Learn how to read crypto charts- the ultimate guide part 1.

This is the first part of an ultimate guide on how to read crypto charts. In this part, you will learn the basics of reading crypto charts. You will learn about the different types of charts and how to read them. You will also learn about the different indicators and how to use them.

How to read crypto charts for beginners – the ultimate guide

Cryptocurrencies are complex and ever-changing ecosystems. As such, it can be difficult to read crypto charts and understand how they work.

This guide will teach you how to read crypto charts for beginners, so that you can get a better understanding of how cryptocurrencies work.

1. Understand what a ‘cryptocurrency’ is

A cryptocurrency is a digital or virtual currency that uses cryptography to secure its transactions and to control the creation of new units.

Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

2. Understand how cryptocurrencies work

Cryptocurrencies are built on blockchain technology. Blockchain is a distributed ledger that allows for transparent, secure and tamper-proof transactions.

Cryptocurrencies are generated through a process called mining. Miners are rewarded with cryptocurrency for verifying and validating transactions on the blockchain.

3. Read the market conditions for each cryptocurrency

Before you can begin to read crypto charts, you first need to understand the market conditions for each cryptocurrency.

Cryptocurrencies are highly volatile, and their prices can change quickly. Therefore, it is important to monitor the market conditions for each cryptocurrency before you invest.

4. Understand the basics of charting

To read crypto charts, you first need to understand the basics of charting.

Cryptocurrencies are traded on a variety of exchanges, and their prices are often displayed on different types of charts.

When you are reading crypto charts, it is important to understand the following terms:

candle: A candle is a graphical representation of a trade that occurred on a cryptocurrency exchange. Candles typically show the volume (in tokens) of trades that occurred over a certain period of time.

A candle is a graphical representation of a trade that occurred on a cryptocurrency exchange. Candles typically show the volume (in tokens) of trades that occurred over a certain period of time. Bollinger Bands: Bollinger Bands are a popular tool used to analyze price movements. They show two bands - the upper band indicates the current price range, and the lower band indicates the range of prices that is likely to be reached in the near future.

Bollinger Bands are a popular tool used to analyze price movements. They show two bands - the upper band indicates the current price range, and the lower band indicates the range of prices that is likely to be reached in the near future.Moving Averages: Moving averages are used to identify longer-term trends in prices. They show the average price over a specific number of periods (usually 10 or 20).

Moving averages are used to identify longer-term trends in prices. They show the average price over a specific number of periods (usually 10 or 20). RSI (Relative Strength Index): RSI is a popular tool used to measure the strength of a trend. The RSI value is usually above 50 when the trend is strong, and below 50 when the trend is weak.

How to read cryptocurrency charts – a step-by-step guide

1. Download a cryptocurrency trading platform. There are many to choose from, but some of the more popular options are CoinMarketCap, CoinGecko, and CoinDesk.

2. Register for an account on the platform.

3. Load up the platform with your chosen cryptocurrency.

4. Find the cryptocurrency you wish to trade on the platform.

5. Click on the chart to display the latest price and information.

6. Look for the green candle symbol next to the cryptocurrency's name. This indicates that the price is currently at or near the bottom of a buying or selling range.

7. If you spot a red candle symbol next to the cryptocurrency's name, this indicates that the price is currently at or near the top of a buying or selling range.

8. Hover your cursor over the candle symbols to see additional information, such as the percentage gain or loss for that particular session, the trading volume for that particular currency, and the 24-hour price history.

9. When you have made your decision, click on the buy or sell button to place your order.

How to interpret cryptocurrency charts – an ultimate guide

Cryptocurrency charts are a great way to track the performance of a digital asset. Here’s what you need to know to interpret them effectively.

1. Look at the price and volume data

The first thing to look at is the price and volume data. This will give you an idea of how active the market is and how much money is being traded.

2. Check the trend

Once you have a good understanding of how active the market is and how much money is being traded, you can look at the trend to see if there is any significant movement.

3. Check the support and resistance levels

Support and resistance levels are important indicators of where the market is likely to stop and start moving in a particular direction. If a cryptocurrency is hitting strong support levels, this may be a sign that the market is healthy and prices are likely to stay high. Conversely, if a cryptocurrency is hitting strong resistance levels, this may be a sign that the market is in trouble and prices are likely to drop.

4. Check the indicators

Some cryptocurrency charts also include indicators such as MACD or RSI. These indicators can help you to determine if the market is heading in a positive or negative direction.

Tips and tricks on how to read cryptocurrency charts like a pro

There is no one definitive way to read cryptocurrency charts like a pro. However, following some basic tips and techniques can help you make sense of the data and make informed investment decisions.

1. Understand the basics of cryptocurrency

Before you can understand cryptocurrency charts, you need to have a basic understanding of what they are and how they work. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

2. Use technical analysis to find trends

Technical analysis is a method of analyzing financial charts in order to identify trends and opportunities. It can help you identify price patterns, underlying support and resistance levels, and other factors that can help you make informed investment decisions.

3. Compare cryptocurrencies to each other

When you are looking at cryptocurrency charts, it is important to compare them to other cryptocurrencies. This will help you determine which ones are worth investing in.

4. Watch for signals from market experts

Cryptocurrency charts are complex data sets, and it can be difficult to make informed investment decisions on your own. If you are looking for guidance, be sure to check out market experts who are monitoring the cryptocurrency markets. They may offer insights that you can use to make better investment decisions.

How to make sense of cryptocurrency charts – a beginner’s guide

Cryptocurrencies are complex and often technical investments. This beginner’s guide will help you make sense of cryptocurrency charts and help you determine if investing in cryptocurrencies is the right decision for you.

What is a cryptocurrency?

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

How do you make money with cryptocurrencies?

There are a few ways to make money with cryptocurrencies. You can sell them on exchanges, mine them using specialized software, or use them to buy goods and services.

How do I use a cryptocurrency chart?

To make sense of cryptocurrency charts, you first need to understand how cryptocurrencies work. Cryptocurrencies are created as a reward for a process known as mining. Miners are rewarded with new cryptocurrency for verifying and recording transactions on the blockchain.

Cryptocurrency charts show the price of a cryptocurrency over time. The chart can be divided into two sections: the upper section shows the price trend, and the lower section shows the 24-hour volume.

To make sense of cryptocurrency charts, you first need to understand how cryptocurrencies work.

Cryptocurrencies are created as a reward for a process known as mining. Miners are rewarded with new cryptocurrency for verifying and recording transactions on the blockchain.

Cryptocurrency charts show the price of a cryptocurrency over time. The chart can be divided into two sections: the upper section shows the price trend, and the lower section shows the 24-hour volume.

To make sense of cryptocurrency charts, you first need to understand how cryptocurrencies work. Cryptocurrencies are created as a reward for a process known as mining. Miners are rewarded with new cryptocurrency for verifying and recording transactions on the blockchain.

What is a blockchain?

A blockchain is a digital ledger of all cryptocurrency transactions. It is constantly growing as “completed” blocks are added to it with a new set of recordings. Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data. Bitcoin, Ethereum, and other cryptocurrencies use blockchains to facilitate secure transactions.

What is a cryptocurrency?

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

A comprehensive guide on how to read cryptocurrency charts

Cryptocurrency charts are essential for understanding the performance of a digital asset. There are a few different types of cryptocurrency charts available, and each one has its own advantages and disadvantages.

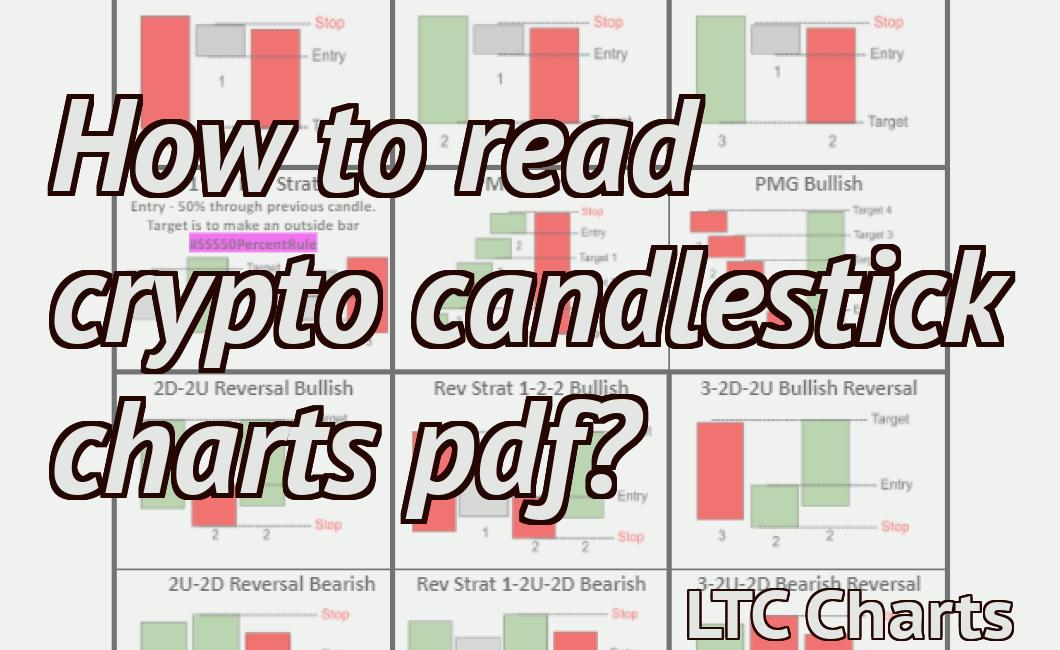

candlestick chart

A candlestick chart is the most basic type of cryptocurrency chart. It displays the price fluctuations of a digital asset over time in the form of short candles.

The advantage of a candlestick chart is that it is easy to understand. Each candle shows the price movement for a specific period of time, making it easy to spot patterns.

However, candlestick charts are limited in their ability to show detailed information. For example, they won’t show the amount of cryptocurrency traded during a given period of time.

Volume chart

A volume chart is similar to a candlestick chart, but it displays the amount of cryptocurrency traded over time.

The advantage of a volume chart is that it provides more detailed information about the performance of a digital asset. For example, it can show the amount of cryptocurrency traded in a specific period of time, the amount of cryptocurrency traded relative to the overall volume of the market, and the percentage of change in volume over a given period of time.

However, volume charts can be more complex to understand than candlestick charts. They also require more technical knowledge to use correctly.

Channel chart

A channel chart is designed to identify trends in the performance of a digital asset.

The advantage of a channel chart is that it can help you identify patterns in the performance of a digital asset. For example, it can show which parts of the market are performing well, which parts of the market are performing poorly, and how the performance of a digital asset has changed over time.

However, channel charts can be more complex to use than other types of cryptocurrency charts. They also require more technical knowledge to understand.

The ultimate guide to reading cryptocurrency charts – part 1

Cryptocurrencies are all about making money. The more people who understand how to read cryptocurrency charts, the better off everyone will be. In this article, we’re going to provide you with the basics of how to read cryptocurrency charts and help you identify important factors to consider.

What is a cryptocurrency chart?

A cryptocurrency chart is a visual representation of the price of a cryptocurrency over time. It allows you to see how prices have changed over time and can be used to predict future movements.

How do I read a cryptocurrency chart?

There are a few key things to keep in mind when reading a cryptocurrency chart:

1. Look at the overall trend

The first thing you should look at is the overall trend. This will tell you whether prices are going up or down. If the trend is positive, prices are likely going to increase over time. If the trend is negative, prices are likely going to decrease over time.

2. Check the highs and lows

Next, check the highs and lows. These are the highest and lowest points in the chart, and can be important indicators of where prices are heading. If prices have hit a high and then fallen down, it may be a sign that the trend is turning. Conversely, if prices have hit a low and then risen up, it may be a sign that the trend is turning.

3. Check the volume

Volume is also important when it comes to reading cryptocurrency charts. This indicates how much buying and selling is happening on the market, and can help you to understand the sentiment of the market. If there is a lot of buying and selling, it may be a sign that investors are positive about the future of the cryptocurrency. Conversely, if there is little or no buying and selling, it may be a sign that investors are negative about the future of the cryptocurrency.

4. Look at the price action

Finally, look at the price action. This includes everything from the size of the rallies and declines to the direction of the trends. If you see a lot of buying and selling happening, this may be a sign that prices are going to go up. Conversely, if you see little or no buying or selling happening, this may be a sign that prices are going to go down.

A beginner’s guide to reading cryptocurrency charts

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, first created in 2009, is the best-known cryptocurrency.

Cryptocurrency charts are used to track the price of cryptocurrencies over time. The price of a cryptocurrency is determined by supply and demand. When demand for a cryptocurrency increases, the price of that cryptocurrency rises. Conversely, when demand for a cryptocurrency decreases, the price of that cryptocurrency falls. Cryptocurrency charts can also be used to predict future prices.

To read cryptocurrency charts, you will need to understand three things: the coin’s name, its symbol, and its price.

1. The coin’s name is the name of the cryptocurrency.

2. The symbol is the unique code that represents the coin on cryptocurrency charts.

3. The price is the value of a single unit of the coin on a given day.

How to read crypto charts – a beginner’s guide

Cryptocurrencies are traded on digital exchanges and can be bought and sold with conventional currency.

To track the price of a cryptocurrency, you will need to use a cryptocurrency chart.

There are a few different types of cryptocurrency charts and it can be confusing which one to use for which cryptocurrency. This guide will help you understand how to read cryptocurrency charts and which ones are best for tracking specific cryptocurrencies.

Cryptocurrency charts are divided into two types – technical and fundamental.

Technical charts are designed to show you how a cryptocurrency is performing on a technical level – for example, how high or low the price has been over time.

Fundamental charts are designed to show you how a cryptocurrency is performing on a fundamental level – for example, how much total supply is left in the currency, or how popular it is among traders.

Technical charts are usually more useful for tracking individual cryptocurrencies, while fundamental charts are more useful for tracking whole categories of cryptocurrencies.

There are a few different types of cryptocurrency charts to use:

1. Candle Chart

A candle chart shows you the price of a cryptocurrency over a specific period of time – for example, one day, one week, or one month.

To use a candle chart, you first need to find the closing price of the cryptocurrency on the chart. Then, you need to find the high and low prices for the cryptocurrency over the specified period of time. Finally, you need to find the percentage difference between the high and low prices.

For example, if the closing price of a cryptocurrency is $100, the high price would be $105 and the low price would be $95, the percentage difference would be 5%.

2. Line Chart

A line chart shows you the price of a cryptocurrency over a specific period of time – for example, one day, one week, or one month.

To use a line chart, you first need to find the closing price of the cryptocurrency on the chart. Then, you need to find the opening and closing prices for the cryptocurrency over the specified period of time. Finally, you need to find the percentage difference between the opening and closing prices.

For example, if the closing price of a cryptocurrency is $100, the opening price would be $10 and the closing price would be $110, the percentage difference would be 10%.

3. OHLC (Open, High, Low, Close) Chart

An OHLC chart shows you the price of a cryptocurrency over a specific period of time – for example, one day, one week, or one month.

To use an OHLC chart, you first need to find the open, high, low, and close prices for the cryptocurrency over the specified period of time. Then, you need to find the percentage difference between each price.

For example, if the open, high, and low prices of a cryptocurrency are $10, $12, and $14 respectively, the percentage difference would be 20%.

How to read crypto charts – an ultimate guide for beginners

Cryptocurrencies are a new form of digital money that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services.

To read crypto charts, you first need to identify the cryptocurrency you are interested in. There are a number of different types of cryptocurrency, so it can be difficult to decide which one to invest in. Once you have identified the cryptocurrency, you need to find a reliable online charting service.

Cryptocurrency charts are usually displayed as graphs with different colors representing different values. The horizontal axis represents time and the vertical axis represents price. Crypto charts often have a number of indicators, such as the MACD indicator, which helps you to identify trends in the market.

It is important to remember that crypto charts are not guaranteed to be accurate and that they should be used as a guide only. Always do your own research before investing in any cryptocurrency.

How to read crypto charts – the ultimate guide

Cryptocurrency charts are notoriously difficult to read. However, with a little bit of practice, you can become a crypto chart ninja.

The first step is to understand what a cryptocurrency chart is. A cryptocurrency chart is a graphical representation of the price of a cryptocurrency over time. Cryptocurrency charts can be divided into two main categories: candlestick charts and line charts.

Candlestick charts are typically used to display the price of cryptocurrencies over time, while line charts are used to display the performance of a cryptocurrency over a longer period of time.

The next step is to understand how to read a cryptocurrency chart. First, identify the opening and closing prices for the chart. Next, look at the bars that are displayed on the chart. The height of the bar reflects the value of the cryptocurrency at that moment. Finally, look at the color of the bar to determine the direction of the trend.

For example, if you are looking at a candlestick chart, you would first identify the opening and closing prices for the chart. You would then look at the bars that are displayed on the chart. The height of the bar reflects the value of the cryptocurrency at that moment. Finally, you would look at the color of the bar to determine the direction of the trend.

If you are looking at a line chart, you would first identify the starting and ending points for the chart. Next, you would look at the lines that are displayed on the chart. The slope of the line reflects the performance of the cryptocurrency over that period of time. Finally, you would look at the color of the line to determine the direction of the trend.