Free Stock Charts For Crypto

If you're looking for free stock charts for crypto, you've come to the right place. Here at Crypto Chart we offer a range of tools to help you make the most informed decisions when it comes to your investments. Whether you're a beginner or a seasoned investor, we have the resources you need to stay up-to-date on all the latest news and developments in the world of cryptocurrencies.

Best Crypto Stock Charts to Watch in 2021

1. Ripple (XRP)

2. Bitcoin Cash (BCH)

3. Ethereum (ETH)

4. EOS (EOS)

5. Litecoin (LTC)

6. Bitcoin SV (BSV)

7. Cardano (ADA)

8. Stellar (XLM)

9. TRON (TRX)

10. IOTA (MIOTA)

5 Free & Best Crypto Stock Charts for Technical Analysis

This article will show you the best crypto stock charts for technical analysis. Technical analysis is the process of using charts and indicators to analyze the stock market and make investment decisions.

1. CoinMarketCap

CoinMarketCap is one of the most popular crypto stock charts on the internet. It provides real-time data on the price of Bitcoin, Ethereum, and other major cryptocurrencies.

2. Coinigy

Coinigy is another popular crypto stock charting platform. It allows you to track prices for Bitcoin, Ethereum, and other major cryptocurrencies.

3. Tradingview

Tradingview is another popular crypto stock charting platform. It provides real-time data on the prices of Bitcoin, Ethereum, and other major cryptocurrencies.

4. Coindesk

Coindesk is a popular website that provides real-time data on the prices of Bitcoin, Ethereum, and other major cryptocurrencies.

5. Kraken

Kraken is a popular crypto exchange that provides real-time data on the prices of Bitcoin, Ethereum, and other major cryptocurrencies.

3 Simple Steps to Create Your Own Crypto Stock Chart

1. Choose a cryptocurrency to track

You will need to choose a cryptocurrency to track in order to create your own crypto stock chart. There are many popular cryptocurrencies to choose from, so it is up to you which one you want to focus on.

2. Collect data on the cryptocurrency's value

Once you have chosen a cryptocurrency to track, you will need to collect data on its value. This data can be collected from online sources, such as CoinMarketCap, or from exchanges that trade the cryptocurrency.

3. Create a visual representation of the cryptocurrency's value

Once you have collected data on the cryptocurrency's value, you will need to create a visual representation of it. This representation can be a crypto stock chart, which will show you how the cryptocurrency's value has changed over time.

How to Use Crypto Stock Charts to Maximize Your Profits

Crypto stock charts can provide a valuable perspective on the underlying digital assets and help you make informed investment decisions.

When navigating the crypto markets, it’s important to keep in mind that prices are highly volatile and can move quickly. This means it’s important to use caution when making investment decisions.

To help you make the most informed decisions, we’ve compiled a list of tips for using crypto stock charts:

1. Understand the Different Types of Cryptocurrencies

When looking at crypto stock charts, it’s important to understand the different types of cryptocurrencies.

There are two main types of cryptocurrencies: decentralized and centralized. Decentralized cryptocurrencies are based on a blockchain technology and are not subject to government or financial institution control. Centralized cryptocurrencies are not based on a blockchain technology and are subject to government or financial institution control.

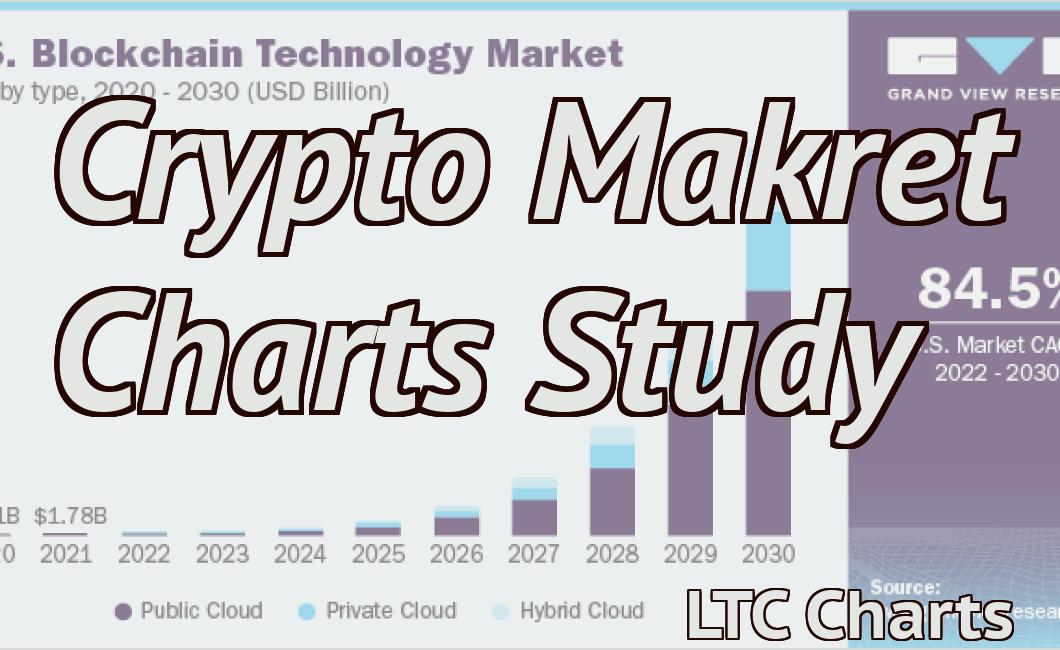

2. Compare Cryptocurrencies Based on Their Market Cap

When comparing cryptocurrencies, it’s important to consider their market cap. Market cap is the total value of a cryptocurrency’s outstanding supply.

Some of the most popular cryptocurrencies have large market caps, while some smaller cryptocurrencies have high market caps. It’s important to compare cryptocurrencies based on their market cap to make informed investment decisions.

3. Use Crypto Stock Charts to Assess the Overall Trends of the Cryptocurrency Markets

Crypto stock charts can help you assess the overall trends of the cryptocurrency markets.

For example, if you see a cryptocurrency that appears to be undervalued, it may be a good time to invest in that cryptocurrency. Conversely, if you see a cryptocurrency that appears to be overvalued, it may be a good time to sell that cryptocurrency.

4. Monitor the Volatility of the Cryptocurrency Markets

Crypto stock charts can also help you monitor the volatility of the cryptocurrency markets.

Volatility is the level of uncertainty in the price of a cryptocurrency. For example, if the price of a cryptocurrency goes up 10%, it may be considered a good investment. However, if the price of a cryptocurrency goes up 100%, it may be considered a bad investment.

5. Consider Buying Cryptocurrencies That Are Being Hacked

One consideration when investing in cryptocurrencies is whether or not they are being hacked. If a cryptocurrency is being hacked, its value may be temporarily reduced. This may be a good time to buy that cryptocurrency. Conversely, if a cryptocurrency is not being hacked, its value may be temporarily increased. This may be a good time to sell that cryptocurrency.

The Benefits of Using Crypto Stock Charts

Crypto stock charts can provide investors with a valuable tool for understanding the performance of digital assets.

Crypto charts can help identify trends and patterns in the prices of digital assets.

Crypto stock charts can also help investors make informed investment decisions.

Crypto stock charts can help investors track the performance of their portfolios over time.

How to Read Crypto Stock Charts

Crypto stock charts can be read in a few different ways. The most common way to read crypto stock charts is to look at the overall trend of the coin. This can be done by looking at the price over time, or by looking at the price relative to the rest of the market.

Another way to read crypto stock charts is to look at specific indicators. This can include things like the MACD, RSI, and Fibonacci retracement levels.

What Do The Different Lines on a Crypto Stock Chart Mean?

Cryptocurrencies are often traded on stock exchanges and displayed on a chart in a variety of ways. Some common formats include the MACD, volume, and RSI.

The MACD is a technical indicator that helps traders identify the trend of an asset. When the MACD line is above the signal line, this suggests that the market is bullish and prices are increasing; Conversely, if the MACD line is below the signal line, this suggests that the market is bearish and prices are decreasing.

Volume indicates how much money is being traded in an asset. When volume is high, this suggests that there is a lot of interest in that asset; Conversely, when volume is low, this suggests that there is less interest in that asset.

RSI is a popular technical indicator that measures the strength of a trend. When the RSI is above 50%, this suggests that the trend is strong; Conversely, when the RSI is below 50%, this suggests that the trend is weak.

How to Analyze Candlestick Patterns in Crypto Stock Charts

Candlestick charts are one of the most common ways to analyze crypto stock charts. Candlestick charts allow you to see the price and volume of a security over time.

The first step is to find the open, high, low, and close prices for the day. Next, find the volume for the day. Finally, find the candlestick patterns for the day.

The following candlestick patterns can be used to analyze crypto stock charts:

engulfing candle: This candlestick pattern is created when the price of a security rises rapidly and then abruptly falls. The volume for this pattern will be high.

This candlestick pattern is created when the price of a security rises rapidly and then abruptly falls. The volume for this pattern will be high. high and low candles: This candlestick pattern is created when the price of a security rises slowly and then suddenly rises. The volume for this pattern will be low.

This candlestick pattern is created when the price of a security rises slowly and then suddenly rises. The volume for this pattern will be low.hammer: This candlestick pattern is created when the price of a security drops rapidly and then suddenly rises. The volume for this pattern will be low.

This candlestick pattern is created when the price of a security drops rapidly and then suddenly rises. The volume for this pattern will be low.neckline: This candlestick pattern is created when the price of a security crosses below the low or rises above the high. The volume for this pattern will be low.

This candlestick pattern is created when the price of a security crosses below the low or rises above the high. The volume for this pattern will be low.V-shaped: This candlestick pattern is created when the volume for a security increases gradually and then suddenly increases.

10 Tips For Successfully Trading With Crypto Stock Charts

1. Do your own research.

Before you start trading with crypto stocks, make sure you have a solid understanding of the underlying technology and the markets in which they operate. This will help you make informed decisions about when and how to trade.

2. Know your risk tolerance.

Crypto stocks are highly volatile and can be risky for inexperienced traders. Before investing any money in these assets, be sure to understand your risk tolerance and how much capital you are willing to risk.

3. Strategy is key.

A successful trading strategy is more important than having the latest algorithm or trading platform. Stick to well-researched and tested strategies that have been proven to work in the past.

4. Stay disciplined.

If you don’t keep a close eye on your portfolio and follow your trading strategy, you could lose all of your investment. Be sure to regularly check your positions and never hesitate to pull the plug if you start to feel out of control.

5. Take advantage of market conditions.

When the market is moving in one direction, it’s often best to stay put and avoid making any trades. But when the market turns, be prepared to take advantage of the new opportunities that may be available.

6. Diversify your portfolio.

While crypto stocks may be volatile, investing in a variety of different assets can help minimize your risk. This will help you minimize the potential for a single bad trade that could ruin your entire investment.

7. Don’t overreact to news events.

Most news events have little impact on the overall price of a crypto stock, so don’t get caught up in the hype and make rash decisions based on emotion. Wait until after the fact to make any decisions based on news events.

8. Use technical indicators.

Some investors use technical indicators to help them identify trends in the markets and make better trading decisions. However, these tools can only be used if you have a good understanding of how they work.

9. Consider holding onto your assets for a longer period of time.

Crypto stocks can be volatile, but they also have the potential for long-term gains. If you are able to hold onto your assets for a period of several months or even years, you could potentially see significant gains.

10. Always do your own research before making any investments.

How to Create Customized Crypto Stock Charts

Customized crypto stock charts are a great way to track the performance of a certain cryptocurrency or digital asset. There are a number of different tools and platforms that allow users to create customized crypto stock charts.

One option is to use a cryptocurrency tracking platform like CoinMarketCap. This platform provides users with real-time data on the prices of different cryptocurrencies and digital assets. Users can then create customized charts that show the performance of specific cryptocurrencies or digital assets.

Another option is to use a cryptocurrency analysis tool like CryptoCompare. This tool allows users to track the performance of different cryptocurrencies and digital assets. Users can then create customized charts that show the performance of specific cryptocurrencies or digital assets.

Finally, users can use a cryptocurrency portfolio tracker like CoinMarketCap or Blockfolio. This tool allows users to track the performance of their cryptocurrency portfolio. Users can then create customized charts that show the performance of specific cryptocurrencies or digital assets.

Why You Should Start Using Crypto Stock Charts

When it comes to investing, there are a few key things to keep in mind. First and foremost, always do your own research. Secondly, try to stick to well-known and reputable exchanges. And finally, pay attention to crypto stock charts.

Crypto stock charts are a great way to track the performance of different cryptocurrencies. By following these charts, you can get an idea of which cryptocurrencies are performing well and which ones are struggling. This information can help you make informed investment decisions.