Crypto Leverage Charts

Crypto Leverage Charts is a tool that allows users to view the leverage of their favorite cryptocurrencies. The charts can be used to see how much leverage is being used by a particular currency, and to compare the leverage of different currencies.

How to Use Crypto Leverage Charts

Crypto leverage charts are used in order to assess the potential for profits with cryptocurrency trading. Crypto leverage charts can be very helpful in determining the potential for making large profits with relatively small investments.

Crypto leverage charts are simply a graphical representation of the amount of leverage that can be used in a given trade. Leverage is simply the proportion of a given investment that can be used to generate profits.

When trading with cryptocurrency, it is important to understand the potential for leverage. This is because leverage allows investors to generate larger profits with relatively small investments.

However, it is also important to be aware of the risks associated with using too much leverage. If a trade goes wrong, using too much leverage can lead to losses that are much greater than the initial investment.

Therefore, it is always important to carefully consider the risks and rewards associated with any given cryptocurrency trade before committing capital.

The Benefits of Using Crypto Leverage Charts

Crypto leverage charts can be very helpful in identifying potential opportunities for investment. By understanding the potential gains and losses associated with a particular investment, individuals can make more informed decisions about whether or not to invest.

Crypto leverage charts can also help investors to identify opportunities to short sell cryptocurrencies. By understanding the potential losses associated with short selling, investors can limit their exposure to potential losses.

The Different Types of Crypto Leverage Charts

There are three types of crypto leverage charts: daily, weekly, and monthly.

Daily Crypto Leverage Charts

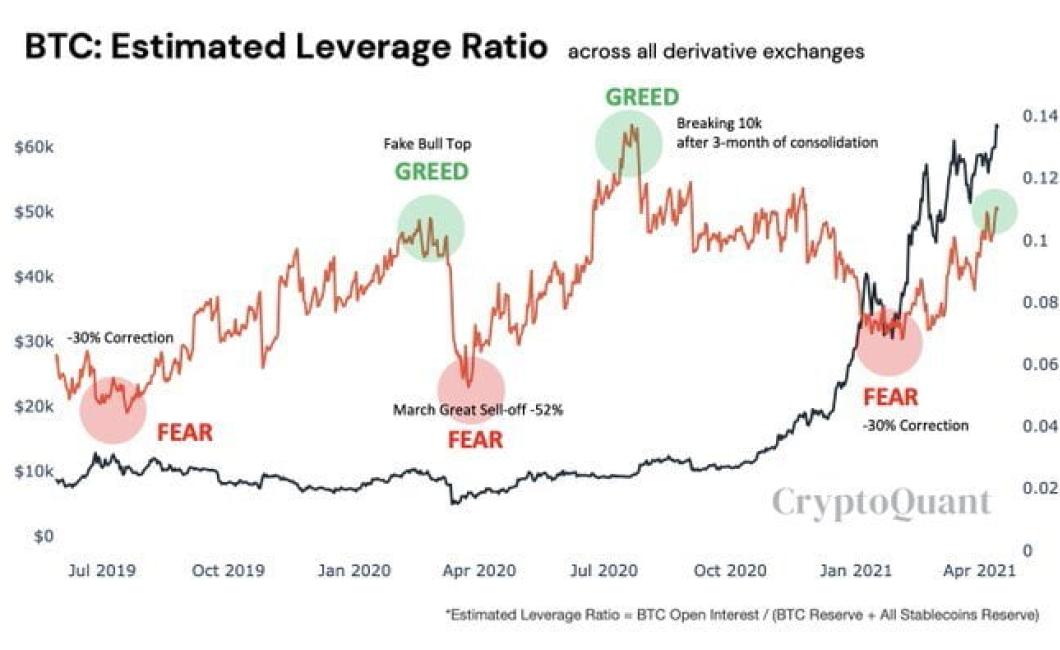

A daily crypto leverage chart shows the amount of leverage that was used on a given day to trade cryptocurrencies. The red line represents the amount of leverage that was used, and the blue line represents the closing price of the cryptocurrency.

Weekly Crypto Leverage Charts

A weekly crypto leverage chart shows the amount of leverage that was used on a given week to trade cryptocurrencies. The red line represents the amount of leverage that was used, and the blue line represents the closing price of the cryptocurrency.

Monthly Crypto Leverage Charts

A monthly crypto leverage chart shows the amount of leverage that was used on a given month to trade cryptocurrencies. The red line represents the amount of leverage that was used, and the blue line represents the closing price of the cryptocurrency.

The Advantages of Crypto Leverage Charts

Crypto leverage charts are a great way for traders to get a sense of how much leverage they are using. By looking at the chart, traders can see how much of a gain or loss they have made relative to their original investment.

This is especially helpful for those who are new to trading and don’t know how to calculate risk. By understanding how much leverage they are using, traders can make more informed decisions about whether or not to continue trading.

The Disadvantages of Crypto Leverage Charts

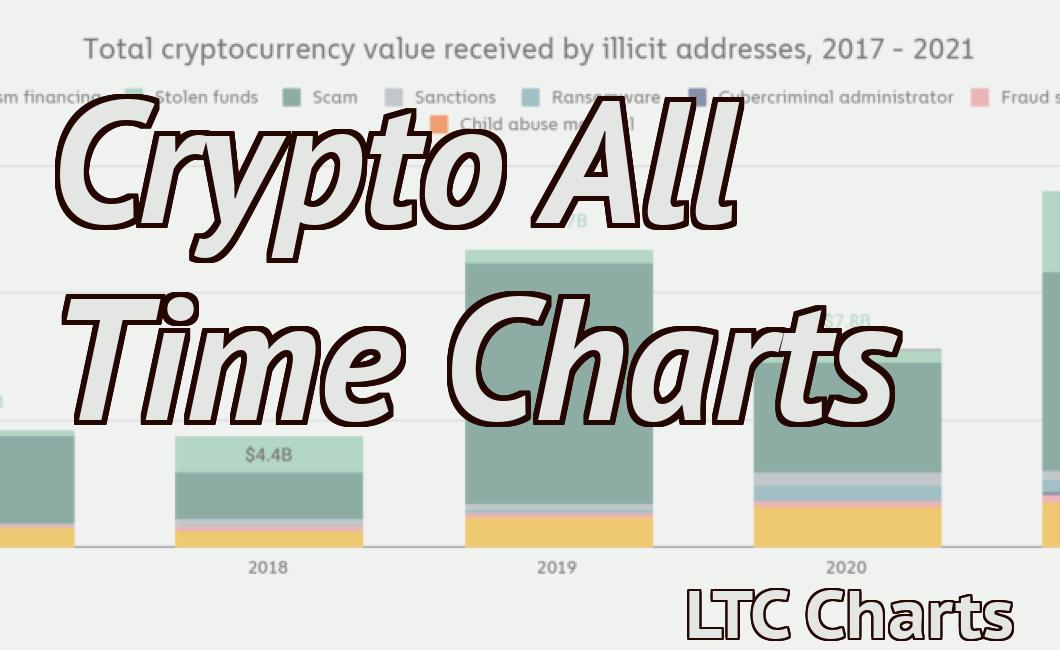

Crypto leverage charts can be misleading. The potential for losses is high when using crypto leverage charts.

Crypto leverage charts can be used to speculate on the price of a digital asset. If the value of the digital asset falls below the amount borrowed, the user may be required to repay the entire amount borrowed plus interest. If the value of the digital asset increases beyond the amount borrowed, the user may only receive a proportion of the increased value. This can lead to large losses if the value of the digital asset falls significantly below the amount borrowed.

Crypto leverage charts can also be used to speculate on the price of a digital asset. If the value of the digital asset falls below the amount borrowed, the user may be required to repay the entire amount borrowed plus interest. If the value of the digital asset increases beyond the amount borrowed, the user may only receive a proportion of the increased value. This can lead to large losses if the value of the digital asset falls significantly above the amount borrowed.

How to Read Crypto Leverage Charts

Crypto leverage charts are used to help traders understand how much of a position they can take with a given amount of money. The chart displays the number of times the underlying asset has been leveraged (i.e. multiplied by the amount of money being invested).

The higher the number, the greater the leverage. For example, a chart with a leverage of 4 means that the trader is investing 400% of the total amount of money in the trade.

Leverage can be a risky proposition, so always consult with a financial advisor before making any trades.

What Do Crypto Leverage Charts Tell Us?

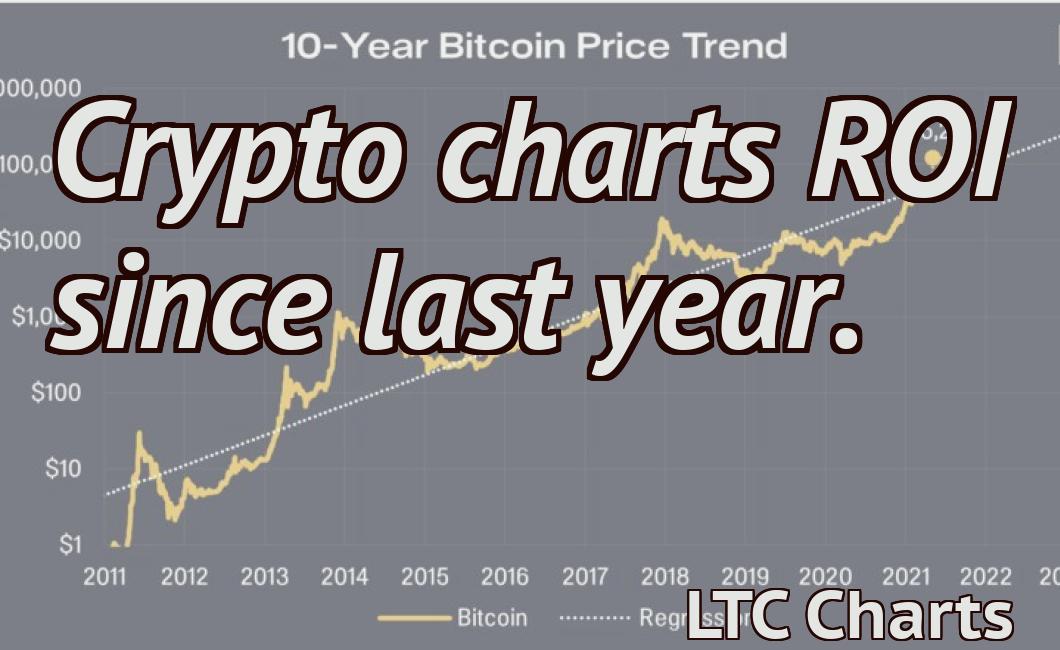

Crypto leverage charts can give investors a rough idea of how much they can expect to make from their investments in a given cryptocurrency over a certain period of time. The charts help investors to identify coins that may be undervalued and those that may be overvalued, and to invest in the latter.

How to Interpret Crypto Leverage Charts

Crypto Leverage Charts can be used to help determine how much risk a Cryptoinvestor is taking on when investing in a particular Cryptoasset.

A simple way to interpret Crypto Leverage Charts is to use them as a guide to help you decide when it is safe to sell your Cryptoassets and when you should continue to hold onto them.

Crypto Leverage Charts can also be used to help you determine when you should increase or decrease your investment in a particular Cryptoasset.

What Can We Learn From Crypto Leverage Charts?

Crypto leverage charts are a great way to see how much of a return you can get on a cryptocurrency investment. They can also be used to identify potential risks associated with a particular cryptocurrency investment. By understanding how much leverage a particular cryptocurrency has, you can better decide whether or not it is a good investment for you.

Cryptocurrency leverage charts can help you make informed decisions about your investments.

How to use Crypto Leverage Charts

To use a crypto leverage chart, first find the cryptocurrency you want to analyze. Next, find the corresponding leveraged position on the chart. The higher the leverage, the greater the potential return on your investment. Finally, compare the return on the cryptocurrency investment to the return on the leveraged position.

Cryptocurrencies with high leverage may offer greater potential returns, but they also carry greater risks. Make sure you understand the risks associated with these investments before deciding whether or not to invest.

How to Analyze Crypto Leverage Charts

Crypto leverage charts are a great way to see how much exposure a trader has to a particular cryptocurrency. By looking at the chart, you can see how much of a position the trader is currently holding and how much leverage they are using.

For example, if a trader holds 1,000 BTC and uses 1:1 leverage, their position would be worth 10,000 BTC. If the price of Bitcoin falls by 10%, the trader's position would lose 10% of its value (or 900 BTC).

Crypto leverage charts can also be used to determine whether or not a trader is over- or under-leveraging their position. For example, if a trader holds 1,000 BTC and uses 1:10 leverage, their position would be worth 100,000 BTC. If the price of Bitcoin falls by 10%, the trader's position would lose 10% of its value (or 900 BTC). However, if the price of Bitcoin rises by 10%, the trader's position would gain 10% of its value (or 1000 BTC).

What Do the Experts Say About Crypto Leverage Charts?

Crypto leverage charts are a popular tool used by traders and investors to gain an edge in the market. They are used to estimate the potential return on investment (ROI) that can be achieved by using a given amount of cryptocurrency leverage.

Many experts believe that crypto leverage charts can be helpful in predicting short-term price movements. However, they caution that overuse of this tool can lead to losses.

What Does the Future Hold for Crypto Leverage Charts?

Crypto leverage charts are becoming an increasingly popular way for investors to track the performance of cryptocurrencies. While it's difficult to say exactly what the future holds for crypto leverage charts, it's likely that they will continue to be used by investors and traders to help them make informed decisions about which cryptocurrencies to invest in.