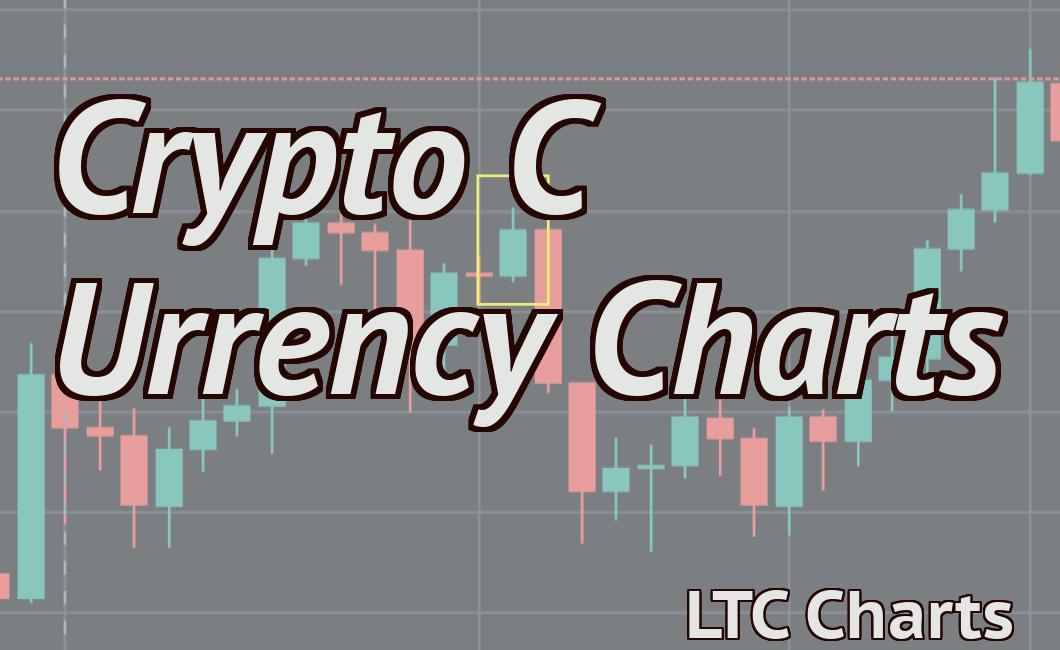

Crypto candlestick charts live.

The article discusses how to read crypto candlestick charts in order to make better investment decisions. It provides an overview of what information is contained in a candlestick chart, and how to interpret that information to make informed investment choices.

Crypto Candlestick Charts: The Basics

Crypto candlestick charts are a great way to visualize the price action of cryptocurrencies. They consist of a set of daily, weekly or monthly candle charts that show the price of a cryptocurrency over a specific time period.

Cryptocurrencies are often traded on exchanges, and they can also be bought and sold on secondary markets. The price of a cryptocurrency can change quickly, and so it’s important to be able to track its movements over time.

Candlestick charts are a great way to do this. They allow you to see the price of a cryptocurrency over a specific period of time, and they also allow you to see how the price has behaved over different time periods.

In this article, we’ll look at the basics of crypto candlestick charts. We’ll also explain how to use them, and we’ll give you a few examples of how they can be used.

What is a Crypto Candlestick Chart?

A crypto candlestick chart is a type of chart that shows the price of a cryptocurrency over a specific time period. Candlestick charts are often used to track the price of cryptocurrencies, but they can also be used to track the price of other assets.

The basic format of a crypto candlestick chart is as follows:

The first column shows the date. The second column shows the open, high, low and close prices for the day. The third column shows the volume for the day. The fourth column shows the crypto currency (or asset) price for the day.

The fifth column shows the percentage change for the day. The sixth column shows the cumulative change for the day. The seventh column shows the 24-hour volume for the day.

The eighth and ninth columns show the open, high, low and close prices for the previous day and the next day, respectively. The tenth column shows the volume for the previous day and the next day, respectively.

The eleventh and twelfth columns show the crypto currency (or asset) price for the previous day and the next day, respectively. The thirteenth column shows the 24-hour volume for the previous day and the next day, respectively.

Crypto Candlestick Charts: How to Use Them

Candlestick charts can be used to track the price of cryptocurrencies, other assets and indices.

To use a crypto candlestick chart, first identify the timeframe that you want to track. For example, you can track the price of a cryptocurrency over a 24-hour period, a 7-day period or a 30-day period.

Next, identify the cryptocurrencies that you want to track. You can track the price of any cryptocurrency that is available on an exchange or on a secondary market.

To track the price of a cryptocurrency over a particular timeframe, identify the start and end dates for that timeframe. For example, you can track the price of a cryptocurrency over a 24-hour period from midnight to midnight.

To track the price of a cryptocurrency over multiple timeframes, you need to identify the start and end dates for each timeframe. For example, you can track the price of a cryptocurrency over a 24-hour period, a 7-day period and a 30-day period.

Finally, identify the columns that you want to use in your crypto candlestick chart. The first column will show the price of the cryptocurrency over the selected timeframe. The second column will show the open, high, low and close prices for the day. The third column will show the volume for the day. The fourth column will show the crypto currency (or asset) price for the day. The fifth column will show the percentage change for the day. The sixth column will show the cumulative change for the day. The seventh column will show the 24-hour volume for the day. The eighth and ninth columns will show the open, high, low and close prices for the previous day and the next day, respectively. The tenth column will show the volume for the previous day and the next day, respectively. The eleventh and twelfth columns will show the crypto currency (or asset) price for the previous day and the next day, respectively. The thirteenth column will show the 24-hour volume for the previous day and the next day, respectively.

Crypto Candlestick Charts: Examples

Here are two examples of how crypto candlestick charts can be used to track the price of cryptocurrencies:

1) To Track the Price of Bitcoin Over Time

To track the price of bitcoin over time, first identify the timeframe that you want to track. For example, you can track the price of bitcoin over a 24-hour period, a 7-day period or a 30-day period.

Next, identify the starting and end dates for that timeframe. For example, you can track bitcoin prices over a 24-hour period from midnight to midnight.

Finally, identify the columns that you want to use in your crypto candlestick chart. The first column will show the price of bitcoin over the selected timeframe. The second column will show the open, high, low and close prices for the day. The third column will show the volume for the day. The fourth column will show the crypto currency (or asset) price for the day. The fifth column will show the percentage change for the day. The sixth column will show the cumulative change for the day. The seventh column will show the 24-hour volume for the day. The eighth and ninth columns will show the open, high, low and close prices for the previous day and the next day, respectively. The tenth column will show the volume for the previous day and the next day, respectively. The eleventh and twelfth columns will show the crypto currency (or asset) price for the previous day and the next day, respectively. The thirteenth column will show the 24-hour volume for the previous day and the next day, respectively.

How to Read Crypto Candlestick Charts

Cryptocurrency candlestick charts are a great way to track the performance of a cryptocurrency over time. These charts show the price and volume of a cryptocurrency over a given period of time.

To use a crypto candlestick chart, first find the date range you want to focus on. This can be found by clicking on the "date" bar at the top of the chart. Next, select the "time frame" you want to view. This can be either "daily," "weekly," or "monthly." Finally, select the "candlestick type" you want to analyze. This can be either "open," "high," "low," or "close."

Once you have selected your options, the chart will display the price and volume data for the chosen time period. To get a better understanding of what's happening on the chart, it's important to understand candlestick terminology.

An "open" candlestick shows that the market opened at the price shown on the candlestick.

A "high" candlestick shows that the market reached the highest price recorded during the time period shown on the candlestick.

A "low" candlestick shows that the market reached the lowest price recorded during the time period shown on the candlestick.

A "close" candlestick shows that the market closed at the price shown on the candlestick.

The Benefits of Live Crypto Candlestick Charts

There are many benefits to using live crypto candlestick charts. One of the most important benefits is that they provide a real-time view of the market conditions. This allows you to make informed decisions about where to buy and sell cryptocurrencies.

Another benefit is that they can help you identify patterns in the market. This can help you predict future trends, and make more informed investment decisions.

Overall, live crypto candlestick charts are an essential part of any cryptocurrency trader's arsenal.

The 5 Most Popular Crypto Candlestick Chart Patterns

1. Bullish candlesticks indicate that the price of a cryptocurrency is going up. They indicate that demand for the cryptocurrency is high and that the price is going to keep going up.

2. Bearish candlesticks indicate that the price of a cryptocurrency is going down. They indicate that demand for the cryptocurrency is low and that the price is going to keep going down.

3. Bullish engulfing candlesticks indicate that the price of a cryptocurrency has reached a high point and is likely to keep going up.

4. Bearish engulfing candlesticks indicate that the price of a cryptocurrency has reached a low point and is likely to keep going down.

5. Dragonfly candlesticks are a combination of bullish and bearish candlesticks. They indicate that the price of a cryptocurrency is in between two points and is likely to go either way.

How to Use Crypto Candlestick Charts to Make Trading Decisions

Crypto candlestick charts are a popular way to analyze cryptocurrency prices. By looking at the chart, you can see the open, high, low, and close prices for a given period of time. You can then use this information to make trading decisions.

To use a crypto candlestick chart, first find the currency you want to trade. You can find this information on various cryptocurrency exchanges. Once you have found the currency, open a new tab or window in your browser and go to CoinMarketCap.com. On the left side of the page, click on the “ candles ” tab. This will display all of the cryptocurrency candles that are currently open. The next step is to select the currency you want to trade. Once you have selected the currency, all of the candles for that particular currency will be displayed.

Now, you will need to find the open, high, low, and close prices for the selected period of time. To do this, you will need to use the “ bar chart ” tool on the right side of the CoinMarketCap page. First, find the “ candles ” tab again. This time, click on the “ bar chart ” tool. This will display all of the bars for the selected period of time. Next, find the bar that corresponds to the open price for the currency you are trading. This will be the top bar on the chart. Next, find the bar that corresponds to the high price for the currency you are trading. This will be the middle bar on the chart. Finally, find the bar that corresponds to the low price for the currency you are trading. This will be the bottom bar on the chart.

Now, you will need to find the closing prices for the selected period of time. To do this, you will need to use the “ candlestick chart ” tool on the right side of the CoinMarketCap page. First, find the “ candles ” tab again. This time, click on the “ candlestick chart ” tool. This will display all of the candlesticks for the selected period of time. Next, find the candlestick that corresponds to the closing price for the currency you are trading. This will be the top candlestick on the chart. Next, find the candlestick that corresponds to the high price for the currency you are trading. This will be the middle candlestick on the chart. Finally, find the candlestick that corresponds to the low price for the currency you are trading. This will be the bottom candlestick on the chart.

The Different Types of Crypto Candlesticks

There are three main types of crypto candlesticks: the Bullish Candlestick, the Bearish Candlestick, and the Inverted Candlestick.

The Bullish Candlestick

The Bullish candlestick is a pattern that shows that the price of a cryptocurrency is rising. It consists of a long body and a short tail. The long body indicates that the price is rising and the short tail indicates that the price is falling.

The Bearish Candlestick

The Bearish candlestick is a pattern that shows that the price of a cryptocurrency is falling. It consists of a long body and a short tail. The long body indicates that the price is rising and the short tail indicates that the price is falling.

Creating a Live Crypto Candlestick Chart

in R

Cryptocurrencies are complex and volatile investment vehicles. To help make informed decisions about whether or not to invest in these digital assets, it is important to have access to reliable information. One way to gain this information is to use a live crypto candlestick chart.

To create a live crypto candlestick chart in R, you will first need to install the rvest package. Then, you can use the rvest::candlestick() function to create a candlestick chart of the top 20 cryptocurrencies by market capitalization.

# install the rvest package library(rvest) # create a candlestick chart of the top 20 cryptocurrencies by market capitalization candlestick(top = round(20, 0), colors = "red", fontSize = 12)

You can also create a live crypto candlestick chart using the qt function from the tibble package.

The Advantages of Using Live Crypto Candlestick Charts

Cryptocurrency candlestick charts are a great way to stay up-to-date with the latest prices and movements in the cryptocurrency market. They provide a visual representation of the price trends over a specific period of time, making it easy to see how prices have changed over time.

Additionally, live crypto candlestick charts make it easy to spot potential buy and sell opportunities. By analyzing the candlestick patterns, you can identify areas where the price is likely to rise or fall. This helps you make informed trading decisions, ensuring that you reap the benefits of increased prices.

Finally, live crypto candlestick charts can be a valuable tool for portfolio management. By tracking the performance of individual cryptocurrencies, you can identify which ones are performing well and which ones are not. This information can help you make informed investment decisions, ensuring that you remain consistent with your overall strategy.