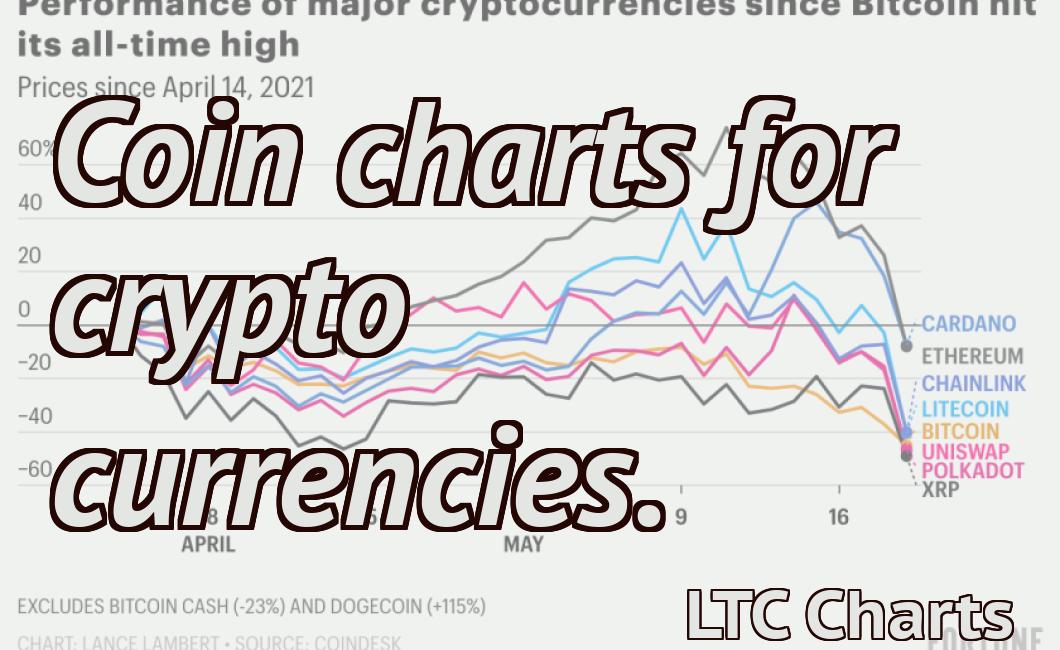

Live crypto markets charts

The article discusses the various live crypto markets charts that are available to investors. It explains how these charts can be used to track the performance of different cryptocurrencies, and how they can be used to make investment decisions.

live crypto markers charts: How to read them

CryptoMarkers charts are designed to help crypto traders and investors make informed decisions about the direction of the market.

The first thing to note is the vertical axis, which represents the percentage change in value from the previous day. The second thing to look for is the horizontal axis, which shows the cumulative value of all the markers in the chart.

If you see a marker that has increased in value significantly, this could be an indication that the market is heading in a positive direction. If you see a marker that has decreased in value, this might indicate that the market is headed in a negative direction.

It's important to keep in mind that these charts are not foolproof, and they won't always give you accurate information about the direction of the market. However, they can be a useful tool for making informed investment decisions.

live crypto markers charts: What do they mean?

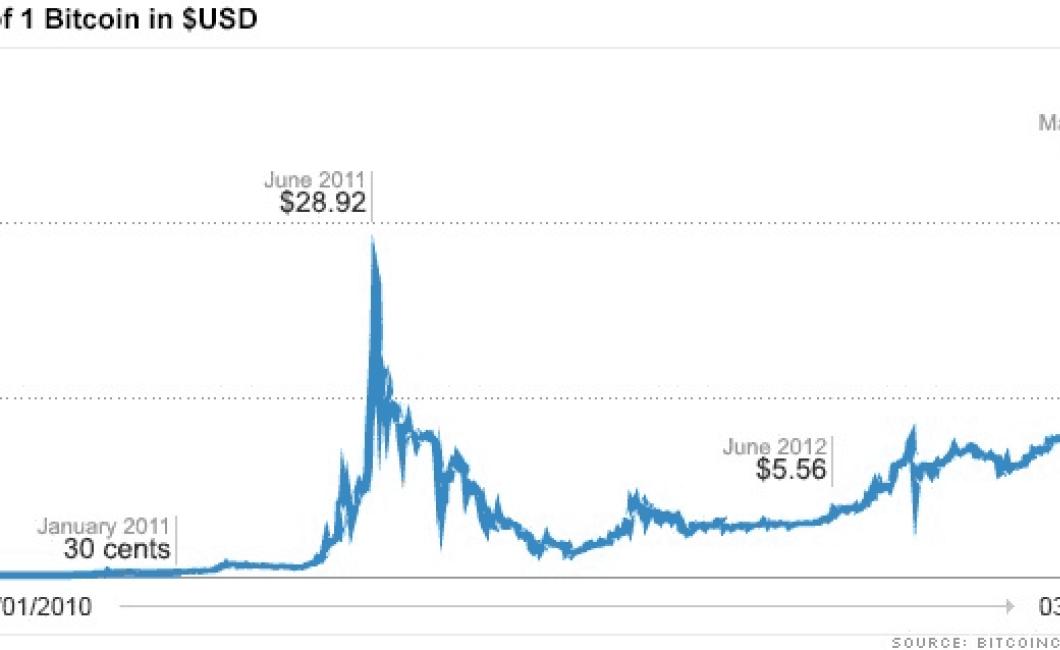

Crypto market markers are charts that show the price of a given cryptocurrency over time. They can be used to track the price of a cryptocurrency, to predict future price movements, and to determine when a cryptocurrency is over or undervalued.

Cryptocurrency market markers can be divided into two categories: short-term and long-term. Short-term market markers are typically created to provide insight into the current state of the cryptocurrency market and to help traders make informed decisions about whether or not to buy or sell a given cryptocurrency. Long-term market markers, on the other hand, are designed to provide investors with an overall picture of the cryptocurrency market and to help them predict future price movements.

Cryptocurrency market markers are not always accurate, and they sometimes change rapidly. Therefore, it is important to use them with caution and to consult with a financial advisor if you are interested in investing in cryptocurrencies.

live crypto markers charts: What to look for

Crypto markers charts are a great way to track the performance of cryptocurrencies. Here are some things to look for:

1. Price trends

Cryptocurrencies are often volatile, so it’s important to track their price movements. Look for cryptocurrencies that are showing consistent growth or decline in price.

2. Volume

Another key indicator to watch is cryptocurrency volume. This can help you identify which cryptocurrencies are becoming more popular.

3. Market capitalization

Another measure to look at is market capitalization. This shows how much money a cryptocurrency has been worth over time.

4. Innovation

When assessing a cryptocurrency’s innovation, pay attention to how new the technology is and how it could change the way we use digital assets.

5. Community support

One important factor to consider is whether the cryptocurrency has a strong community supporting it. This can show how committed users are to the project and how likely they are to continue investing in it.

live crypto markers charts: How to use them

Cryptocurrency markers charts are a great way to keep track of your investments. They can help you identify the best time to buy or sell a cryptocurrency.

To use a cryptocurrency marker chart, first find the price of a cryptocurrency you want to track. Then, find the date on which the price was recorded. Finally, find the marker on the chart corresponding to the date.

For example, if you want to track the price of Bitcoin, find the Bitcoin price on a cryptocurrency marker chart on December 1, 2017. Then, find the marker on the chart corresponding to December 1, 2017. The marker for Bitcoin on December 1, 2017, is $11,000.

live crypto markers charts: Tips and tricks

Crypto markers charts are a great way to keep track of your portfolio and make informed decisions about when and where to buy and sell cryptocurrencies. Here are some tips to help you get the most out of crypto markers charts:

1. Create a trading plan

Before you begin trading cryptocurrencies, it’s important to create a trading plan. This will help you stay disciplined and avoid making impulsive decisions.

2. Use technical analysis

Technical analysis is an important tool for keeping track of the market. Use indicators such as moving averages and trend lines to help you predict where the market is going.

3. Consider your investment goals

Before you invest in cryptocurrencies, it’s important to consider your investment goals. Do you want to make short-term profits or do you want to invest for the long term?

4. Pay attention to news events

News events can have a big impact on the market. Keep track of major announcements and how they might impact the price of cryptocurrencies.

5. Use margin trading

If you want to try trading cryptocurrencies, it’s important to use margin trading. This allows you to increase your investment while limiting your risk.

live crypto markers charts: Secrets revealed

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services.

live crypto markers charts: The ultimate guide

There are many different types of crypto markers charts available online. This guide will outline the most important features to look for when choosing a crypto marker chart.

Crypto Marker Charts

A crypto marker chart is a visual representation of cryptocurrency prices over time. They can be used to track the progress of a cryptocurrency, to identify patterns in price movements, and to make informed investment decisions.

Crypto marker charts are often divided into two main types: candlestick charts and line charts.

Candlestick charts are typically used to display the prices of cryptocurrencies over time. They are composed of a series of candlesticks, each representing a different period of time. The size and colour of the candlestick corresponds to the price of the cryptocurrency at that point in time.

Line charts are used to display the movement of cryptocurrencies over time. They are composed of a series of lines, each representing a different period of time. The colour and thickness of the line corresponds to the price of the cryptocurrency at that point in time.

Some other important features to look for when choosing a crypto marker chart include:

The chart’s layout: The layout of a crypto marker chart will determine how easily it can be used to analyse data. A good layout will make it easy to see the latest price movements and to identify any trends.

The chart’s scale: The scale of a crypto marker chart will determine how granular the data is displayed. A thin line graph may only show changes in price up to a certain threshold, while a thick line graph may show changes in price up to a much greater degree.

The chart’s time frame: The time frame of a crypto marker chart will determine how long it covers. A one-day chart will only show data for one day, while a six-month chart will show data for six months.

Crypto Marker Charts: Candlestick Charts

Candlestick charts are typically used to display the prices of cryptocurrencies over time. They are composed of a series of candlesticks, each representing a different period of time. The size and colour of the candlestick corresponds to the price of the cryptocurrency at that point in time.

The following are some of the most important features to look for when choosing a candlestick chart:

The chart’s layout: The layout of a candlestick chart will determine how easily it can be used to analyse data. A good layout will make it easy to see the latest price movements and to identify any trends.

The chart’s scale: The scale of a candlestick chart will determine how granular the data is displayed. A thin line graph may only show changes in price up to a certain threshold, while a thick line graph may show changes in price up to a much greater degree.

The chart’s time frame: The time frame of a candlestick chart will determine how long it covers. A one-day chart will only show data for one day, while a six-month chart will show data for six months.

live crypto markers charts: FAQ

The following are Frequently Asked Questions about crypto markers charts.

What is a crypto marker chart?

A crypto marker chart is a visual representation of cryptocurrency prices. It shows the value of a given cryptocurrency over time, and can be used to track the performance of a cryptocurrency portfolio.

How do I create a crypto marker chart?

To create a crypto marker chart, you first need to gather your cryptocurrency prices (in bitcoin, for example). You can then use a tool like CoinMarketCap to generate a graph showing the prices over time. Next, you'll need to add markers to represent each point in the graph. For each marker, you'll need to specify the date and the value of the cryptocurrency at that date. Finally, you'll need to create a legend to help you understand the chart's contents.

Is a crypto marker chart a accurate representation of cryptocurrency prices?

There is no one definitive answer to this question. Each crypto marker chart will likely show different results depending on the data it uses and the way it's compiled. Ultimately, you should use a crypto marker chart as a tool for tracking your cryptocurrency portfolio rather than relying on it for accurate price predictions.

Can I use a crypto marker chart to track my cryptocurrency investments?

Yes, you can use a crypto marker chart to track your cryptocurrency investments. However, be aware that each cryptocurrency marker chart will likely show different results depending on the data it uses and the way it's compiled. Ultimately, you should use a crypto marker chart as a tool for tracking your cryptocurrency portfolio rather than relying on it for accurate price predictions.