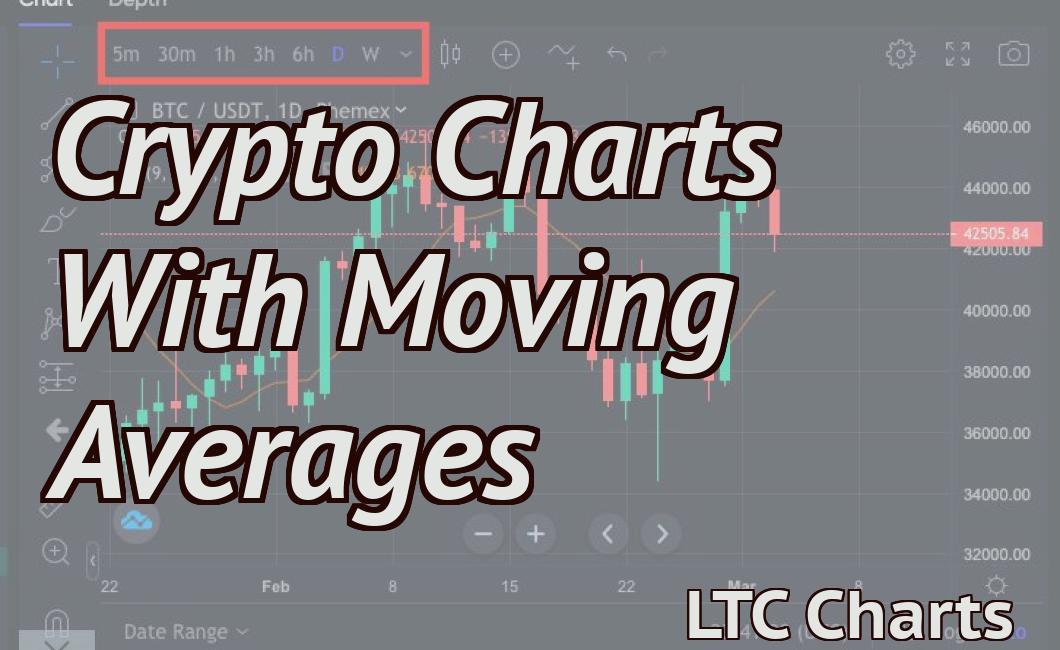

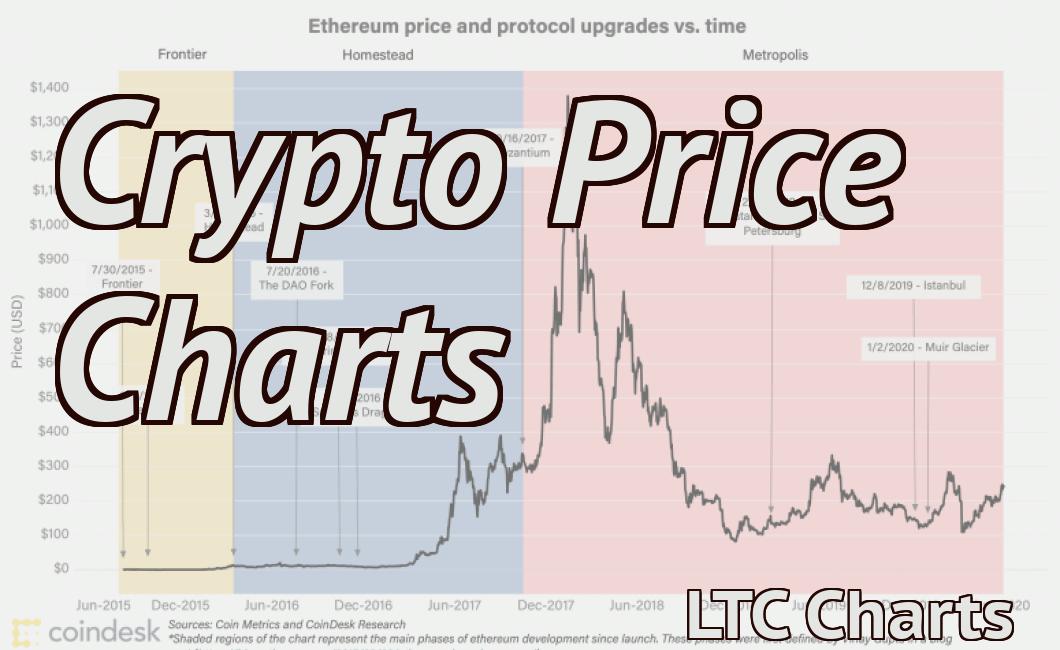

The Robinhood crypto charts are different.

The Robinhood crypto charts are different from other charts because they are based on a 12-hour time frame instead of the more traditional 24-hour time frame. This difference allows for a more accurate portrayal of price action over a shorter period of time.

How to read Robinhood Crypto charts

The Robinhood Crypto charts show the price and volume for a given cryptocurrency over time. Each column of the chart represents a different time period. The leftmost column is for the past day, the middle column is for the past week, and the rightmost column is for the past month.

What do the different colors mean on Robinhood Crypto charts?

The different colors on Robinhood Crypto charts represent the value of a cryptocurrency at different points in time. For example, blue might represent the value of a cryptocurrency at its lowest point, while yellow might represent the value of a cryptocurrency at its highest point.

How to interpret Robinhood Crypto chart patterns

The Robinhood Crypto chart patterns can help you to predict when a crypto asset is about to experience a price increase or decrease.

A bullish pattern indicates that the price of the asset is about to increase, while a bearish pattern indicates that the price of the asset is about to decrease.

The following Robinhood Crypto chart patterns are based on the SMA 20 period simple moving average:

A bullish signal indicates that the price of the asset is about to increase above the 20-period simple moving average, while a bearish signal indicates that the price of the asset is about to decrease below the 20-period simple moving average.

A horizontal line crossing the 20-period simple moving average above or below indicates that the price of the asset is about to experience a price increase or decrease, respectively.

Five must-know chart patterns for Robinhood Crypto traders

1. A bullish engulfing pattern indicates that the price of a security is about to increase significantly.

2. A bearish engulfing pattern signals that the price of a security is about to decrease significantly.

3. The double bottom formation indicates that the price of a security has dropped significantly and is likely to drop again.

4. The head and shoulders pattern is a sign that the price of a security is about to increase significantly.

5. The cup and handle formation indicates that the price of a security is about to decrease significantly.

The three most common mistakes made when reading Robinhood Crypto charts

1. Not understanding the technical indicators

2. Focusing on the wrong metrics

3. Not having a proper trading plan

How to use moving averages to tradeRobinhood Crypto

There is no one-size-fits-all answer to this question, as the best way to use moving averages to trade Robinhood Crypto may vary depending on your individual trading strategy. However, some common tips on how to use moving averages to trade on Robinhood Crypto include using them as a tool to help identify potential trend changes, and using them to help set your trading targets.

What is support and resistance on Robinhood Crypto charts?

A support level is a price point where buyers are more likely to buy than sellers, and a resistance level is a price point where sellers are more likely to sell than buyers.

Trading breakouts on Robinhood Crypto charts

Breaking out on Robinhood Crypto charts can be a useful way to identify potential trades. When a cryptocurrency breaks out above its previous trading range, it is likely that there is strong interest in the asset and that it is time to start buying.

When a cryptocurrency breaks out below its previous trading range, it is likely that there is weak or no interest in the asset and that it is time to start selling.

Using Fibonacci retracements to tradeRobinhood Crypto

Fibonacci retracements are a popular tool for traders to use when analyzing charts. When used correctly, Fibonacci retracements can help identify potential support and resistance levels.

To use Fibonacci retracements on Robinhood Crypto, first open the chart in question. Next, locate the area of the chart where you want to begin your analysis. Next, draw a horizontal line at the midpoint of the area you selected. Finally, draw two vertical lines at the points that the horizontal line intersects with the bottom and top of the area you selected.

Now, using the Fibonacci retracements tool in your trading software, find the point at which the two vertical lines intersect. This will be your Fibonacci retracement level. If the price reaches this level, it may indicate that there is support available for the asset. If the price falls below this level, it may indicate that there is resistance available for the asset.

Put it all together - A step-by-step guide to reading and trading Robinhood Crypto charts

1. Open Robinhood and create an account.

2. Deposit funds into your account.

3. Navigate to the "Cryptocurrencies" section of the app and select a coin to trade.

4. Click on the "Trades" button in the top left corner of the chart and select a trade from the list.

5. Enter the amount of cryptocurrency you want to trade and the price at which you want to sell it.

6. Click on the "Buy" button and wait for the trade to complete.

7. Receive your cryptocurrency in your account and sell it if you wish.

Becoming a master of Robinhood Crypto chart reading

To become a master of Robinhood Crypto chart reading, you'll need to be able to read the charts quickly and understand what's happening. You'll also need to be able to make informed decisions about what to buy and sell.

To improve your chart reading skills, we recommend that you watch our video on how to read Robinhood Crypto charts. In this video, we walk you through the different elements of a crypto chart and how to interpret them.

Once you've watched the video, you'll be able to better understand what's happening on the charts and make more informed decisions about your investments.