How to see crypto charts.

If you're interested in tracking the value of cryptocurrencies, you'll need to know how to read crypto charts. Charts are an essential tool for technical analysis, which can help you predict future price movements. There are a few different types of crypto charts, but the most popular ones are candlestick charts and bar charts. Candlestick charts show the open, high, low, and close prices for a given period of time. Bar charts show the open, high, low, and close prices for a given period of time, as well as the volume traded during that period. Both types of charts can be used to identify trends and support and resistance levels.

How to Understand Crypto Charts

Crypto charts are a visual representation of the current market conditions for cryptocurrencies. They are produced by various cryptocurrency tracking websites and can be used to help investors understand the performance of different cryptocurrencies.

Cryptocurrencies are traded on exchanges and can go up or down in price. Crypto charts show the price of a cryptocurrency over a period of time, usually 24 hours. The x-axis shows the time period and the y-axis shows the price of the cryptocurrency.

Cryptocurrencies are often divided into two categories - digital assets and tokens. Digital assets are cryptocurrencies that are stored on a digital ledger, such as Bitcoin, Ethereum and Ripple. Tokens are digital assets that act as units of exchange. They can be used to purchase goods and services or to invest in other cryptocurrencies.

Cryptocurrencies are decentralized, meaning they are not controlled by a single entity. This makes them risky and volatile.

A Beginner's Guide to Crypto Charting

Cryptocurrency charts are essential for anyone interested in investing in digital currencies. Charting tools allow you to see how the price of a given cryptocurrency has changed over time, and can help you make informed decisions about whether or not to buy or sell.

Before you get started with charting, it’s important to understand some basic concepts about cryptocurrencies. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution regulation.

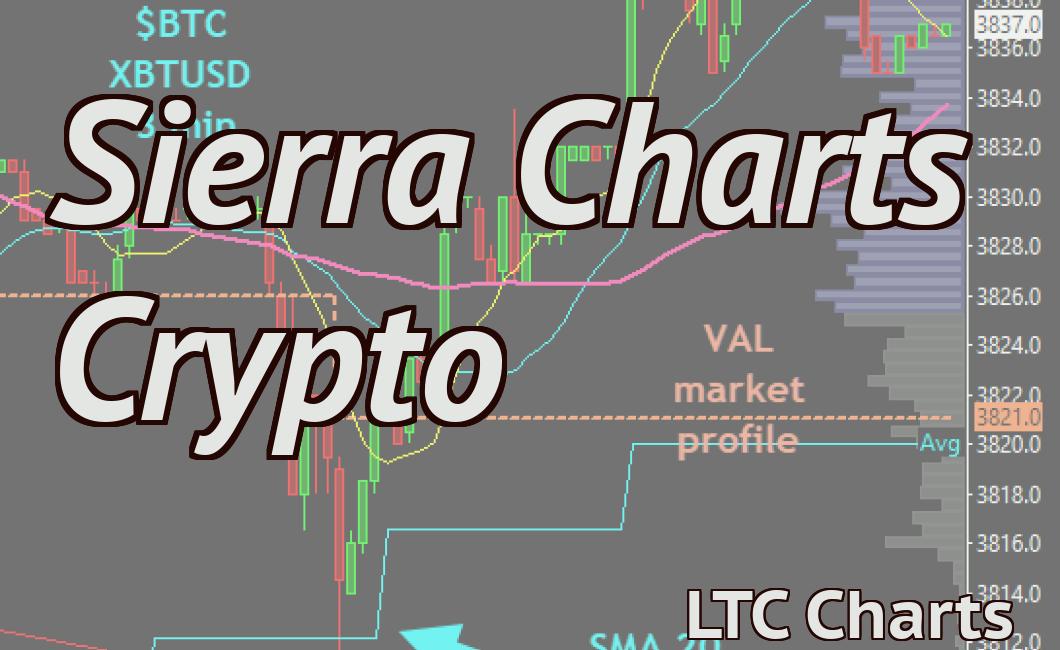

To create a cryptocurrency chart, you will need a few essential tools. The first is a cryptocurrency tracking software, such as CoinMarketCap. This software will allow you to view all of the latest cryptocurrency prices and charts. You can also use this software to find the best performing cryptocurrency of the day.

The second tool you will need is a Bitcoin or Ethereum wallet. This is where you will store your cryptocurrencies. Once you have installed the cryptocurrency tracking software and created a wallet, you can begin charting your cryptocurrencies.

To start charting your cryptocurrencies, you will first need to find the correct cryptocurrency charting platform. There are a number of different platforms available, so it’s important to find one that suits your needs. Some popular platforms include CoinMarketCap, Coinigy, and TradingView.

Once you have found the right platform, you will need to add your cryptocurrencies. To do this, you will first need to find your wallet address. Your wallet address is a unique sequence of letters and numbers that corresponds to your cryptocurrencies. You can find your wallet address by visiting your cryptocurrency tracking software and clicking on “Wallets”.

After you have found your wallet address, you will need to add your cryptocurrencies to the platform. To do this, click on the “Coins” tab, and then select the cryptocurrency you wish to chart. Next, you will need to find the correct price data for your chosen cryptocurrency. To do this, click on the “Charts” tab, and then select the “Price Charts” option. Finally, you will need to find the correct timeframe for your chosen cryptocurrency. To do this, click on the “Timeframes” tab, and then select the “Daily, Weekly, Monthly” option.

Once you have found the correct price data and timeframe, you will need to begin charting your chosen cryptocurrency. To do this, click on the “Charts” tab, and then select the “Candlestick Charts” option. Next, you will need to find the correct currency symbol for your chosen cryptocurrency. To do this, click on the “Symbols” tab, and then select the “Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Ethereum Classic (ETC), Dash (DASH), Monero (XMR), Zcash (ZEC)” option. Finally, you will need to find the correct timeframe for your chosen cryptocurrency. To do this, click on the “Timeframes” tab, and then select the “Daily, Weekly, Monthly” option.

Once you have found the correct timeframe and currency symbol, you will need to begin charting your chosen cryptocurrency. To do this, click on the “Charts” tab, and then select the “Candlestick Charts” option. Next, you will need to find the correct chart type for your chosen cryptocurrency. To do this, click on the “Chart Types” tab, and then select the “Candlestick Chart” option. Finally, you will need to find the correct indicator for your chosen cryptocurrency. To do this, click on the “Indicators” tab, and then select the “Open/Close” option.

After you have found the correct chart type, indicator, and timeframe, you will need to begin charting your chosen cryptocurrency. To do this, click on the “Charts” tab, and then select the “Candlestick Charts” option. Next, you will need to find the correct timeframe for your chosen cryptocurrency. To do this, click on the “Timeframes” tab, and then select the “Daily, Weekly, Monthly” option.

Once you have found the correct timeframe and Candlestick Chart type, you will need to begin charting your chosen cryptocurrency. To do this, click on the “Charts” tab, and then select the “ candle chart” option. Next, you will need to find the correct marker for your chosen cryptocurrency. To do this, click on the “Markers” tab, and then select the “Bubble Size” option. Finally, you will need to find the correct timeframe for your chosen cryptocurrency. To do this, click on the “Timeframes” tab, and then select the “Daily, Weekly, Monthly” option.

Once you have found the correct timeframe and Candlestick Chart type, marker, and timeframe, you will be ready to begin trading your chosen cryptocurrency. To do this, click on the “Trades” tab, and then select the “Buy/Sell” option. Next, you will need to enter your desired price target for your chosen cryptocurrency. To do this, enter the amount of cryptocurrency you wish to purchase at your desired price target, and then click on the “Buy” button. Finally, you will need to enter your desired price target for your chosen cryptocurrency. To do this, enter the amount of cryptocurrency you wish to sell at your desired price target, and then click on the “Sell” button.

After you have completed these steps, your chosen cryptocurrency should be trading at your desired price target. If not, please check your charts and indicators for any errors or incorrect data. Once you have corrected any errors or completed any additional trading requirements, you can begin re-charting your chosen cryptocurrency at your desired price target.

The Basics of Crypto Charting

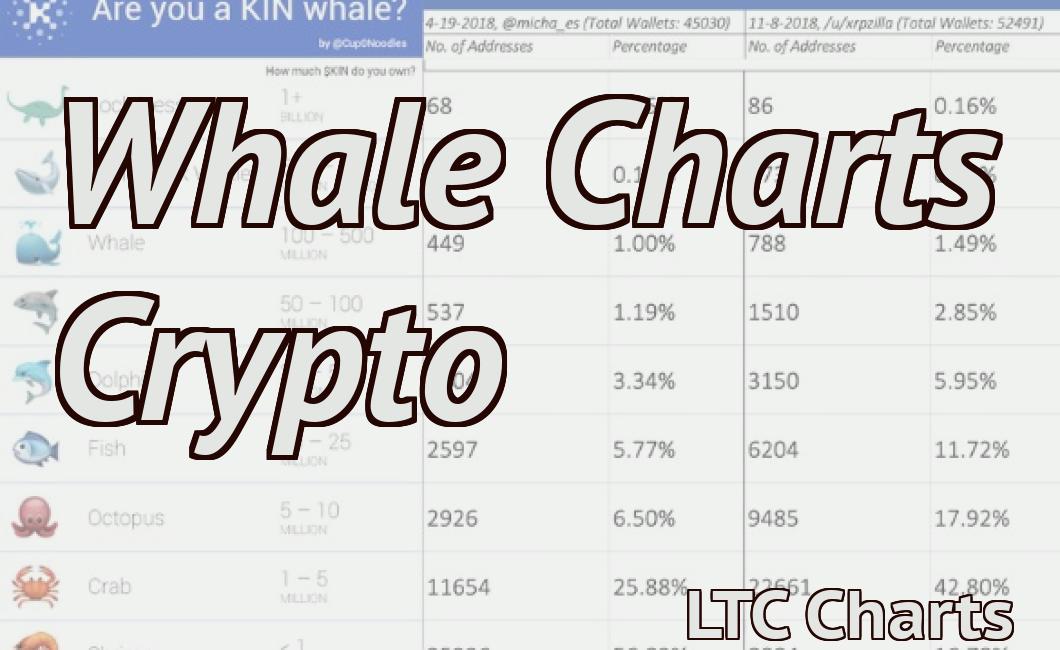

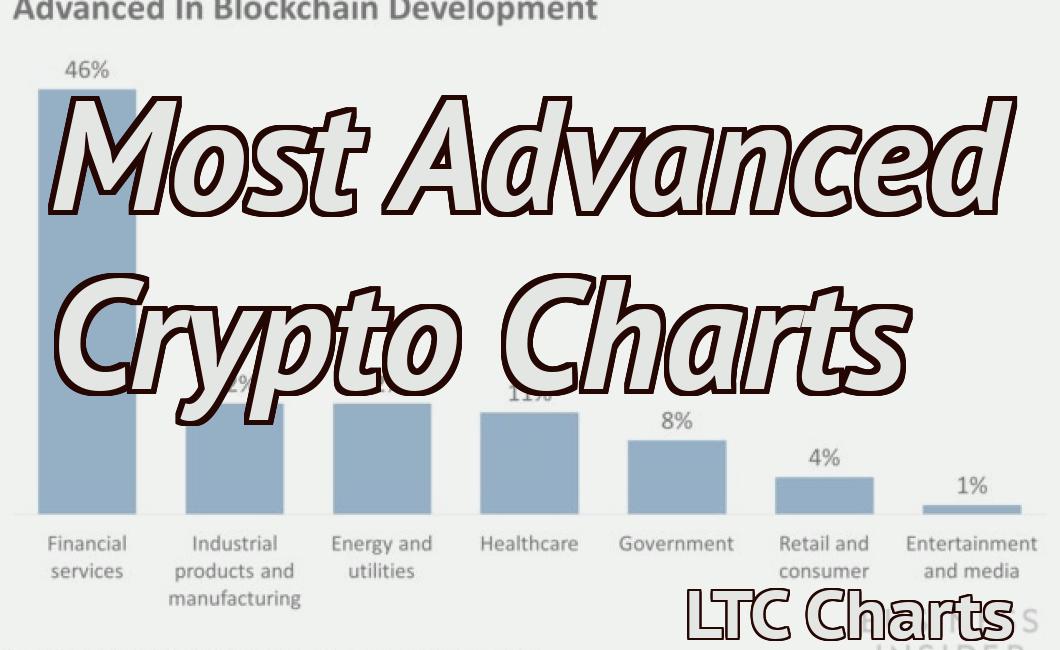

Crypto charts are used to track the performance of cryptocurrencies and other digital assets. Crypto charts display various data points, including the price of a cryptocurrency, its market cap, and its trading volume.

Cryptocurrencies are often traded on exchanges, and their prices can fluctuate quickly. Crypto charts can help you track the price and performance of a cryptocurrency over time.

Crypto charts can also be used to identify trends and patterns in a cryptocurrency’s price. For example, you might be able to identify a cryptocurrency’s “hot spot” – a region where its price is especially high. You can also use crypto charts to predict the future price of a cryptocurrency.

How to Use Crypto Charts

Crypto charts are a great way to get an overview of the current price and market activity for a particular cryptocurrency.

To use a crypto chart, first find the cryptocurrency you want to track. For example, if you're looking for the price of Bitcoin, you would search for "Bitcoin" on CoinMarketCap. Once you've found the specific cryptocurrency you're interested in, click on the "Charts" link in the menu bar at the top of the page.

On the Crypto Chart page, you'll see a variety of different charts and graphs. To view the price chart, click on the "Price" tab. To view the market activity graph, click on the "Market" tab. To view the block chain activity graph, click on the "Blockchain" tab.

If you want to zoom in or out on any of the graphs, simply use the mouse cursor to drag it closer or further to your desired location. You can also double-click on any graph to enlarge it.

If you want to switch between different tabs on the Crypto Chart page, simply click on the tab that interests you. For example, if you want to view the market activity graph, but you also want to view the block chain activity graph, you would click on the "Blockchain" tab and then click on the "Market" tab.

The Benefits of Crypto Charting

Cryptocurrencies are a new asset class with many potential benefits for investors.

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are traded on decentralized exchanges and can also be used to purchase goods and services. They are often considered to be more volatile than traditional assets, but this can also make them more risky and rewarding.

There are many potential benefits of investing in cryptocurrencies, including:

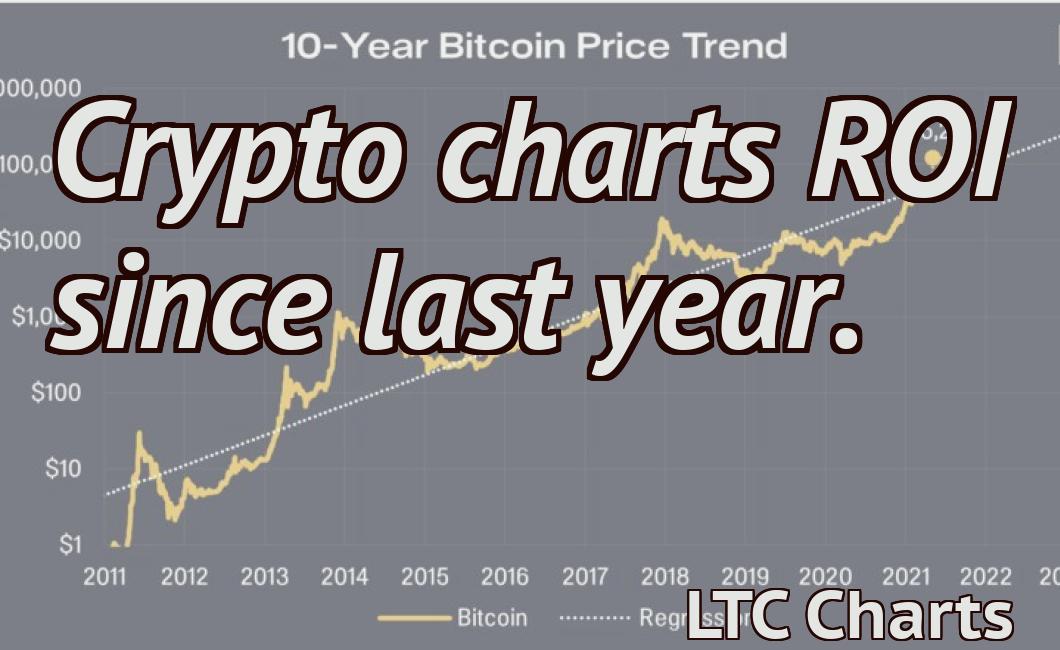

1. Increased Returns: Cryptocurrencies are often considered to be more volatile than traditional assets, which can lead to increased returns.

2. Increased Privacy: Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. This can lead to increased privacy and security for investors.

3. Reduced Risk: Cryptocurrencies are not subject to government or financial institution control, which can reduce risk.

4. Increased Liquidity: Cryptocurrencies are traded on decentralized exchanges, which can increase liquidity.

How to Read Crypto Charts

Cryptocurrencies are primarily traded on digital exchanges, and their prices are displayed on charts.

Crypto charts are divided into two main types: technical and fundamental. Technical charts show the price of a cryptocurrency over time, while fundamental charts are used to analyze a cryptocurrency’s underlying value.

To read a crypto chart, start by locating the price of the cryptocurrency on the chart. Use this figure to identify the specific time period being examined. For example, if the price is located at the bottom of the chart, the chart is displaying prices from the past day. If the price is located at the top of the chart, the chart is displaying prices from the past week.

Next, locate the indicator(s) that are being displayed on the chart. These indicators will provide information about the current state of the cryptocurrency. For example, if the chart is displaying prices, an indicator for the prices might be displayed. If the chart is displaying volumes, an indicator for volume might be displayed.

Once the indicator has been located, use it to determine what is happening with the price of the cryptocurrency. For example, if the indicator is displaying prices, use this figure to determine how much the price has changed since the last time it was displayed. If the indicator is displaying volumes, use this figure to determine how much trading activity has occurred since the last time it was displayed.

What Crypto Charts Mean

Cryptocurrency charts are used by traders and investors to track the value of digital assets, such as Bitcoin and Ethereum. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrency charts can be used to track the price of a digital asset, its volume of trade, and its overall market capitalization. Cryptocurrencies are often traded on decentralized exchanges and can also be bought and sold on traditional exchanges.

Cryptocurrency charts can be used to track the price of a digital asset, its volume of trade, and its overall market capitalization.

How to Analyze Crypto Charts

Cryptocurrency charts are a great way to track the price and activity of different cryptocurrencies.

The first thing you'll want to do is find a cryptocurrency chart that is relevant to your investment. There are many cryptocurrency charts available online, so it's important to find one that is specific to the coins you're interested in.

Once you've found a chart, you'll want to understand what it is telling you. Cryptocurrency charts typically show the price of a cryptocurrency over time, as well as the amount of active transactions.

You can also use cryptocurrency charts to track the performance of a particular cryptocurrency. By studying the chart and understanding how it is changing, you can get an idea of how the coin is performing.

The Different Types of Crypto Charts

Cryptocurrency charts are essential for traders and investors who want to track the price of a particular digital asset. There are a few different types of cryptocurrency charts, each with its own advantages and disadvantages.

candlestick charts

Candlestick charts are probably the most well-known type of cryptocurrency chart. They use a series of candlesticks to represent the price of a digital asset over time. Candlestick charts are easy to understand, and they can be used to analyze price movements in detail.

One downside of candlestick charts is that they can be difficult to interpret if you don't know how to read them. Additionally, candlestick charts can be vulnerable to manipulation, so they're not ideal for investment purposes.

bar charts

Bar charts are similar to candlestick charts, but they use a series of horizontal bars to represent the price of a digital asset. Bar charts are easier to read than candlestick charts, and they can be used to track the price of a digital asset over time.

One downside of bar charts is that they can be less detailed than candlestick charts. Additionally, bar charts can be less resistant to manipulation, so they're not ideal for investment purposes.

line charts

Line charts are similar to bar charts, but they use a series of vertical lines to represent the price of a digital asset. Line charts are easier to read than bar charts, and they can be used to track the price of a digital asset over time.

One downside of line charts is that they can be less detailed than bar charts. Additionally, line charts can be less resistant to manipulation, so they're not ideal for investment purposes.

How to Create Your Own Crypto Chart

To create your own crypto chart, start by gathering data from a variety of sources. You can find market data from exchanges, news articles, and other online sources.

Once you have your data, you will need to create a charting software program. There are many free and commercial options available, so choose one that best suits your needs.

Next, you will need to gather information about each of the coins you are charting. This includes their price, circulating supply, and other relevant data.

Finally, you will need to create a title and description for your chart. These will help viewers understand what the chart is showing and how it relates to the overall market.

The Advantages of Using Crypto Charts

Crypto charts are an excellent way to quickly and easily understand the trends and movements of various cryptocurrencies. By utilizing these charts, you can gain an understanding of how each coin is performing, as well as identifying any potential investment opportunities.

Cryptocurrencies are constantly moving and changing, which can make it difficult to keep track of all the different coins. By using crypto charts, you can quickly and easily see which coins are doing well and which ones may be in trouble. This information can help you make informed investment decisions.

Cryptocurrencies are also incredibly volatile, which can make them difficult to invest in without knowing what you're doing. By using crypto charts, you can easily see which coins are losing value and which ones are gaining value. This information can help you decide whether it's worth investing in a specific coin.