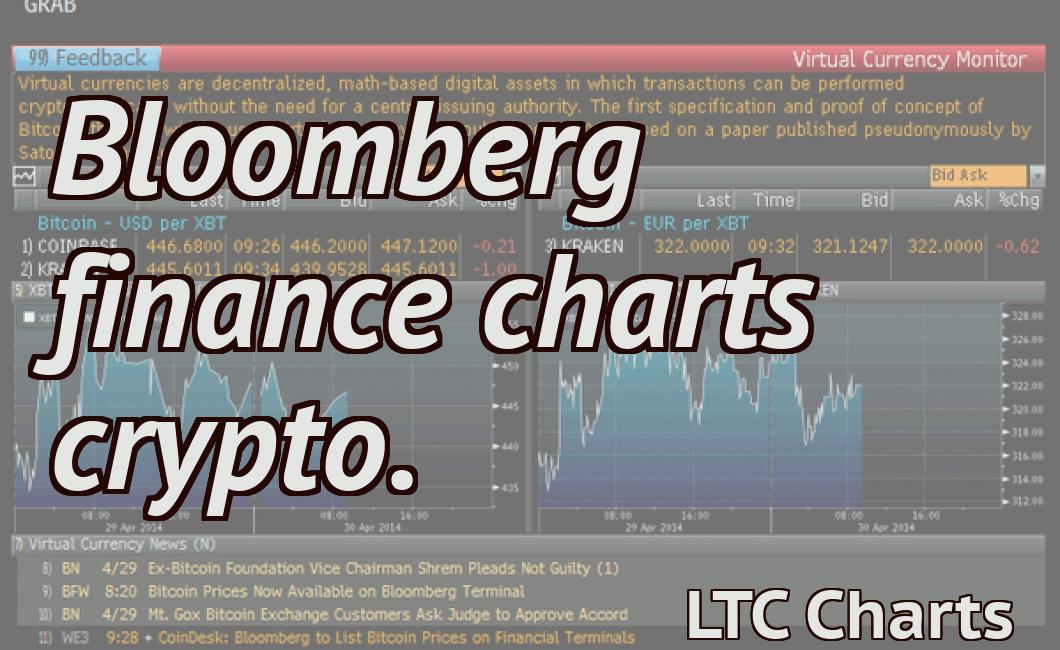

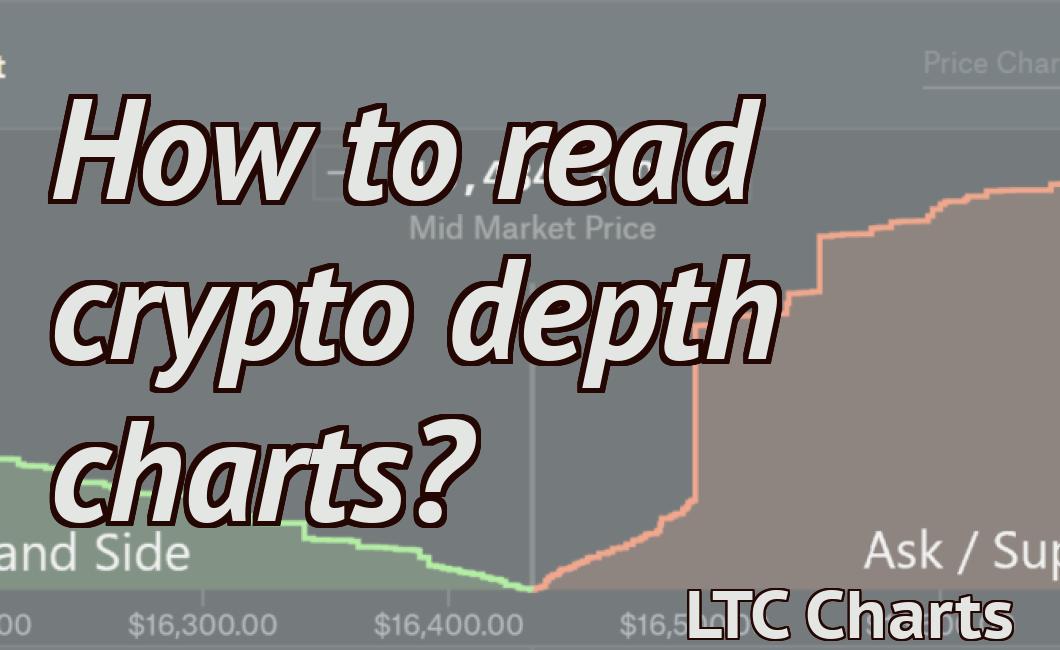

Global Crypto Charts

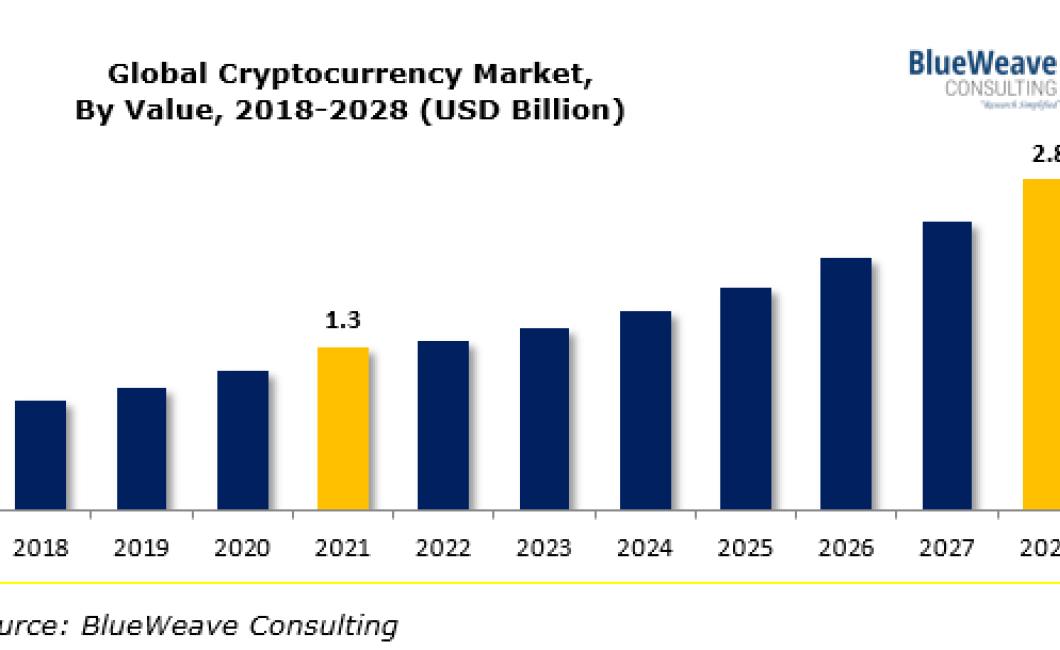

This article provides an overview of global crypto charts, with a focus on the top 10 cryptocurrencies by market capitalization. It looks at the price performance of each cryptocurrency over the past year, and provides some insights into the factors driving the market.

Bitcoin vs. Ethereum: Which is the Better Investment?

Bitcoin and Ethereum are two of the most popular cryptocurrencies in the world. They both have a lot of supporters, but which one is the better investment?

Bitcoin

Bitcoin is often seen as the better investment option because it is more stable than Ethereum. Bitcoin has been able to hold its value better than many other cryptocurrencies, even during some of the most volatile periods. This makes it a good option for investors who want to protect their assets.

Ethereum

Ethereum is also a popular cryptocurrency, but it has seen more volatility than Bitcoin. This makes it a risky investment option, but it has the potential to be much more profitable. Ethereum is also known for its ability to handle more transactions than Bitcoin. This makes it a good option for businesses that need to process a lot of transactions.

Bitcoin Price Fluctuations: What's Causing Them and How Will They Affect the Market?

Bitcoin price fluctuations are caused by a variety of factors, but most commonly they are a result of geopolitical events, financial market volatility and changes in demand for Bitcoin.

Geopolitical Events:

Geopolitical events can cause large price fluctuations in Bitcoin as investors react to news and events. For example, in late 2013, the Chinese government announced that it was going to start regulating Bitcoin and other digital currencies. This caused a significant price drop in Bitcoin, although it has since recovered.

Financial Market Volatility:

Financial market volatility can cause large price fluctuations in Bitcoin as investors react to news and events. For example, in late 2013, the Chinese government announced that it was going to start regulating Bitcoin and other digital currencies. This caused a significant price drop in Bitcoin, although it has since recovered.

Changes in Demand for Bitcoin:

Changes in demand for Bitcoin can cause large price fluctuations as investors react to news and events. For example, in late 2013, the Chinese government announced that it was going to start regulating Bitcoin and other digital currencies. This caused a significant price drop in Bitcoin, although it has since recovered.

Cryptocurrency Prices Plummet as Bitcoin Falls Below $7,000

Cryptocurrencies are falling across the board as Bitcoin falls below $7,000.

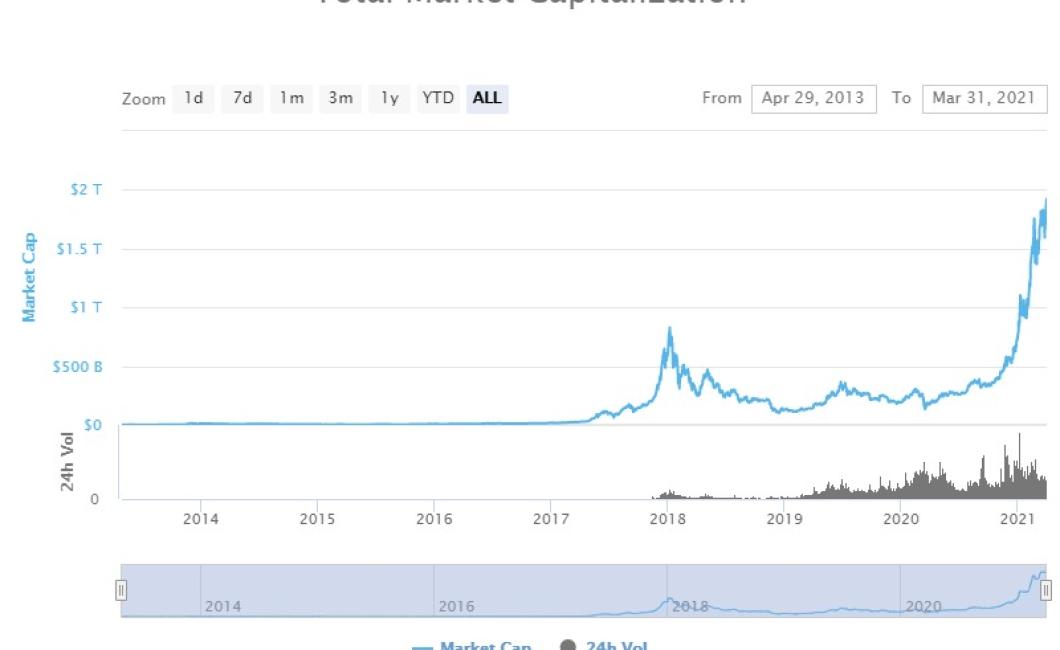

The total market capitalization of all cryptocurrencies is now just over $140 billion, according to CoinMarketCap.com. Bitcoin’s share of that is just under 30%, or $47.3 billion.

Bitcoin was trading at $7,095 on Wednesday morning, down more than 10% from its all-time high of $7,291 hit on Dec. 17.

The other major cryptocurrencies are all down as well. Ethereum is down more than 20%, Ripple is down more than 30%, and Bitcoin Cash is down more than 40%.

There are a number of reasons why cryptocurrencies are falling.

Some investors are withdrawing their money from cryptocurrencies because they are worried about the security of their investments. Bitcoin and other cryptocurrencies are not regulated by any government, which makes them a risky investment.

Some people are also concerned about the possible impact of a global financial crisis on the value of cryptocurrencies. A global financial crisis would make it difficult for people to get money and buy cryptocurrencies, which would probably cause their prices to fall.

Another reason for the fall in the prices of cryptocurrencies is that some companies are starting to stop accepting them as payment. This includes major companies like Microsoft, Starbucks, and Subway.

Bitcoin Cash Surges Above $1,000 as Crypto Markets Rebound

Bitcoin Cash is surging in value as the crypto markets rebound. On Sunday, Bitcoin Cash was trading at $1,040 before starting to surge above $1,000. At press time, Bitcoin Cash is trading at $1,107.

Bitcoin Cash has seen a significant increase in value in recent weeks due to investor confidence in the cryptocurrency. The value of Bitcoin Cash has surged due to its inclusion on major exchanges such as Binance and Coinbase.

Many cryptocurrency investors believe that the crypto market will continue to rebound in the near future. This is likely to result in an increase in the value of Bitcoin Cash and other cryptocurrencies.

Ethereum's Price Climbs to Nearly $500 as Bitcoin Stabilizes

Ethereum's price climbed to nearly $500 on Tuesday as Bitcoin stabilized. Ethereum is up about 20% in the past two days.

Litecoin Jumps 20% as Bitcoin Price Continues to Climb

Bitcoin and Litecoin continue to surge in value, with Litecoin jumping 20% in value on the news that Coinbase is adding support for the digital currency.

Coinbase is one of the most popular and well-known platforms for buying and selling cryptocurrencies, and its addition of Litecoin support means that a wider range of investors can get involved in the market.

Bitcoin prices are currently up more than 30% in the past month, and many experts are predicting that this trend will continue until at least the end of the year.

Ripple's XRP Token Gains 5% Amidst Crypto Market Upturn

Ripple’s XRP token gained 5% in value against the US dollar and other major cryptocurrencies during the week of January 14th according to data from CoinMarketCap.

XRP is currently trading at $0.271, up from $0.257 at the start of the week. Bitcoin and Ethereum are both up around 7% during the same period.

The overall market trend has been positive, with most major cryptocurrencies posting gains over the past seven days. Bitcoin, Ethereum, and Litecoin are all up more than 20% from their all-time lows reached in December.

Ripple’s XRP token has been seeing a lot of interest lately as investors look for opportunities in the rapidly growing cryptocurrency market. The company announced earlier this month that it had signed a partnership with payment provider MoneyGram to help speed up cross-border payments using XRP.

Ripple has also been working on developing its own blockchain network, which could make it a major player in the cryptocurrency space.

Bitcoin SV Jumps 30% as Altcoins Surge in Value

Bitcoin SV (BSV) is up 30% as the altcoin market surges in value.

Bitcoin Cash (BCH) is up 50% on the day, Ethereum (ETH) is up 23% and Ripple (XRP) is up by more than 40%.

Bitcoin SV is a spin-off of bitcoin that was created in early 2019. It is based on the original bitcoin code but with a different block size. Bitcoin SV is designed to be faster and cheaper than bitcoin.

The altcoin market has been surging in value this week as investors look for safe havens in the face of global political uncertainty.

Monero Sees Double-Digit Gains as Crypto Markets Rebound

The world’s second most popular cryptocurrency, Monero, is seeing a significant resurgence in value this week as the crypto markets rebound.

As of this writing, Monero is up 10 percent on the week and stands at $212.

This is in stark contrast to the week prior, when Monero was down nearly 18 percent on the week.

Some of the factors that may be contributing to Monero’s recent resurgence include positive news from Japan, which is one of Monero’s largest markets, and increasing adoption by businesses and individuals.

In addition, the overall market trend is also helping Monero as investors look for opportunities to invest in a more stable market.

Monero is currently the fifth most valuable cryptocurrency on the market with a market cap of $2.8 billion.

TRON's Justin Sun Acquires BitTorrent in $140 Million Deal

Justin Sun, founder and CEO of TRON, has announced that the company has acquired BitTorrent Corporation in a $140 million deal. According to Sun, the acquisition will help TRON become a leading content distribution platform.

"We are very excited to join the BitTorrent family and to help them achieve their goal of becoming the world's leading content distribution platform," Sun said in a statement. "We believe that the combined power of TRON and BitTorrent will help create a more open and decentralized internet, which is vital for the growth of online entertainment."

BitTorrent is a leading file-sharing platform that allows users to share files between devices. The company has over 150 million registered users and more than 2 billion active monthly users.

TRON plans to use BitTorrent's technology to help distribute content across the TRON network. The acquisition is also expected to help TRON build a digital entertainment ecosystem.

"The acquisition of BitTorrent by TRON is a major milestone that will help us build a more open and decentralized internet. We are excited to work with Justin Sun and the TRON team to bring the best content experience to our users," said BitTorrent CEO Sean Parker.

TRON's acquisition of BitTorrent follows a string of other significant deals for the company in recent months. In February, TRON acquired BitTorrent's parent company, Justin Sun and Co. Ltd for an undisclosed amount. That same month, TRON announced it had acquired blockchain data analysis company FileCoin. And in November, TRON announced it had acquired BitTorrent's peer-to-peer protocol and client software.

EOSIO 2 Launches with Major Upgrade to Blockchain Protocol

EOSIO 2.0, the upgraded blockchain protocol for decentralized applications, was officially launched today by Block.one and the EOS Core Arbitration Forum.

The new protocol offers faster transaction speeds, more scalability, and enhanced security, making it an attractive choice for blockchain-based applications.

“EOSIO is the most advanced blockchain platform in the world and this upgrade provides developers the tools they need to create the next generation of decentralized applications,” said Dan Larimer, founder of Block.one.

The new protocol also includes a new governance system that allows block producers to vote on changes to the protocol. This provides a more democratic approach to protocol development and eliminates the need for third-party arbitration.

“The launch of EOSIO 2.0 marks an important milestone in the development of blockchain technology,” said Brendan Blumer, CEO of the EOS Core Arbitration Forum. “This upgrade provides developers with a more efficient and scalable platform that is secure and transparent. We are excited to continue our work with the Block.one team to help make EOSIO the most popular blockchain platform in the world.”

EOSIO 2.0 is available for download at https://eosio.org/download/.