Newbie Crypto Charts

If you're new to the world of cryptocurrency, you may be wondering what all the fuss is about. Crypto charts can help you understand what's going on in the market, and can also be a valuable tool for making informed investment decisions. In this article, we'll take a look at some of the most popular crypto charts, and explain what they can tell you about the market.

Which Crypto Charts are Newbie Friendly?

Cryptocurrency charts are often not as beginner friendly as other types of charts. For example, stock charts may have more detail and be easier to understand. Cryptocurrency charts may also lack some of the basic information that is found on other charts, such as price and volume.

How to Read Crypto Charts for Beginners

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. The largest cryptocurrency by market cap is bitcoin, followed by Ethereum, Bitcoin Cash, Ripple, and Litecoin.

The Different Types of Crypto Charts

Cryptocurrencies are created through a process called mining. Miners are rewarded with cryptocurrencies for verifying and recording transactions on the blockchain.

The most popular type of cryptocurrency chart is the candlestick chart. This type of chart displays the price of a cryptocurrency over time, typically in intervals of 10 minutes. Candlestick charts are useful for watching short-term movements.

Another popular type of cryptocurrency chart is the bar chart. This type of chart displays the price of a cryptocurrency over time, typically in intervals of 1 hour. Bar charts are useful for tracking long-term movements.

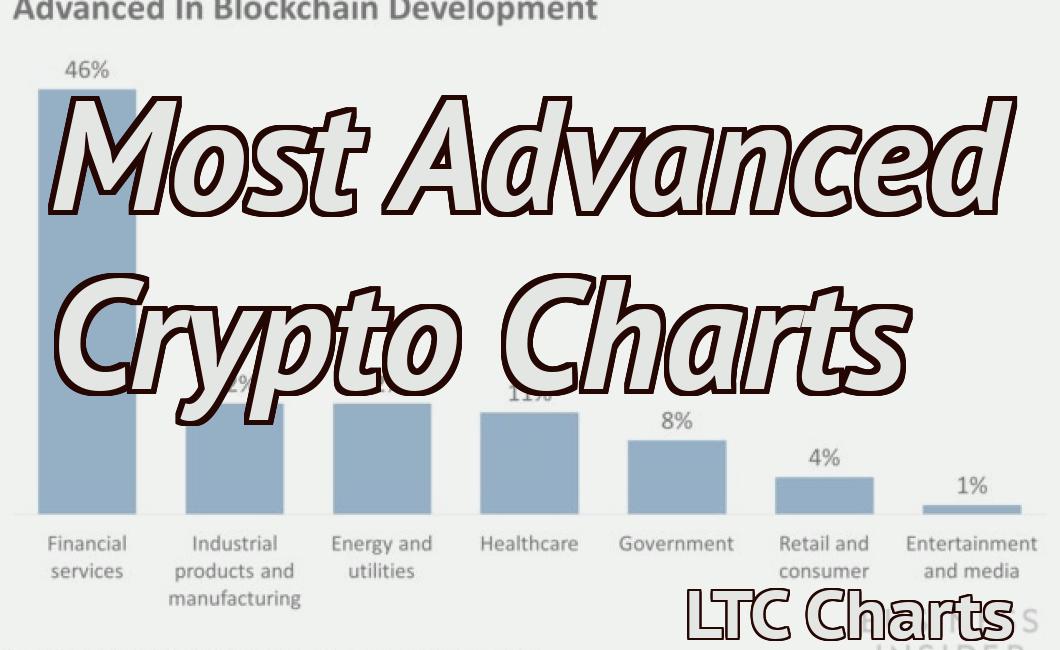

Another type of cryptocurrency chart is the pie chart. This type of chart displays the percentage of a cryptocurrency's total market value. Pie charts are useful for understanding how a cryptocurrency is divided among different stakeholders.

How to Use Crypto Charts to Your Advantage

Crypto charts are a great way to stay up to date on the latest cryptocurrency movements. By following the charts, you can get an idea of where prices are headed and whether or not you should buy or sell.

There are a few things to keep in mind when using crypto charts:

1. Don’t overreact to the charts. It’s important not to get too excited or panicked about the movements, as this can lead to bad decision-making.

2. Always do your own research. While crypto charts can be a helpful tool, always remember that they are only one part of the equation. Before making any investment decisions, it’s important to do your own research and consult with a financial adviser.

3. Be patient. The cryptocurrency market is volatile, and prices can move quickly. It’s important not to get too attached to a particular investment, as there is a good chance that it will go down in value later on.

5 Tips for Newbie Crypto Chart Traders

1. Do your research. The first and most important thing you can do before trading is to do your research. Read as many articles, watch videos, and take in as much information as you can. This will help you understand the markets and the coins better, and will give you a better idea of what to look for when trading.

2. Stick to a strategy. When trading, always have a strategy in place. Whether you are buying or selling, know what you are looking for and stick to it. This will help you avoid making mistakes, and will also help you to make more informed decisions.

3. Don’t overtrade. When trading, always be aware of your losses and don’t overtrade. This can lead to big losses, and is not a wise decision. Stick to a few coins and trades at a time to avoid getting too emotionally invested in the market.

4. Don’t get too greedy. When trading, always remember not to get too greedy. Greed can lead to big mistakes, and is not a good way to make money in the crypto markets. Stick to a plan, and only trade what you believe is worth trading.

5. Be patient. When trading, always be patient. The markets can move quickly and you may not be able to get all of your money out quickly if you are wrong about the trade. Wait for the right moment to sell, and then wait for the right moment to buy.

What do All Those Lines on a Crypto Chart Mean?

Cryptocurrencies are a digital asset class that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

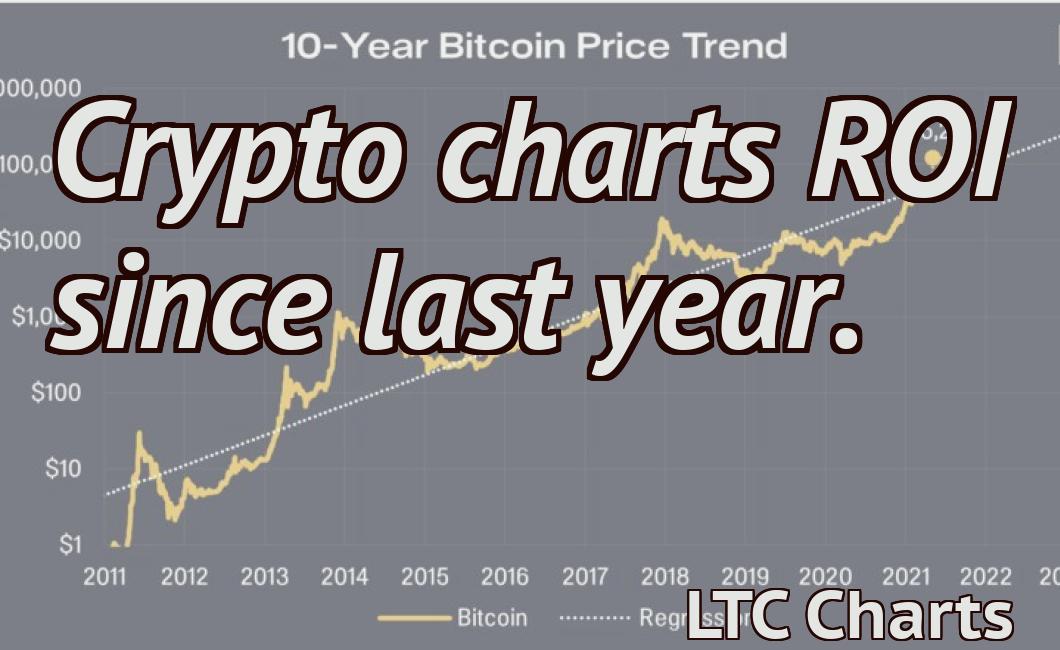

A "cryptocurrency chart" typically displays the price of a cryptocurrency over time, with the x-axis representing time and the y-axis representing the price. Lines on a cryptocurrency chart represent changes in price.

Cryptocurrencies are unique in that their value is not tied to any physical asset. This has led to a great deal of speculation about their value. Cryptocurrencies are often traded on exchanges, and their prices can be affected by a range of factors, including news, technical analysis, and geopolitical events.

A Beginner's Guide to Interpreting Cryptocurrency Charts

Cryptocurrency charts can be a great way to track the performance of individual cryptocurrencies and make informed investment decisions.

In this beginner's guide, we'll explain how to interpret cryptocurrency charts and help you get started tracking the performance of your favorite cryptocurrencies.

What Is a Cryptocurrency Chart?

A cryptocurrency chart is a graphical representation of the price history of a cryptocurrency. It shows the price over time, and can be used to track the performance of a cryptocurrency portfolio.

Cryptocurrency charts are useful for:

Tracking the performance of a cryptocurrency portfolio

Making informed investment decisions

Interpreting the price action of a cryptocurrency

Charting technical indicators

Understanding the market sentiment

Tracking the Performance of a Cryptocurrency Portfolio

Cryptocurrencies are often traded on exchanges, and the price of a cryptocurrency can change rapidly. Tracking the performance of a cryptocurrency portfolio can be complex and time consuming.

Cryptocurrency charts can help you track the performance of your portfolio over time. By understanding the technical indicators on a cryptocurrency chart, you can make informed investment decisions.

Interpreting the Price Action of a Cryptocurrency

Cryptocurrencies are volatile, and the price of a cryptocurrency can change rapidly. Cryptocurrency charts can be used to track the performance of a cryptocurrency portfolio, but they are not always accurate.

Cryptocurrency charts can be used to interpret the price action of a cryptocurrency. By understanding the trend, you can make informed investment decisions.

Charting Technical Indicators

Cryptocurrency charts can be used to chart technical indicators. Technical indicators can help you understand the market sentiment and track the performance of a cryptocurrency portfolio.

Understanding the Market Sentiment

Cryptocurrencies are often traded on exchanges, and the price of a cryptocurrency can change rapidly. Cryptocurrency charts can be used to track the performance of a cryptocurrency portfolio, but they are not always accurate.

Cryptocurrency charts can be used to interpret the price action of a cryptocurrency. By understanding the trend, you can make informed investment decisions.

How to Analyze a Cryptocurrency Chart for Beginners

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

To analyze a cryptocurrency chart, you will need to understand the following concepts:

Cryptocurrency price : The price of a cryptocurrency is determined by supply and demand.

: The price of a cryptocurrency is determined by supply and demand. Cryptocurrency market cap : The market cap of a cryptocurrency is the total value of all outstanding units.

: The market cap of a cryptocurrency is the total value of all outstanding units. Cryptocurrency price chart : A cryptocurrency price chart displays the price of a cryptocurrency over time.

: A cryptocurrency price chart displays the price of a cryptocurrency over time. Cryptocurrency volume: Cryptocurrency volume is the number of transactions conducted on a cryptocurrency exchange.

10 Essential Tips for Newbie Crypto Chart Traders

1. Understand the basics of cryptocurrency trading.

Before you start trading cryptocurrencies, it is important to understand the basics of how they work. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

2. Do your research.

Before you start trading cryptocurrencies, it is important to do your research. Learn about the different cryptocurrencies and their underlying technologies. Also, be sure to understand the risks involved in trading them.

3. Stay informed.

Keep up to date on the latest news and events related to cryptocurrencies. This will help you better understand how the market is evolving and help you make informed decisions when trading cryptocurrencies.

4. Stay disciplined.

Cryptocurrencies are volatile investments. Be prepared to lose some money while you are learning how to trade them. Don’t let emotions get in the way of making sound investment decisions.

5. Use a trading strategy.

Before you start trading cryptocurrencies, it is important to develop a trading strategy. This will help you avoid common mistakes that new cryptocurrency traders often make.

6. Use a cryptocurrency trading platform.

Using a cryptocurrency trading platform can help you stay organized and track your investments more easily.

7. Set stop losses and limits.

Before you start trading cryptocurrencies, it is important to set stop losses and limits. This will help you avoid losing all your money if the price of a cryptocurrency falls sharply.

8. Use a proper wallet for storing cryptocurrencies.

Do not store cryptocurrencies in an online wallet or on a computer that is connected to the internet. Instead, use a cryptocurrency wallet that is specially designed for storing cryptocurrencies.

9. Be patient.

Cryptocurrencies are still in their early stages and there are often lot of uncertainties surrounding them. Be patient and keep an open mind while you are learning how to trade them.

The Do's and Don'ts of Trading Cryptocurrency Charts for Beginners

Do your research

The first and most important thing you can do when trading cryptocurrency charts is to do your research. This means understanding the technical indicators and how they work, as well as the historical trends of the various cryptocurrencies.

Don't overreact

Another important thing to remember when trading cryptocurrency charts is to never overreact. This means always keeping a cool head and not letting your emotions get the best of you. If you do overreact, you may end up making mistakes that could cost you money.

Don't trade on emotion

Finally, never trade on emotion. This means always keeping your goals in mind and not letting your emotions get in the way of making sound financial decisions.

How to Make Money Trading Cryptocurrency Charts for Beginners

There are a few ways to make money trading cryptocurrency charts for beginners.

Some people trade cryptocurrencies by buying and selling them on exchanges. This is how most people make money trading cryptocurrency charts for beginners. You can find a list of the best exchanges here.

Another way to make money trading cryptocurrency charts for beginners is to invest in them. This is how some very rich people make their money. You can find out more about investing in cryptocurrencies here.

A Beginner's Guide to Making a Profit from Cryptocurrency Charts

If you’re new to cryptocurrency, you may be wondering how to make a profit from charts. Here’s a beginner’s guide to making a profit from cryptocurrency charts.

1. Understand what a cryptocurrency chart is and how it works

A cryptocurrency chart is a visual representation of the price of a cryptocurrency over time. It shows the price of a cryptocurrency over a set period of time, typically 24 or 48 hours.

Cryptocurrency charts are useful for two reasons:

They can help you understand the price of a cryptocurrency over time. This is useful if you want to know how the price of a cryptocurrency has changed over the past day, week, or month.

They can help you make a decision about whether to buy or sell a cryptocurrency. If the price of a cryptocurrency is rising, it may be a good time to buy. If the price of a cryptocurrency is falling, it may be a good time to sell.

2. How to make a profit from cryptocurrency charts

To make a profit from cryptocurrency charts, you first need to understand how the price of a cryptocurrency changes over time.

Then, you need to understand how to trade cryptocurrencies. Trading cryptocurrencies involves buying one cryptocurrency and selling another cryptocurrency. This is how you make a profit from cryptocurrency charts.

3. What factors affect the price of a cryptocurrency

There are many factors that affect the price of a cryptocurrency. These include:

The market demand for the cryptocurrency. The more people who want to buy or sell a cryptocurrency, the higher the price will be.

The supply and demand for the cryptocurrency. The more people who want to buy or sell a cryptocurrency, the lower the price will be.

The other cryptocurrencies that are trading with the cryptocurrency you’re buying or selling. If the other cryptocurrencies are also rising in price, this will increase the price of the cryptocurrency you’re buying or selling.

4. How to trade cryptocurrencies

To trade cryptocurrencies, you first need to buy one cryptocurrency and sell another cryptocurrency. This is how you make a profit from cryptocurrency charts.

To buy a cryptocurrency, you need to find an online exchange where you can buy the cryptocurrency. You can find online exchanges by searching for “cryptocurrency exchange” or “cryptocurrency trading” on Google.

To sell a cryptocurrency, you need to find an online exchange where you can sell the cryptocurrency. You can find online exchanges by searching for “cryptocurrency exchange” or “cryptocurrency trading” on Google.