Crypto Charts Signals

This article discusses various crypto charts and signals that can be used by investors to make informed decisions about their investments. It covers topics such as support and resistance levels, moving averages, and price patterns.

crypto charts signals: The Future of Currency Trading

Cryptocurrencies are a new type of digital asset that uses cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Bitcoin is the first and most well-known cryptocurrency. Bitcoin is traded on a variety of exchanges and can also be used to purchase goods and services.

Other popular cryptocurrencies include Ethereum, Litecoin, and Bitcoin Cash. Cryptocurrencies are not backed by any government or central institution, so they are highly volatile and can be difficult to value.

Many investors believe that cryptocurrencies will become more accepted and valuable over time. Cryptocurrencies may eventually become the standard form of currency for online transactions.

crypto charts signals: How to Make Money with Bitcoin

Bitcoin is a digital asset and a payment system:3 It operates as a decentralized peer-to-peer network. Transactions are verified by network nodes through cryptography and recorded in a public dispersed ledger called a blockchain. Bitcoin was invented by an unknown person or group of people under the name Satoshi Nakamoto.

Bitcoin has been criticized for the amount of electricity consumed by mining. As of 2015, The Economist estimated that even if all miners used modern facilities, the combined electricity consumption would be 166.7 megawatts (1.46 terawatt-hours per year).

crypto charts signals: The Benefits of Cryptocurrency Trading

Cryptocurrencies have been making headlines as of late as they are becoming more popular as a form of investment. While there are many benefits to trading cryptocurrencies, here are five of the biggest:

1. Easier to Use and Less Risky Than Traditional Investments

As cryptocurrencies are decentralized, they are not subject to the same regulations as traditional investments. This means that they are less risky and easier to use than traditional investments.

2. Greater Returns Than Traditional Investments

Cryptocurrencies have exhibited higher returns than traditional investments in the past. This is due to the fact that cryptocurrencies are not subject to the same regulations as traditional investments.

3. Greater Flexibility Than Traditional Investments

Cryptocurrencies are more flexible than traditional investments. This means that you can trade them for a variety of reasons, including speculation and hedging.

4. Greater Privacy Than Traditional Investments

Cryptocurrencies are more private than traditional investments. This is due to the fact that they are not subject to the same regulations as traditional investments.

5. Greater Freedom of Choice Than Traditional Investments

Cryptocurrencies give you greater freedom of choice than traditional investments. This is because you can choose which cryptocurrencies to invest in.

crypto charts signals: The Risks of Cryptocurrency Trading

Cryptocurrencies have become a hot topic in recent years, with many people interested in trading them. However, before you start trading cryptocurrencies, it's important to understand the risks involved.

1. Volatility

One of the biggest risks associated with cryptocurrency trading is the volatility of the markets. This means that the prices of cryptocurrencies can be very unstable, swinging quickly and dramatically up or down.

This volatility can be difficult to understand and predict, and it can be difficult to stomach when it goes against your own investment plans. If you're not prepared for the swings in prices, you could find yourself losing a lot of money very quickly.

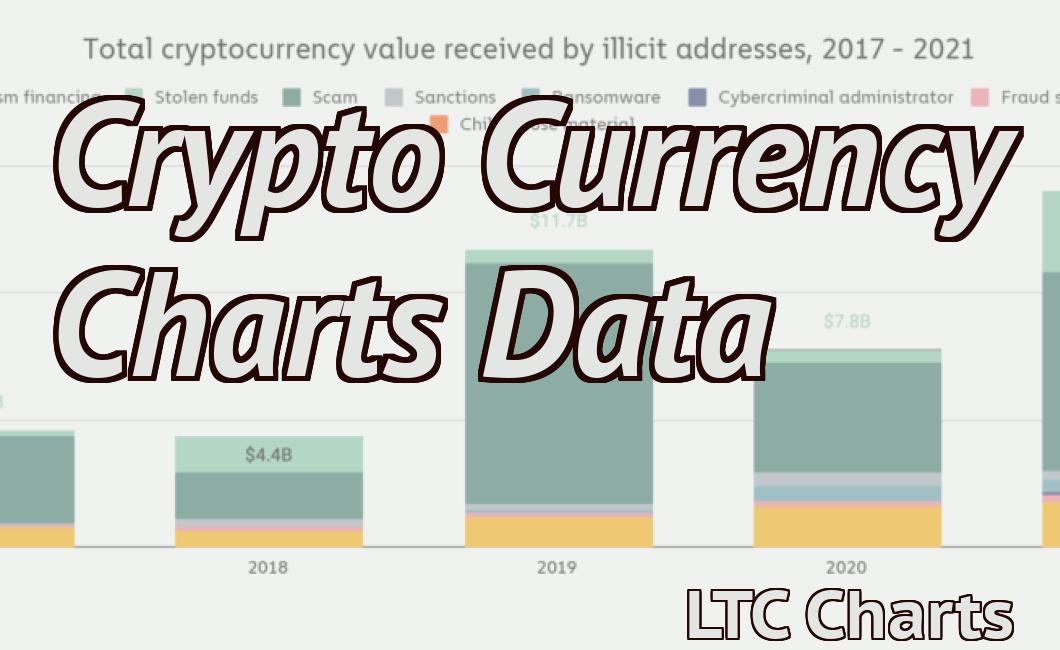

2. The risk of theft

Another big risk associated with cryptocurrency trading is the risk of theft. Cryptocurrencies are digital, so they can be stolen easily if they're not properly protected.

If your cryptocurrency is stolen, it's likely that you won't be able to get it back. This could lead to a big loss, and it could also create a lot of difficult situations and headaches down the road.

3. The risk of fraud

Another big risk associated with cryptocurrency trading is the risk of fraud. Cryptocurrencies are digital, so they're vulnerable to scam artists who may try to steal your money or deceive you into making false investments.

If you're not careful, you could easily fall victim to fraudulent activities and end up losing a lot of money.

4. The risk of market crashes

Another risk associated with cryptocurrency trading is the risk of market crashes. Cryptocurrencies are famously volatile, and a market crash can cause the prices of cryptocurrencies to plummet.

If you're not prepared for a market crash, you could find yourself losing a lot of money very quickly.

5. The risk of investing in a volatile market

Finally, another big risk associated with cryptocurrency trading is the risk of investing in a volatile market. Cryptocurrencies are famously volatile, so if you invest money in them expecting them to be stable and reliable, you could be disappointed.

Cryptocurrencies are still in their early stages, and there's a lot of room for them to grow and improve. However, they can also suffer from huge swings in prices, which means that you could lose a lot of money if you invest in them without being prepared for that volatility.

crypto charts signals: The Basics of Cryptocurrency Trading

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services.

crypto charts signals: The Different Types of Cryptocurrency

Signals

There are different types of cryptocurrency signals and each one can provide you with a different type of information.

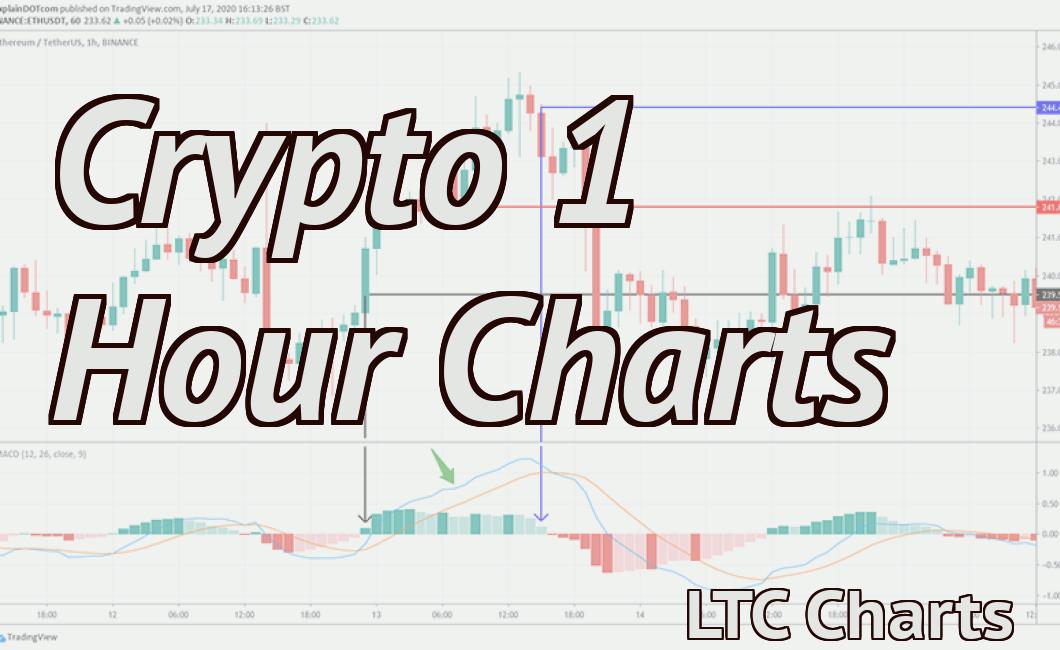

1. Technical indicators: Technical indicators are used to identify patterns in price and volume data that can indicate the health of a cryptocurrency market. Some of the most popular technical indicators include the Bollinger Bands, the 50/200EMA, and the MACD.

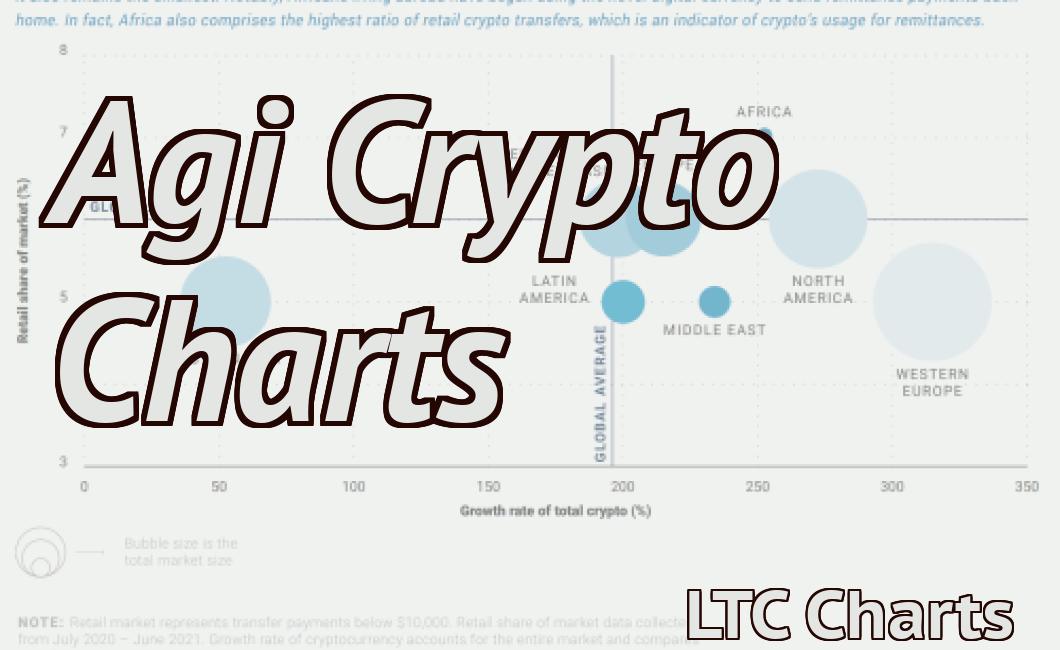

2. Social media analysis: Social media analysis can help you to identify trends and patterns in the way that people are talking about cryptocurrencies. Some of the most popular social media analysis tools include Twitter bots, Google Trends, and Facebook Insights.

3. Fundamental analysis: Fundamental analysis is the study of a company's financial statements to determine whether or not it is worth investing in. Some of the most popular fundamental analysis tools include the P/E Ratio, the ROIC, and the Price-to-Earnings Ratio.

crypto charts signals: How to Choose a Cryptocurrency Exchange

Cryptocurrency exchanges are essential for trading cryptocurrencies. There are a number of factors to consider when choosing an exchange, including fees, security, and user experience. Here are some tips for choosing a cryptocurrency exchange:

fees

The fees charged by a cryptocurrency exchange will play a major role in determining which exchange is the best for you. Some exchanges offer lower fees than others, but beware of exchanges with high fees that may charge hidden fees.

security

Cryptocurrency exchanges are essential for trading cryptocurrencies, but they are also high-risk investments. Make sure that the exchange you choose is reliable and has a strong security system in place.

user experience

One of the most important factors to consider when choosing a cryptocurrency exchange is the user experience. Make sure that the exchange you choose is easy to use and has comprehensive customer support.

crypto charts signals: The Advantages of Cryptocurrency Trading

Cryptocurrency trading signals are a great way to improve your trading skills and make more money. Here are some of the advantages of using cryptocurrency trading signals:

1. Increased profits

Using cryptocurrency trading signals can help you make more money. By following the right signals, you can make consistent profits in your trading activities.

2. Improved trading skills

Learning how to use cryptocurrency trading signals can help you improve your trading skills. By following the right signals, you can improve your ability to spot opportunities and make smart decisions in your trading activities.

3. Automated trading

Cryptocurrency trading signals can help you automate your trading activities. By using cryptocurrency trading signals, you can reduce the time and effort you spend on trading. This can help you focus on other aspects of your business.

4. Flexible trading

You can trade cryptocurrency signals in a variety of ways. You can use them to trade manually or use them to automate your trading activities. This makes it easier for you to trade profitably and without having to spend a lot of time on trading.

crypto charts signals: The Disadvantages of Cryptocurrency Trading

Cryptocurrency trading can be a lucrative investment, but it also comes with a number of risks. Here are three of the biggest:

1. Lack of Regulation

Unlike traditional securities markets, cryptocurrency markets are largely unregulated. This means that there is no central body that can guarantee the safety and security of investors’ funds. In fact, some of the most notorious cryptocurrency exchanges have been known to go bankrupt, resulting in the loss of millions of dollars of investors’ money.

2. Volatility

Cryptocurrency prices are highly volatile, which makes it difficult for investors to predict how their investments will perform. This volatility can be both good and bad, as it can provide short-term rewards for those who know how to capitalize on it, but it can also lead to large losses for those who don’t.

3. Fraud

Cryptocurrencies are often targeted by fraudsters, who try to exploit vulnerabilities in the system to steal money from unsuspecting investors. As with any investment, it’s important to do your homework before investing in cryptocurrencies, and to be vigilant for signs of fraud.

crypto charts signals: Should You Start Trading Cryptocurrency?

Cryptocurrencies are a fascinating investment opportunity, but it’s important to do your research before starting to trade them. There are a lot of factors to consider, including the potential risks and rewards. Here are some tips to help you decide if trading cryptocurrencies is right for you:

1. Do your research

Before trading cryptocurrencies, it’s important to do your research. There are a lot of risks involved, so it’s important to be aware of them. Make sure you understand the risks involved in trading cryptocurrencies and understand the potential rewards.

2. Consider your investment goals

Before you start trading cryptocurrencies, it’s important to consider your investment goals. Are you looking to make money quickly? Are you looking to invest in a long-term project? You need to decide what kind of trader you are before you start trading.

3. Consider the risk vs. reward

One of the main considerations when trading cryptocurrencies is risk vs. reward. The risk is the chance of losing your money, and the reward is the potential gain if you are successful. You need to decide how much risk you are willing to take on in order to achieve your desired reward.

4. Understand the volatility of cryptocurrencies

One of the main risks associated with trading cryptocurrencies is their volatility. Cryptocurrencies are highly volatile, which means that their value can change rapidly. This can be a risk if you don’t know how to handle volatile prices.

5. Consider your financial stability

Many people are hesitant to trade cryptocurrencies because they don’t have any financial stability. If you’re not prepared to lose your money, trading cryptocurrencies may not be the best option for you. Before you start trading, make sure you have a solid understanding of cryptocurrency trading and have a plan for how you will handle any losses.