Understanding Candlesticks And Wicks Crypto Charts Site:youtube.com

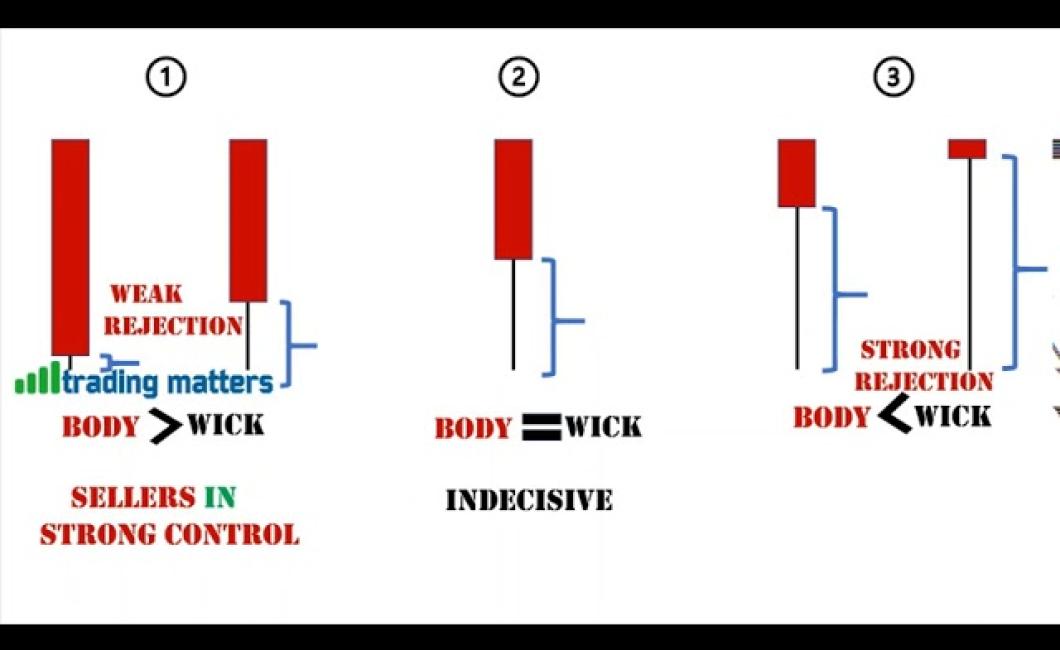

If you're new to cryptocurrency trading, then you might be wondering what all those colorful candlesticks on your charts mean. In this video, we'll explain everything you need to know about candlesticks and wicks. Candlesticks are used to show the open, high, low, and close price for a given period of time. The body of the candlestick represents the open and close price, while the wicks represent the high and low prices. If the candlestick is green, it means the price went up during that period of time. If the candlestick is red, it means the price went down during that period of time. The wicks can also be used to show you where the price was rejected. For example, if the price goes up to a certain level and then starts to come back down, that's called a rejection wick. Rejection wicks can be used to show you where there might be resistance or support levels. If the price is constantly getting rejected at a certain level, that's a good indication that it might be a resistance level. Candlesticks and wicks are a great way to visualize price action and make informed trading decisions.

How to Read a Candlestick Chart

There are three basic elements of candlestick charts: the open, the high, and the low. The open is the first price point where the candlestick was formed. The high is the highest price point reached for the day, and the low is the lowest price point reached for the day. The other two elements are the volume and the moving average. The volume is the number of shares traded at each price point, and the moving average is a mathematical calculation that smooths out the movements of prices over time.

What Do Candlesticks & Wicks Mean?

A candlestick is a visual representation of stock prices over time. It shows the open, high, low and close prices for a particular day. A wick is the part of the candle that burns.

3 Ways to Use Candlestick Charts

1. Identify Patterns

Candlestick charts can be used to identify patterns in data. For example, you may be interested in finding out how stock prices change over time, or how customer sentiment changes over time.

2. Forecast Results

Candlestick charts can be used to forecast future results. For example, you may want to know what will happen to stock prices over the next few days, or what will happen to sales over the next quarter.

3. Analyze Data

Candlestick charts can be used to analyze data. For example, you may want to know how many customers have made a purchase in the last week, or what percentage of customers are satisfied with your product.

How to Analyze Candlestick Charts

Candlestick charts are a visual representation of stock prices. The bars on the chart show the amount of change in price over a certain time period. The width of the bars indicates how much the price has changed relative to the previous bar.

To analyze a candlestick chart, you first need to understand what the chart is showing. Candlestick charts are most commonly used to display changes in stock prices. You can use them to see if the stock is going up or down, and how far it has gone up or down.

Next, you need to understand how to read a candlestick chart. The most important thing to remember is that the width of the bars indicates how much the price has changed relative to the previous bar. The color of the candlestick also indicates what kind of change occurred.

If the stock is going up, the candlestick will be green. If the stock is going down, the candlestick will be red. If the stock is staying the same, the candlestick will be white.

Finally, you need to understand how to use candlestick charts to trade stocks. Candlestick charts are not always accurate, so you should always use them as a guide, not as a gospel.

Trading with Candlestick Charts

Candlestick charts are a popular way to plot price movements over time. They consist of a series of candlesticks, each representing a day's trading activity.

Each candlestick is composed of three sections: the open, the close, and the high. The open represents the price at the beginning of the day, the close represents the price at the end of the day, and the high represents the highest price of the day.

The candlestick chart can be used to analyze price movements and identify patterns.

Tips for Using Candlestick Charts

To use candlestick charts effectively, be familiar with the different types of candlesticks and their meanings. In addition, be aware of how to read the chart's indicators.

The Five Types of Candlesticks

A candlestick is made up of two parts: the body and the shadow. The body is the actual candlestick shape, and the shadow is the area that is darkened by the candle's flame.

The following are the five types of candlesticks:

Bullish Candlestick: The body is filled with candles, indicating that prices are rising.

Bearish Candlestick: The body is empty or only has a single candle, indicating that prices are falling.Peg Candlestick: The body has two candles, one above the other. This indicates that the price is currently trading in a narrow range.Hammer Candlestick: The body has three candles, one above the other two. This indicates that the price is nearing a peak or trough.Cross Candlestick: The body has four or more candles, indicating that prices are moving rapidly and erratically.

Indicators in Candlestick Charts

The indicators in a candlestick chart can help you to determine the trend of the market. These indicators include the open, high, low, close, and volume indicators.

The Open indicator is displayed when the market opens. It shows you how much money was traded during the opening minutes of trading.

The High indicator is displayed when the market reached its highest point during the day.

The Low indicator is displayed when the market reached its lowest point during the day.

The Close indicator is displayed when the market closed. It shows you how much money was traded during the closing minutes of trading.

The Volume indicator is displayed as a percentage of the total volume of the market during the day.

Getting Started with Candlestick Charting

Candlestick charting is a popular way to visualize and analyze financial data. Candlestick charts are easy to create and use, and they can provide you with a quick overview of how your stock is performing.

To create a candlestick chart, start by navigating to your stock's official website or ticker symbol. Next, click on the "Candlestick Chart" link on the main page.

You'll now be prompted to select your data source. You can use candlestick charts to visualize either real-time or historical data. If you're using real-time data, you'll need to provide a time frame for your chart (e.g. 1 minute, 5 minutes, or 30 minutes).

If you're using historical data, you can select the date range for your chart (e.g. today, yesterday, or 1 week ago). You can also choose to display only the top or bottom five candlesticks for each data point.

Finally, you'll need to provide your chart's title and description. Candlestick charts are easy to understand, so it's important to provide helpful information such as the date and time of each candle.

Candlestick charts are a great way to quickly see how your stock is performing. Be sure to familiarize yourself with the different types of candlesticks and how to use them to best inform your trading decisions.