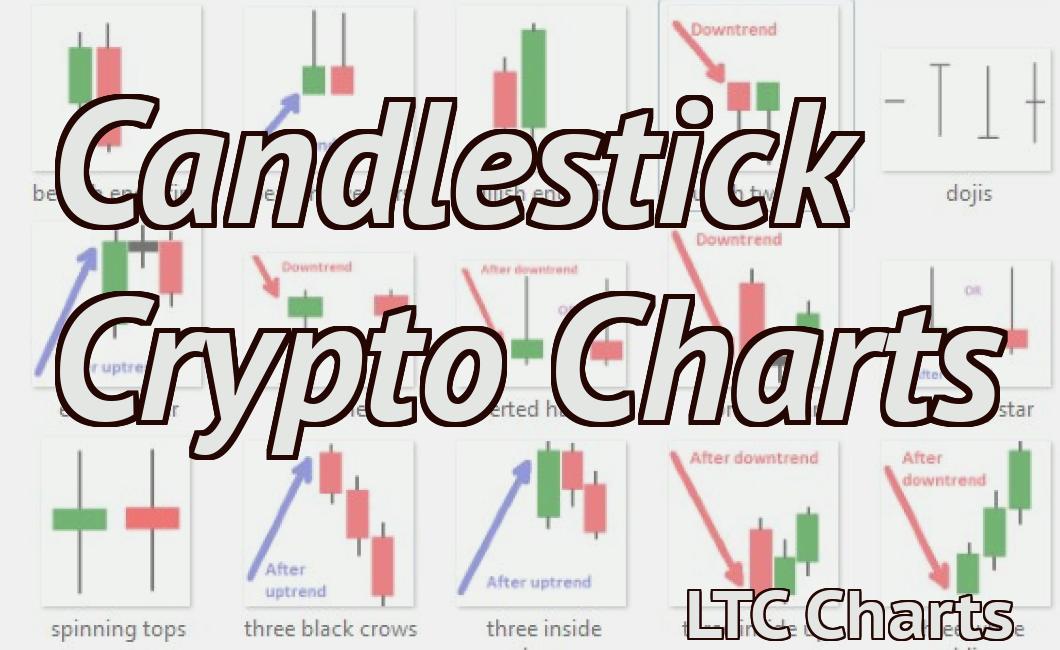

Please compare crypto charts.

This article provides a side-by-side comparison of crypto charts.

How to read crypto charts

Cryptocurrency charts can be difficult to read, but with a little practice you'll be able to decipher the latest trends.

The first thing to understand is that cryptocurrency prices are always fluctuating. This means that the prices of individual cryptocurrencies can go up and down a lot.

To make it easier to follow the trends, you'll want to focus on the different axes on the chart. The most important one is the price axis, which shows how much the cryptocurrency has been worth over time.

The other important axes are the volume (how many coins have been traded) and the 24-hour change (how much the value has changed in the last day or 24 hours).

If you want to know whether a cryptocurrency is going up or down, you can look at the trend line. This is a graph that shows how the price has been moving over time, and it can be a good indicator of whether the price is going to increase or decrease in the future.

Finally, it's important to remember that cryptocurrency charts are always changing, so don't get too attached to any specific trend. Always keep an eye on the latest data to make sure you're as informed as possible about the current market conditions.

The difference between crypto charts

and stock charts

Cryptocurrencies and stocks are two different types of investments. Cryptocurrencies are digital or virtual assets that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Stock charts are a graphical representation of a company's stock price over time. They typically use a horizontal axis to represent time and a vertical axis to represent the stock's price. The x-axis shows the number of days since the beginning of the chart, while the y-axis shows the stock price.

Which is better - crypto chart A or B?

Crypto chart A is better because it is easier to read.

How to compare crypto charts

Cryptocurrencies are unique in that they are traded on exchanges and can be compared in a variety of ways.

One way to compare crypto charts is to look at the market capitalization of each coin. This measures the total value of all coins in circulation. The larger the market cap, the more valuable the coin.

Another way to compare crypto charts is to look at the price trends of each coin. This shows how the price of a coin has changed over time. If a coin's price is increasing, it is likely that there is demand for that coin. If a coin's price is decreasing, it may be a sign that there is a lack of demand for that coin.

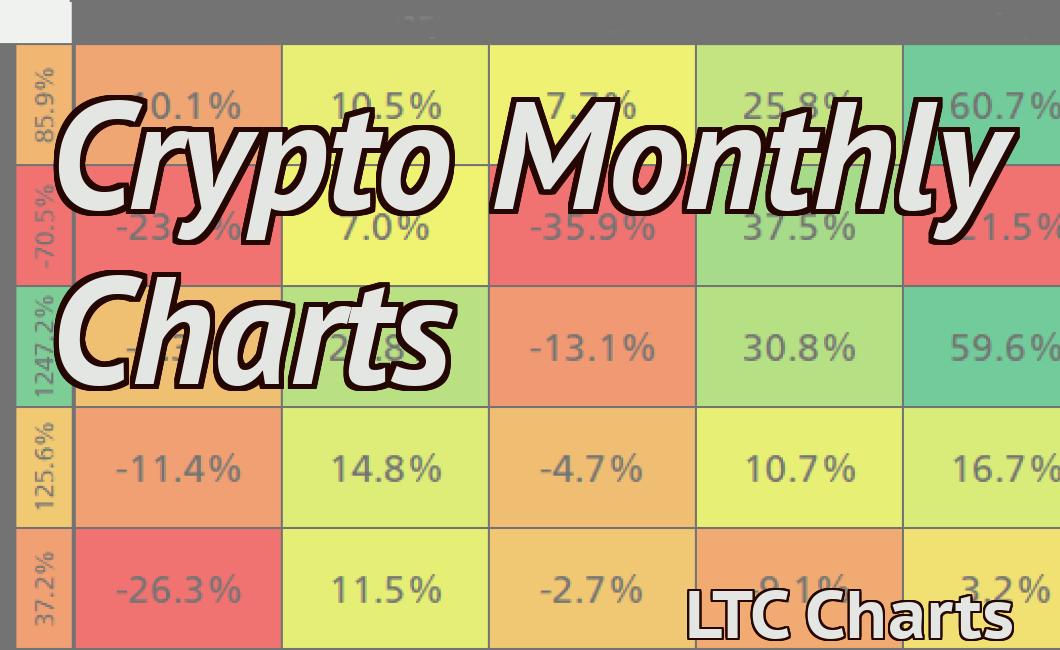

The benefits of comparing crypto charts

There are many reasons why you might want to compare crypto charts. Compare the prices of different cryptocurrencies over time to see which ones are rising and falling the most. Compare the prices of different cryptocurrencies against each other to see who is the most valuable. Compare the prices of different cryptocurrencies against the value of gold to see how valuable they are relative to other investments.

The best way to compare crypto charts

There is no one definitive answer to this question. Different people will have different preferences and opinions, which means that there is no one right way to compare crypto charts. Some people might prefer to look at crypto charts in terms of market cap, while others might prefer to focus on the price of a specific cryptocurrency. Ultimately, the best way to compare crypto charts is to look at what you think is the most important information.

Why you should compare crypto charts

The main reason to compare crypto charts is to identify trends and patterns. You can use this information to make informed investment decisions.

Cryptocurrencies are complex and evolving products, so it’s important to constantly monitor prices and performance to stay ahead of the curve. Compare crypto charts to get a snapshot of the current market conditions, so you can make informed investment decisions.

How to make the most out of comparing crypto charts

There are a few things to keep in mind when comparing crypto charts.

The first is to make sure that you are comparing apples to apples. Different cryptocurrencies have different characteristics, and it can be difficult to compare them accurately. For example, Ethereum has a higher price per unit than Bitcoin, but Bitcoin has a larger market cap. It can be helpful to look at other metrics, such as market capitalization or circulating supply, in order to get a more accurate picture of each cryptocurrency's worth.

Secondly, it is important to remember that crypto prices are highly volatile. This means that the values of individual cryptos can fluctuate rapidly over short periods of time. It is important to keep this in mind when comparing charts, in order to avoid getting too excited or discouraged by sudden changes in value.

Last but not least, it is important to be aware of the risks associated with investing in cryptocurrencies. While there are a number of reputable cryptocurrencies out there, there is also a risk of losing all of your investment if the cryptocurrency fails to live up to its expectations. Always do your research before investing in any new cryptocurrency, and consult a financial advisor if you have any questions.

What you can learn from comparing crypto charts

Cryptocurrencies are a new and exciting investment opportunity, but it can be hard to know which ones are worth investing in. One way to try to figure this out is to compare crypto charts.

By looking at different crypto charts, you can get an idea of how a cryptocurrency is performing and whether it is likely to continue doing well.

Some things to consider when comparing crypto charts include:

The price of the cryptocurrency

How long the cryptocurrency has been trading for

The volume of the cryptocurrency

The market cap of the cryptocurrency

The percentage of the total global cryptocurrency market cap that the cryptocurrency represents

The trend of the cryptocurrency

Some tips for choosing a good cryptocurrency to invest in:

Look for a cryptocurrency with a low price and high volume. This means that the cryptocurrency is likely to be well-known and popular, and there is a lot of interest in it.

Choose a cryptocurrency with a low market cap, as this indicates that it is not as well-known as more popular cryptocurrencies.

Be cautious of cryptocurrencies with a high percentage of the global market cap. These cryptocurrencies are more likely to be well-known and popular, which could mean that they are overvalued.

Look for a cryptocurrency that is trending upwards, as this indicates that it is likely to continue doing well in the future.