Are crypto charts the same as stock charts?

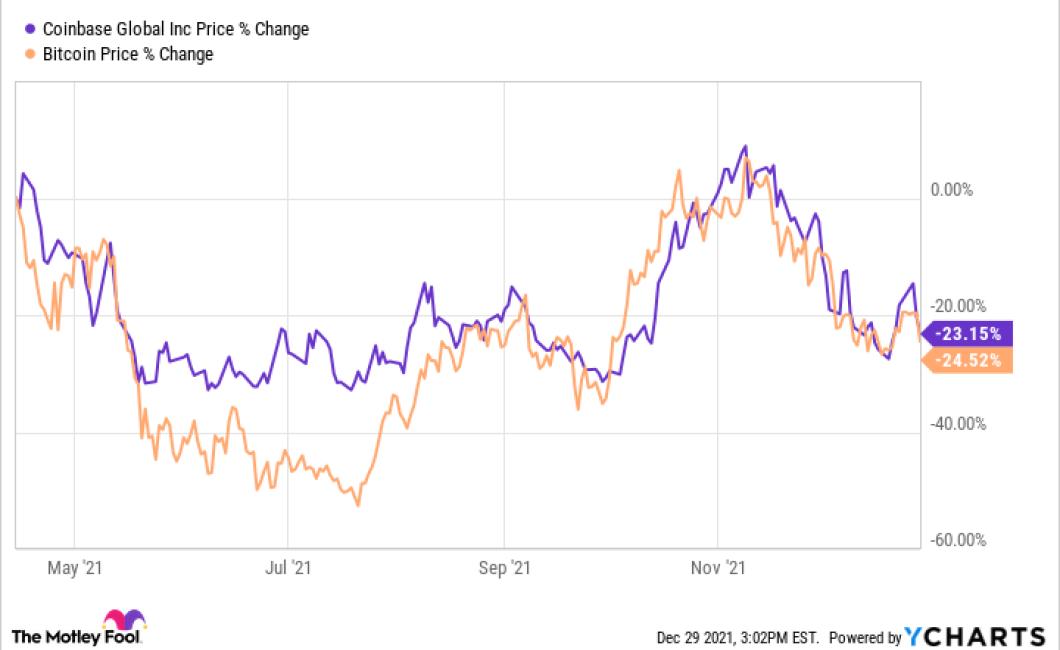

Crypto charts and stock charts are similar in that they both track the movements of a given asset over time. However, there are some key differences between the two. For one, crypto charts tend to be much more volatile than stock charts, due to the nature of the underlying asset. Additionally, crypto charts often provide more detailed information, such as candlestick patterns and volume data.

Crypto charts vs. stock charts: the similarities and differences

Cryptocurrencies and stocks are two types of assets that share some similar features, but also have some important differences. Here’s a closer look at the similarities and differences between these two types of charts:

Cryptocurrencies and stocks both use prices to indicate how valuable an asset is. Cryptocurrencies use decentralized blockchain technology to maintain a record of all transactions, so their prices are determined by supply and demand. Stock prices are determined by a number of factors, including company performance, investor sentiment, and overall market conditions.

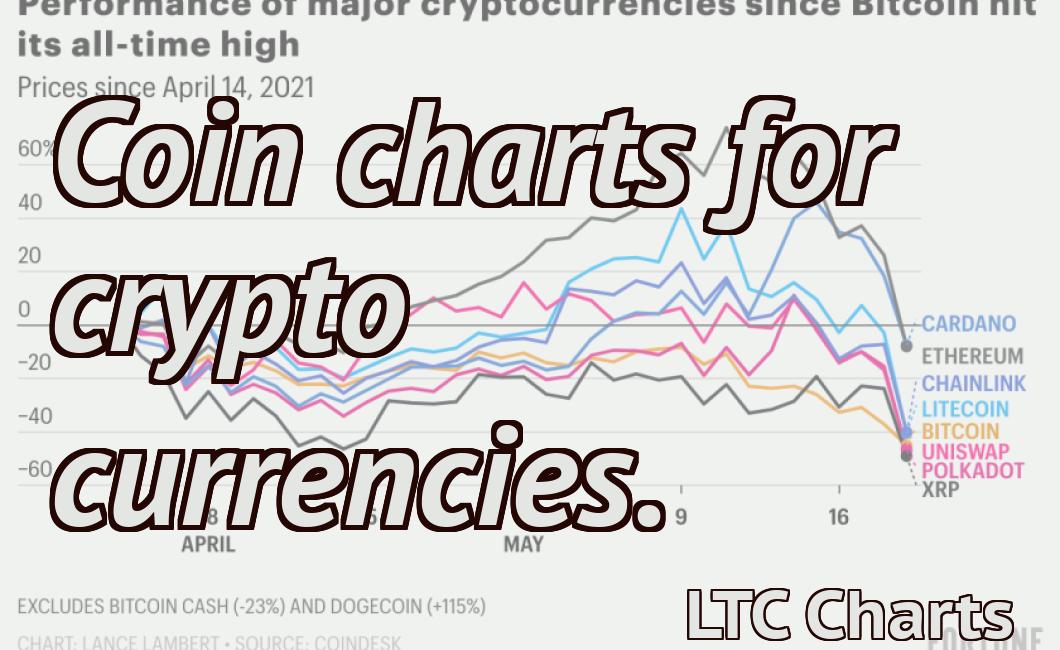

Cryptocurrencies and stocks also share some similarities in how they move prices. Cryptocurrencies are volatile, meaning their prices can vary a lot from one day to the next. This volatility makes it difficult to predict how much an asset will worth in the future. Stocks, on the other hand, are generally more stable and predictable. Over a period of several days or weeks, stock prices usually move relatively close to their average value.

Stocks and cryptocurrencies also share some important differences. For example, stocks are backed by physical assets such as factories or companies, while cryptocurrencies are not. Stocks are also regulated by governments, while cryptocurrencies are not.

Overall, cryptocurrencies and stocks share some similarities, but they also have some important differences. As with any type of investment, it’s important to do your own research before making any decisions.

How to read crypto charts: the basics

Crypto charts show the performance of different cryptocurrencies over time. The horizontal axis represents time, and the vertical axis represents value.

Cryptocurrencies are divided into sections based on their market capitalization. The top section is for the most valuable cryptocurrencies, and the bottom section is for the least valuable cryptocurrencies.

The different cryptocurrencies are represented by different colors. The most valuable cryptocurrencies are represented by green, and the least valuable cryptocurrencies are represented by red.

The size of the circles indicates how much value the cryptocurrency has gained or lost over the last 24 hours. The bigger the circle, the more value the cryptocurrency has gained or lost.

The height of the lines indicates how much value the cryptocurrency has gained or lost over the last 7 days. The taller the line, the more value the cryptocurrency has gained or lost.

The bottom line shows the total value of all cryptocurrencies in the chart.

What do crypto charts tell us?

Cryptocurrency charts are used to track the price of a digital asset over time. They can be used to identify trends and to predict future movements.

How to interpret crypto charts

Cryptocurrencies are often traded on digital exchanges and can be highly volatile. This means that the prices of cryptocurrencies can rise and fall quickly.

Cryptocurrencies are often traded on digital exchanges and can be highly volatile. This means that the prices of cryptocurrencies can rise and fall quickly.

The anatomy of a crypto chart

The anatomy of a crypto chart is as follows:

1. The horizontal axis shows the price of a cryptocurrency over time.

2. The vertical axis shows the market capitalization of a cryptocurrency.

3. The circles on the chart represent cryptocurrencies.

4. The green, blue, and red lines on the chart represent the highest, lowest, and average prices of a cryptocurrency, respectively.

5. The gray line on the chart represents the price of a cryptocurrency over a specific period of time.

Crypto chart patterns and what they mean

Cryptocurrencies are a relatively new asset class, and their popularity means there are many chart patterns to be found. Here are some of the more common ones:

1. Ascending triangles: These patterns indicate that the price of a cryptocurrency is rising gradually but steadily. The pattern typically starts with a small increase in price followed by a larger one, and then another smaller one. This suggests that people are buying the cryptocurrency in increasing numbers, which is likely leading to its eventual rise in value.

2. Converting triangles: These patterns indicate that a cryptocurrency is slowly but steadily becoming more valuable. The pattern typically starts with a small increase in price followed by a larger one, and then another smaller one. This suggests that people are trading in the cryptocurrency, which is likely leading to its eventual rise in value.

3. Fibonacci retracements: These patterns indicate that the price of a cryptocurrency is slowly but steadily returning to its previous level. The pattern typically starts with a small decrease in price followed by a larger one, and then another smaller one. This suggests that people are selling the cryptocurrency, which is likely leading to its eventual fall in value.

Using crypto charts to predict price movements

Cryptocurrency charts can be used to predict price movements. For example, if you see that the price of a cryptocurrency is moving up, you may want to buy in order to increase your holdings. Conversely, if the price is moving down, you may want to sell in order to decrease your holdings.

The benefits of using crypto charts

Crypto charts can be extremely helpful for traders and investors. They allow you to see the progress of a particular cryptocurrency over time, which can help you make more informed decisions.

Crypto charts can also help you identify trends. If you see that a particular cryptocurrency is experiencing strong growth, it may be a good idea to invest in it. Conversely, if you see that a cryptocurrency is experiencing heavy losses, it may be a good time to sell off your holdings.

Crypto charts can also help you spot potential scams. If you see a cryptocurrency that is experiencing rapid gains, it may be a sign that the company behind the coin is fraudulent. Similarly, if a cryptocurrency is experiencing heavy losses, it may be a sign that the coin is about to crash.

The limitations of crypto charts

Crypto charts are great for showing trends, but they cannot be used to predict future prices.

Why crypto charts are different from stock charts

Cryptocurrencies are not just another type of stock. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.