a company's stock price is trending down, it may be a good time to sell shares of the company. If a company's stock price is trending up, it may be a good time to buy shares of the company.