Crypto Indicators Charts

This article provides an overview of the different types of charts that are commonly used by cryptocurrency traders to help make informed decisions about when to buy and sell digital assets. The article discusses the pros and cons of each type of chart, as well as common indicators that are used to interpret them.

Crypto Indicators: A Beginner's Guide

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

The Most Important Crypto Indicators

Bitcoin

Bitcoin is the cryptocurrency that was invented by Satoshi Nakamoto. Bitcoin is a digital asset and a payment system. Transactions are verified by network nodes through cryptography and recorded in a public dispersed ledger called a blockchain. Bitcoin is sometimes referred to as the first cryptocurrency, although prior systems existed. Bitcoin is unique in that there are a finite number of them: 21 million.

Bitcoin has been in a bull market for the past few years and is expected to continue to grow. The value of a single bitcoin has increased from $0.003 to over $19,000 in just over 10 years.

Ethereum

Ethereum is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of fraud or third party interference. Ethereum uses a blockchain for security and transactions.

Ethereum is growing quickly and is expected to be one of the most valuable cryptocurrencies in the future. The value of a single Ethereum has increased from $8 to over $800 in just over a year.

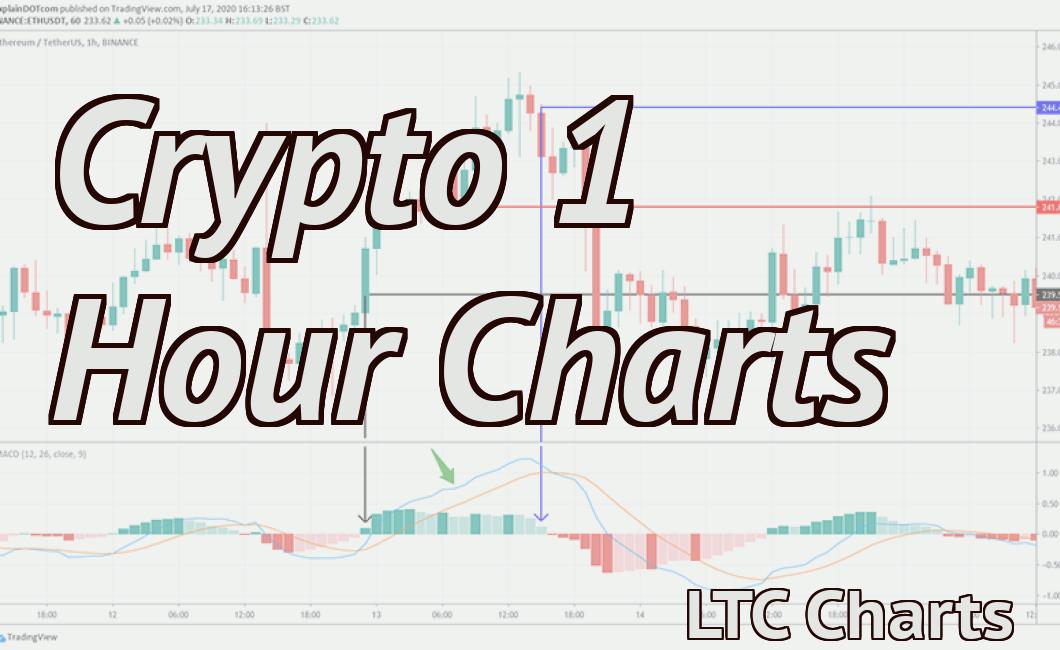

The Best Crypto Indicators for Day Trading

There are different types of crypto indicators that can be used for day trading purposes. Some of the most popular ones include the MACD, RSI, and Ichimoku Cloud.

The MACD is a popular technical indicator that measures the difference between two moving averages. The RSI is a technical indicator that measures the strength of a stock’s relative movement. The Ichimoku Cloud is a popular technical indicator that measures the trend direction and momentum of a stock.

Each of these indicators has its own benefits and drawbacks. It is important to choose the right one for your own trading strategy.

The Best Crypto Indicators for Swing Trading

There are a number of different indicators that can be used for swing trading cryptocurrencies. These indicators can help traders identify when a price is about to change direction, and allow them to take advantage of these changes.

The following indicators can be used for swing trading cryptocurrencies:

1. MACD

The MACD is a technical indicator that can be used to help identify when a price is about to change direction. The MACD indicator plots the average value of the MACD line over a given period of time. When the MACD line is moving higher, this indicates that the price is about to increase in value, and when the MACD line is moving lower, this indicates that the price is about to decrease in value.

2. RSI

The RSI indicator is also known as the “momentum” indicator. It plots the relative strength of a cryptocurrency against the rest of the market. When the RSI is moving higher, this indicates that demand for the cryptocurrency is increasing, and when the RSI is moving lower, this indicates that demand for the cryptocurrency is decreasing.

3. Fibonacci retracement levels

Fibonacci retracement levels can also be used for swing trading cryptocurrencies. These levels correspond to points where the price of a cryptocurrency has decreased by 50% or increased by 100%. When a cryptocurrency reaches a Fibonacci retracement level, this indicates that the price is about to change direction.

4. Time-frame analysis

Swing traders can also use time-frame analysis to identify when a price is about to change direction. For example, traders might look at a cryptocurrency’s 24-hour chart to see if the price is about to change direction.

The Best Crypto Indicators for Long-Term Investing

Cryptocurrencies are volatile, and it can be difficult to predict their future performance. However, there are a few indicators that can help you track the health of the crypto market and make informed investment decisions.

1. CoinMarketCap.com

CoinMarketCap.com is the world’s leading cryptocurrency market data aggregator. It provides real-time prices and volumes for over 1,500 coins and tokens. This information can help you track the performance of individual coins and tokens as well as the overall market trend.

2. Bitfinex

Bitfinex is one of the world’s leading digital asset exchanges. It offers a variety of trading platforms, including a margin trading platform. This allows you to speculate on the price movements of cryptocurrencies without having to put up a large investment.

3. BitMEX

BitMEX is one of the world’s leading bitcoin and cryptocurrency derivatives exchanges. It offers a variety of contract types, including futures, options, and swaps. This allows you to speculate on the price movements of cryptocurrencies without having to put up a large investment.

4. CoinMarketCap.com

CoinMarketCap.com is the world’s leading cryptocurrency market data aggregator. It provides real-time prices and volumes for over 1,500 coins and tokens. This information can help you track the performance of individual coins and tokens as well as the overall market trend.

3 Simple Crypto Indicators that Work

Cryptocurrency prices are notoriously volatile, so it can be tough to tell when a market is about to experience a significant shift. However, there are a few simple indicators that can help you track the markets more accurately.

1. Order books: When buyers and sellers are vying for a limited supply of assets, the markets will tend to move in tandem. This is shown by the order books – a list of all the orders that have been placed for a specific asset. When the order books are tightly clustered around the current price, this is a sign that the market is experiencing strong demand. Conversely, when the order books are spread out, this indicates that there is less demand for the asset and that the price may be about to drop.

2. Volume: When investors start to sell an asset, they will typically do so in large quantities. This is shown by the volume of trading – the number of contracts exchanged in a given period of time. When volume is high, this indicates that many people are selling the asset, and this is usually a sign that the market is about to drop. Conversely, when volume is low, this indicates that few people are selling the asset, and this is usually a sign that the market is about to rise.

3. Cryptocurrency prices over time: It’s important to keep an eye on how cryptocurrency prices have behaved over time. This can help you identify patterns that may indicate when the markets are about to shift. For example, if prices have been trending upwards for several months, it might be a good indication that the market is about to experience a major shift. Conversely, if prices have been trending downwards for a longer period of time, this might be an indication that the market is about to experience a reversal.

5 Powerful Crypto Indicators Every Trader Needs to Know

!

1. Price levels

A good indicator to look at when trading cryptocurrencies is price levels. When the price of a coin reaches a certain level, this often indicates that there is strong demand for that coin and that it is likely to stay at that level for a while.

2. Volume

Another important indicator to look at when trading cryptocurrencies is volume. When a lot of people are buying and selling a coin, this often indicates that the coin has a lot of value and is likely to stay at its current price for a while.

3. Technical indicators

Technical indicators can help traders figure out when a cryptocurrency is about to make a big move up or down. These indicators can include things like the Bollinger Band, RSI, and the MACD.

4. Social media activity

Cryptocurrencies are often very volatile, which means that they can change a lot in price depending on what people are saying about them on social media. If you see a lot of positive chatter surrounding a certain cryptocurrency, this may indicate that it is worth investing in. Conversely, if you see a lot of negative chatter, this may indicate that it is worth avoiding that cryptocurrency.

How to Use Crypto Indicators to Maximize Your Profits

Crypto indicators are a great tool to help you make informed decisions when trading cryptocurrencies. They can help you identify opportunities, determine trends, and predict future price movements.

Here are four crypto indicators you can use to maximize your profits:

1. MACD

The Moving Average Convergence-Divergence indicator (MACD) is a technical indicator used to identify the overbought and oversold conditions of a stock, currency, or other financial instrument.

When the MACD is rising, this indicates that the asset is overvalued and may be subject to a potential market correction. Conversely, when the MACD is falling, this suggests that the asset may be undervalued and is ripe for investment.

2. RSI

The Relative Strength Index (RSI) is a technical indicator that measures the speed and change of a security's price movement over time.

When the RSI is above 50%, this indicates that the market is bullish and prices are likely to increase. Conversely, when the RSI falls below 50%, this suggests that the market is bearish and prices are likely to decrease.

3. Bollinger Bands

The Bollinger Bands are a technical indicator used to measure volatility. They consist of two bands: the upper band indicates a more stable market and the lower band indicates a more volatile market.

When the Bollinger Bands are in the middle area (between the upper and lower bands), this indicates that the market is in equilibrium. When the Bollinger Bands are moving closer to the upper band, this suggests that the market is more volatile and is prone to price fluctuations. When they move closer to the lower band, this indicates that the market is less volatile and is less likely to experience price fluctuations.

4. Fibonacci Retracements

Fibonacci retracements are a technical analysis tool used to identify areas of support and resistance. They are derived from the Fibonacci sequence, which describes the relationship between two ratios: the 0.618 Fibonacci ratio and the 0.382 Fibonacci ratio.

When prices reach support or resistance levels based on the Fibonacci sequence, this can indicate where buyers or sellers are likely to establish new positions.

2 Essential Crypto Indicators for any Trading Strategy

1. Price Movement

The price of a cryptocurrency should always be a key indicator when analyzing a trading strategy. The price of a cryptocurrency should move in a consistent and predictable manner, so it can be used as a basis for predicting future price movements.

2. Volume

Another key indicator to look at is the volume of a cryptocurrency. Volume should increase and decrease in a predictable manner, which can be used to predict future price movements.

3. Supply and Demand

Another important indicator to look at is the supply and demand of a cryptocurrency. The supply and demand of a cryptocurrency should always be in equilibrium, so it can be used to predict future price movements.

Trading with crypto indicators – a step by step guide

If you’re looking to trade with crypto indicators, there are a few things you need to do first.

1. Create a trading account with a reputable broker or exchange

2. Deposit funds into your account

3. Create an account with a crypto trading platform

4. Load your trading account with the appropriate crypto assets

5. Set up your crypto indicators

6. Start trading!

1. Create a trading account with a reputable broker or exchange

Before you can start trading with crypto indicators, you'll need to create a trading account with a reputable broker or exchange. This will allow you to trade with real money and avoid potential scams and fraud.

2. Deposit funds into your account

Once you have your trading account set up, you'll need to deposit funds into it. This will allow you to trade with real money and make profits.

3. Create an account with a crypto trading platform

Next, you'll need to create an account with a crypto trading platform. This will allow you to track the prices of various crypto assets and trade them using your crypto indicators.

4. Load your trading account with the appropriate crypto assets

Once you have an account with a crypto trading platform, you'll need to load your account with the appropriate crypto assets. This will allow you to trade with real money and make profits.

5. Set up your crypto indicators

Now that you have your trading account set up and loaded with the appropriate crypto assets, you'll need to set up your crypto indicators. This will allow you to track the prices of various cryptocurrencies and predict future trends.

How to read and understand crypto indicators

There is no one definitive way to read and understand crypto indicators. However, some basic steps include understanding the concept of a cryptocurrency, understanding how exchanges work, and understanding how to read charts. Additionally, it is important to be aware of the different types of crypto indicators and their uses.

What do crypto indicators mean?

Crypto indicators are a type of technical analysis used to measure the health of a cryptocurrency market. They can be used to identify potential areas of price support and resistance, and can provide valuable insights into the overall trend of a given coin.