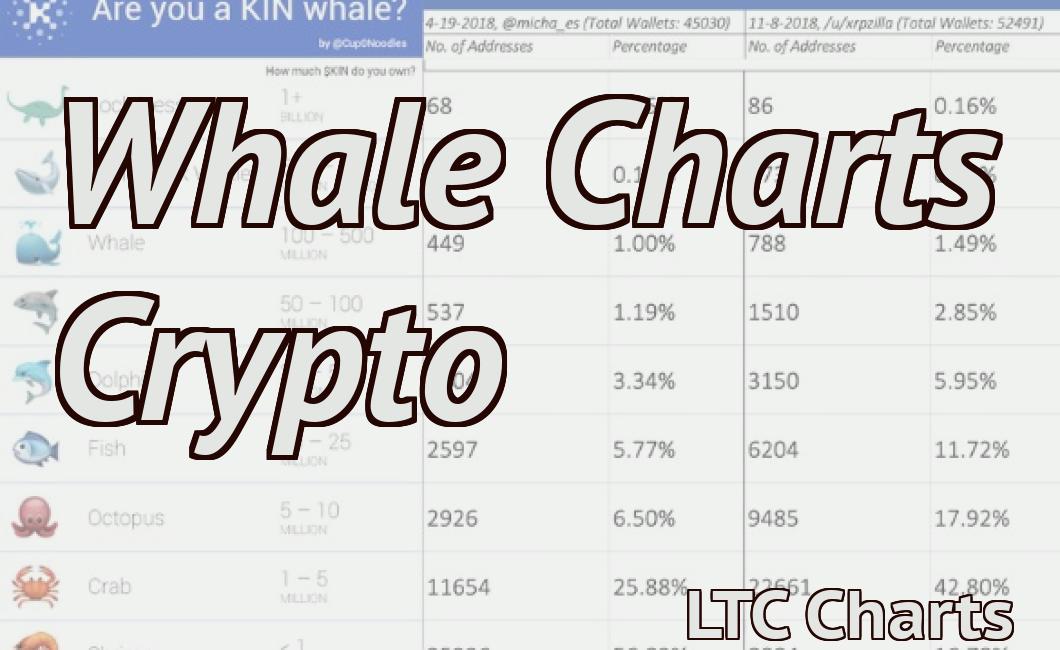

Crypto Tech Charts

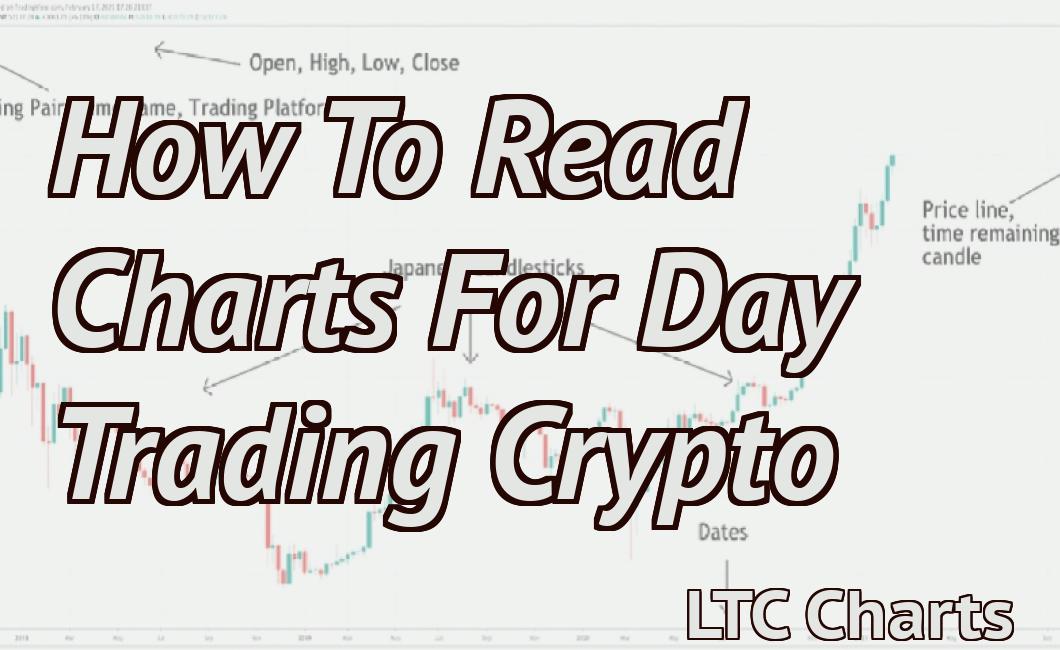

This article covers the basics of crypto tech charts and how to read them.

How to read crypto tech charts

Crypto technical charts can be read in a variety of ways, but the most common is to use indicators to help predict price movements.

Some common indicators used to read crypto technical charts include:

1. MACD (moving average convergence divergence) indicator

2. Bollinger Bands

3. RSI (relative strength index)

4. Fibonacci retracements

5. Volume

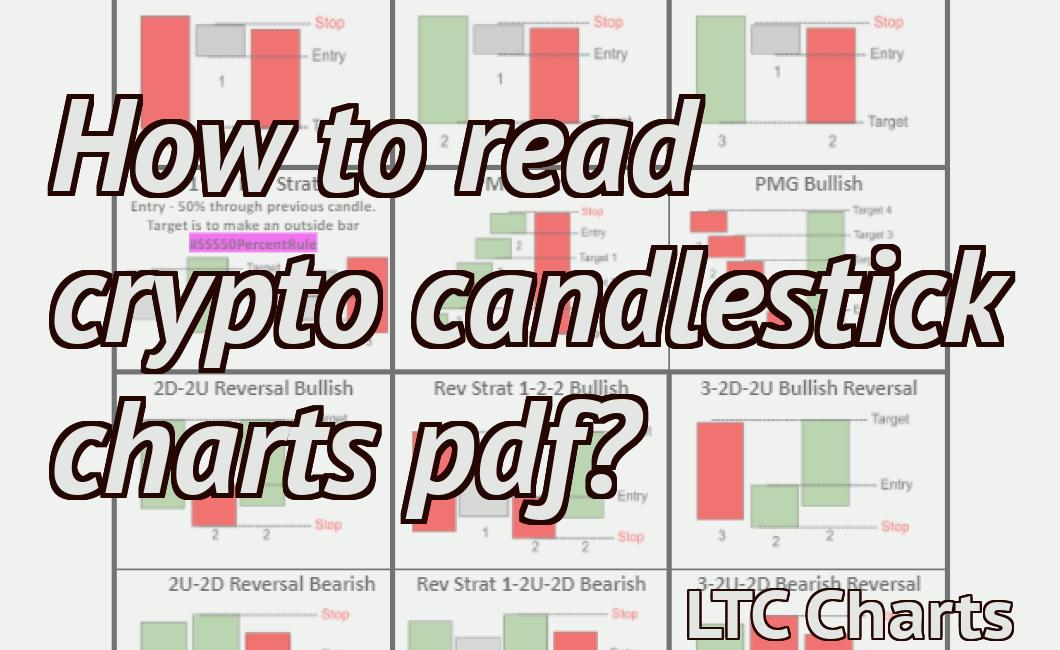

The most important crypto tech chart patterns

1. Bullish engulfing pattern

2. Head-and-shoulders pattern

3. Double top pattern

4. Triangle pattern

5. Fibonacci retracement

3 simple steps to start reading crypto tech charts

1. Browse through different crypto exchanges and track the prices of different cryptocurrencies.

2. Follow the latest news and updates related to cryptocurrencies.

3. Analyze the trends and analyze the performance of different cryptocurrencies.

A beginner's guide to crypto tech chart analysis

Crypto tech charts can be used for a variety of things, such as identifying trends, identifying support and resistance levels, and determining when a cryptocurrency is over or undervalued.

Here are four simple tips for using crypto tech charts:

1. Look for trendlines. A trendline is a line on a crypto tech chart that shows the overall trend of the cryptocurrency. If the cryptocurrency is trending upwards, the trendline will be located near the top of the chart, while if the cryptocurrency is trending downwards, the trendline will be located near the bottom of the chart.

2. Check for support and resistance levels. If a cryptocurrency is trading below its support level, this means that there is strong selling pressure in the market and the currency may soon experience a price decline. If a cryptocurrency is trading above its resistance level, this means that there is strong buying pressure in the market and the currency may soon experience a price increase.

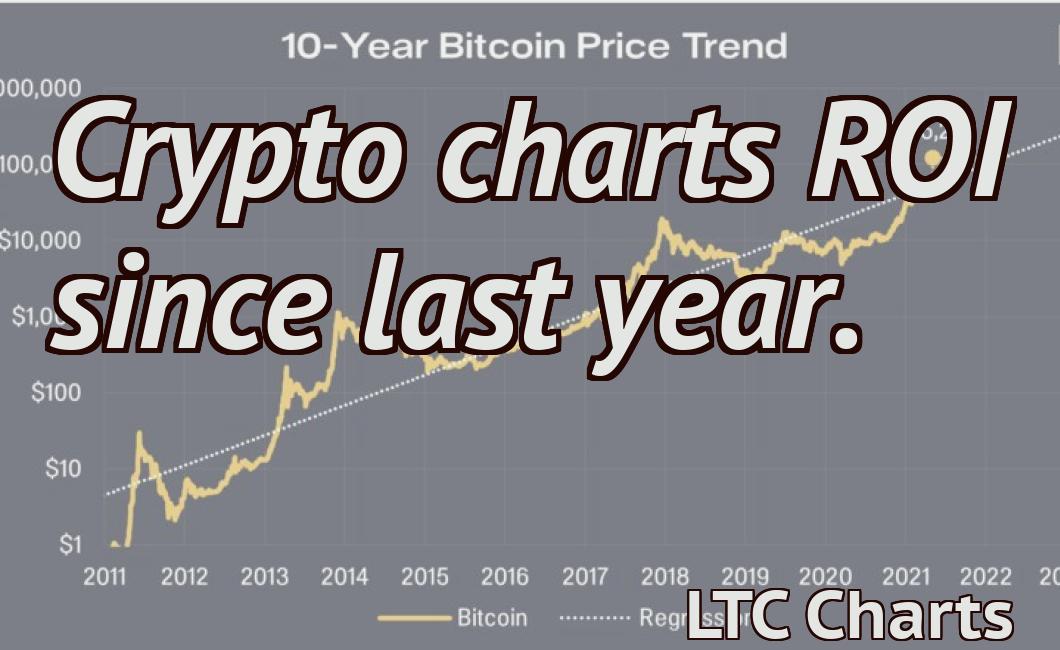

3. Compare the value of the cryptocurrency to its historical price data. This will help you determine when the cryptocurrency is over or undervalued.

4. Stay Vigilant. Always keep an eye on the market conditions and be prepared to make changes to your trading strategy should the conditions change.

The 5 most common crypto tech chart mistakes

1. Focusing on price instead of volume

2. Ignoring the overall trend

3. Forgetting about market conditions

4. Ignoring market sentiment

5. Focusing on one specific coin or token

How to spot emerging trends using crypto tech charts

Crypto technical charts can be used to identify emerging trends. Some of the most commonly used indicators are the moving averages, the MACD, and the stochastic indicator.

Moving averages are a type of technical indicator that is used to smooth out price movements. They indicate how much the price has moved over a specific period of time. The longer the moving average, the smoother the graph will be.

The MACD is a popular technical indicator that helps to identify trends. It is composed of two indicators: the MACD histogram and the MACD signal line. The MACD histogram shows the difference between the closing prices over a period of time and the opening prices. The MACD signal line indicates the direction of the trend.

The stochastic indicator is used to identify patterns in price movement. It is composed of three indicators: the stochastic oscillator, the stochastic trendline, and the stochastic volume. The stochastic oscillator measures the degree of randomness in price movement. The stochastic trendline indicates whether the current price is above or below the average price over a period of time. The stochastic volume measures how many shares have been traded over a specific period of time.

The benefits of reading crypto tech charts

Cryptocurrency charts are a great way to stay up to date on the latest trends and developments in the crypto world. By tracking various metrics such as price, volume, and technical indicators, you can quickly and easily identify trends and patterns that may signal investment opportunities.

How to use crypto tech charts to improve your trading

Cryptocurrency trading can be a highly profitable venture, but it can also be a risky business. To make the most informed decisions when trading cryptocurrencies, it’s important to use reliable cryptocurrency tech charts.

Cryptocurrency tech charts are a valuable resource for traders because they provide a visual representation of the prices and movements of various cryptocurrencies. By using crypto tech charts, you can quickly and easily identify trends and patterns in the market. This information can then be used to make informed trading decisions.

To get started using crypto tech charts, you first need to find a reputable charting service. There are a variety of services available, so it’s important to find one that is suited to your specific needs. Some popular services include CoinMarketCap and TradingView.

Once you have found a suitable charting service, you need to create an account and log in. Next, you need to select the cryptocurrencies you want to track. You can track as many cryptocurrencies as you want, but make sure to keep track of the different price movements for each one.

Once you have selected the cryptocurrencies you want to track, you need to input the relevant data into the charting service. This data includes the current price, the 24-hour volume, and the historical price data.

Next, you need to look for potential trends and patterns in the data. By doing this, you can quickly and easily identify potential investment opportunities.

By using crypto tech charts, you can improve your trading skills and make more informed decisions. By using reliable charts and data, you can increase your chances of success in the cryptocurrency market.

The power of crypto tech charts in cryptocurrency trading

Crypto tech charts are one of the most important tools in cryptocurrency trading. They can show you a detailed overview of the market and help you make informed decisions.

Crypto tech charts are a graphical representation of blockchain data. They show the performance of cryptocurrencies, altcoins, and other digital assets over time.

They can help you understand how the market is performing, identify trends, and make informed trading decisions.

Crypto tech charts can also help you optimize your trading strategies. By understanding the market dynamics, you can improve your chances of success.

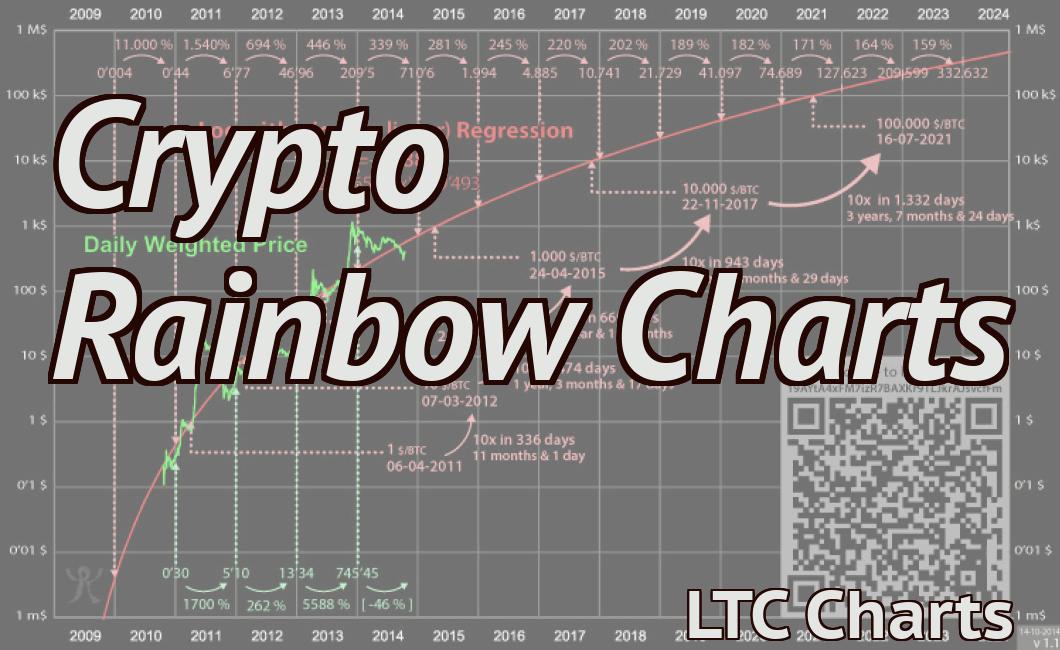

Types of crypto tech charts

There are two main types of crypto tech charts:

1. Technical analysis

2. Volume analysis

Technical analysis is based on the principle that price movements reflect underlying trends. It uses technical indicators to predict future trends.

Volume analysis looks at how much trading activity is taking place in a particular asset. It can help you identify trends and patterns in trading activity.

Both technical analysis and volume analysis are important tools in cryptocurrency trading. They can help you make informed trading decisions and optimize your strategies.

How to use crypto tech charts

To use crypto tech charts effectively, you need to understand how they work.

First, understand the basics of blockchain data. This will help you understand how crypto tech charts work.

Next, familiarize yourself with the different types of crypto tech charts. This will help you understand the different uses for crypto tech charts.

Finally, use crypto tech charts to make informed trading decisions. This will help you achieve success in cryptocurrency trading.