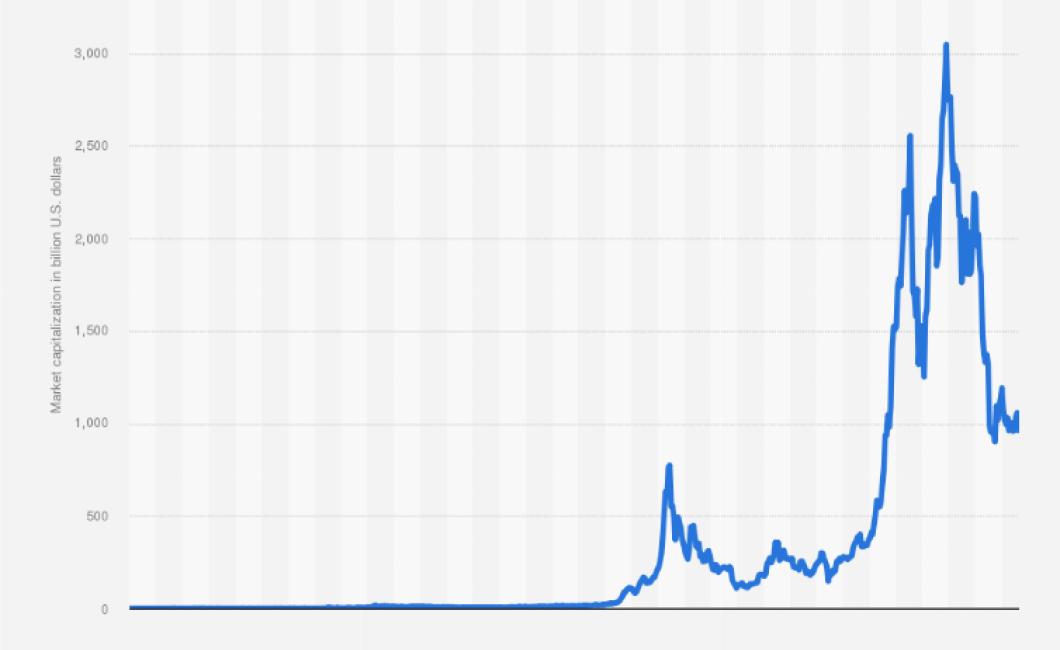

The crypto charts are relative to bitcoin.

This article discusses how the crypto charts are relative to bitcoin. Bitcoin is the most dominant cryptocurrency, so it is used as the benchmark for other cryptocurrencies. The article explains that because bitcoin is worth more than other cryptocurrencies, the crypto charts are relative to it.

Bitcoin vs. Ethereum: The Battle of the Crypto Charts

Bitcoin and Ethereum are two of the most popular cryptocurrencies in the world. They both have their own unique properties that set them apart from one another.

Bitcoin

Bitcoin is the first and most well-known cryptocurrency. It was created in 2009 by an unknown person or group of people under the name Satoshi Nakamoto. Bitcoin is based on a blockchain technology, which allows it to be securely and transparently transferred between users. Bitcoin is also unique in that it has no central authority. Instead, it is managed by a network of dedicated nodes.

Ethereum

Ethereum is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of fraud or third party interference. Ethereum is different from Bitcoin in that it does not have a fixed supply. Ethereum’s total supply will be capped at 100 million coins. This means that there is a finite number of Ethereum tokens that will be created over time. Ethereum also allows for more complex Smart Contracts than Bitcoin.

Bitcoin vs. Litecoin: The Tale of the Crypto Charts

Bitcoin and Litecoin are two of the most popular cryptocurrencies in the world. They both have their own unique set of features and benefits that make them stand out from the rest. In this article, we will compare and contrast the two cryptocurrencies to help you decide which one is right for you.

Bitcoin

Bitcoin started off as a purely digital currency, with no real-world counterpart. Over time, however, it has evolved into a much more complex and versatile system.

Bitcoin is decentralized, meaning it is not subject to government or financial institution control. This makes it an attractive option for those who are concerned about their privacy and security.

Bitcoin also has a very high degree of liquidity, meaning it can be easily transferred between users and traded on exchanges. This makes it a powerful tool for investment and trading purposes.

Litecoin

Litecoin was created as a more affordable alternative to Bitcoin. It is based on the same blockchain technology as Bitcoin, but it has a much lower maximum supply of 21 million coins. This means that Litecoin is potentially more valuable than Bitcoin in the long run.

Litecoin also has a number of additional features that make it an attractive option for users. For example, it is faster and more efficient than Bitcoin when it comes to transactions.

Overall, Bitcoin and Litecoin are two powerful cryptocurrencies that have a lot to offer different types of users. If you are interested in exploring these options further, you should definitely do your research and compare the two side-by-side.

Bitcoin vs. Ripple: The Race to the Top of the Crypto Charts

The race to the top of the cryptocurrency charts is on! Bitcoin and Ripple are two of the most popular digital currencies on the market, and each is vying for supremacy.

Bitcoin

Bitcoin was created in 2009, and it is the first and most well-known cryptocurrency. Bitcoin is decentralized, meaning that there is no central authority that controls it. This makes it difficult to track and tax, and it has been used for black market transactions and money laundering.

However, Bitcoin has seen a surge in popularity in recent years, and it is now one of the most valuable cryptocurrencies on the market. Bitcoin is traded on exchanges all over the world, and it has seen a significant increase in value in 2018.

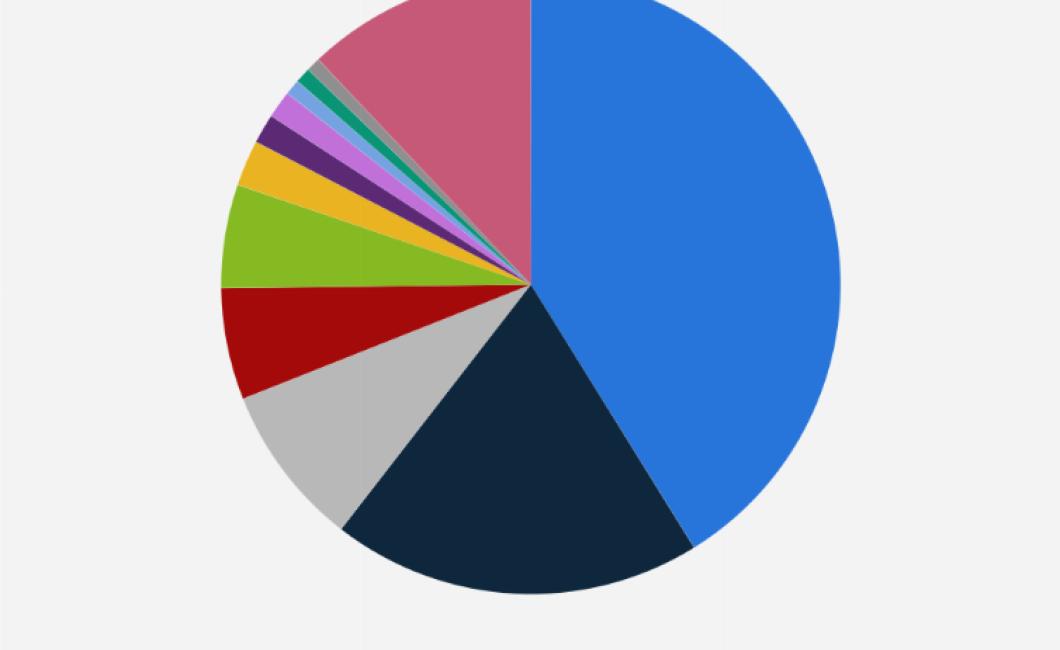

Bitcoin currently has a market cap of $147 billion, and it is ranked number one on the list of the most valuable cryptocurrencies.

Ripple

Ripple was created in 2012, and it is based on the blockchain technology. Ripple is a peer-to-peer network, and it allows for quick and easy transactions between different parties.

Ripple has seen a surge in popularity in recent years, and it is now one of the most valuable cryptocurrencies on the market. Ripple is traded on exchanges all over the world, and it has seen a significant increase in value in 2018.

Ripple currently has a market cap of $75 billion, and it is ranked number two on the list of the most valuable cryptocurrencies.

Bitcoin vs. Monero: The Battle for the Bottom of the Crypto Charts

As cryptocurrencies continue to gain in popularity, it becomes more important to scrutinize which ones are the best investments. Bitcoin and Monero are two of the most popular cryptocurrencies on the market, and their popularity has spawned a number of imitators. In this article, we will compare and contrast Bitcoin and Monero to determine which is the better investment.

Bitcoin

Bitcoin was created in 2009 by an unknown person or group of people under the name Satoshi Nakamoto. Bitcoin is a digital currency that uses cryptography to secure its transactions and to control the creation of new units. Bitcoin is unique in that there are a finite number of them: 21 million.

Bitcoin has been incredibly successful in terms of both popularity and value. As of October 2017, Bitcoin was worth over $10,000 per coin. This success has led to the development of numerous imitators, but Bitcoin remains the dominant cryptocurrency on the market.

One downside of Bitcoin is that its transactions are slow and expensive. This is due to the fact that Bitcoin uses blockchain technology, which is an extremely complex and expensive network. As a result, many businesses have decided not to accept Bitcoin as a form of payment.

Monero

Monero is a cryptocurrency that was created in April 2014. Like Bitcoin, Monero is based on blockchain technology. However, Monero uses a different cryptographic algorithm than Bitcoin, which makes it more anonymous and secure.

Like Bitcoin, Monero has also been very successful in terms of both popularity and value. As of October 2017, Monero was worth over $600 per coin. This success has led to the development of numerous imitators, but Monero remains the dominant cryptocurrency on the market.

One downside of Monero is that its transactions are slow and expensive. This is due to the fact that Monero uses blockchain technology, which is an extremely complex and expensive network. As a result, many businesses have decided not to accept Monero as a form of payment.

In conclusion, Bitcoin is the better investment than Monero. Bitcoin is more successful and valuable than Monero, and its transactions are faster and cheaper. However, Monero remains the dominant cryptocurrency on the market, and investors should keep an eye on it to see if its popularity continues to grow.

Bitcoin vs. Dogecoin: The Epic Shuffle of the Crypto Charts

Bitcoin and Dogecoin are two of the most popular cryptocurrencies on the market. They both boast high trading volumes and have experienced rapid price appreciation over the past year or so.

However, their popularity has not always been a smooth ride. Bitcoin and Dogecoin have experienced a number of dramatic price swings over the past several months.

In this article, we will compare and contrast the two cryptocurrencies and explore how their prices have fluctuated.

Bitcoin vs. Dogecoin: Price History

Bitcoin and Dogecoin both experienced rapid price appreciation over the past year or so. Bitcoin went from being worth just $0.08 per coin to being worth more than $1,200 per coin in 2017. Dogecoin followed a similar trajectory, growing from being worth just $0.0025 per coin to being worth more than $0.10 per coin in 2017.

However, their popularity has not always been a smooth ride. Bitcoin and Dogecoin have experienced a number of dramatic price swings over the past several months.

Bitcoin vs. Dogecoin: Price Analysis

Bitcoin and Dogecoin are two of the most popular cryptocurrencies on the market. However, their popularity has not always been a smooth ride. Bitcoin and Dogecoin have experienced a number of dramatic price swings over the past few months.

In this article, we will compare and contrast the two cryptocurrencies and explore how their prices have fluctuated.

Bitcoin and Dogecoin: Technical Analysis

Bitcoin and Dogecoin both boast high trading volumes and have experienced rapid price appreciation over the past year or so. However, their popularity has not always been a smooth ride. Bitcoin and Dogecoin have experienced a number of dramatic price swings over the past few months.

In this article, we will explore how their prices have fluctuated using technical analysis. We will look at their charts, charts patterns, and Fibonacci support/resistance levels.

Bitcoin vs. Dogecoin: Conclusion

Bitcoin and Dogecoin are two of the most popular cryptocurrencies on the market. They both boast high trading volumes and have experienced rapid price appreciation over the past year or so. However, their popularity has not always been a smooth ride. Bitcoin and Dogecoin have experienced a number of dramatic price swings over the past few months.

Technical analysis can be a useful tool for analyzing cryptocurrencies such as Bitcoin and Dogecoin. By looking at their charts, charts patterns, and Fibonacci support/resistance levels, investors can better understand how their prices have fluctuated.

Bitcoin vs. Namecoin: The Showdown of the Crypto Charts

Bitcoin and Namecoin are two of the most popular cryptocurrencies in the world. They both have their own unique properties that set them apart from other cryptocurrencies.

Bitcoin

Bitcoin is the most well-known cryptocurrency and has been in circulation for several years. Bitcoin is based on a blockchain technology and is not government-controlled. Bitcoin is not inflationary, and its supply is limited to 21 million coins.

Namecoin

Namecoin is a cryptocurrency that was created in January 2011. Namecoin is based on the blockchain technology and uses the same mining process as Bitcoin. Namecoin also has a fixed supply of 21 million coins. Namecoin is not inflationary and can be used to purchase goods and services.

Bitcoin vs. Auroracoin: The Battle of the Crypto charts

Bitcoin is the pioneer in the world of cryptocurrencies. Created in 2009, Bitcoin is a decentralized digital currency that uses peer-to-peer technology to operate. Bitcoin is popular for its user-friendliness and its low transaction fees.

Auroracoin, created in 2014, is the second most popular cryptocurrency after Bitcoin. Auroracoin is a decentralized digital currency that uses blockchain technology to operate. Unlike Bitcoin, Auroracoin is not based on a digital currency algorithm but rather on a distributed network of nodes that maintain the blockchain. This makes it more secure and efficient than Bitcoin.

The popularity of Bitcoin and Auroracoin has led to a fierce battle for the top spot on the global cryptocurrency charts. On March 10, 2018, Bitcoin surpassed Ethereum to become the world’s second most valuable cryptocurrency. Ethereum remained the world’s leading blockchain platform, with a market capitalization of $28 billion.

Bitcoin vs. Megacoin: The Scramble for the Top of the Crypto Charts

Bitcoin and Megacoin are vying for the top spot on the most popular cryptocurrency charts. Bitcoin has been making steady gains in recent weeks, while Megacoin has seen a sharp increase in its value.

Bitcoin is currently the number one cryptocurrency on CoinMarketCap, with a market capitalization of over $19 billion. Megacoin is currently in second place, with a market capitalization of $2.7 billion.

The rise in the value of Megacoin may be due to its affiliation with the Bitcoin network. Megacoin is designed to function as a digital currency with similar features to Bitcoin, but with some key differences. For example, Megacoin is designed to be more stable than Bitcoin, and it can be used to purchase goods and services.

Bitcoin vs. Megacoin: The Battle for the Top of the Cryptocurrency Charts

Bitcoin and Megacoin are vying for the top spot on the most popular cryptocurrency charts. Bitcoin has been making steady gains in recent weeks, while Megacoin has seen a sharp increase in its value.

Bitcoin is currently the number one cryptocurrency on CoinMarketCap, with a market capitalization of over $19 billion. Megacoin is currently in second place, with a market capitalization of $2.7 billion.

The rise in the value of Megacoin may be due to its affiliation with the Bitcoin network. Megacoin is designed to function as a digital currency with similar features to Bitcoin, but with some key differences. For example, Megacoin is designed to be more stable than Bitcoin, and it can be used to purchase goods and services.

Bitcoin vs. Novacoin: The Fight for the Top of the Crypto Charts

Bitcoin vs. Novacoin: The Fight for the Top of the Crypto Charts

Bitcoin and Novacoin are two of the most popular digital currencies on the market today. They both have their own unique set of benefits and drawbacks, which makes them strong contenders for the top spots on the crypto charts.

Bitcoin

Bitcoin is the most popular digital currency on the market today. It was created in 2009 by an anonymous person or group of people under the name Satoshi Nakamoto. Bitcoin is a decentralized currency, meaning that it is not subject to government or financial institution control. This makes it a potential safe haven for investors in times of economic uncertainty.

Another major benefit of Bitcoin is that it is not subject to inflation. Bitcoin is limited to 21 million units, which means that it will eventually become worthless if it isn't used for transactions. This is a major drawback compared to other currencies, which can print more units as needed.

Novacoin

Novacoin is a digital currency that was created in 2012. It is based on the bitcoin protocol, but has a different design. Novacoin is designed to be more user-friendly, with an easier to use wallet interface. Novacoin also has a fixed supply of 21 million units, which makes it more stable than bitcoin.

One major advantage of Novacoin over bitcoin is that it has a much larger market cap. Novacoin has been traded on exchanges for over $10 million USD since its creation, compared to bitcoin's $2 billion USD market cap.

Bitcoin vs. Novacoin: The Battle for the Top Spot

Bitcoin and Novacoin are two of the most popular digital currencies on the market today. They both have their own unique set of benefits and drawbacks, which makes them strong contenders for the top spots on the crypto charts.

Bitcoin is the most popular digital currency on the market today. It was created in 2009 by an anonymous person or group of people under the name Satoshi Nakamoto. Bitcoin is a decentralized currency, meaning that it is not subject to government or financial institution control. This makes it a potential safe haven for investors in times of economic uncertainty.

Another major benefit of Bitcoin is that it is not subject to inflation. Bitcoin is limited to 21 million units, which means that it will eventually become worthless if it isn't used for transactions. This is a major drawback compared to other currencies, which can print more units as needed.

Novacoin is a digital currency that was created in 2012. It is based on the bitcoin protocol, but has a different design. Novacoin is designed to be more user-friendly, with an easier to use wallet interface. Novacoin also has a fixed supply of 21 million units, which makes it more stable than bitcoin.

One major advantage of Novacoin over bitcoin is that it has a much larger market cap. Novacoin has been traded on exchanges for over $10 million USD since its creation, compared to bitcoin's $2 billion USD market cap.

Bitcoin vs. Quark: The Tussle at the Top of the Crypto charts

Bitcoin and Quark are two of the most popular cryptocurrencies in the world. Both coins have seen significant growth in value over the past year, with Bitcoin reaching a peak of $19,783 per coin in December 2017 and Quark reaching a peak of $1,183 per coin in January 2018.

Bitcoin vs. Quark: The Differences

Bitcoin and Quark are both digital currencies, but they differ in a number of key ways. Bitcoin is designed to be a decentralized currency, meaning that it is not subject to government or financial institution control. Quark, on the other hand, is a centralized currency that is supported by a single company.

Bitcoin vs. Quark: The Competition

Bitcoin and Quark are two of the most popular cryptocurrencies in the world, but they face competition from other digital currencies. Ethereum, Litecoin, and Bitcoin Cash are all major competitors to Bitcoin and Quark.