What formula should be used on crypto charts to find triangles?

The article discusses the different formulas that can be used to find triangles on crypto charts. It outlines the pros and cons of each formula and provides guidance on which one to use based on the trader's goals.

How to Use Triangles to Find the Right Crypto Chart Formula

To find the right cryptocurrency chart formula, you will need to understand how to use triangles. Triangles are used to identify trends and patterns in data. By understanding how to use triangles, you can find the right cryptocurrency chart formula to track your investments.

To use triangles to find the right cryptocurrency chart formula, start by identifying the trend you want to track. For example, if you want to track the trend of Bitcoin prices, you would look for a triangle that shows a upward trend. Next, identify the indicator you want to use to track the trend. For example, if you are looking for a Bitcoin price chart, you would use the closing price of Bitcoin. Finally, use the triangle formula to identify the appropriate timeframe for your investment. For example, if you are looking for a Bitcoin price chart that covers the past month, you would use the triangle formula to calculate the closing price for the past month.

The 3 Best Triangle Formulas for Crypto Charts

When it comes to cryptocurrency charts, there are a few triangle formulas that are often used. These triangle formulas can help to create attractive and informative charts that can help investors and traders to better understand the dynamics of a given cryptocurrency.

1. Fibonacci Retracement

The Fibonacci retracement is a popular triangle formula that is used to identify the areas of support and resistance. This formula was developed by Leonardo Fibonacci in the early 13th century, and it is based on the Fibonacci sequence.

The Fibonacci retracement is used to identify the levels of support and resistance in a given market. When using this formula, investors and traders can identify areas where prices have been stable in the past and where they may be more likely to bounce back or break out.

2. Ichimoku Kinko Hyo

Ichimoku Kinko Hyo is a popular technical analysis tool that is used to identify the trend of a given market. This tool uses five colors to indicate the level of activity in a given market.

The colors used in Ichimoku Kinko Hyo are red, green, blue, white, and black. The colors correspond to the levels of momentum in a given market. When using this tool, investors and traders can identify the current trend and whether or not it is heading in a positive or negative direction.

3. MACD

The MACD is a popular technical analysis tool that is used to identify the trend of a given market. This tool uses moving averages to indicate the level of momentum in a given market.

The MACD uses three Moving Averages to indicate the level of momentum in a given market. The MACD uses the Signal Line, the Divergence Line, and the MACD Line. When using this tool, investors and traders can identify the current trend and whether or not it is headed in a positive or negative direction.

How to Read Crypto Charts with Triangles

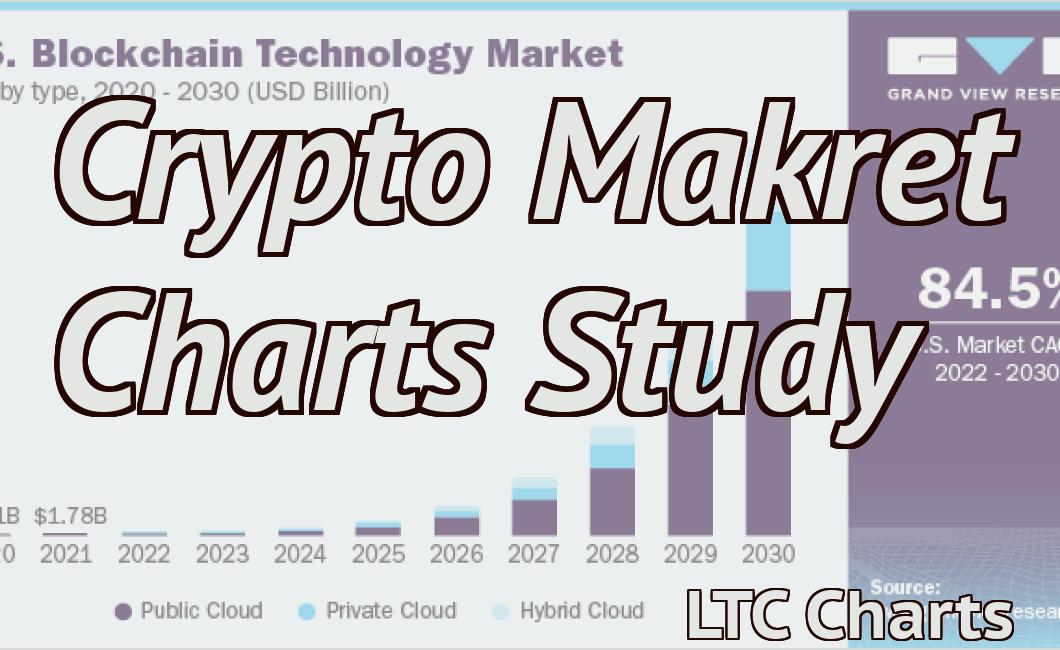

Cryptocurrencies are often traded on exchanges and can be viewed in a number of different ways. One way to view cryptocurrencies is to look at their price over time. This can be done by looking at a cryptocurrency's price on a given day, week, or month, and then looking at the price over that same period of time in previous years.

Another way to view cryptocurrencies is by looking at their value against other currencies. This can be done by looking at the value of a cryptocurrency against one or more other currencies, or by looking at the total value of all cryptocurrencies in circulation.

Cryptocurrencies can also be viewed in terms of their market capitalization. This is calculated by multiplying a cryptocurrency's price by the total number of coins in circulation.

The Ultimate Guide to Triangles on Crypto Charts

Triangles are a popular technical indicator used to measure the momentum of a cryptocurrency. The indicator consists of the three largest candles on the chart, and is used to identify whether the current trend is up, down, or sideways.

The triangle indicator is a helpful tool for traders because it can help to confirm trend changes and identify potential reversals. When used correctly, the triangle can help to identify buy and sell signals.

How to Use the Triangle Indicator on Cryptocurrency Charts

To use the triangle indicator on cryptocurrency charts, first select the three largest candles on the chart. Next, plot the indicators on the chart according to the instructions provided by the software. Finally, use the triangle indicator to determine whether the current trend is up, down, or sideways.

Keep in mind that the triangle indicator is only one piece of information that you need to make informed trading decisions. Always use other indicators, such as moving averages or Bollinger Bands, to help you better understand the market conditions.

How to Use Fibonacci Retracements to Find Triangles in Crypto Charts

There are several ways to use Fibonacci retracements to find triangles in crypto charts.

Using Fibonacci Retracements to Identify Support and Resistance

One way to use Fibonacci retracements is to identify support and resistance levels.

If the price is trading near a support level, it is likely that there is strong buying pressure present.

Likewise, if the price is trading near a resistance level, it is likely that there is strong selling pressure present.

Using Fibonacci Retracements to Identify Trendlines

Another way to use Fibonacci retracements is to identify trendlines.

If the price is trading near a trendline, it is likely that there is strong buying pressure present.

Likewise, if the price is trading near a trendline, it is likely that there is strong selling pressure present.

Using Fibonacci Retracements to Identify Areas of Oversold or Overbought Conditions

Finally, another way to use Fibonacci retracements is to identify areas of oversold or overbought conditions.

If the price is trading near an area of oversold conditions, it is likely that there is weak demand present.

Likewise, if the price is trading near an area of overbought conditions, it is likely that there is strong demand present.

The triangle breakout strategy for crypto charts

When you are trading cryptocurrencies, it is important to have a breakout strategy. This will help you identify when a security is about to break out of its current trading range and make a purchase or sell order.

There are a few different triangle breakout strategies that you can use when trading cryptocurrencies. The following are two of the most popular strategies:

The bottom-up breakout strategy

The top-down breakout strategy

Both of these strategies involve identifying a security's breakout price point and then making a purchase or sell order at or above that price point.

How to find support and resistance using triangles on crypto charts

Finding support and resistance is one of the most important skills you can learn when trading on cryptocurrency charts.

To find support, look for a triangle where the bottom of the triangle is near the price you want to buy, and the top of the triangle is near the price you want to sell.

If the price is inside the triangle, that means there's support and you can buy the cryptocurrency at that price.

If the price is outside the triangle, that means there's resistance and you can't buy the cryptocurrency at that price.

To find resistance, look for a triangle where the bottom of the triangle is near the price you want to sell, and the top of the triangle is near the price you want to buy.

If the price is inside the triangle, that means there's resistance and you can't sell the cryptocurrency at that price.

If the price is outside the triangle, that means there's support and you can sell the cryptocurrency at that price.

Using trend lines to identify triangles in crypto charts

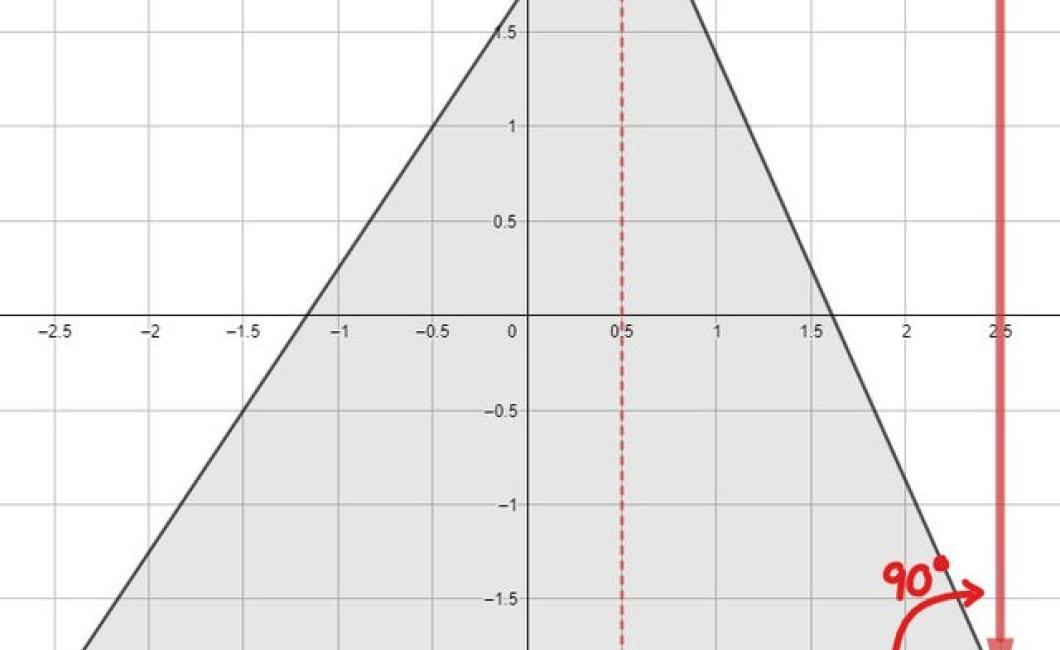

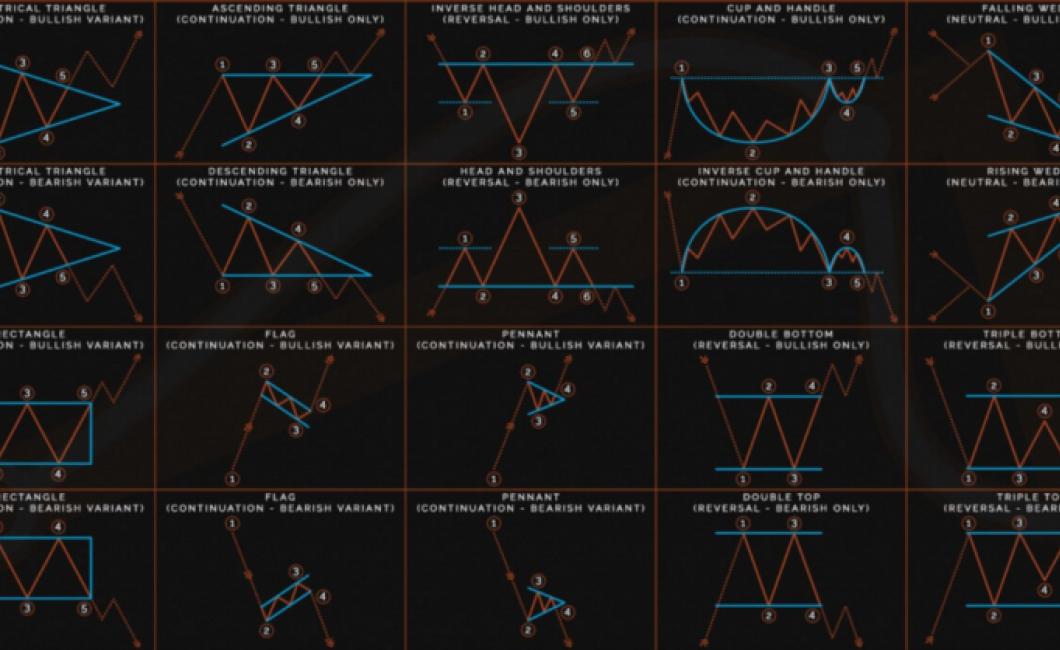

There are three types of triangles that can appear in crypto charts: ascending, descending, and symmetrical.

An ascending triangle is when the price of a cryptocurrency is increasing, and it has reached the apex of its trajectory.

A descending triangle is when the price of a cryptocurrency is decreasing, and it has reached the bottom of its trajectory.

A symmetrical triangle is when the price of a cryptocurrency is staying the same, but it has reached a point where it is starting to move in the same direction.

The power of the triangle in crypto charting

One of the most powerful tools in crypto charting is the triangle.

When you see a triangle, it's a sign that there is a potential for price movement in the near future.

The shape of the triangle can be used to determine the direction of the price movement.

The three points of the triangle are called the apex, the base, and the hypotenuse.

The apex is the highest point of the triangle and is typically where the price of the asset is at its highest.

The base is the lowest point of the triangle and is typically where the price of the asset is at its lowest.

The hypotenuse is the middle point of the triangle and is where the price of the asset is likely to move between the apex and the base.

Why triangles are important in crypto charting

Triangles are an important part of any crypto chart. They are used to identify uptrends and downtrends. When a triangle is formed, it means that the price is about to change direction.

How to use triangles to your advantage in crypto trading

Triangles can be used in crypto trading to your advantage. When examining a triangle, it is important to understand the three points of the triangle: the apex, the base, and the hypotenuse.

The apex is the point at which the triangle's sides meet. The base is the point closest to the apex. The hypotenuse is the longest side of the triangle and is the side that connects the apex and the base.

When examining a triangle, it is important to understand the three points of the triangle: the apex, the base, and the hypotenuse.

The apex is the point at which the triangle's sides meet. The base is the point closest to the apex. The hypotenuse is the longest side of the triangle and is the side that connects the apex and the base.

When examining a triangle, it is important to understand the three points of the triangle: the apex, the base, and the hypotenuse.

The apex is the point at which the triangle's sides meet. The base is the point closest to the apex. The hypotenuse is the longest side of the triangle and is the side that connects the apex and the base.

When examining a triangle, it is important to understand the three points of the triangle: the apex, the base, and the hypotenuse.

The key to trading triangles is understanding how they work and using that information to your advantage. When studying a triangle, pay attention to where the apex and base are located, as well as where the hypotenuse lies. This will give you important information about where the market is headed.