Free Trading Charts Crypto

Looking for a way to get free trading charts for your favorite cryptocurrency? Look no further! In this article, we'll show you how to get started withcryptocurrency charting tools.

How to Read Crypto Charts for Beginners

Cryptocurrencies are a digital asset class that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are generated through a process called mining. Miners attempt to solve complex mathematical problems to earn cryptocurrency. Once a miner solves the problem, they are rewarded with cryptocurrency.

Cryptocurrencies are traded on decentralized exchanges and can also be used to purchase goods and services.

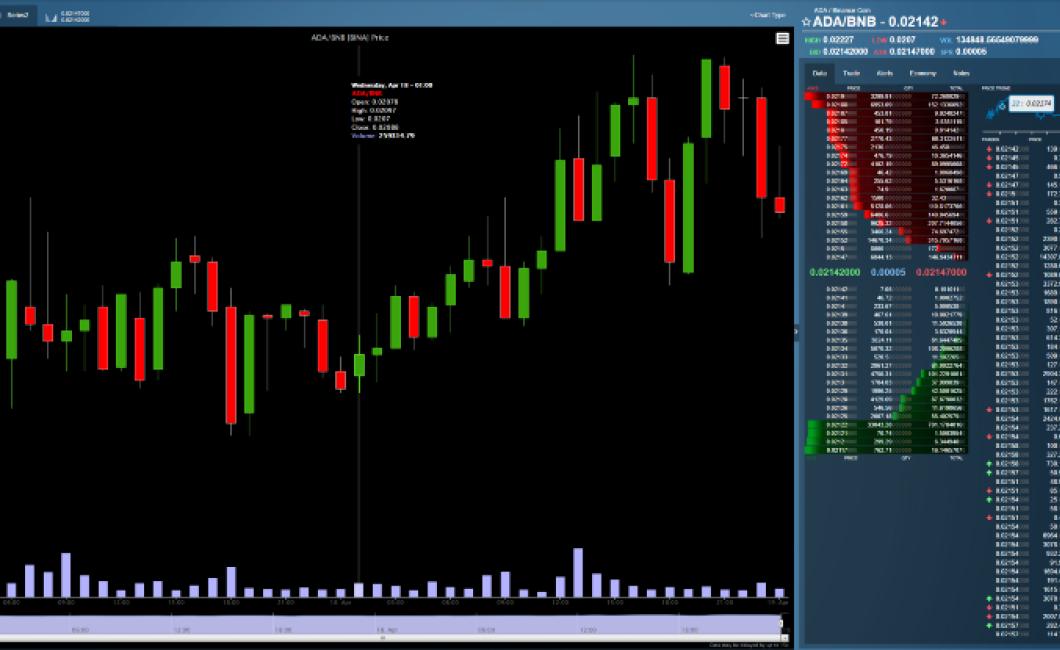

To read cryptocurrency charts for beginners, begin by understanding what each column in the chart represents. The first column is the price of the cryptocurrency, in dollars. The second column is the number of cryptocurrencies in circulation. The third column is the market cap, which is the total value of all cryptocurrencies in circulation. The fourth column is the volume, which is the number of cryptocurrency transactions over the past 24 hours. The fifth column is the price change, which is the change in the price of the cryptocurrency over the past 24 hours. The sixth column is the percentage change, which is the percentage change in the price of the cryptocurrency over the past 24 hours. The seventh column is the 24-hour volume, which is the total volume of cryptocurrency transactions over the past 24 hours. The eighth column is the 7-day volume, which is the total volume of cryptocurrency transactions over the past 7 days. The ninth column is the 14-day volume, which is the total volume of cryptocurrency transactions over the past 14 days. The 10th column is the 1-month volume, which is the total volume of cryptocurrency transactions over the past month. The 11th column is the 3-month volume, which is the total volume of cryptocurrency transactions over the past 3 months. The 12th column is the 6-month volume, which is the total volume of cryptocurrency transactions over the past 6 months. The 13th column is the 12-month volume, which is the total volume of cryptocurrency transactions over the past year. The 14th column is the 24-month volume, which is the total volume of cryptocurrency transactions over the past two years.

Next, look at the chart to understand how the price of the cryptocurrency has changed over the past 24 hours. Physically, this column shows you how much money has changed hands in cryptocurrency transactions over the past 24 hours. The higher this number is, the more active the market for that cryptocurrency is.

Next, look at how the price of the cryptocurrency has changed over the past 7 days. This column shows you how much money has changed hands in cryptocurrency transactions over the past 7 days. The higher this number is, the more active the market for that cryptocurrency is.

Next, look at how the price of the cryptocurrency has changed over the past 14 days. This column shows you how much money has changed hands in cryptocurrency transactions over the past 14 days. The higher this number is, the more active the market for that cryptocurrency is.

Next, look at how the price of the cryptocurrency has changed over the past month. This column shows you how much money has changed hands in cryptocurrency transactions over the past month. The higher this number is, the more active the market for that cryptocurrency is.

Next, look at how the price of the cryptocurrency has changed over the past 3 months. This column shows you how much money has changed hands in cryptocurrency transactions over the past 3 months. The higher this number is, the more active the market for that cryptocurrency is.

Next, look at how the price of the cryptocurrency has changed over the past 6 months. This column shows you how much money has changed hands in cryptocurrency transactions over the past 6 months. The higher this number is, the more active the market for that cryptocurrency is.

Next, look at how the price of the cryptocurrency has changed over the past year. This column shows you how much money has changed hands in cryptocurrency transactions over the past year. The higher this number is, the more active the market for that cryptocurrency is.

Finally, look at how the price of the cryptocurrency has changed over the past two years. This column shows you how much money has changed hands in cryptocurrency transactions over the past two years. The higher this number is, the more active the market for that cryptocurrency is.

A Beginner's Guide to Trading Crypto

-Currencies

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. As of February 2018, there were over 1,500 different cryptocurrencies available.

When you buy cryptocurrency, you are buying a digital asset that is issued by a digital issuer and usually has a fixed supply. Cryptocurrencies are traded on decentralized exchanges and can also be used to purchase goods and services.

Before you start trading cryptocurrencies, it is important to understand what they are, what they are not, and what you need to do to participate in the market. This beginner's guide will help you get started.

The Different Types of Crypto Charts

Cryptocurrency charts are used to track the performance of digital assets such as Bitcoin, Ethereum, and Litecoin. There are three main types of cryptocurrency charts:

1. Volume-Based Cryptocurrency Charts

Volume-based cryptocurrency charts typically display the total value of all cryptocurrency transactions over a given period of time. This gives investors a good indication of how active the market is and how valuable various cryptocurrencies are.

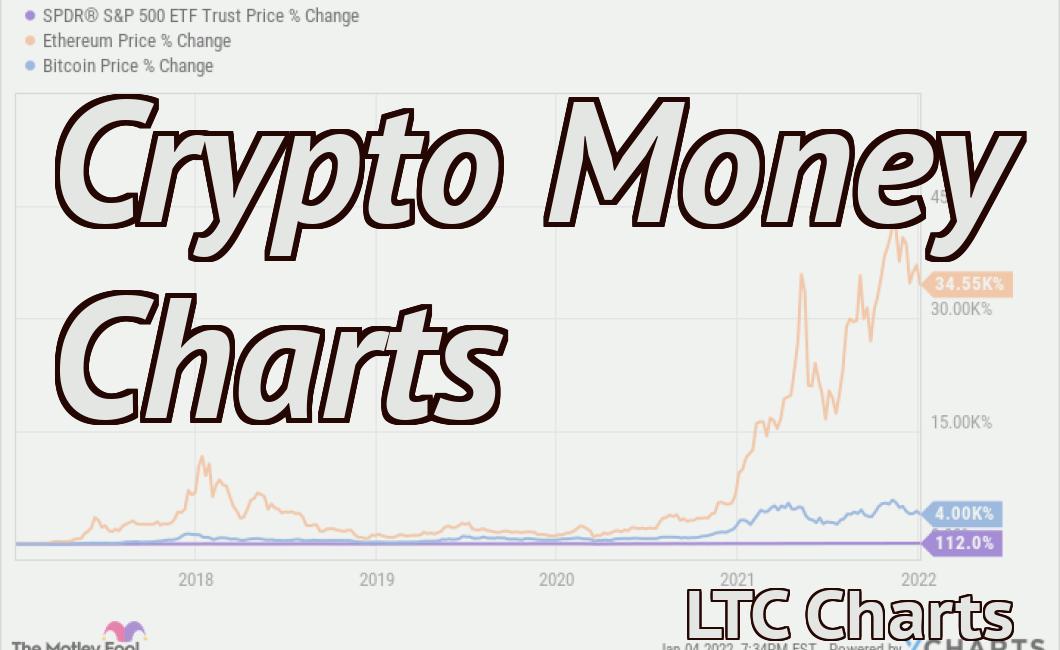

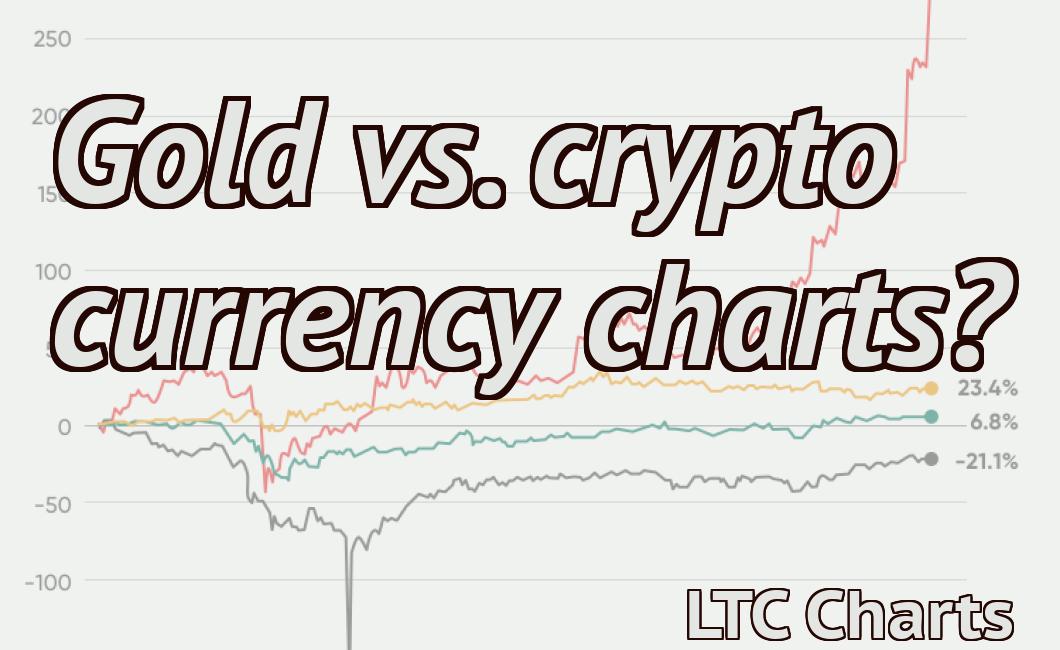

2. Price-Based Cryptocurrency Charts

Price-based cryptocurrency charts display the price of a given cryptocurrency over a given period of time. They can help investors track the performance of a particular cryptocurrency against other currencies and against the overall market.

3. Circulating Supply Cryptocurrency Charts

Circulating supply cryptocurrency charts display the amount of cryptocurrency that is currently in circulation. This information can be helpful for investors who want to know how much of a particular cryptocurrency is available on the market.

How to Use Crypto Charts to Make Better Trades

Crypto charts are a great way to help you make better trades. By understanding how the different charts work, you can better predict where the market is likely to go next.

1. Look at the general trend of the market.

The first thing you want to do is look at the general trend of the market. This will help you understand how the market is moving and whether it’s headed in a positive or negative direction.

2. Compare prices against each other.

Next, you want to compare prices against each other to see where the market is likely to go next. By understanding where the market is heading, you can make better trades.

3. Watch for signals.

Finally, watch for signals from the charts to help you make better decisions about where to invest your money. By following signals, you can make sure that you’re making the most informed decisions possible.

What You Need to Know About Crypto Charting

Crypto charting is a way to track the price of cryptocurrencies and other digital assets. It can help you understand how the market is performing, and it can help you make better decisions about where to invest your money.

There are a few different types of crypto charting programs, and each one has its own advantages and disadvantages. Here are some of the most popular types of crypto charting:

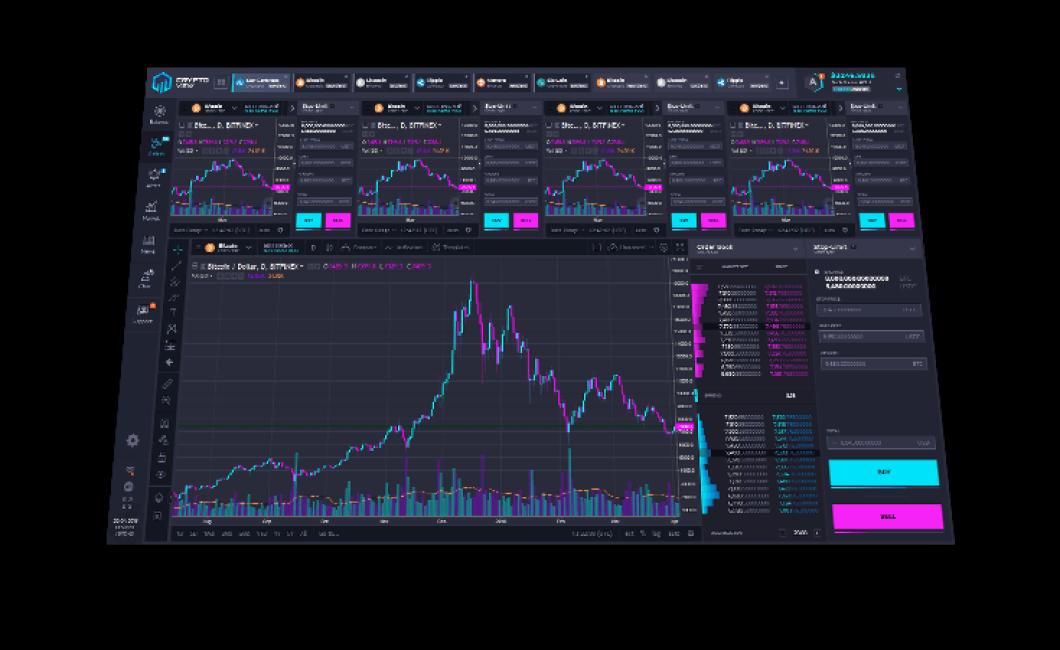

1. TradingView

TradingView is one of the most popular crypto charting programs on the market. It's free to use, and it offers a wide range of features and tools.

One of the biggest advantages of TradingView is its user interface. It's very userfriendly, and it's easy to understand. This makes it a great choice for beginners who are trying to learn about cryptocurrency trading.

Another great feature of TradingView is its live tracking system. This system allows you to follow the prices of specific cryptocurrencies as they change over time. This is a great way to keep track of how the market is performing.

However, TradingView does have some limitations. For example, it doesn't offer support for altcoins. This means that you won't be able to track the prices of altcoins like Bitcoin Cash or Ethereum Classic.

2. Coinigy

Coinigy is another well-known crypto charting program. It's free to use, and it offers a wide range of features and tools.

One of the biggest advantages of Coinigy is its user interface. It's very userfriendly, and it's easy to understand. This makes it a great choice for beginners who are trying to learn about cryptocurrency trading.

Another great feature of Coinigy is its live trading system. This system allows you to follow the prices of specific cryptocurrencies as they change over time. This is a great way to keep track of how the market is performing.

However, Coinigy does have some limitations. For example, it doesn't offer support for altcoins. This means that you won't be able to track the prices of altcoins like Bitcoin Cash or Ethereum Classic.

3. Kraken

Kraken is one of the largest crypto exchanges in the world. It offers a wide range of features and tools, including crypto charting programs.

One of the biggest advantages of Kraken is its user interface. It's very userfriendly, and it's easy to understand. This makes it a great choice for beginners who are trying to learn about cryptocurrency trading.

Another great feature of Kraken is its live trading system. This system allows you to follow the prices of specific cryptocurrencies as they change over time. This is a great way to keep track of how the market is performing.

However, Kraken does have some limitations. For example, it doesn't offer support for altcoins. This means that you won't be able to track the prices of altcoins like Bitcoin Cash or Ethereum Classic.

The Benefits of Using Crypto Charts

There are many benefits to using crypto charts. One of the most important benefits is that they can help you to better understand the market. This can help you to make better investment decisions and to identify potential trends.

Crypto charts also provide a useful way to track your portfolio. By monitoring the prices of individual cryptocurrencies, you can see how your investments are performing. This can help you to make informed decisions about where to invest your money.

Crypto charts can also be a useful way to monitor your finances. By tracking your spending and your income, you can see how your financial situation is changing over time. This can help you to make informed decisions about how to spend your money and where to invest your money.

Crypto charts can also be a helpful way to stay up-to-date on the latest news in the cryptocurrency market. By tracking the prices of individual cryptocurrencies, you can stay informed about which coins are growing in popularity and which coins are falling in value. This can help you to make better investment decisions.

The Basics of Crypto Technical Analysis

Crypto technical analysis is the practice of analyzing cryptocurrency charts and trends in order to forecast future price movements. Crypto technical analysis can be used to identify potential opportunities and predict future price movements.

Cryptocurrencies are decentralized, digital tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are unique in that they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges and can also be purchased directly from cryptocurrency mining pools or individual investors.

How to Trade Cryptocurrencies Using Technical Analysis

Technical analysis is the use of technical indicators to predict future price movements in securities, commodities, and other financial markets. Technical analysis can be used to identify opportunities in the market before they become too costly to exploit.

There are a number of technical analysis tools that can be used to trade cryptocurrencies. Some of the most popular tools include the moving average, the oscillator, and the RSI.

The moving average is a simple technical indicator that can be used to track the trend of a security or commodity. The moving average is calculated by taking the average value of a set of data points over a particular period of time.

The oscillator is a technical indicator that is used to identify potential price reversals. The oscillator is composed of two indicators: the moving average crossover point (MACP) and the exponential moving average (EMA). The MACP is used to identify short-term price reversals, while the EMA is used to identify long-term reversals.

The RSI is a technical indicator that is used to measure the strength of a security or commodity's price trend. The RSI is composed of a 20-day moving average and a 100-day moving average. The 20-day moving average is used to identify short-term trends, while the 100-day moving average is used to identify long-term trends.