Look at crypto charts.

This article looks at crypto charts and discusses what they mean for investors.

How to read crypto charts

Cryptocurrency charts are a great way to get an idea of the price and volume of a digital currency over time. To read a cryptocurrency chart, you first need to find the currency you want to study. After that, you need to find the cryptocurrency's chart on a website like CoinMarketCap.com. Once you've found the chart, you will need to find the date and time of the measurement. After that, you will need to look for the " candles " on the chart. Candles are the small squares that show the movement of the price over a certain period of time.

The 5 most important crypto charts

1. Bitcoin price (BTC)

2. Ethereum price (ETH)

3. Bitcoin Cash price (BCH)

4. Litecoin price (LTC)

5. Cardano price (ADA)

A beginner's guide to crypto charting

Cryptocurrencies are a new and exciting investment opportunity, but it can be difficult to understand their price movements. This guide will help you become a better crypto charting trader.

1. Choose a cryptocurrency to track

The first step is to choose a cryptocurrency to track. There are many options available, so it is important to research which one is the best fit for your investment goals. Some of the most popular cryptocurrencies to track include Bitcoin, Ethereum, and Bitcoin Cash.

2. Understand the basics of a cryptocurrency chart

A cryptocurrency chart is a visual representation of a cryptocurrency's price movement over time. It can be helpful to understand some of the basics of charting before beginning to trade.

a. The Y-axis shows the price of a cryptocurrency over time, while the X-axis shows the number of units of that cryptocurrency traded.

b. The green line is the price trend, and the red line is the price chart's resistance level.

c. The width of the chart reflects the volume of trading that has taken place on that particular day.

d. The color of the chart reflects the market sentiment at that particular time. For example, a green chart might indicate that the market is bullish, while a red chart might indicate that the market is bearish.

3. Use technical indicators to help make better trading decisions

Technical indicators can help you make better trading decisions by indicating when a cryptocurrency is about to make a change in direction. Some common technical indicators used in cryptocurrency trading include the RSI ( Relative Strength Index ), MACD ( Moving Average Convergence Divergence ), and Bollinger Bands .

4. Monitor social media for news and updates

News can often trigger a shift in the market sentiment, so it is important to monitor social media for updates and news related to cryptocurrencies. For example, if you are investing in Bitcoin, be sure to keep an eye out for news related to Ethereum and other altcoins.

The essentials of crypto charting

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are traded on decentralized exchanges and can also be used to purchase goods and services. Cryptocurrency investors are often passionate about the coins they are trading, and may be willing to pay more for a specific coin than others.

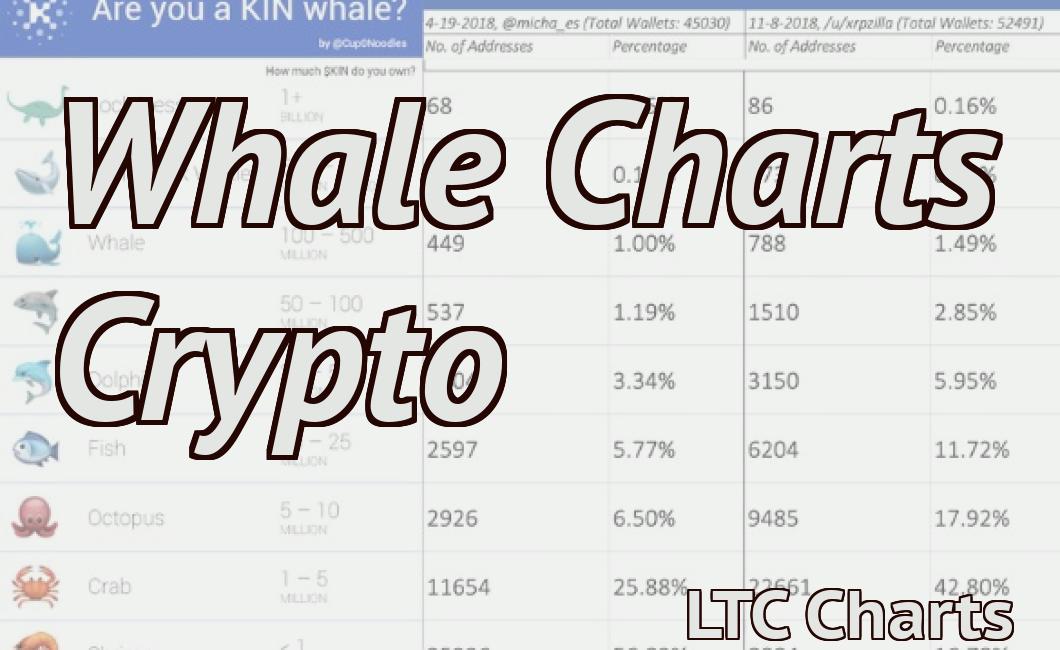

Cryptocurrencies are often correlated with each other, which allows investors to make more informed decisions about their investments. Many exchanges offer tools that allow investors to track the prices of multiple cryptocurrencies at the same time.

Crypto charting for beginners

Cryptocurrencies are a type of digital asset that uses cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution regulation.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. Cryptocurrencies are often considered high-risk investments, and can be volatile.

A tutorial on crypto charting

Crypto trading can be a bit confusing, so we’ve put together a quick guide on how to use crypto charting tools to help you make informed decisions.

First, choose the right crypto trading platform

There are a number of different crypto trading platforms available, so it important to choose the one that is best suited for your needs. Some of the most popular platforms include Coinbase, Bitfinex, Binance and OKEx.

Once you have chosen your platform, you will need to deposit your cryptocurrency into the platform.

Next, open a trade

Now that you have your cryptocurrency deposited, it’s time to start trading! To open a trade, navigate to the ‘trades’ section of your chosen platform and select the ‘buy’ or ‘sell’ button.

Next, enter the amount of cryptocurrency you wish to purchase or sell and select the price at which you wish to buy or sell.

Now, wait for the trade to complete

Once you have entered the details of your trade, you will need to wait for it to complete. This could take a few minutes, so please be patient!

Once the trade has completed, you will be able to see the results in the ‘trades’ section of your chosen platform.

If you want to learn more about crypto trading, we recommend visiting our dedicated guides section. Here, you can find information on everything from how to trade Ethereum to how to trade Bitcoin.

How to make sense of crypto charts

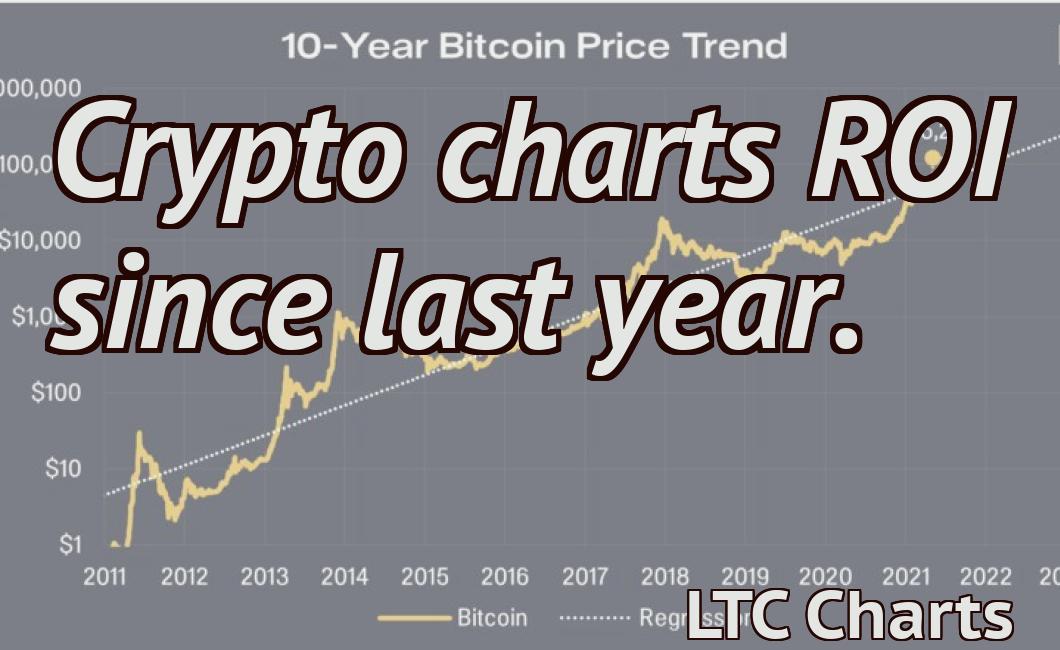

Cryptocurrencies are complex and speculative, which means that it can be difficult to understand how they're performing on a given day or week.

One approach is to use crypto charts to get an overview of the market conditions. Crypto charts show the price of a cryptocurrency over time, and can be used to identify trends and reversals.

Cryptocurrency charts can also be used to predict future price movements. For example, if you see that a particular cryptocurrency is dropping in price, you might want to sell it before it falls any further.

Bear in mind, however, that crypto charts are not guaranteed to be accurate, and they can be subject to manipulation. So always do your own research before investing in any cryptocurrencies.