Reading Crypto Trading Charts

If you want to get into cryptocurrency trading, you need to be able to read crypto trading charts. This may seem like a daunting task, but it's actually not too difficult once you know what you're looking for. In this article, we'll give you a crash course on reading crypto trading charts so that you can start making profitable trades. Crypto trading charts can be a little confusing at first glance, but they're actually not too difficult to understand. There are three main types of information that you'll find on a chart: price, volume, and market capitalization. Price is the most important piece of information on the chart, as it shows you how much a particular cryptocurrency is worth. The volume is also important, as it shows you how many trades are being made in a particular cryptocurrency. Market capitalization is less important, but it can give you an idea of how popular a particular cryptocurrency is. Once you know what all of the different pieces of information on the chart mean, you'll be able to start making trades with confidence. Just remember to always do your own research before making any trades, as the cryptocurrency market can be volatile.

How to read crypto trading charts

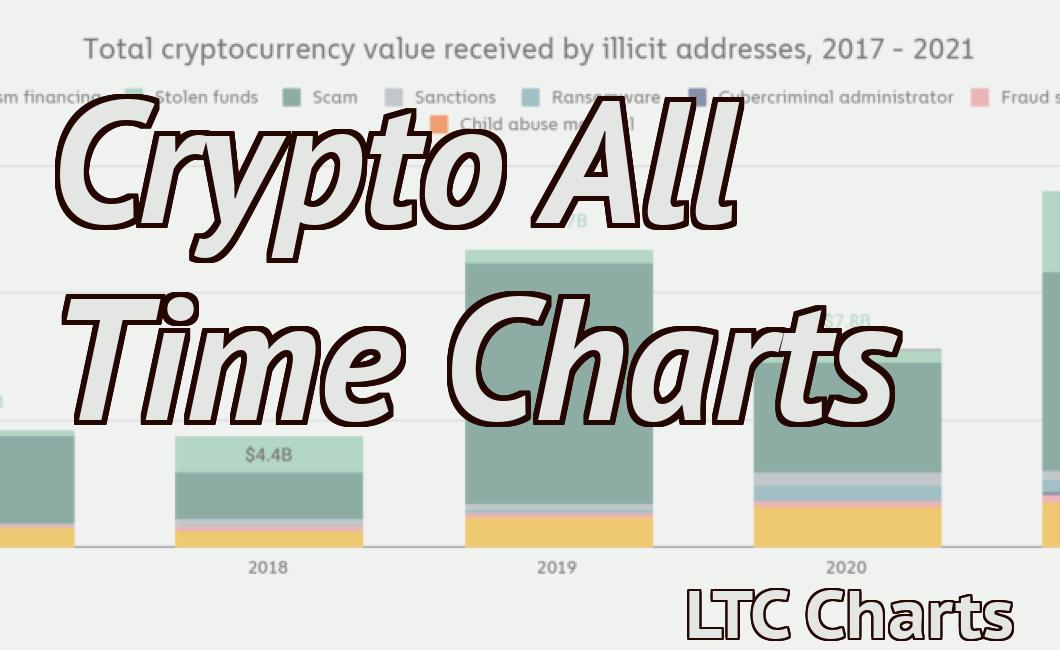

Cryptocurrency trading charts are used to track the movement of prices of digital assets over time. They can be used to assess the market conditions and to make informed investment decisions.

To read a cryptocurrency trading chart, you will need to first identify the type of chart that you are looking at. There are three main types of cryptocurrency trading charts:

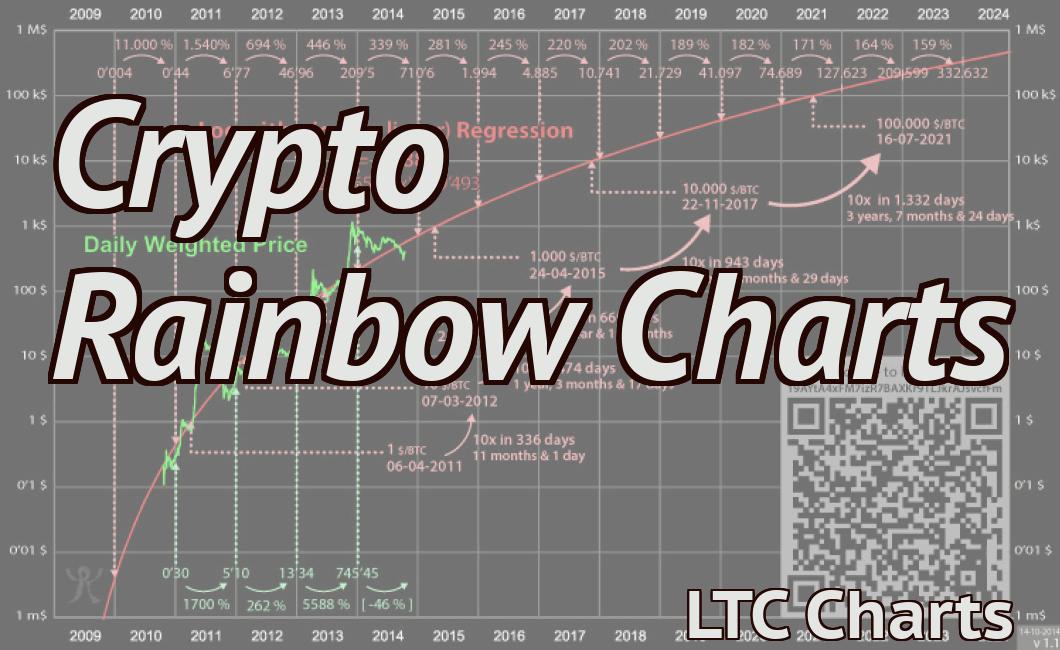

1. Time-based charts show the historical price data for a given period of time.

2. Volume-based charts track the amount of transactions that have taken place over a given period of time.

3. Supply-based charts show the estimated future supply of a digital asset.

Once you have identified the type of chart, you will need to understand how to read it.

Time-based charts

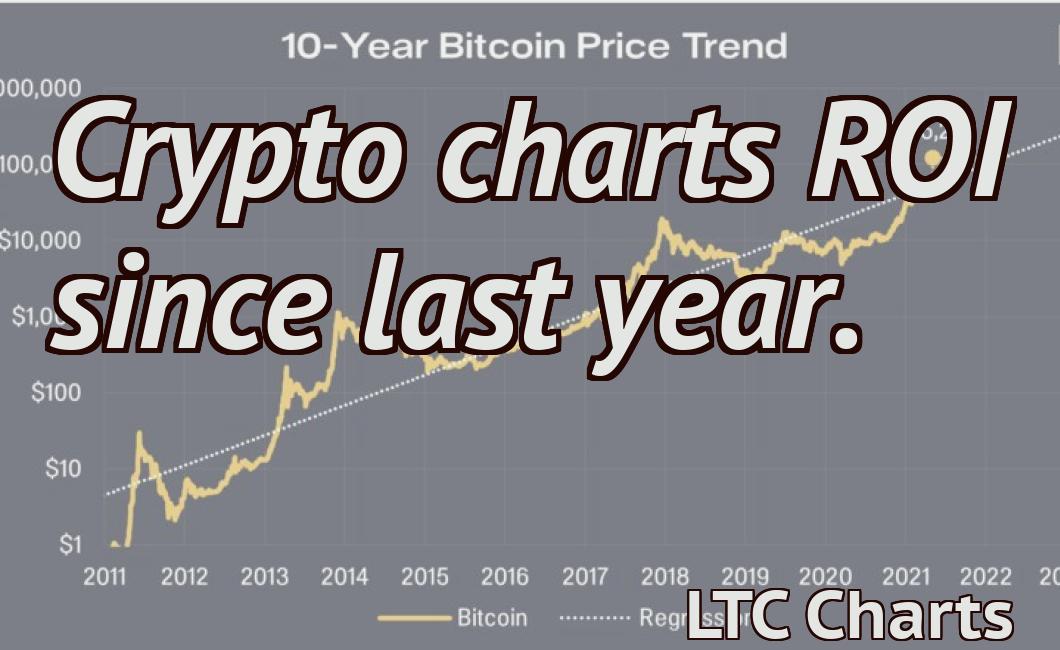

Time-based charts are usually used to track the trends in cryptocurrency prices. They show the historical price data for a given period of time, and you can use them to identify the peaks and troughs in the market.

To understand how the market is currently performing, you will first need to identify the peak and the valley. The peak is the highest point in the graph, and the valley is the lowest point.

The slope of the graph indicates the direction of the market trend. If the slope is positive, then the market is trending upwards, and if the slope is negative, then the market is trending downwards.

You can also use the graph to identify the reversal points in the market. A reversal point is a point in the graph where the market trend changes direction.

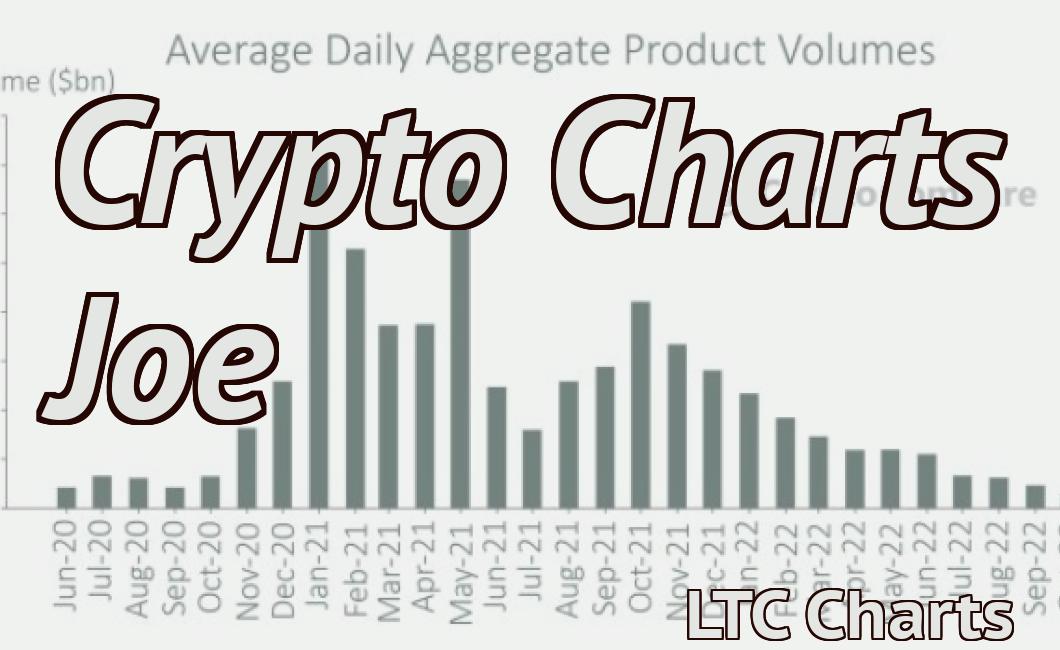

Volume-based charts

Volume-based charts are used to track the trends in cryptocurrency prices based on the amount of transactions that have taken place over a given period of time.

To understand how the market is currently performing, you will first need to identify the high and low points in the graph. The high point is the maximum point in the graph, and the low point is the minimum point.

The volume at these points shows how active the market is. The more activity there is, the higher the volume will be.

You can also use the graph to identify the reversal points in the market. A reversal point is a point in the graph where the market trend changes direction.

Supply-based charts

Supply-based charts show the estimated future supply of a digital asset.

To understand how the market is currently performing, you will first need to identify the peak and the valley. The peak is the highest point in the graph, and the valley is the lowest point.

The slope of the graph indicates the direction of the market trend. If the slope is positive, then the market is trending upwards, and if the slope is negative, then the market is trending downwards.

You can also use the graph to identify the reversal points in the market. A reversal point is a point in the graph where the market trend changes direction.

Tips for reading crypto trading charts

There is no one definitive way to read crypto trading charts. However, following some general tips can help you get started:

1. Look at the overall trend.

2. Check the indicators and see if they are indicating a buy or sell signal.

3. Consider where the price is relative to the support and resistance levels.

4. Pay attention to volume and whether it is increasing or decreasing over time.

The basics of reading crypto trading charts

Crypto trading charts are often used to help traders analyze and predict the price movement of digital assets. Trading charts display the price and volume of a particular cryptocurrency over a given period of time. Cryptocurrency exchanges make their charts available to the public, so anyone can view them.

Cryptocurrency trading charts can be divided into two main types: technical analysis and fundamental analysis. Technical analysis is focused on analyzing the price movements of a digital asset in order to predict future price trends. Fundamental analysis considers the factors that influence the price of a digital asset, such as supply and demand.

Technical analysis is based on the assumption that past price movements indicate future price movements. Technical analysts use indicators to identify patterns in the price data and use that information to make predictions about future prices. Some common technical analysis tools include moving averages, volume indicators, and Bollinger bands.

Fundamental analysis is based on the assumption that the price of a digital asset is determined by the underlying fundamentals of the market. Fundamental analysts look at factors such as the total supply of a digital asset, demand from buyers, and the political and economic conditions of a given country. They use this information to make predictions about future price movements.

Crypto trading charts can be used to make predictions about the future price movement of a digital asset. Technical analysis is based on the assumption that past price movements indicate future price movements. Technical analysts use indicators to identify patterns in the price data and use that information to make predictions about future prices.

Fundamental analysis is based on the assumption that the price of a digital asset is determined by the underlying fundamentals of the market. Fundamental analysts look at factors such as the total supply of a digital asset, demand from buyers, and the political and economic conditions of a given country. They use this information to make predictions about future price movements.

Getting Started with Reading Crypto Trading Charts

According to CoinMarketCap, there are currently over 1,600 cryptocurrencies available for trading on exchanges. This vast array of options can be difficult to navigate, let alone understand.

To help you get started with crypto trading charts, we’ve put together a guide that will teach you the basics of reading crypto trading charts.

Before You Begin

Before you can read crypto trading charts, you need to have a basic understanding of cryptocurrency and blockchain technology. If you don’t have a solid understanding of these concepts, you'll likely find it difficult to make informed trading decisions.

We recommend reading our comprehensive guide to understanding cryptocurrency and blockchain technology before continuing.

How to Read Crypto Trading Charts

When you're looking at a crypto trading chart, the first thing you'll want to do is identify the key indicators. These indicators are used to track the health of a cryptocurrency's market price.

Some of the most common indicators include:

The MACD (Moving Average Convergence Divergence) indicator measures the strength of a cryptocurrency's trend. It displays two lines on the chart, one moving up and the other moving down. The closer the lines are to each other, the stronger the trend is.

The RSI (Robot Trading Indicator) is a technical indicator that measures the volatility of a cryptocurrency's price. A higher RSI indicates more volatility in the market, which is good news for buyers.

The Volume Index (VI) tracks the amount of trading activity in a cryptocurrency's market. A higher VI indicates more active markets, which is good news for buyers.

You'll also want to look for trendlines and Fibonacci retracements. Trendlines are line patterns that indicate the direction of a cryptocurrency's trend. Fibonacci retracements are tools used to calculate potential support and resistance levels.

Once you've identified the key indicators, you can begin to analyze the data. This analysis will help you determine whether the market is in a healthy uptrend or downtrend.

If you're looking to buy into a cryptocurrency, you'll want to keep an eye on the prices at which the indicators are crossing. This will help you determine when the market is most likely to reach a healthy buying point.

If you're looking to sell your cryptocurrency, you'll want to watch for signs that the market is about to reach a healthy selling point. This will help you avoid selling at a loss.

How to interpret crypto trading charts

Crypto trading charts are used to help traders make informed decisions about the best time to buy or sell cryptocurrencies.

There are a number of factors to consider when interpreting crypto trading charts, including the current market conditions, the price of the cryptocurrency you're interested in, and the volume of the trade.

If you're new to crypto trading, it's important to keep in mind that market conditions can change rapidly and often unpredictably. So always be prepared to adjust your trading strategy as necessary.

How to make sense of crypto trading charts

Cryptocurrencies are traded on a variety of exchanges, and these exchanges provide different types of charts that can help traders make sense of the market.

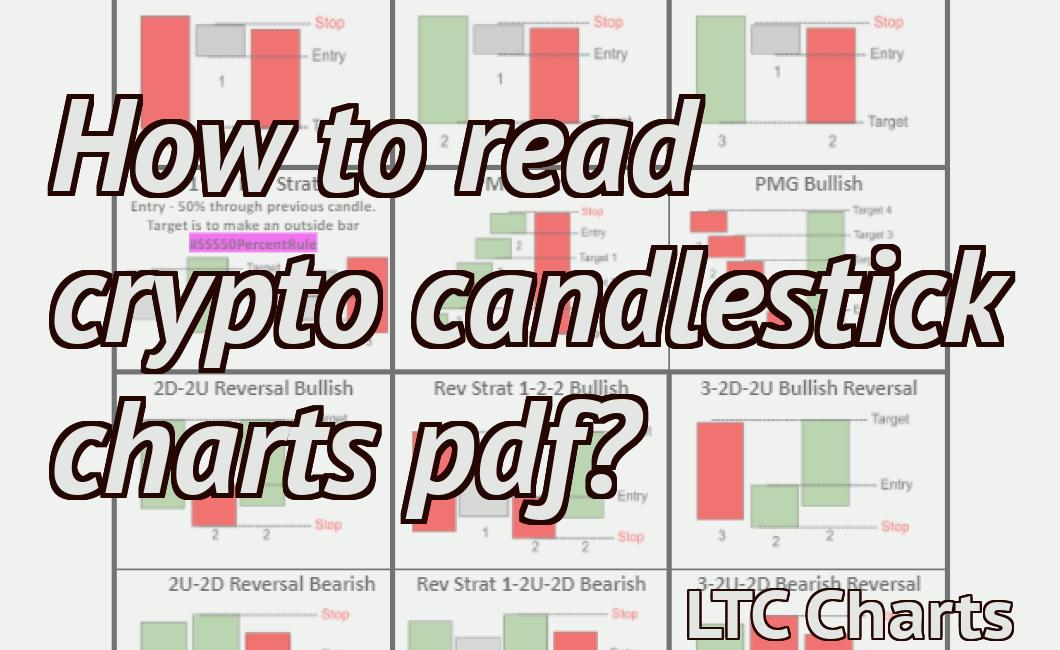

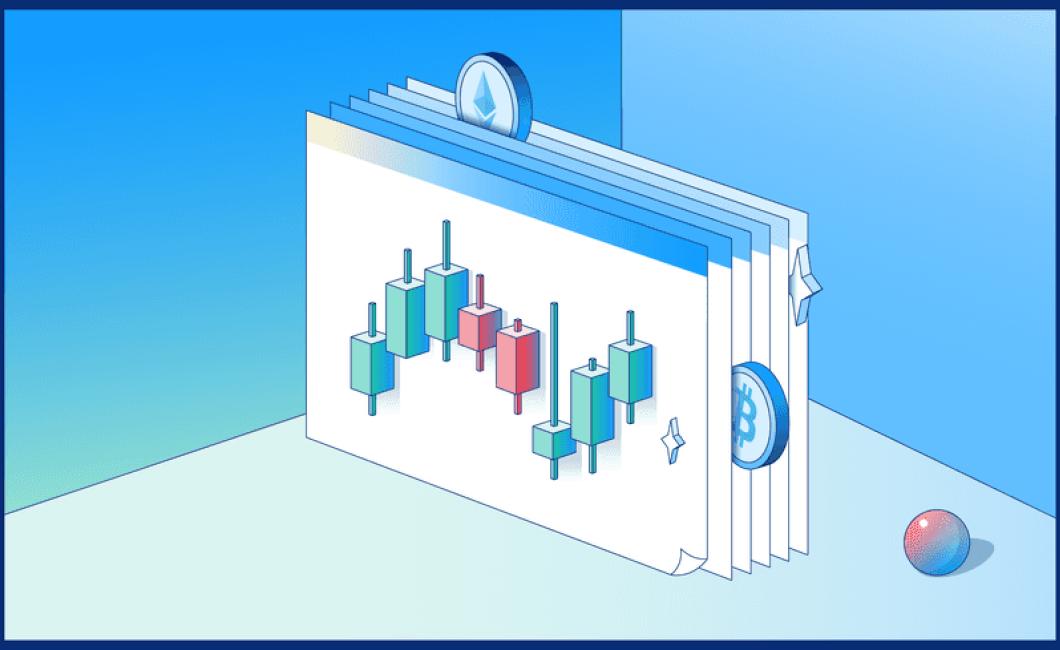

The most common type of chart is a candlestick chart, which displays the price of a cryptocurrency over a given period of time. Candlestick charts are useful for tracking short-term movements in the market, and they can be helpful in identifying patterns in price movement.

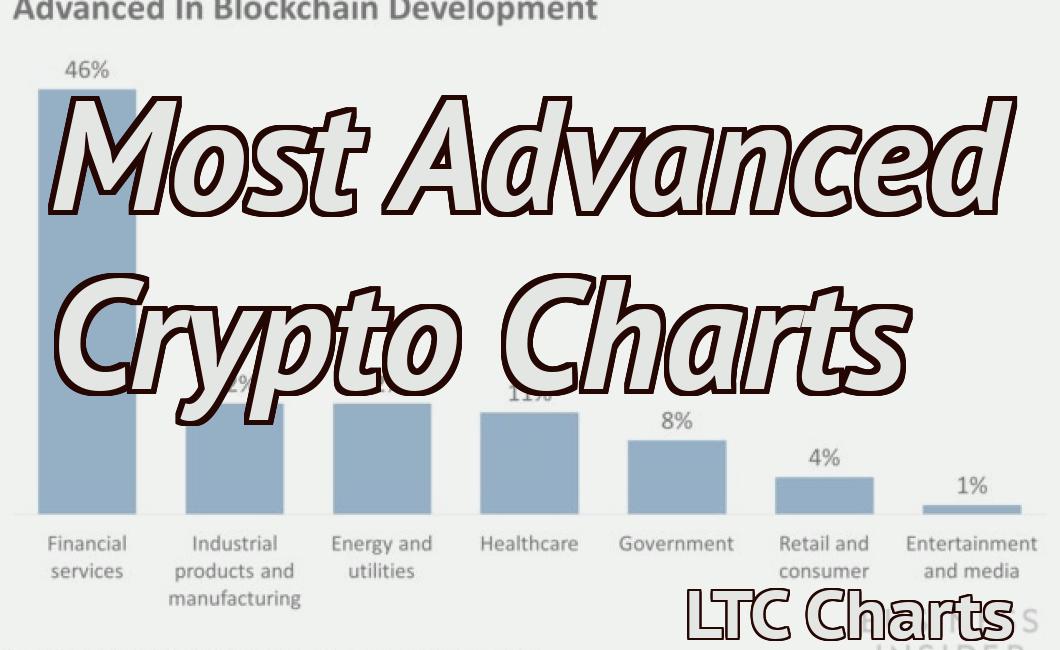

Another type of chart that is commonly used in the cryptocurrency market is the bar chart. Bar charts provide a graphical representation of the volume of a given cryptocurrency over a period of time, and they can be used to identify patterns in market activity.

Finally, cryptocurrency traders may also be interested in using technical analysis to make sense of the market. Technical analysis looks at historical data in order to identify patterns in price movement, and it can help traders to predict future trends in the market.