Who to follow to start understanding signals and TA from live charts crypto?

If you're looking to start understanding technical analysis and signals from live cryptocurrency charts, there are a few people you should follow. First, @MatiGreenspan is a great resource for general market analysis and commentary. For more specific technical analysis and signals, @ta4bit is excellent. Finally, @nebraskangooner is a great source for general trading and investing information, including a lot of crypto-related content.

who to follow to start understanding signals and ta from live charts crypto

There is no single authority on signals and TA from live charts crypto, but some good resources to follow include:

CryptoCompare – This website provides comprehensive information on all major cryptocurrencies, including signals and TA from live charts crypto.

CoinMarketCap – This website provides comprehensive information on all major cryptocurrencies, including signals and TA from live charts crypto.

CryptoCurrency News – This website provides daily news coverage of all major cryptocurrencies, including signals and TA from live charts crypto.

how to get started with signals and ta from live charts crypto

There is no one definitive answer to this question. However, some resources that may be helpful include:

-exploring the official Signal and TA channels on Telegram;

-reading through the Signal and TA tutorials on the Signal website;

-checking out the Signal and TA trading resources on CoinMarketCap.com;

-familiarizing yourself with the different types of signals and ta signals available on the market.

what you need to know about signals and ta from live charts crypto

A signal is a technical indicator that is used to identify when a security is about to experience a change in price. Ta is a technical indicator that is used to identify when a security is oversold or overbought.

beginner's guide to signals and ta from live charts crypto

A signal is an indication that prices on a given cryptocurrency exchange are about to change. A TA (Technical Analysis) is a technique used to predict future prices by studying past price movements.

everything you need to know about signals and ta from live charts crypto

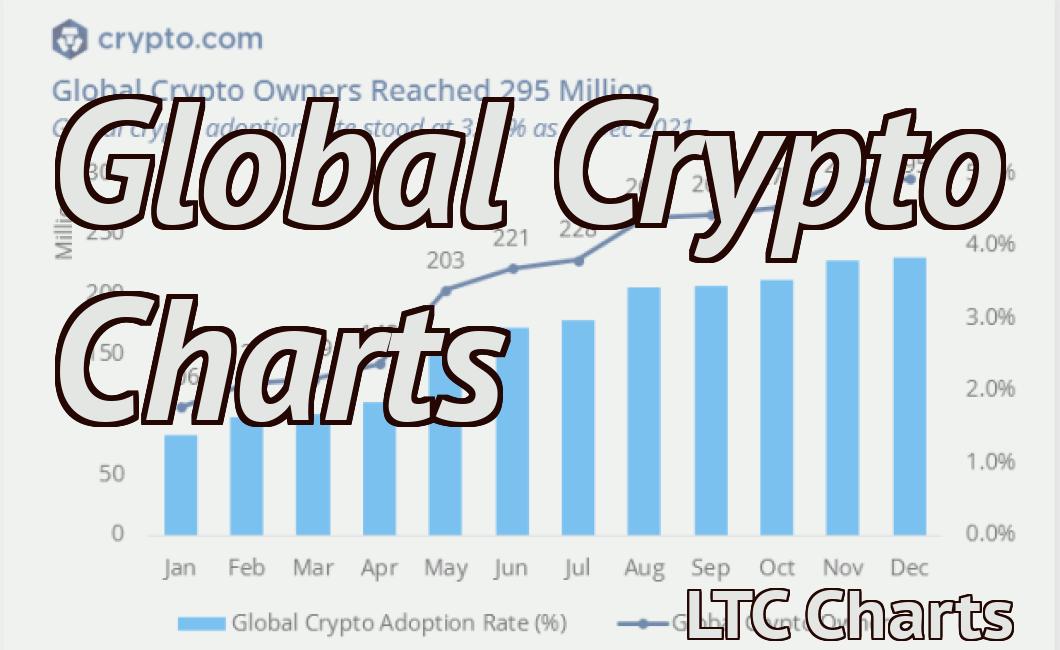

Signals and Ta are two important indicators used to analyze the performance of a cryptocurrency. They are derived from the price of a cryptocurrency over a given period of time and can be used to predict future movements.

the ultimate guide to signals and ta from live charts crypto

This ultimate guide to signals and TA from live charts crypto will show you how to make money trading cryptocurrency.

Cryptocurrency trading is a highly speculative activity. Any price movements you see in this article are purely hypothetical and based on hypothetical assumptions. You should never use real money to gamble with cryptocurrencies.

1. Understand what signals you need

Before you can start trading cryptocurrencies, you need to understand what signals you need.

There are a few different types of signals you can use to make money trading cryptocurrencies.

1. Technical analysis

Technical analysis is the use of charts and indicators to identify patterns in price action and make predictions about future trends.

Technical analysis can help you identify potential opportunities and risks associated with a cryptocurrency.

2. Fundamental analysis

Fundamental analysis is the analysis of a cryptocurrency based on its underlying fundamentals. These fundamentals include things like the company’s financial health, its management team, and the technology it uses.

Fundamental analysis can help you identify potential opportunities and risks associated with a cryptocurrency.

3. Combining both technical and fundamental analysis

You can use both technical and fundamental analysis to make more informed decisions about whether to buy or sell a cryptocurrency.

4. Avoid trading during volatile periods

Cryptocurrencies are highly volatile, and it’s important to avoid trading during volatile periods.

Volatile periods include times when the price of a cryptocurrency is moving rapidly up or down. This type of volatility can make it difficult to make money trading cryptocurrencies.

5. Use a cryptocurrency trading strategy

If you want to make money trading cryptocurrencies, you need to use a cryptocurrency trading strategy.

A cryptocurrency trading strategy is a set of rules that you follow when buying and selling cryptocurrencies.

A good cryptocurrency trading strategy will help you avoid making mistakes.

6. Stay informed about market conditions

It’s important to stay informed about market conditions.

If you know what to look for, you can track market conditions and make informed decisions about whether to buy or sell a cryptocurrency.

7. Use a cryptocurrency exchange

You can also use a cryptocurrency exchange to buy and sell cryptocurrencies.

Exchanges offer a variety of features, including security measures and 24/7 customer support.

8. Don’t forget taxes

Cryptocurrencies are considered property, not currency, for tax purposes. This means that you’ll have to pay taxes on any profits you make from trading cryptocurrencies.

9. Be prepared to lose money

Cryptocurrencies are highly risky, and you can lose money if you don’t make sensible decisions about your investments.

10. Take care when investing in cryptocurrencies

Cryptocurrencies are highly volatile, and investing in them is risky. Before investing money in cryptocurrencies, be sure to do your research.