Guru Crypto Charts

If you're looking for cryptocurrency charts that you can rely on, look no further than Guru Crypto Charts. Our team of experts have years of experience in the industry and know what to look for in a good chart. We only recommend the best of the best, so you can be sure that you're getting accurate information.

How to Use Crypto Charts to Maximize Your Profits

Crypto charts can help you to maximize your profits by identifying trends and helping you to make informed investment decisions.

When you are looking at crypto charts, it is important to keep the following things in mind:

1) Technical Analysis

Technical analysis is the use of charts and indicators to identify trends and patterns in the market. When analyzing charts, it is important to keep a close eye on the following indicators:

1) MACD (moving average convergence divergence)

2) RSI (relative strength index)

3) The 4-hour chart

4) The daily chart

5) The weekly chart

When looking at these indicators, it is important to keep in mind the following:

1) The MACD is a technical indicator that helps to identify whether the market is bullish or bearish. The MACD indicator will show a positive reading if the market is advancing and a negative reading if the market is declining.

2) The RSI is an indicator that helps to identify whether the market is oversold or overbought. The RSI indicator will show a positive reading if the market is strong and a negative reading if the market is weak.

3) The 4-hour chart is a useful chart for identifying short-term trends.

4) The daily chart is a useful chart for identifying long-term trends.

5) The weekly chart is a useful chart for identifying short-term trends and long-term trends.

When looking at crypto charts, it is important to remember that there is no one right way to trade. So, take the time to analyze different charts and find the ones that work best for you.

The Benefits of Using Crypto Charts

Crypto charts are a great way to see how a particular cryptocurrency is performing over time. They can provide insights into how the market is behaving, and help you make informed investment decisions.

Here are some of the benefits of using crypto charts:

1. They can help you understand how the market is behaving

Crypto charts can help you understand how the market is behaving. They can show you how volatile the market is, and how prices are moving over time. This can help you make informed investment decisions.

2. They can show you how a cryptocurrency is performing

Cryptocurrencies are often traded on exchanges, so it can be difficult to track their performance over time. Crypto charts can help you see how a cryptocurrency is performing on an individual basis, and how its prices are changing. This can help you make more informed investment decisions.

3. They can help you track your portfolio

When you use crypto charts, you can track your portfolio's performance over time. This can help you identify any areas where you need to adjust your investment strategy.

The Top 9 Crypto Charts You Should Be Using

1. CoinMarketCap

2. CoinGecko

3. CoinMarketCap (Live)

4. CoinMarketCap (24h)

5. CoinMarketCap (7d)

6. CoinMarketCap (30d)

7. CoinMarketCap (Daily)

8. CoinMarketCap (Weekly)

9. CoinMarketCap (Monthly)

How to Read and Understand Crypto Charts

Cryptocurrencies are created as a way to secure payments and conduct transactions without the need for a third party. Cryptocurrency charts are used to track the performance of these digital assets.

Cryptocurrencies are divided into two categories: digital assets and tokens. Digital assets are cryptocurrencies that are represented by an underlying blockchain technology. Tokens are digital assets that are not associated with a blockchain.

Cryptocurrencies are traded on exchanges and can also be traded peer-to-peer. Cryptocurrency charts show the price of a digital asset over time. The most popular cryptocurrency charts are the CoinMarketCap and the CoinDesk charts.

To read and understand a crypto chart, you first need to understand the different types of data that is displayed on a chart. The four main types of data that are displayed on a crypto chart are market cap, price, volume, and supply.

Market cap is the total value of all outstanding tokens in circulation. Price is the price at which a token was last sold on an exchange. Volume is the amount of tokens that have been traded on an exchange in the past 24 hours. Supply is the total number of tokens that will be available in the future.

To read a crypto chart, you first need to determine what type of chart you are looking at. There are three types of crypto charts: daily, weekly, and monthly. Daily charts show the price over a 24-hour period. Weekly charts show the price over a 7-day period. Monthly charts show the price over a 30-day period.

Next, you need to determine what data you want to see on the chart. The four main types of data that are displayed on a crypto chart are market cap, price, volume, and supply.

Market cap is the total value of all outstanding tokens in circulation. Price is the price at which a token was last sold on an exchange. Volume is the amount of tokens that have been traded on an exchange in the past 24 hours. Supply is the total number of tokens that will be available in the future.

Next, you need to determine where you want to start the charting process. On CoinMarketCap, you can start the charting process by clicking on the “coins” tab and selecting a cryptocurrency. On CoinDesk, you can start the charting process by clicking on the “charts” tab and then selecting a cryptocurrency.

Next, you need to determine how long you want to view the chart for. On CoinMarketCap, you can view a crypto chart for 1 day, 7 days, or 30 days. On CoinDesk, you can view a crypto chart for 1 day, 7 days, or 30 days.

To read and understand a crypto chart, you first need to understand the different types of data that is displayed on a chart. The four main types of data that are displayed on a crypto chart are market cap, price, volume, and supply.

Market cap is the total value of all outstanding tokens in circulation. Price is the price at which a token was last sold on an exchange. Volume is the amount of tokens that have been traded on an exchange in the past 24 hours. Supply is the total number of tokens that will be available in the future.

Next, you need to determine where you want to start the charting process. On CoinMarketCap, you can start the charting process by clicking on the “coins” tab and selecting a cryptocurrency. On CoinDesk, you can start the charting process by clicking on the “charts” tab and then selecting a cryptocurrency.

Next, you need to determine how long you want to view the chart for. On CoinMarketCap, you can view a crypto chart for 1 day, 7 days, or 30 days. On CoinDesk, you can view a crypto chart for 1 day, 7 days, or 30 days.

The Different Types of Crypto Charts

Cryptocurrency charts are used to provide an overview of the performance of a particular cryptocurrency. There are four main types of cryptocurrency charts:

1. Price charts

Price charts give an overview of the movement of the price of a cryptocurrency over time. They display the price of a cryptocurrency over a specific period of time, and can be used to identify patterns in the price movement.

2. Volume charts

Volume charts show the amount of cryptocurrency that has been traded over a certain period of time. They can help identify changes in demand for a cryptocurrency, and can be used to predict future trends in the market.

3. Circular volume charts

Circular volume charts are a type of volume chart that displays the total value of a cryptocurrency over a period of time, as well as the percentage of that value that is represented by each type of transaction. This information can be used to identify patterns in the market and to predict future trends.

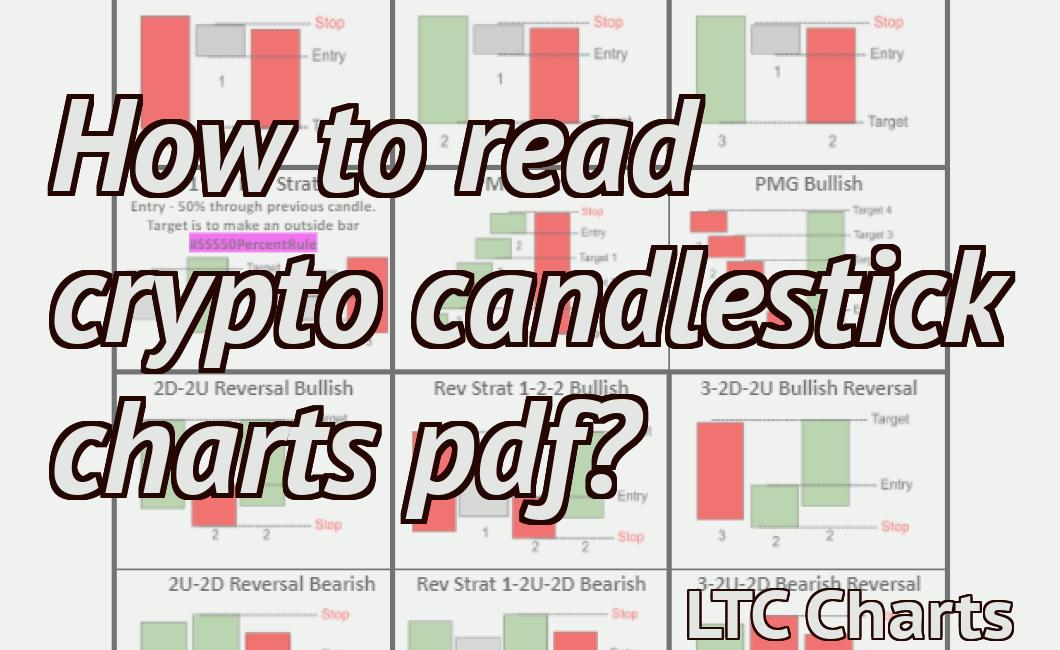

4. Candlestick charts

Candlestick charts are a type of volume chart that displays the movement of the price of a cryptocurrency over time, as well as the color of each candlestick. They can help to identify patterns in the market and to predict future trends.

7 Tips for Getting the Most Out of Crypto Charts

Crypto charts are often used to track the price of cryptocurrencies. However, they can also be used to track other digital assets.

1. Use a cryptocurrency chart that is reputable.

There are many different cryptocurrency charts available online. Make sure to choose a chart that is reputable and has a large user base. This will ensure that the data is reliable.

2. Compare different cryptocurrency charts.

Different cryptocurrency charts provide different information. Compare different charts to find the one that is most useful for your needs.

3. Use a cryptocurrency chart as a guide.

Do not blindly follow the cryptocurrency chart. Instead, use it as a guide to help you make informed decisions.

4. Use a cryptocurrency chart for research.

Use the cryptocurrency chart to do research on the latest trends. This will help you to stay informed about current market conditions.

5. Use a cryptocurrency chart to monitor your portfolio.

Monitoring your portfolio with a cryptocurrency chart can help you make informed decisions about your investments.

How to Make Money with Crypto Charts

Crypto charts are a great way to make money with cryptocurrency. They allow you to track the price of a particular cryptocurrency over time, and make money based on how the price changes.

To start making money with crypto charts, you first need to find a cryptocurrency that you want to track. Once you have chosen a cryptocurrency, you need to find a crypto charting platform. There are a variety of different platforms available, so it is important to choose one that is tailored to your needs.

Once you have found a platform, you need to register for an account. This will allow you to access the platform's features, and start tracking the price of your chosen cryptocurrency.

To make money with crypto charts, you need to be able to spot trends in the price of your cryptocurrency. If you can identify a trend early on, you can make money by trading on that trend.

Overall, crypto charts are a great way to make money with cryptocurrency. They allow you to track the price of a particular cryptocurrency over time, and make money based on how the price changes.

The Dos and Don’ts of Crypto Charting

Crypto charting is a process of analyzing the performance of a cryptocurrency over time. It can be used to identify important trends and make informed investment decisions. However, there are a few things that you should avoid when doing crypto charting.

Don't focus solely on the price

Charting is a valuable tool, but it's not the only factor that matters when investing in cryptocurrencies. The price of a cryptocurrency is important, but it's not the only factor that determines its value. The size of a market cap, the number of active users, and the quality of a project are all important factors to consider.

Don't get distracted by rumors

Cryptocurrencies are volatile and price movements can be very dramatic. This makes it easy to get caught up in rumors and speculation. Stick to facts and data when analyzing cryptocurrencies, and don't let rumors influence your decision-making.

Don't invest more than you can afford to lose

Cryptocurrencies are volatile and price movements can be very dramatic. This makes it easy to get caught up in rumors and speculation. Stick to facts and data when analyzing cryptocurrencies, and don't let rumors influence your decision-making.

5 Essential Tips for Newbies Who Want to Use Crypto Charts

1. Use a reliable cryptocurrency charting platform.

There are a number of reliable cryptocurrency charting platforms available, including CoinMarketCap, CoinGecko, and CoinMarketCap.com. Make sure to choose a platform that is easy to use and that has a wide range of charts and indicators.

2. Read up on cryptocurrency related topics.

Before you start trading or investing in cryptocurrencies, it is important to have a basic understanding of their underlying technology and how they work. This can be gained by reading up on cryptocurrency related articles and topics, including but not limited to: blockchain, Bitcoin, Ethereum, and altcoins.

3. Do your research before buying cryptocurrencies.

Before you buy any cryptocurrencies, make sure you do your research and understand the risks involved. It is important to be aware of the potential for high volatility and to be well-prepared for any potential price crashes.

4. Stay up to date with current events involving cryptocurrencies.

Keep up to date with current events involving cryptocurrencies so that you can make informed decisions when trading or investing in them. This includes but is not limited to: news about regulatory changes, new partnerships, and Initial Coin Offerings (ICOs).

5. Only invest what you are willing to lose.

Never invest more money than you are willing to lose in cryptocurrencies. This includes but is not limited to: your own money, your retirement savings, and your children’s college funds.