Understanding Charts In Crypto

If you're new to the world of cryptocurrency, you might be feeling a bit overwhelmed by all the information out there. One of the most important things to understand is charts. In this article, we'll break down what charts are and how they can help you make informed decisions about your investments. Charts are simply a graphical representation of data. In the case of cryptocurrency, charts can show you the price of a coin over time, as well as the volume of trade and other important information. One of the most important things to look at when analyzing a chart is the trend. This is simply the overall direction that the price seems to be moving in. Is it going up? Down? Sideways? Another important thing to look at is support and resistance levels. These are points where the price has trouble breaking through either on the way up or on the way down. Analyzing these levels can give you an idea of where the coin might head next. Finally, don't forget to pay attention to news! Cryptocurrency is a very volatile market and news can often have a big impact on prices. By keeping an eye on both charts and news, you'll be in a much better position to make informed decisions about your investments.

How to Read Crypto Charts

Crypto exchanges are a great way to track the value of cryptocurrencies. There are many different exchanges that you can use, so it is important to find one that is reliable and provides the information that you need.

To start, find an exchange that you are interested in. Once you have found the exchange, open it up and look for the charts. The charts will show you the value of the cryptocurrencies that are being traded on the exchange.

To use the charts, you will first need to understand how to read them. Each chart will have a few different pieces of information. The first thing that you will see on the chart is the price. This is the price that the cryptocurrency is currently trading at.

Next, you will see the volume. This is the amount of cryptocurrency that has been traded on the exchange in the past 24 hours.

The next thing that you will see on the chart is the supply and demand. This is a graph that shows how much demand there is for the cryptocurrency and how much supply there is.

The last thing that you will see on the chart is the candle. This is a graphic that shows the movement of the price over a specific period of time.

A Beginner's Guide to Charting in Crypto

Cryptocurrencies are powered by blockchain technology, which allows for a decentralized and secure system. Cryptocurrencies are also open-source, meaning that anyone can review and modify the code.

Cryptocurrencies are built on a blockchain, which is a digital ledger of all cryptocurrency transactions. Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data. Bitcoin, the first and most well-known cryptocurrency, is based on the blockchain technology.

To create a chart in cryptocurrencies, you will need to install a cryptocurrency wallet, which is a software program that stores your cryptocurrencies. After you have installed the wallet, you will need to generate a new wallet address. Next, you will need to buy Bitcoin or Ethereum using your newly generated address. After you have bought the cryptocurrency, you will need to send it to your wallet address. Finally, you will need to open your wallet and generate a new chart.

The Different Types of Charts in Crypto

There are three types of charts that can be used in order to analyze crypto markets: price charts, volume charts, and order books.

1. Price Charts

A price chart is a graphical representation of prices over time. This can be used to track the movement of prices and to identify patterns.

2. Volume Charts

Volume charts show the amount of activity in a given market over time. This can be used to measure liquidity and to identify trends.

3. Order Books

An order book is a graphical representation of the orders that are currently being placed in a market. This can be used to measure liquidity and to predict future movements.

How to Use Technical Analysis with Crypto Charts

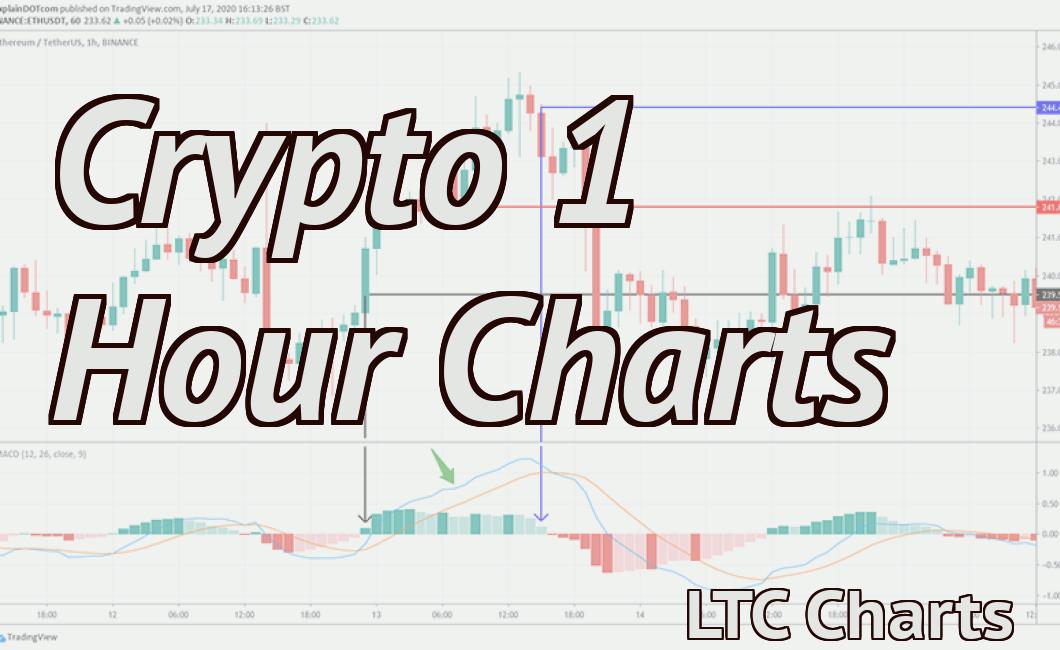

Technical analysis is the use of historical price data and other technical factors to predict future price movements. Crypto charts are perfect for technical analysis because they display detailed information about all of the major cryptocurrencies.

To use technical analysis with crypto charts, first find the appropriate timeframe for your analysis. For example, if you are looking to predict the future price movements for a specific cryptocurrency, you will need to use a longer timeframe (e.g., 1 day, 3 days, 1 month, 3 months, 6 months, 1 year).

Once you have selected the timeframe, you will need to find the appropriate technical indicators. The most popular technical indicators used for crypto analysis are the moving averages (MA), Bollinger Bands (BB), and RSI (relative strength index).

To use technical analysis with crypto charts, first find the appropriate timeframe for your analysis.

After you have selected the timeframe and technical indicators, you will need to find the appropriate charts. The most popular charts used for technical analysis are the cryptocurrency charts (e.g., BTC/USD, ETH/USD, LTC/USD).

To use technical analysis with crypto charts, first find the appropriate timeframe for your analysis.

After you have selected the timeframe and charts, you will need to find the appropriate data points. The most popular data points used for technical analysis are the historical price data for the cryptocurrency you are analyzing (e.g., BTC/USD, ETH/USD, LTC/USD).

The Benefits of Using Charts in Crypto Trading

There are many benefits to using charts in crypto trading. Charts can help traders make informed decisions about where to put their money in order to maximize their profits.

1. Charting Allows You to See Your Progress Over Time

One of the most important benefits of using charts in crypto trading is that they can help you see your progress over time. By seeing where you have been and where you are going, you can make better decisions about where to place your money and how to adjust your strategy as needed.

2. Charts Can Help You Spot Patterns

Charts can also help you spot patterns. By looking at historic data, you can see how prices have moved and what factors have influenced them. This can help you predict future movements, which can give you an edge in the market.

3. Charts Can Help You Avoid False Signals

Another benefit of using charts in crypto trading is that they can help you avoid false signals. Many people fall victim to fake signals because they are not able to see the big picture. By using charts, you can see the overall trend and make better decisions based on that information.

4. Charts Can Help You Identify Trends

One of the most important things you can do when trading cryptocurrencies is to identify trends. By looking at charts, you can see where prices have been going and what may be causing them to move in a particular direction. This can help you make better investment decisions and avoid falling victim to false signals.

5. Charts Can Help You Make Predictions

Another benefit of using charts in crypto trading is that they can help you make predictions. By looking at past data, you can see what factors have influenced prices in the past and how those factors might affect future movements. This can help you make better predictions about where prices are going and what actions you should take to profit from that information.

How to identify key support and resistance levels in crypto charts

There’s no definitive answer to this question, as it depends on the specific cryptocurrency and the type of chart being used. However, some key indicators that may be useful in identifying key support and resistance levels include:

The price of the cryptocurrency at which a particular level of support or resistance is found.

The volume of trading activity at the level of support or resistance.

The price of related cryptocurrencies (if any) at the level of support or resistance.

The trend of the cryptocurrency at the level of support or resistance.

using Fibonacci retracements to find entry and exit points in crypto trading

Fibonacci retracements can be used to identify entry and exit points in crypto trading.

An example of using Fibonacci retracements to find entry and exit points in crypto trading could look like this:

If the price of a crypto falls below the lower Fibonacci retraction line (LF), then it may be a good time to buy the cryptocurrency. Conversely, if the price rises above the upper Fibonacci retraction line (UR), then it may be a good time to sell the cryptocurrency.

Similarly, if the price falls below the lower Fibonacci support line (LS), then it may be a good time to sell the cryptocurrency. Conversely, if the price rises above the upper Fibonacci support line (US), then it may be a good time to buy the cryptocurrency.

Japanese Candlesticks: What They Are and How to Use Them

A candlestick is a charting tool used to display the price of a security over time. The candlestick shows the open, high, low, and close prices for a given trading day.

There are three types of candlesticks: the open, the high, and the low.

The open candlestick shows the price at the beginning of the trading day.

The high candlestick shows the highest price recorded during the trading day.

The low candlestick shows the lowest price recorded during the trading day.

The close candlestick shows the price at the end of the trading day.

The Significance of Chart Patterns in Crypto Trading

Chart patterns are a popular tool used by traders to identify potential opportunities and track the movement of securities. Chart patterns are composed of a series of indicators that are used to identify repeating patterns in price movement.

When you identify a chart pattern, you can use it as a guide to make trading decisions. For example, if you see a pattern of price movement that corresponds with a breakout or reversal, you may decide to buy or sell securities based on that information.

Chart patterns can also provide you with important information about the market conditions that are affecting the security you are trading. For example, if you see a pattern that corresponds with a downtrend in the market, that may suggest that there is an opportunity to buy the security at a lower price.

There are many different chart patterns that can be used to identify opportunities in the securities market. If you are new to trading, it is a good idea to study chart patterns and use them as a tool to make better trading decisions.

Head and Shoulders, Cup and Handle...What Do These Mean?

The meaning of these common terms is pretty straightforward. Head and shoulders, cup and handle, and the like are all references to the stock market. When the stock market goes up, the prices of head and shoulders and cup and handle go up too. When the stock market goes down, the prices of these items go down as well.

Plotting Trendlines on Crypto Charts

Cryptocurrencies are notorious for their volatile prices. This means that it can be tough to predict where prices will go next. However, there are some techniques you can use to help make predictions.

One way to do this is to plot trendlines on crypto charts. By doing this, you can see how prices have behaved in the past and determine where they are likely to go in the future.

Trendlines can help you make informed predictions about where prices are likely to go.

For example, if you see a crypto price trendline that slopes upwards, this suggests that prices are likely to continue climbing in the future. Conversely, if you see a downwards-sloping trendline, this suggests that prices are likely to decline in the future.

Trendlines can be helpful when predicting the future price of cryptocurrencies.

However, it is important to remember that trends can change very quickly in the cryptocurrency world. So, always keep an eye on cryptocurrency prices in order to stay ahead of the curve.

Making use of Moving Averages in Crypto Trading

Moving averages (MA) are a technical analysis tool that traders use to help identify potential price trends. MA can be used to identify support and resistance levels, as well as to predict where the market is heading.

When using MA in crypto trading, traders should keep in mind that the tool is not infallible. Moving averages can be unpredictable and can sometimes lead traders astray. However, MA is a valuable tool that can be used to improve investment decisions.