Crypto candle charts live.

The article discusses how to read and interpret crypto candle charts in order to make informed decisions about trading cryptocurrencies.

How to read crypto candle charts

To read crypto candle charts, you will need to first understand what they are and how they work. A crypto candle chart is a graphical representation of how the price of a cryptocurrency is moving over time. They are often used to show the volatility of a cryptocurrency and can be used to identify when a cryptocurrency is about to make a big move.

To create a crypto candle chart, you will first need to gather some information about the cryptocurrency you are interested in. This information can include its price, the number of active addresses, and the number of blocks mined. You will also need to gather information about the time frame you are interested in, which can be either 24 hours, 7 days, or 30 days.

Once you have this information, you will need to create a chart using a trading platform like TradingView.com. Once you have created your chart, you will need to add in the information about the time frame you are interested in. You will then need to add in the price and active addresses of the cryptocurrency. You will also need to add in the number of blocks mined.

Finally, you will need to add in the volatility of the cryptocurrency. This can be done by multiplying the price of the cryptocurrency by the standard deviation of the price.

3 things you need to know about crypto candle charts

1. A crypto candle chart is a visual representation of the price movement of a cryptocurrency over a given period of time.

2. Crypto candle charts are created using a variety of different tools and can show the price of a cryptocurrency over a range of time periods, from minutes to weeks or even months.

3. Crypto candle charts can be helpful in understanding the trend of a cryptocurrency over time, and can also be used to identify potential buying and selling opportunities.

What do crypto candle charts mean?

Crypto candle charts are used to visualize the performance of a digital asset over a certain period of time. They are often used to track the price movement of a specific cryptocurrency.

How to trade using crypto candle charts

Crypto candle charts are a type of technical analysis that show how an asset is trading relative to its previous candle. Crypto candle charts are used to help traders identify trends and prices.

To use crypto candle charts, first find the closing price for the previous candle. This will be the point at which the candle was closed. Next, find the opening price for the current candle. This will be the point at which the candle was opened. Finally, find the difference between the closing price for the previous candle and the opening price for the current candle. This will be the candle's volume.

Use this information to analyze the asset's trend and make trading decisions.

How to make money with crypto candle charts

There are a few different ways to make money with crypto candle charts. The first is to create a candle chart that displays the price of a cryptocurrency over a period of time. You can then use this information to predict future prices and make profits.

Another approach is to use a candle chart to track the performance of a digital asset. This will allow you to make informed decisions about whether or not to buy or sell the asset. Finally, you can use a candle chart to track the price of a cryptocurrency in relation to another currency. This will allow you to make informed trading decisions.

What are the benefits of using crypto candle charts?

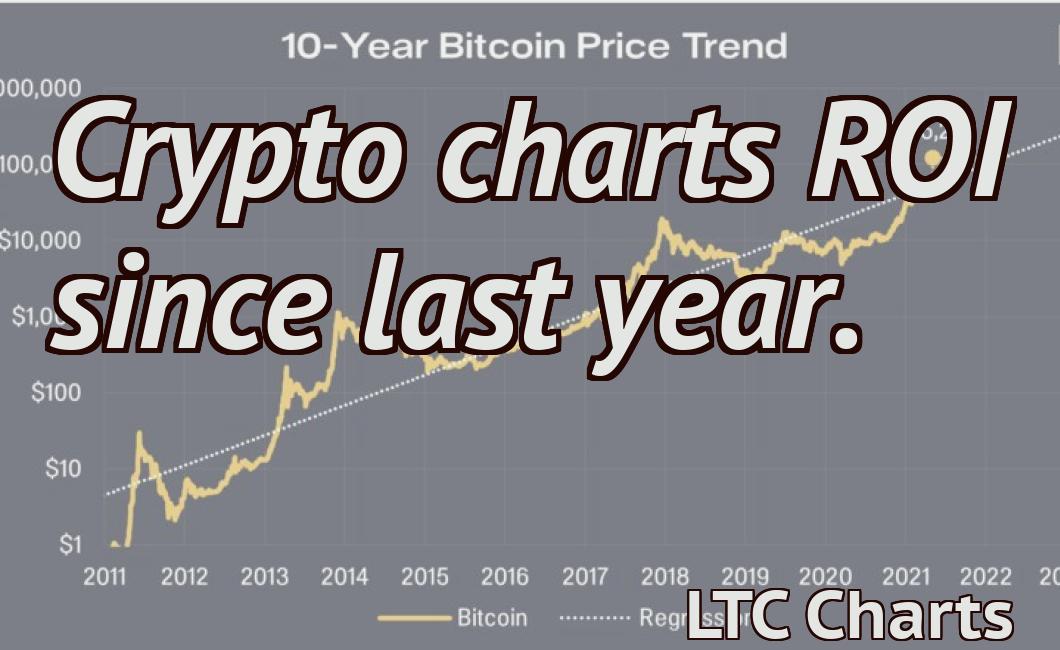

Crypto candle charts offer investors a way to track the performance of various cryptocurrencies over time. This information can help investors make informed decisions about which cryptocurrencies to invest in.

What are the risks of using crypto candle charts?

There are a few risks associated with using crypto candle charts. The most obvious risk is that the prices of assets on the chart may not accurately reflect the real-world value of those assets. Additionally, crypto candles can be easily manipulated by individuals or groups seeking to cause price volatility. Finally, crypto candles can be difficult to interpret and may not provide accurate information about the health of a crypto economy.

How to get started with crypto candle charts

There is no one-size-fits-all answer to this question, as the best way to get started with crypto candle charts depends on your specific needs and preferences. However, some tips on how to get started with crypto candle charts include:

1. Determine your goals.

Before starting to use crypto candle charts, it is important to determine your goals. Are you looking to track the performance of a specific cryptocurrency over time? Are you interested in understanding how the market is performing overall? Once you have determined your goals, you can begin using crypto candle charts to achieve them.

2. Choose a cryptocurrency or asset to track.

Once you have determined your goals, the next step is to choose a cryptocurrency or asset to track. This can be done by searching for a specific cryptocurrency or by browsing the available charts. Once you have found the cryptocurrency or asset you want to track, you can begin using crypto candle charts to monitor its performance.

3. Choose a chart type and timeframe.

Next, you need to choose a chart type and timeframe. There are two main types of charts: hourly and daily. Each has its own benefits and drawbacks, so it is important to choose the right one for your needs. Additionally, you can choose to track one specific cryptocurrency or asset over time, or you can track a range of cryptocurrencies or assets over different time periods.

4. Set up your charting platform.

Once you have chosen your cryptocurrencies or assets to track, and selected a chart type and timeframe, you need to set up your charting platform. This will include selecting your data source (e.g., exchanges), configuring your chart settings (e.g., colors, labels), and importing your data.

5. Start tracking your data.

Now that you have set up your charting platform and imported your data, it is time to start tracking your data. This can be done by clicking on the “start tracking” button on your chart, or by manually entering the data into your charting platform. Once you have tracked your data for a few weeks or months, you can begin to analyze it using crypto candle charts.

Why you should start using crypto candle charts

Crypto candle charts are a great way to track the performance of an individual cryptocurrency over time. By analyzing candle patterns, you can get a good idea of how a particular coin is performing.

The 5 best crypto candles charts

1. Bitcoin (BTC)

2. Ethereum (ETH)

3. Litecoin (LTC)

4. Bitcoin Cash (BCH)

5. EOS (EOS)

The 5 worst crypto candles charts

The 5 worst crypto candles charts can be summarized as follows:

1. A cryptocurrency that is experiencing a rapid price decline.

2. A cryptocurrency that is experiencing a sustained price decline.

3. A cryptocurrency that has experienced a price spike but is now experiencing a price decline.

4. A cryptocurrency that has experienced a price spike but is now experiencing a price stability.

5. A cryptocurrency that has experienced a price stability but is now experiencing a price decline.

How to use crypto candles charts to your advantage

Crypto candles charts can be used to help you make informed decisions about whether or not to invest in a particular cryptocurrency.

The first step is to find a cryptocurrency that you are interested in. Once you have found a cryptocurrency, you will need to find a crypto candle chart for that cryptocurrency.

Cryptocoins are often listed on various cryptocurrency exchanges and can be traded between different users. Cryptocurrency exchanges often list new and upcoming cryptocurrencies and will typically have a variety of crypto candles charts available.

Once you have found a crypto candle chart for the cryptocurrency that you are interested in, the next step is to study the chart.

Cryptocurrency candles charts are often divided into two sections: the white candle and the black candle.

The white candle is the period during which the price of the cryptocurrency increased. The black candle is the period during which the price of the cryptocurrency decreased.

Cryptocurrencies are often volatile and can see large swings in their prices. It is important to pay attention to both the white and black candles on a crypto candle chart in order to make informed decisions about whether or not to invest in that cryptocurrency.

Cryptocurrencies are often risky investments and it is important to do your own research before investing any money. Do not trust anyone else when it comes to making decisions about investing in cryptocurrencies.