How to read crypto depth charts?

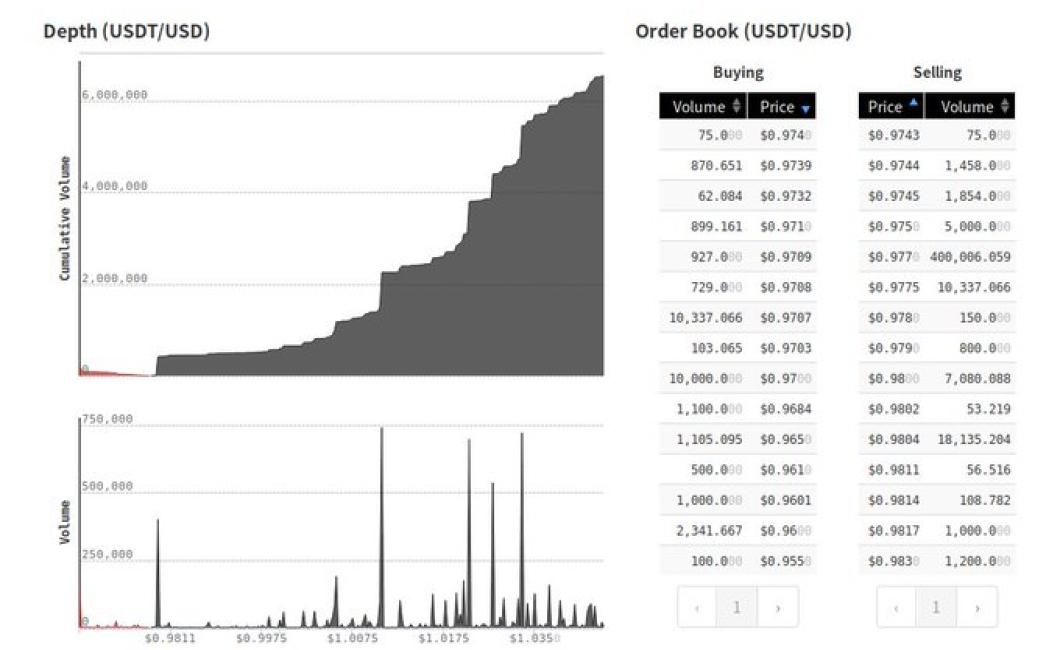

Crypto depth charts are tools that allow traders to visualize the order book for a given cryptocurrency exchange. By understanding how to read these charts, traders can gain an edge in the market.

How to read crypto depth charts: The basics

Crypto depth charts are a way to track the price and volume of a cryptocurrency over time. They are also used to measure the health of a cryptocurrency market.

Cryptocurrencies are listed in order from the most valuable to the least valuable. The height of each column corresponds to the price of the cryptocurrency at that particular moment. The width of each column corresponds to the volume of the cryptocurrency at that particular moment.

To read the crypto depth chart, start at the bottom and work your way up. Each column will tell you what happened in price and volume at that particular moment. Pay attention to the green and red lines, which indicate whether the price is increasing or decreasing. If the line is red, then the price is decreasing, and if the line is green, then the price is increasing.

How to read crypto depth charts: A step-by-step guide

Step 1: Identify the support and resistance levels.

The first step is to identify the support and resistance levels. These are the levels where the price of a cryptocurrency has been stable for a certain period of time, and can be used as a reference point when looking at the chart.

Step 2: Identify the trend.

Next, you need to identify the trend. This will help you understand how the price of a cryptocurrency is moving and what direction it is heading in.

Step 3: Check the indicators.

Then, you need to check the indicators to see if they are indicating a buy or sell opportunity. Some common indicators include the volume and the MACD (moving average convergence divergence).

How to read crypto depth charts: Tips and tricks

Crypto market depth charts are a great way to get an idea of the liquidity and price volatility of different cryptocurrencies.

1. Look for coins with high liquidity. This means that there is a lot of buyers and sellers trading these coins, which gives you a sense of confidence that you will be able to sell your coins at a good price.

2. Compare the prices of different coins. Look for coins that are trading at a lower price than others, indicating that there is more demand for them.

3. Check the volume of each coin. This will give you an idea of how active the market is for these coins.

4. Compare the prices of different coins over time. This will help you determine which coins are going up or down in price.

How to read crypto depth charts: A beginner's guide

Cryptocurrencies are complex financial instruments with a variety of different features. To make informed decisions when trading them, it's important to understand the basics of crypto depth charts.

A crypto depth chart is a graphical representation of a cryptocurrency's market cap and price over time. It provides an overview of the relative sizes of different cryptocurrencies, and can be used to identify potential investment opportunities.

To create a crypto depth chart, you first need to find a cryptocurrency's market cap. This is the total value of all the cryptocurrency tokens in circulation. To find this information, you can use popular cryptocurrency exchanges like CoinMarketCap or CoinGecko.

Next, you need to find a cryptocurrency's price. This is the price at which a given quantity of cryptocurrency tokens is currently available for purchase. You can find this information on popular cryptocurrency exchanges like CoinMarketCap or CoinGecko.

To create a crypto depth chart, you then need to plot each cryptocurrency's market cap and price on a graph. You can do this using any graphics software, like Microsoft Excel or Google Sheets.

Once you have plotted each cryptocurrency's market cap and price, you can use the information in the graph to identify potential investment opportunities. For example, if you see that a cryptocurrency has recently experienced a large increase in its market cap, this could be an indication that its value is increasing. If you see that a cryptocurrency's price is low compared to its market cap, this could be an indication that its value is undervalued.

How to read crypto depth charts: An essential guide

When you're looking at a crypto depth chart, you're looking at a graphical representation of how much money various cryptos are worth.

The height of each column represents the value of that particular cryptocurrency at a certain point in time. The width of each column represents the number of transactions that have taken place for that particular cryptocurrency during that same time period.

The color of each row corresponds to the value of that particular cryptocurrency at that moment. The darker the color, the higher the value.

How to read crypto depth charts: The ultimate guide

Crypto depth charts are a great way to track the performance of different cryptocurrencies. By looking at the chart, you can see how much value the cryptocurrency has gained or lost in the past 24 hours.

To read a crypto depth chart, first find the currency you want to track. Then, look for the “24-hour” column on the left side of the chart. This column shows how much value the cryptocurrency has gained or lost in the past 24 hours.

Next, look for the “24-hour volume” column on the right side of the chart. This column shows how much value the cryptocurrency has traded in the past 24 hours.

Finally, look for the “7-day” column on the right side of the chart. This column shows how much value the cryptocurrency has gained or lost in the past 7 days.

How to read crypto depth charts: The definitive guide

There is no one definitive way to read crypto depth charts. However, some general tips include studying the overall trend of the market, looking for specific patterns (such as a sudden increase in buy orders or a decrease in sell orders), and gauging how much volatility (or price movement) is present.

How to read crypto depth charts: Your complete guide

What is a crypto depth chart?

A crypto depth chart is a visual representation of how much a given cryptocurrency is worth on the various exchanges. It shows how much buying and selling pressure is currently exerted on the coin, and can be a useful tool for predicting future price movements.

How to read a crypto depth chart: The basics

To read a crypto depth chart, you first need to understand how it works. On the chart, each horizontal line represents a certain amount of buying or selling pressure. The closer two lines are to each other, the more intense the buying and selling pressure is.

So, if two lines are close to each other, this means that there is a lot of buying and selling pressure on that cryptocurrency. If the lines are far apart, then there is less buying and selling pressure on that cryptocurrency.

You can also see how much the price of a given cryptocurrency has changed over time by looking at the chart's histogram. This shows you how often the price has changed throughout the day, week, or month.