Crypto Candlestick Charts Explained

If you want to trade cryptocurrencies, you need to understand crypto candlestick charts. They may look complicated at first, but they're actually pretty simple once you know what you're doing. Here's a quick guide to reading crypto candlesticks so that you can make better trades.

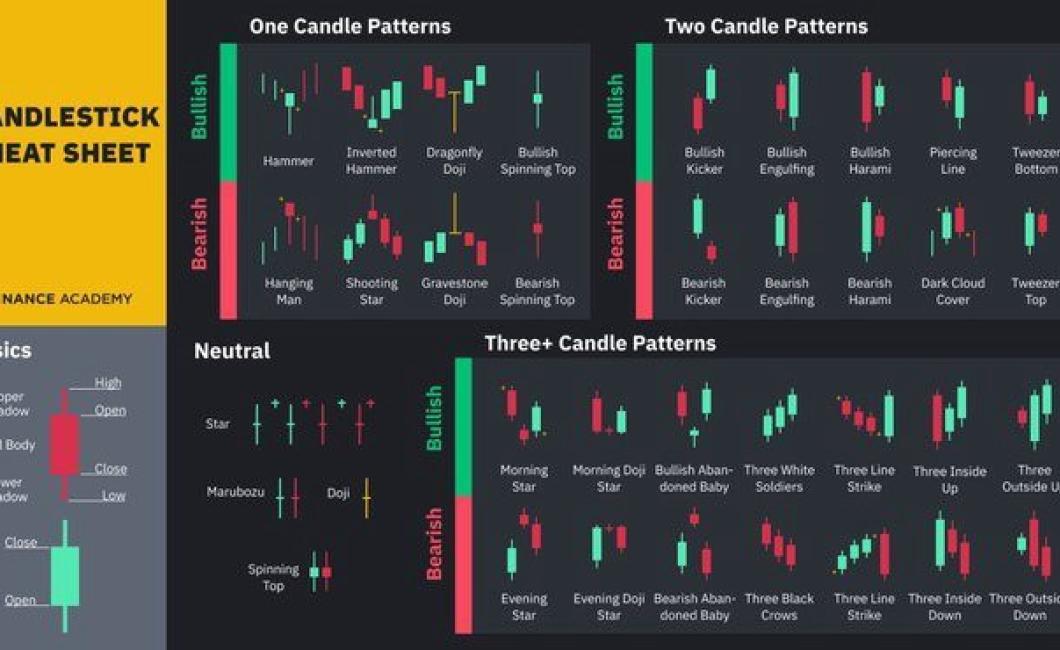

The basics of crypto candlestick charts

Crypto candlestick charts show the price movement of cryptocurrencies over time. They are used to identify patterns and trends in price action.

A candlestick is a type of chart that shows the price movement of a cryptocurrency over time. Candlestick charts are usually used to identify patterns and trends in price action.

Each candlestick is represented by a rectangular shape. The height of the candlestick corresponds to the price change over the period it represents. The width of the candlestick indicates the amount of volume traded over the period it represents.

The colors of the candlestick indicate the market sentiment at the time it was created. Green candlesticks indicate positive sentiment, while red candlesticks indicate negative sentiment.

How to read crypto candlestick charts

Crypto candlestick charts are a graphical representation of the price action of cryptocurrencies. Candlesticks are divided into four parts: the open, the high, the low, and the close. The size of the candlestick corresponds to the value of the asset at that point in time.

The open is the first candlestick and shows the price at the opening of the trading day. The high is the candlestick that is farthest up the chart and reflects the highest point reached during the trading day. The low is the candlestick that is farthest down the chart and reflects the lowest point reached during the trading day. The close is the last candlestick and shows the price at the end of the trading day.

To read crypto candlestick charts, start by locating the open candlestick. This candlestick will show you the price at the beginning of the trading day. Next, locate the high candlestick. This candlestick will show you the price at the peak of the trading day. If the asset reached its peak during the day, the high candlestick will be very large. If the asset reached its peak later in the day, the high candlestick will be smaller. Next, locate the low candlestick. This candlestick will show you the price at the low point of the trading day. Finally, locate the close candlestick. This candlestick will show you the price at the end of the trading day.

To understand how to read crypto candlestick charts, it is important to understand how to read charts. Candles are used to represent prices because they have a long history of displaying price movements. When you see a candle that has closed above its opening price, this is called an "up candle." When you see a candle that has closed below its opening price, this is called a "down candle." When two candles meet at a point, this is called a "cross."

The benefits of using crypto candlestick charts

Crypto candlestick charts can provide valuable information about the performance of a cryptocurrency over a given period of time. By analyzing the patterns that emerge over time, investors can gain a better understanding of how their chosen asset is performing.

Additionally, candlestick charts can help to identify potential buy and sell points, which can help to ensure that an investment is made in the most opportune moment. By tracking the movement of prices over time, investors can make informed decisions about when to sell or buy assets.

The different types of crypto candlestick charts

There are three types of crypto candlestick charts:

1. Bullish candle

A bullish candle indicates that the price of a cryptocurrency is going up. A bullish candle consists of a long tail and a high close.

2. Bearish candle

A bearish candle indicates that the price of a cryptocurrency is going down. A bearish candle consists of a short tail and a low close.

3. Inverted candle

An inverted candle indicates that the price of a cryptocurrency has gone down but is starting to recover. An inverted candle consists of a long tail and a low close.

The most important things to look for in crypto candlestick charts

In order to make informed decisions about whether or not to buy or sell cryptocurrencies, it is important to familiarize yourself with the different types of candlestick charts that are available.

The most common type of candlestick chart is the chronological one, which displays the price of a cryptocurrency over time.

Another important aspect to look for on a candlestick chart is the opening and closing prices, as these can give you an idea of where the price was at the beginning and end of the trading session.

You should also pay attention to the volume of a cryptocurrency over the course of a day, as this can provide you with insight into how popular it is.

Finally, you should look for indicators on a candlestick chart to get a better understanding of the market conditions at that moment. Some common indicators include the Bollinger Bands, the MACD, and the RSI.

How to use crypto candlestick charts to make better trading decisions

Crypto candlestick charts are a great way to make better trading decisions. By understanding what is happening with the price of a cryptocurrency over time, you can better determine whether or not to buy or sell.

To use crypto candlestick charts, first find the time frame you want to look at. For example, you might want to look at the price of a cryptocurrency over the past week.

Next, find the candlestick chart type that best suits your needs. For example, if you are looking for information about the price of a cryptocurrency over the past day, you would use a candlestick chart.

Finally, use the information on the candlestick chart to make your trading decisions. For example, if the price of a cryptocurrency has been moving up and down, you might want to buy when the price is low and sell when the price is high.

Why crypto candlestick charts are the best way to track cryptocurrency price action

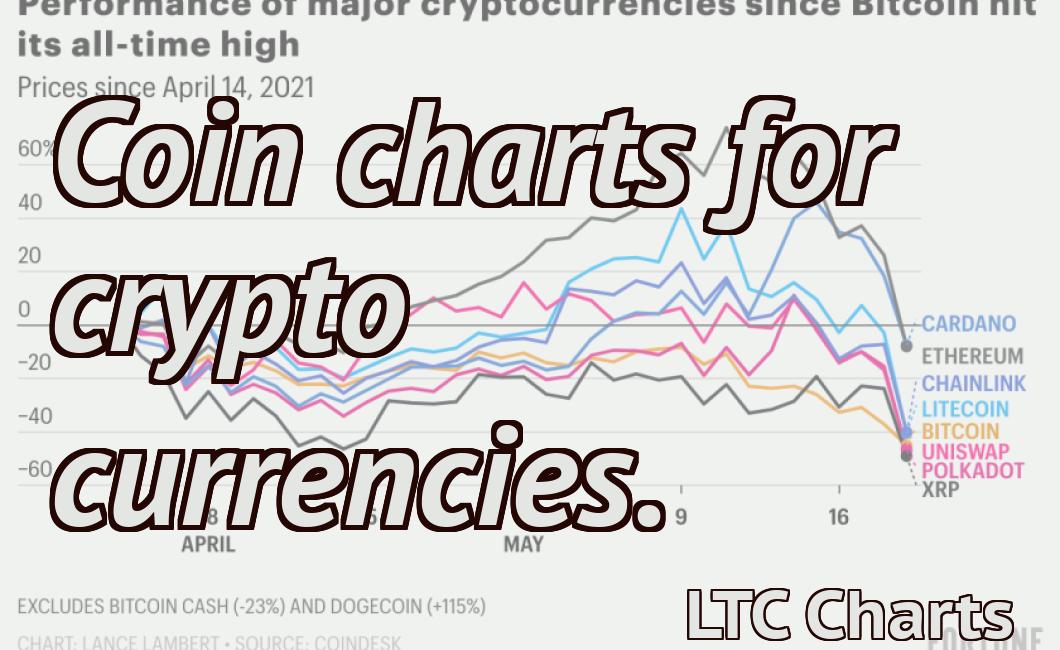

Cryptocurrency candlestick charts are the most efficient way to track the price action of digital tokens. They display the price action of a particular cryptocurrency over time, and make it easy to see the various trends that are happening.

The benefits of using candlestick charts include the following:

They are easy to understand. Candlestick charts are designed to be simple to read, and they are easy to follow.

Candlestick charts are designed to be simple to read, and they are easy to follow. They are interactive. Candlestick charts allow you to zoom in and out, and to move between different timeframes. This makes it easy to track specific market trends.

Candlestick charts allow you to zoom in and out, and to move between different timeframes. This makes it easy to track specific market trends. They are responsive. Candlestick charts are constantly updated, so you can always see the latest market movements.

Candlestick charts are constantly updated, so you can always see the latest market movements. They are efficient. Candlestick charts allow you to see how the prices of different cryptocurrencies are related to each other. This makes it easy to identify trends and make informed investment decisions.

Candlestick charts allow you to see how the prices of different cryptocurrencies are related to each other. This makes it easy to identify trends and make informed investment decisions. They are accurate. Candlestick charts are usually very accurate when it comes to predicting future market movements.

How to use candlestick charts to track cryptocurrency price action

To use candlestick charts to track cryptocurrency price action, you first need to create an account on a cryptocurrency trading platform. Once you have an account, you will need to deposit some of your chosen cryptocurrency into your account. Then, you will need to open a trading account with one of the leading cryptocurrency exchanges. Once you have an account with a cryptocurrency exchange, you will need to deposit your chosen cryptocurrency into your trading account. Next, you will need to open a trading account with one of the leading cryptocurrency exchanges. Once you have an account with a cryptocurrency exchange, you will need to deposit your chosen cryptocurrency into your trading account. Next, you will need to open a trading account with one of the leading cryptocurrency exchanges. Once you have an account with a cryptocurrency exchange, you will need to deposit your chosen cryptocurrency into your trading account. Next, you will need to open a trading account with a cryptocurrency candlestick charting platform. Once you have an account with a cryptocurrency candlestick charting platform, you will need to download the platform’s software. Once you have downloaded the platform’s software, you will need to open a new trading account. Next, you will need to set up your trading account settings. Next, you will need to select the currency pairs that you want to trade. Finally, you will need to select the time frame that you want to trade in. Once you have selected all of your settings, you will be ready to start trading!