Crypto Charts With Moving Averages

This article looks at crypto charts with moving averages to help you spot trends and make better-informed trading decisions.

How to Use Crypto Charts with Moving Averages

Crypto charts are a great way to monitor performance over time and identify trends. You can use moving averages to help identify short-term trends and anticipate future movements.

To use moving averages on a crypto chart:

1. Open the crypto chart in your trading platform of choice.

2. Click on the "Analysis" tab at the top of the page.

3. Click on the "Moving Averages" button.

4. Select the time period you would like to use moving averages for.

5. Click on the "Create Moving Average" button.

6. Enter the average value for the selected time period.

7. Click on the "Update Moving Averages" button.

The Benefits of Using Moving Averages in Crypto Trading

Moving averages are a popular tool in technical analysis. They can be used to identify trends and help you make better trading decisions. Here are five benefits of using moving averages in crypto trading.

1. Moving averages can help you identify trends.

If you use moving averages to monitor your portfolio, they will help you identify trends. You can use them to identify when the price is rising or falling, and to help you determine when the trend is changing.

2. Moving averages can help you predict future prices.

If you use moving averages to make trading decisions, you can use them to predict future prices. By tracking the average price over time, you can get a better idea of where the price is headed. This can help you make informed decisions about when to buy or sell.

3. Moving averages can help you reduce risk.

By using moving averages, you can reduce your risk of losing money on your investments. By knowing how the price has been moving over time, you can avoid making risky investments that could lead to losses.

4. Moving averages can help you improve your trading skills.

If you use moving averages to analyze your portfolio, you will improve your trading skills. By tracking the average price, you will learn how to better identify trends and predict future prices. This will help you make more informed decisions about when to buy or sell.

5. Moving averages can help you stay disciplined in your trading.

If you use moving averages to track your portfolio, you will stay disciplined in your trading. By following the trend, you will avoid making sudden and unplanned changes to your investment strategy. This will help you maintain a consistent approach to trading, and increase your chances of success.

3 Simple Moving Average Strategies for Crypto Trading

The most common way to trade cryptocurrencies is by using a moving average. Moving averages are a technical analysis tool that can be used to identify potential buying and selling opportunities.

There are a few different types of moving averages that can be used for crypto trading:

1. Simple Moving Average (SMA)

A simple moving average is a technical analysis tool that is used to identify potential buying and selling opportunities. The SMA is used to smooth out the volatility of a security over time.

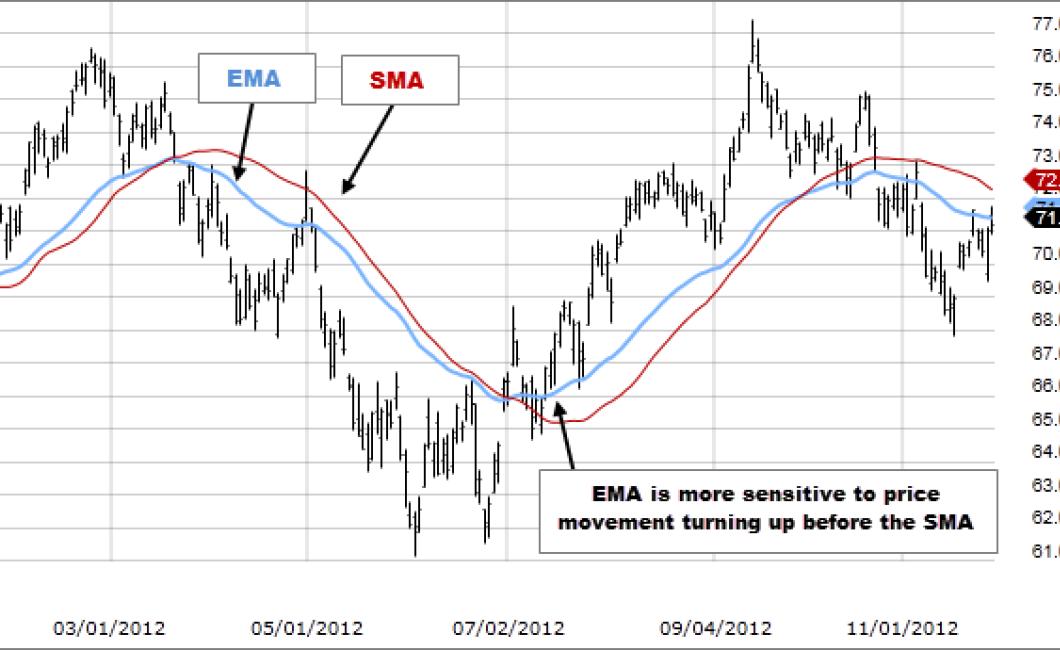

2. Exponential Moving Average (EMA)

An exponential moving average is a technical analysis tool that is used to identify potential buying and selling opportunities. The EMA is used to smooth out the volatility of a security over time.

3. Cross-Section Moving Average (CMA)

A cross-section moving average is a technical analysis tool that is used to identify potential buying and selling opportunities. The CMA is used to take into account the volume and price action of a security over time.

How to Read and Analyze Crypto Charts with Moving Averages

Moving averages are a popular technical analysis tool that can be used to identify price trends and determine when a security is oversold or overbought.

To read a crypto chart using moving averages, first identify the type of moving average you are using. There are three types of moving averages: simple, exponential, and weighted.

After identifying the type of moving average, find the current moving average on the chart. This will be represented by a horizontal line. The next step is to find the original price point at which the moving average was set. This can be found by finding the point where the moving average crosses the original price point.

Now, find the latest price point at which the moving average has crossed the original price point. This will be represented by the bottom of the moving average’s “hockey stick”. The final step is to find the average of this latest price point and the previous (original) price point. This will be the moving average’s current value.

To use moving averages to analyze crypto charts, first find the type of moving average you are using. There are three types of moving averages: simple, exponential, and weighted.

After identifying the type of moving average, find the current moving average on the chart. This will be represented by a horizontal line. The next step is to find the original price point at which the moving average was set. This can be found by finding the point where the moving average crosses the original price point.

Now, find the latest price point at which the moving average has crossed the original price point. This will be represented by the bottom of the moving average’s “hockey stick”. The final step is to find the average of this latest price point and the previous (original) price point. This will be the moving average’s current value.

5 Tips for Using Moving Averages in Crypto Trading

Moving averages are a popular tool used in technical analysis. They are used to identify trends and predict future price movements. Here are five tips for using moving averages in crypto trading:

1. Use a Moving Average to Identify Trends

Moving averages can be used to identify trends in the market. By using a moving average, you can see how the prices have been moving over time and identify potential trends.

2. Use a Moving Average to Predict Future Price Movements

Moving averages can also be used to predict future price movements. By using a moving average, you can see how the prices have been moving over time and determine where the prices are likely to move next.

3. Use a Moving Average to Mitigate Risk

Moving averages can help you mitigate risk in the market. By using a moving average, you can see how the prices have been moving over time and determine where the prices are likely to move next. This can help you avoid making risky investments.

4. Use a Moving Average to Optimize Trading Strategy

Moving averages can also be used to optimize trading strategies. By using a moving average, you can see how the prices have been moving over time and optimize your trading strategy accordingly.

5. Use Moving Averages with Caution

Moving averages should be used with caution. They are not always accurate and can lead to false conclusions about the market.

The Dos and Don'ts of Using Moving Averages in Crypto Trading

The first thing you need to know about moving averages is that they are not a tool for day trading. They are used for long-term trend analysis and should only be used when you have a good understanding of chart patterns and how they work.

The most important thing to remember when using moving averages is that they are not always correct. If the market is moving quickly, the moving average may not be able to keep up and may give you false signals. If you are trying to trade on the basis of moving averages, you need to be prepared to adjust your trading strategy as the market moves.

Here are some tips on how to use moving averages in crypto trading:

1. Use Moving Averages to Find Long-Term Trend

When you are looking for a long-term trend, moving averages can help you find it. By using a moving average, you can smooth out the volatility of the market and see what is actually happening over a longer period of time.

2. Use Moving Averages to Identify Support and Resistance

Moving averages can also help you identify support and resistance levels. When you see a moving average cross a resistance level, that may be a sign that the market is about to move higher. Likewise, if you see the moving average cross a support level, that may be a sign that the market is about to move lower.

3. Use Moving Averages to Detect Trends

If you are looking for trends, moving averages can help you find them. By using a long-term moving average, you can smooth out the volatility of the market and see which direction the market is heading. This can be helpful in spotting trends early on.