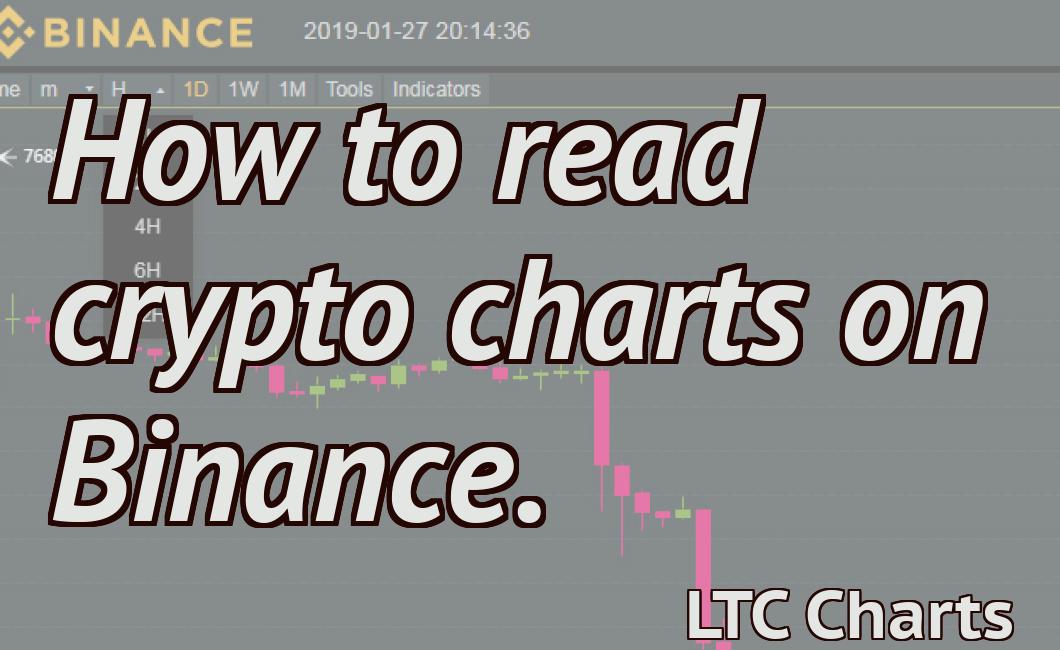

Best Free Crypto Candlestick Charts

The article discusses the best free crypto candlestick charts that are available online. It compares the features of the different charts and provides links to where they can be found.

Best free crypto candlestick charts: The top 5 platforms to use

for crypto candlestick charts

1. TradingView: TradingView is a popular platform for crypto candlestick charts. It offers a variety of features, such as custom indicators and charting tools.

2. CoinMarketCap: CoinMarketCap is another popular platform for crypto candlestick charts. It provides comprehensive data on cryptocurrency prices and volumes.

3. Kraken: Kraken is a leading exchange for trading cryptocurrencies. It offers a variety of features, such as candlestick charts and order books.

4. TradingView: TradingView is a popular platform for crypto candlestick charts. It offers a variety of features, such as custom indicators and charting tools.

5. CoinMarketCap: CoinMarketCap is another popular platform for crypto candlestick charts. It provides comprehensive data on cryptocurrency prices and volumes.

Best free crypto candlestick charts: A comprehensive guide

Cryptocurrencies are a digital asset class that uses cryptography to secure its transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges, which makes them vulnerable to hacking and fraud. As a result, some experts have suggested that investors should only invest in cryptocurrencies if they are comfortable with the risk.

This article provides a comprehensive guide to free crypto candlestick charts.

What is a crypto candlestick chart?

A crypto candlestick chart is a type of technical analysis chart used to identify trends in cryptocurrency prices.

The basic principle behind crypto candlestick charts is that they display the price action of a cryptocurrency over time. Each candlestick represents a transaction, and the color of the candle corresponds to the price of the cryptocurrency at the time of the transaction.

Crypto candlestick charts can be used to identify patterns such as breakout prices, buy and sell signals, and trend reversals.

How to create a crypto candlestick chart

To create a crypto candlestick chart, you first need to gather data about the prices of your cryptocurrency. You can use blockchain data or external data sources.

Once you've gathered your data, you need to calculate the volume for each transaction. This will help you determine how active the market is.

Next, you need to create a chart template. You can use a free crypto candlestick charting software or create your own template using a graphical programming language.

Finally, you need to fill in the data for each candlestick. You will need to include the date, the time of the transaction, the price of the cryptocurrency at the time of the transaction, and the volume of the transaction.

How to use a crypto candlestick chart

Once you've created your crypto candlestick chart, you can use it to identify trends in cryptocurrency prices. You can also use it to identify buy and sell signals and trend reversals.

To use a crypto candlestick chart, first identify the trend you want to analyze. Next, find the desired timeframe for your chart. Finally, plot the prices for each candlestick on the chart using the appropriate data.

Best free crypto candlestick charts: How to choose the right one for you

There are different types of crypto candlestick charts, but the most important thing is to find one that is suitable for your needs. Here are some tips to help you choose the right one:

1. Look at the type of data displayed

Some crypto candlestick charts display price data, while others display volume data. If you are looking for a chart that displays price data, you will want to choose a candlestick chart with Bollinger Bands. If you are looking for a chart that displays volume data, you will want to choose a candlestick chart with MACD indicators.

2. Look at the time period covered

Some crypto candlestick charts cover a long time period, while others cover a short time period. If you are looking for a candlestick chart that covers a long time period, you will want to choose a candlestick chart withlines. If you are looking for a candlestick chart that covers a short time period, you will want to choose a candlestick chart with bars.

3. Look at the type of plotted data

Some crypto candlestick charts plot price data, while others plot volume data. If you are looking for a chart that plots price data, you will want to choose a candlestick chart with Bollinger Bands. If you are looking for a chart that plots volume data, you will want to choose a candlestick chart with MACD indicators.

4. Look at the type of indicators used

Some crypto candlestick charts use only price data, while others use both price and volume data. If you are looking for a candlestick chart that uses only price data, you will want to choose a candlestick chart with lines. If you are looking for a candlestick chart that uses both price and volume data, you will want to choose a candlestick chart with MACD indicators.

Best free crypto candlestick charts: The ultimate beginner's guide

Cryptocurrency candlestick charts are a great way to track the price of a digital asset over time. They can be a helpful tool for beginners who are looking to invest in cryptocurrencies.

In this guide, we will teach you how to create and use cryptocurrency candlestick charts. We will also provide a list of the best free crypto candlestick charts available online.

What is a cryptocurrency candlestick chart?

A cryptocurrency candlestick chart is a graphical representation of the price of a digital asset over time. It shows the opening, high, low, and closing prices for each day.

Candlestick charts are popular among cryptocurrency traders because they provide a visual representation of price action. They can help you identify patterns in the market and make more informed trading decisions.

How to create a cryptocurrency candlestick chart

To create a cryptocurrency candlestick chart, you will first need to gather the necessary data. You will need to include the date, the asset name, and the open, high, low, and closing prices for each day.

Once you have this information, you can begin to create the chart. First, open your favourite graphing software and create a new graph. Next, select the data that you gathered from your past transactions. Finally, add a candle symbol to the chart and start plotting!

Here are some of the best free cryptocurrency candlestick charts available online:

1. CoinMarketCap - CoinMarketCap is one of the most popular sources for cryptocurrency data. They offer a variety of different candlestick charts, including cryptocurrency candlestick charts. This chart allows you to view the price of various cryptocurrencies over time. You can also filter the data by type, market cap, and more.

2. Coinigy - Coinigy is another popular source for cryptocurrency data. They offer a variety of different candlestick charts, including cryptocurrency candlestick charts. This chart allows you to view the price of various cryptocurrencies over time. You can also filter the data by type, market cap, and more.

3. TradingView - TradingView is another popular source for cryptocurrency data. They offer a variety of different candlestick charts, including cryptocurrency candlestick charts. This chart allows you to view the price of various cryptocurrencies over time. You can also filter the data by type, market cap, and more.

4. CryptoCompare - CryptoCompare is another popular source for cryptocurrency data. They offer a variety of different candlestick charts, including cryptocurrency candlestick charts. This chart allows you to view the price of various cryptocurrencies over time. You can also filter the data by type, market cap, and more.

Best free crypto candlestick charts: A beginner's guide to reading them

Cryptocurrencies are volatile, and as such, candlesticks can be a useful tool to help traders make informed decisions. In this article, we'll outline the basics of candlestick charts and explain how to read them.

What is a candlestick chart?

A candlestick chart is a graphical representation of the performance of a given cryptocurrency over a given period of time. It consists of a series of candlesticks, each representing a specific trading moment.

How do I read a candlestick chart?

The purpose of candlestick charts is to provide a visual representation of prices. The most important thing to remember when reading a candlestick chart is to pay attention to the color and shape of the candlesticks.

Color : Candlesticks with green or red borders are high or low volume, respectively. This is an important indicator to watch for, as it can help you determine if the price is trending up or down.

: Candlesticks with green or red borders are high or low volume, respectively. This is an important indicator to watch for, as it can help you determine if the price is trending up or down. Shape: Candlesticks with long tails indicate an uptrend, while those with short tails indicate a downtrend.

For example, if you see a candlestick with a long tail and a green border, this means that the price of the cryptocurrency was high volume and went up in value. If you see a candlestick with a short tail and a red border, this means that the price of the cryptocurrency was low volume and went down in value.

How can I use candlestick charts to trade cryptocurrencies?

Candlestick charts can be used to identify trends and make informed trading decisions. For example, if you see that the price of a cryptocurrency is trending up, you may want to buy more of it. Conversely, if you see that the price of a cryptocurrency is trending down, you may want to sell your holdings.

Best free crypto candlestick charts: The different types and what they mean

There are many types of candlestick charts and they all have different meanings. Here are the most common types and what they mean:

1) Bullish: This candlestick pattern means that the price is going up. The first candle is usually big and filled with green, which indicates that the price is rising. The second candle is usually smaller and filled with blue, which signals that the price is continuing to rise.

2) Bearish: This candlestick pattern means the opposite - that the price is going down. The first candle is usually small and filled with red, which signals that the price is falling. The second candle is usually bigger and filled with green, which indicates that the price is rising.

3) Harami: This candlestick pattern is a combination of the bullish and bearish patterns. It means that the price is moving between the two patterns, which can be confusing. The first candle is usually big and filled with both red and green, which signals that the price is moving between the two patterns. The second candle is usually smaller and either filled with red or green, which signals which direction the price is moving.

Best free crypto candlestick charts: How to use them to make better trades

Candlestick charts are a great way to visualize what is going on with a stock or cryptocurrency. They can help you to make better trades by showing you how the price is moving over time.

To use candlestick charts, you first need to find a reliable source of information. This can be a crypto exchange, news site, or social media platform. Once you have found a source of information, you will need to find a good charting platform. There are many good platforms available, but some of the most popular include TradingView and Coindesk.

Once you have found a platform and a source of information, you will need to create a chart. The first step is to select the type of chart that you want to use. There are three main types of charts: candlestick charts, line charts, and bar charts.

Next, you will need to select the timeframe that you want to use. Candlestick charts are used to show the price movement over time, while line charts show the price movement over a fixed timeframe. Bar charts are used to show the volume and price movement over a fixed timeframe.

After you have selected the timeframe and type of chart, you will need to select the data that you want to use. This will include the symbol name, the price, and the time period.

Finally, you will need to create the chart. To do this, you will first need to select the type of chart that you want to use. There are three main types of charts: candlestick charts, line charts, and bar charts.

Next, you will need to select the timeframe that you want to use. Candlestick charts are used to show the price movement over time, while line charts show the price movement over a fixed timeframe. Bar charts are used to show the volume and price movement over a fixed timeframe.

After you have selected the timeframe and type of chart, you will need to select the data that you want to use. This will include the symbol name, the price, and the time period.

Finally, you will need to create the chart. To do this, you will first need to select the type of chart that you want to use. There are three main types of charts: candlestick charts, line charts, and bar charts.

Next, you will need to select the timeframe that you want to use. Candlestick charts are used to show the price movement over time, while line charts show the price movement over a fixed timeframe. Bar charts are used to show the volume and price movement over a fixed timeframe.

After you have selected the timeframe and type of chart, you will need to select the data that you want to use. This will include the symbol name, the price, and the time period.

Finally, you will need to create the chart. To do this, you will first need to select the type of chart that you want to use. There are three main types of charts: candlestick charts, line charts, and bar charts.

Next, you will need to select the timeframe that you want to use. Candlestick charts are used to show the price movement over time, while line charts show the price movement over a fixed timeframe. Bar charts are used to show the volume and price movement over a fixed timeframe.

After you have selected the timeframe and type of chart, you will need to select the data that you want to use. This will include the symbol name, the price, and the time period.

Finally, you will need to create the chart. To do this, you will first need to select the type of chart that you want to use. There are three main types of charts: candlestick charts, line charts, and bar charts.

Best free crypto candlestick charts: 5 tips for using them effectively

Cryptocurrency candlestick charts are a great way to track the performance of a digital asset over time. However, they can be difficult to use effectively. Here are five tips for using cryptocurrency candlestick charts effectively.

1. Use candlestick charts to monitor short-term trends.

Candlestick charts are best used to monitor short-term trends. In general, long candlesticks indicate strong price movement, while short candlesticks indicate more moderate price movement.

2. Use candlestick charts to identify buy and sell signals.

When you see a candlestick with a white body and a black head, this is considered a buy signal. When you see a candlestick with a red body and a black head, this is considered a sell signal.

3. Use candlestick charts to determine when to buy or sell.

If you see a candlestick with a long white body and a short black head, this is considered a buy signal. If you see a candlestick with a long red body and a short black head, this is considered a sell signal.

4. Use candlestick charts to identify oversold or overbought conditions.

If the price of an asset is consistently below the lower boundary of the candlestick, this is considered an oversold condition. If the price of an asset is consistently above the upper boundary of the candlestick, this is considered an overbought condition.

5. Use candlestick charts to identify market trends.

Candlestick charts can help you identify market trends. For example, if you see a pattern of rising or falling prices, this may be indicative of a market trend.

Best free crypto candlestick charts: 3 common mistakes to avoid

Cryptocurrencies are a new and exciting asset class, but like any investment, there are risks. Here are three common mistakes to avoid when trading cryptocurrencies:

1. Focusing on the price instead of the chart.

2. Trading too frequently.

3. Not diversifying your portfolio.

Best free crypto candlestick charts: The bottom line

Crypto candlestick charts are a great way to get an overview of the price action of a cryptocurrency. By looking at the chart, you can see how the price has behaved over time, and what factors have influenced the price movement.

Some of the best free crypto candlestick charts available online include CoinMarketCap's Cryptocurrency Candlestick Chart and TradingView's Cryptocurrency Candlestick Chart.