Candlestick Crypto Charts

Candlestick charts are one of the most popular types of charts used by cryptocurrency traders. They provide a visual representation of price action and can be used to identify trends and potential trading opportunities.

Get Started with Candlestick Crypto Charts

Candlestick charts are a great way to get started with cryptocurrency trading. They are simple to use and provide a visual representation of what is happening in the market.

To use candlestick charts, first open up a charting program such as TradingView.com. Once you are logged in, click on the " candlestick charts " tab at the top of the page.

Candlestick charts are composed of three sections: the body, the upper shadow, and the lower shadow. The body shows the current price of the asset, while the upper shadow and lower shadow show how much the price has changed since the previous day's close.

To get started with candlestick charts, simply select the currency or asset you want to trade and open the chart. Next, find the " candles " tab on the right-hand side of the screen. This will display all the candlesticks that have been created for that particular chart.

To move between the different candlesticks, simply click on the one you want to see. To close out of the chart, simply click on the "x" in the top right-hand corner.

How to Read Candlestick Crypto Charts

Candlestick charts are one of the most popular ways to track the performance of cryptocurrencies. They show the price and volume of a cryptocurrency over a given period of time.

To use a candlestick chart, first find the "Open" and "High" prices for a given day. These are the prices at the beginning and end of the day, respectively. Next, find the "Close" price for the day. This is the price at which the market closed for the day. Finally, find the "Volume" for that day. This is the number of coins or tokens traded during that day.

To see how a cryptocurrency's price has changed over time, you can use a candlestick chart to plot the "Open," "Close," and "Volume" values for each day. You can then see how the price has fluctuated over the course of the day.

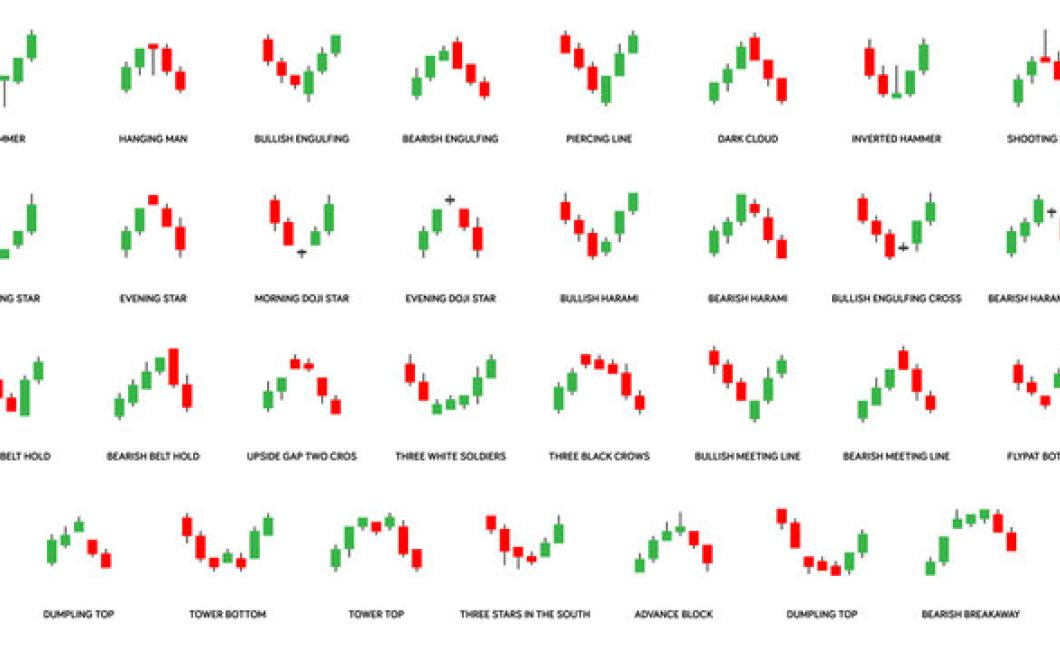

Candlestick Crypto Chart Patterns

There are many different types of crypto chart patterns, but some of the more common ones include:

• Bull and Bear Flag: A bullish flag is when the price moves upwards in a consistent and sustained manner, with occasional corrections along the way. A bear flag is when the price moves downwards in a consistent and sustained manner, with occasional corrections along the way.

• Double Top: When the price rises sharply and then falls again soon afterwards, this is called a double top.

• Head and Shoulders: A head and shoulders pattern is formed when the price rises sharply up to a peak, and then falls back down again, but this time the price falls below the previous low point.

Trading with Candlestick Crypto Charts

Candlestick Crypto Charts are popular for trading because they provide a visual representation of the price action of a given cryptocurrency. These charts allow you to see how the price has moved over time, and what patterns are emerging.

To use Candlestick Crypto Charts, first open a chart in your favorite trading platform. Once open, you will want to identify the currency you want to trade. To do this, find the currency symbol in the top left corner of the chart, and hover your mouse over it. This will display the name of the currency, as well as its value in parentheses.

Next, find the "Candlestick" tool in the lower left corner of the chart. This will allow you to graph the price action of the given currency over time. You can select different time periods to view, or you can use the "Auto-Play" feature to have the chart automatically update every minute.

Once you have selected the timeframe and data you want to view, you will see a grid of candlesticks on the chart. Each candlestick represents a 24-hour period, and shows the price of the given currency at the opening and closing of that period.

To trade with Candlestick Crypto Charts, first identify the patterns that are emerging. For example, if you are looking for an entry point into a market, you may want to look for candlesticks that are forming a bullish or bearish pattern.

Once you have identified a pattern, you can place an order with your trading platform using the prices that are displayed in the candlesticks. If the candlestick is touching or crossing the price you are targeting, then your order will be executed automatically.

Tips for Using Candlestick Crypto Charts

When using candlestick charts, it is important to have a clear understanding of what they are and how they work. Candlestick charts are used to illustrate changes in price over time.

Candlestick charts are composed of two parts: the body and the shadows. The body is the area that shows the actual price movement, while the shadows are lines that show the change in price over a given period of time.

To create a candlestick chart, first find the open and close prices for the given period of time. Next, draw a line from the open price to the close price. This line will be the body of the candlestick chart.

Next, draw a line from the close price to the open price for the next period of time. This line will be the shadow of the first candlestick.

Do this for each period of time, creating as many candlesticks as necessary. To make the chart easier to read, it is important to keep the shadows short and the body wide.

One final note on candlestick charts: it is important to remember that they are not intended to be used as a prediction tool. Instead, they should be used to illustrate changes in price over time.

Advanced Candlestick Crypto Charting Techniques

There are a few different candlestick crypto charting techniques that can be used to analyze the performance of a cryptocurrency.

The first technique is to use a simple candlestick chart. This is where you simply plot the price of a cryptocurrency over time and use the candlestick pattern to identify any changes in price.

The second technique is to use a trendline analysis. This is where you identify any potential trends in the price of a cryptocurrency and use that information to make investment decisions.

Lastly, you can use a volume analysis to help you identify any potential rallies or drops in the price of a cryptocurrency.