Charts to view cryptocurrency.

This article outlines the different types of charts that can be used to view cryptocurrency data, including line charts, candlestick charts, and bar charts. Each type of chart has its own advantages and disadvantages, so it is important to choose the right one depending on the information you are trying to glean from the data.

How to read cryptocurrency charts

Cryptocurrency charts are visual representations of the performance of a cryptocurrency over time. They show the price and volume of a cryptocurrency over a given period of time.

To read cryptocurrency charts:

1. Find the cryptocurrency you want to track on the chart.

2. Click on the chart to enlarge it.

3. Use the scroll bar to scroll through the data.

4. Use the mouse to move around the chart.

5. Use the keyboard to zoom in or out.

The most important crypto charts every trader should know

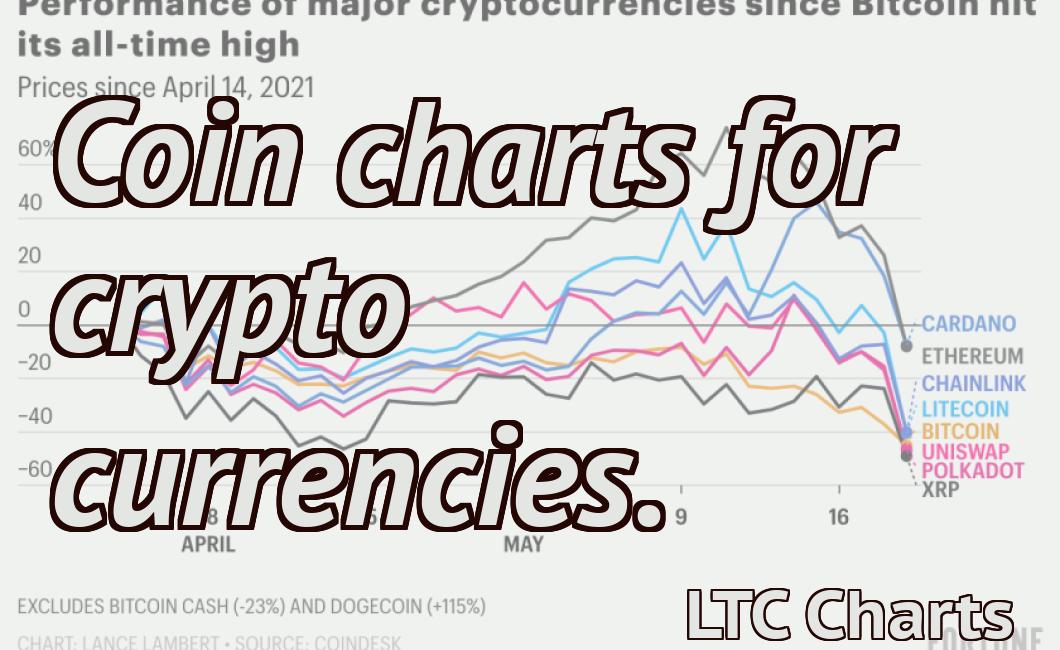

Cryptocurrencies are a new asset class and there are a lot of different charts that can be used to track prices. Here are the most important charts for traders:

1. Bitcoin Price Chart

The most important cryptocurrency chart is the bitcoin price chart. This chart shows the price of bitcoin over time. The bitcoin price chart is often used to determine the value of other cryptocurrencies.

2. Ethereum Price Chart

The Ethereum price chart is also important. This chart shows the price of Ethereum over time. Ethereum is often used as a replacement for bitcoin in many cases.

3. Litecoin Price Chart

The Litecoin price chart is also important. This chart shows the price of Litecoin over time. Litecoin is often used as a replacement for bitcoin in many cases.

4. Bitcoin Cash Price Chart

The Bitcoin Cash price chart is also important. This chart shows the price of Bitcoin Cash over time. Bitcoin Cash is often used as a replacement for bitcoin in many cases.

The must-know basics of reading cryptocurrency charts

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, for example, is not subject to government regulation but is instead governed by a network of computers.

Cryptocurrency charts are used to track the price of a cryptocurrency over time. Cryptocurrency prices are typically displayed as a three-dimensional chart with prices on the X-axis, time on the Y-axis, and volume on the Z-axis.

A beginner's guide to crypto charting

Cryptocurrencies are a new and growing market. As a result, there are many different ways to track their prices and performance. This guide will teach you how to use crypto charting tools to monitor your investments.

1. Choose a crypto charting platform

There are several different crypto charting platforms available. Popular choices include CoinMarketCap and TradingView.

2. Set up your account

To access the tools on these platforms, you'll need to set up an account. This can be done by providing your name, email address, and password.

3. Choose a currency or asset to track

Once you've set up your account, you'll need to choose a currency or asset to track. Popular choices include Bitcoin, Ethereum, and Litecoin.

4. Access your charts

To access your charts, click on the "Charts" tab on the left-hand side of the screen. This will display a list of all the currencies or assets that you're tracking.

5. Analyse your data

Once you've selected a currency or asset, you can start analysing your data. This will allow you to see how the price of this asset is changing, and how it compares to other currencies or assets.

The essentials of crypto charting for beginners

Crypto charting can be a great way to track the price movement of digital assets. There are a few essential things you need to know before you get started.

1. Understand the coins you are tracking

First, you need to understand the coins you are tracking. Each coin has its own unique set of features and characteristics that will affect how you track it.

2. Know your tools

Second, you need to know your tools. You can use a variety of different tools to track crypto prices, and each one will have its own benefits and drawbacks.

3. Be patient

Finally, be patient. The crypto market is volatile, and prices can move quickly and unpredictably. It takes time to learn how to track crypto prices effectively, and there is no guarantee that you will make money in the short term.

How to make sense of crypto charts

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. Bitcoin, Ethereum, and other cryptocurrencies are often referred to as “digital assets.”

Cryptocurrency charts are a way to track the prices of cryptocurrencies. Cryptocurrency charts typically display the price of a cryptocurrency over time, as well as indicators such as the percentage of change or volume.

How to trade cryptocurrencies using charts

Cryptocurrencies are traded on various exchanges and can be bought and sold using various methods. Cryptocurrencies are often traded on exchanges in pairs, with one currency being exchanged for another.

To trade cryptocurrencies using charts, first find an exchange that trades the cryptocurrency you want to trade. On the exchange, find the currency you want to trade and locate the chart for that currency. On the chart, find the price for the currency and locate the candlestick that corresponds to the price you are looking for. The middle of the candlestick is the "high" and the bottom is the "low."

Next, locate the "close" for the candlestick. This is the price at which the candlestick was closed, or the price at which the market made a new buy or sell order. The closer the price is to the close, the more likely it is that the price will close at or near that price.

Now locate the "volume" for the day. Volume is an indication of how active the market is and is measured in units of dollars. The higher the volume, the more active the market is.

Finally, locate the "direction" for the day. The direction for the day is determined by whether the market is going up (bulls) or down (bears).

A guide to cryptocurrency technical analysis

Cryptocurrency technical analysis is the process of studying a cryptocurrency’s price and performance in order to make informed investment decisions. Cryptocurrencies are unique in that their prices are largely determined by supply and demand, rather than fiat currency. As such, technical analysis can be used to identify opportunities and predict future price movements.

Several popular cryptocurrency technical indicators include the moving average (MA), Bollinger Bands (BB), and Fibonacci retracements.

Moving average

A moving average is a technical indicator that measures the average price of a cryptocurrency over a given period of time. The moving average is calculated by adding the prices of the past N days and dividing the result by N. The default setting for most moving averages is 10 days, so a moving average of 20 would include the prices for the last 10 days, 15 would include the prices for the last 15 days, and so on.

The use of a moving average can help traders identify patterns in the price of a cryptocurrency and gauge the strength of current demand. Moving averages can also be used to identify potential support and resistance levels in the market.

Bollinger Bands

Bollinger Bands are a type of technical indicator that uses standard deviation to measure price volatility. Bollinger Bands consist of two bands, one above the other. The band above the lower band is known as the “high band,” and the band above the upper band is known as the “low band.”

The purpose of Bollinger Bands is to help traders identify areas of strong and weak price activity. When prices move outside of the Bollinger Bands, this indicates that there is greater price volatility present.

Fibonacci retracements

Fibonacci retracements are a type of technical indicator that uses Fibonacci ratios to measure price movement. Fibonacci ratios are ratios found in nature that relate to the growth of plants and animals. The most well-known Fibonacci ratio is the 0.618 ratio, which relates to the length of a human’s forearm.

The use of Fibonacci retracements can help traders identify opportunities to buy or sell a cryptocurrency based on recent price movements. Fibonacci retracements can also be used to identify areas of strong support and resistance in the market.

How to interpret cryptocurrency charts for trading

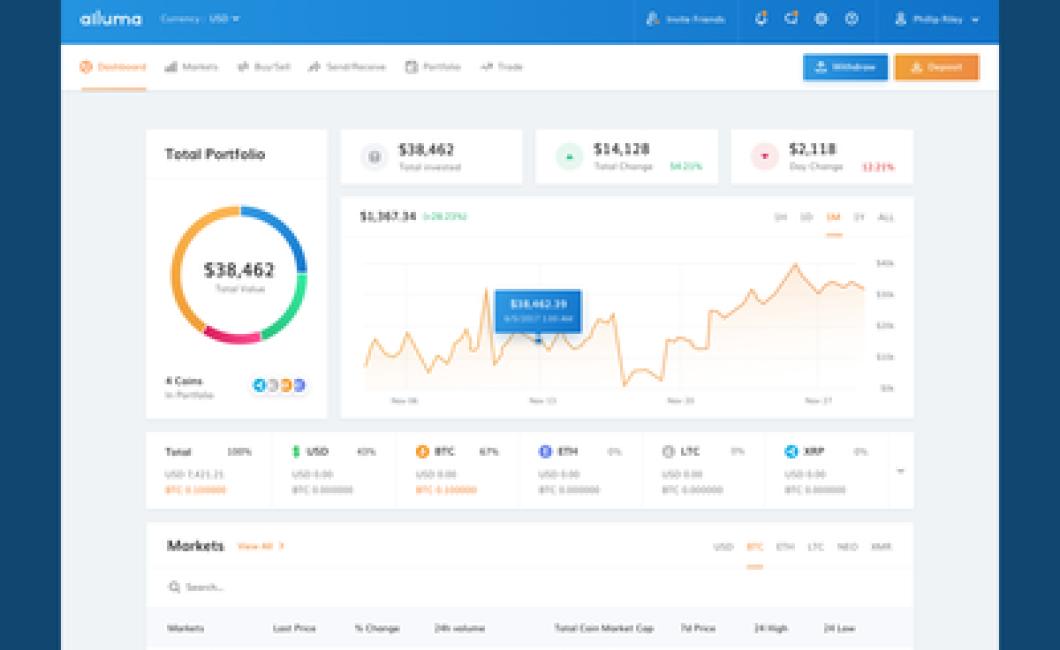

Cryptocurrency charts are a useful tool for traders and investors. They can help you to understand the current state of the market and to make informed decisions about which cryptocurrencies to buy or sell.

Cryptocurrency charts typically show the price of a cryptocurrency over time, as well as its cumulative volume (the number of coins that have been traded). You can use this information to help you to understand how the market is performing and to make informed trading decisions.

Here are some tips to help you to interpret cryptocurrency charts:

1. Look at the overall trend

The first thing you need to do is to look at the overall trend of the market. This will help you to understand how the market is performing and which cryptocurrencies are performing the best at the moment.

2. Check the volatility

Another important thing to check is the volatility of the market. This is important because it will tell you how risky it is to trade cryptocurrencies. If the market is volatile, this means that prices can change rapidly and unpredictably.

3. Check the volume

Another thing to look at is the volume of the market. This will tell you how active the market is and whether there is a lot of interest in the cryptocurrencies being traded.

4. Look at the price trends

Finally, you should also look at the price trends of the different cryptocurrencies. This will help you to understand how the market is changing and which cryptocurrencies are experiencing the most growth right now.