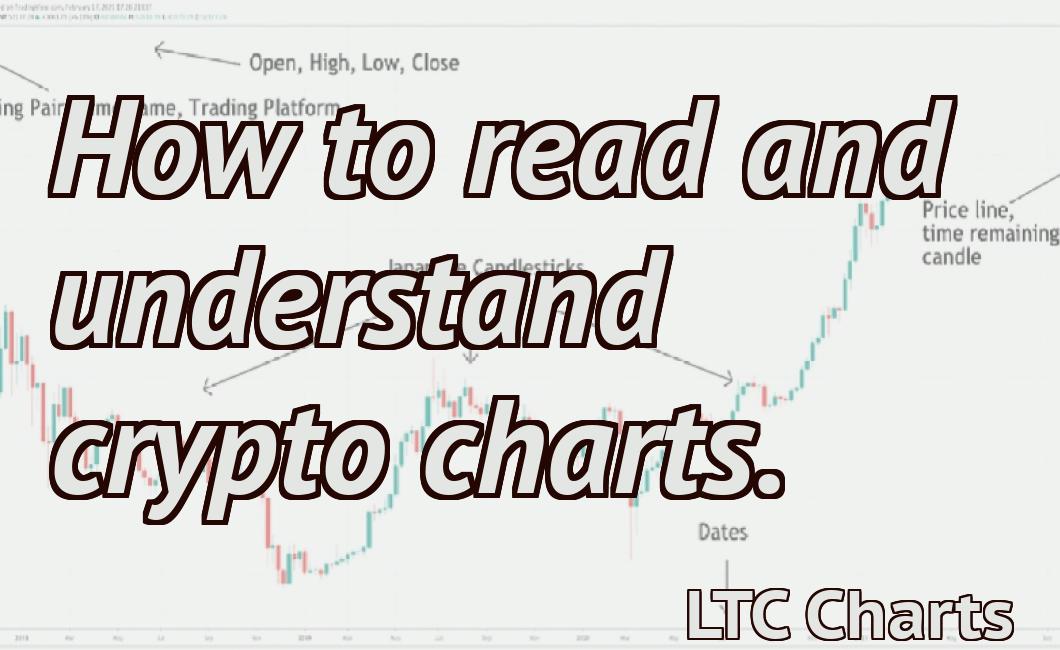

Trading Crypto Charts

If you're serious about trading cryptocurrencies, then you need to be able to read and interpret crypto charts. Charts are an essential tool for technical analysis, which is a method of predicting future price movements by analyzing past price data. There are many different types of charts that can be used to trade cryptos, but the most important thing is to understand how to read them. In this article, we'll take a look at some of the most popular crypto charts and explain how to interpret them.

How to read crypto charts for beginners

Cryptocurrencies are complex and can be difficult to understand. To make it easier for beginners, here is a guide on how to read crypto charts.

1. Look at the price and volume of the coin.

2. Check the trend of the coin.

3. Compare the price of the coin to other coins in the market.

4. Look at the technical indicators to see if the coin is over or undervalued.

The most important crypto chart patterns

Crypto chart patterns are a way for traders to identify recurring patterns in the price of a cryptocurrency. These patterns can provide clues about where the price is headed next.

There are a variety of crypto chart patterns, and each one can provide a different set of clues. Here are the three most important ones:

1. Head-and-shoulders

A head-and-shoulders pattern is a sideways movement that typically lasts for about two months. The price will usually go up and then down again, but it will usually stay within a certain range.

2. Cup and handle

A cup and handle pattern is a sideways movement that typically lasts for about four weeks. The price will go up and then down, but it will usually stay within a certain range.

3. Double top and bottom

A double top or bottom is a pattern that occurs when the price goes up two times and then falls back down. It's usually followed by a new upward trend.

Trading crypto: Technical analysis 101

Technical analysis is a method of forecasting future price movements by studying past price movements. Technical analysts look for patterns in market data that they believe will indicate future price movements.

Technical analysts may use a variety of indicators to help them identify trends. Some common indicators used in technical analysis are moving averages, Bollinger bands, Fibonacci retracements, and volume.

Moving averages are a simple trend-following tool that uses a fixed number of previous prices to calculate a new average. If the current price is above the moving average, the analyst may consider the trend to be positive and predict increased prices ahead. If the current price is below the moving average, the analyst may consider the trend to be negative and predict decreased prices ahead.

Bollinger bands are a type of technical indicator that helps analysts identify potential market tops and bottoms. The bands are created by dividing the market price range into two equal parts and setting a lower band at the lower end of the range and an upper band at the upper end of the range. If the market price crosses the lower band, this is considered a bullish signal; if the market price crosses the upper band, this is considered a bearish signal.

Fibonacci retracements are another type of technical indicator that is used to identify potential market tops and bottoms. Fibonacci retracements are based on the Fibonacci sequence, which starts with 0, 1, 1, 2, 3, 5, 8, 13, etc. The Fibonacci sequence stipulates that every second number in the sequence is the sum of the previous two numbers in the sequence. For example, the Fibonacci retracement for the stock market might be drawn at 38.2% of the original decrease from the peak to the bottom of the market.

The volume of a particular security's trading activity can also be used to help analysts identify potential market trends. High volumes may indicate positive sentiment and increased investor confidence, while low volumes may indicate negative sentiment and decreased investor confidence.

Crypto charts: 3 things you need to know

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services.

How to use charts when trading cryptocurrencies

Cryptocurrencies are traded on decentralized exchanges and can be easily tracked on various charts. There are a variety of charts available, but some of the most popular are the candlestick chart, the bar chart, and the line chart.

Candlestick charts are used to track the price of a cryptocurrency over time. They consist of a series of candlesticks, each representing a specific period of time. The size and color of the candlestick will indicate the price movement over that period.

Bar charts are used to track the amount of cryptocurrency traded over a given period of time. They consist of a series of bars, each representing a different volume. The color of the bar will indicate the type of order that was placed at that moment.

Line charts are used to track the price movement over a period of time. They consist of a series of lines, each representing a different price point. The width of the line will indicate the amount of change between each point in the line.

What do crypto charts tell us?

Cryptocurrencies are based on blockchain technology, which enables secure, transparent and tamper-proof transactions. Cryptocurrencies are often traded on decentralized exchanges, and their prices are determined by supply and demand. Cryptocurrencies are often used as an investment, and their prices can fluctuate rapidly.