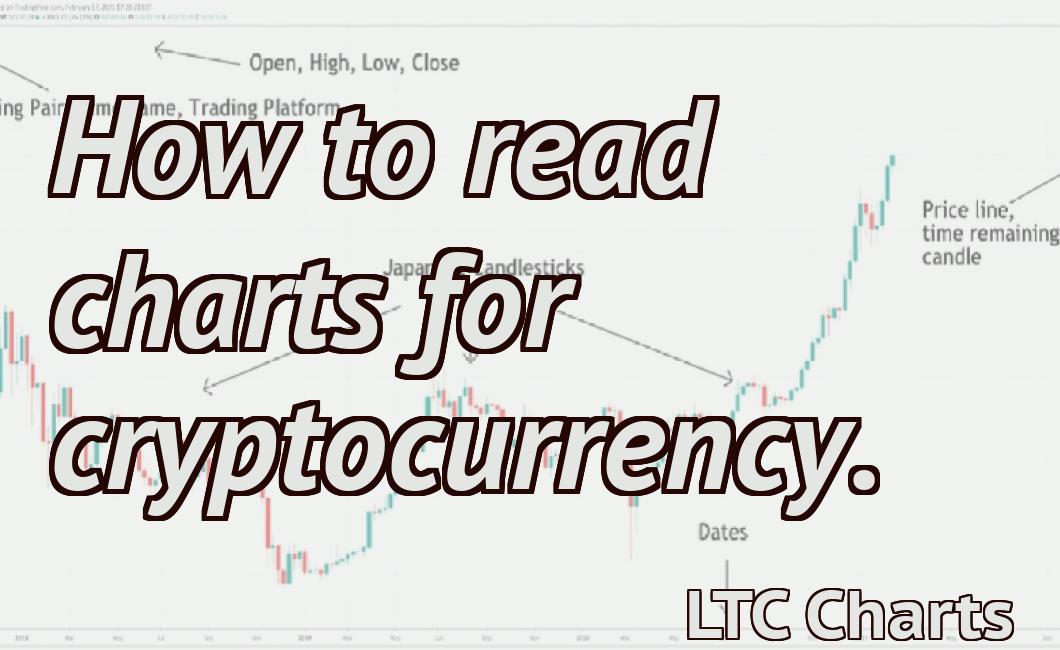

How to read crypto candlestick charts

If you want to get into the cryptocurrency market, you need to know how to read crypto candlestick charts. These charts provide valuable information that can help you make informed investment decisions. Here's a guide on how to read them.

Beginner's Guide to Reading Crypto Candlestick Charts

Candlestick charts are a popular way to visualize cryptocurrency prices. They show the price of a cryptocurrency over time, with each candlestick representing a 24-hour period.

To use candlestick charts, you first need todownload and install a candlestick charting software. Popular candlestick charting programs include Poloniex's CandleStickCharts and TradingView's Candlestick Charts. Once you have the software installed, open it and click on the "candlestick charts" tab.

Next, you'll need to find the cryptocurrency you want to analyze. To do this, select the currency from the list on the left and click on the "buy" or "sell" button next to the price column. This will highlight the corresponding candlestick on the chart.

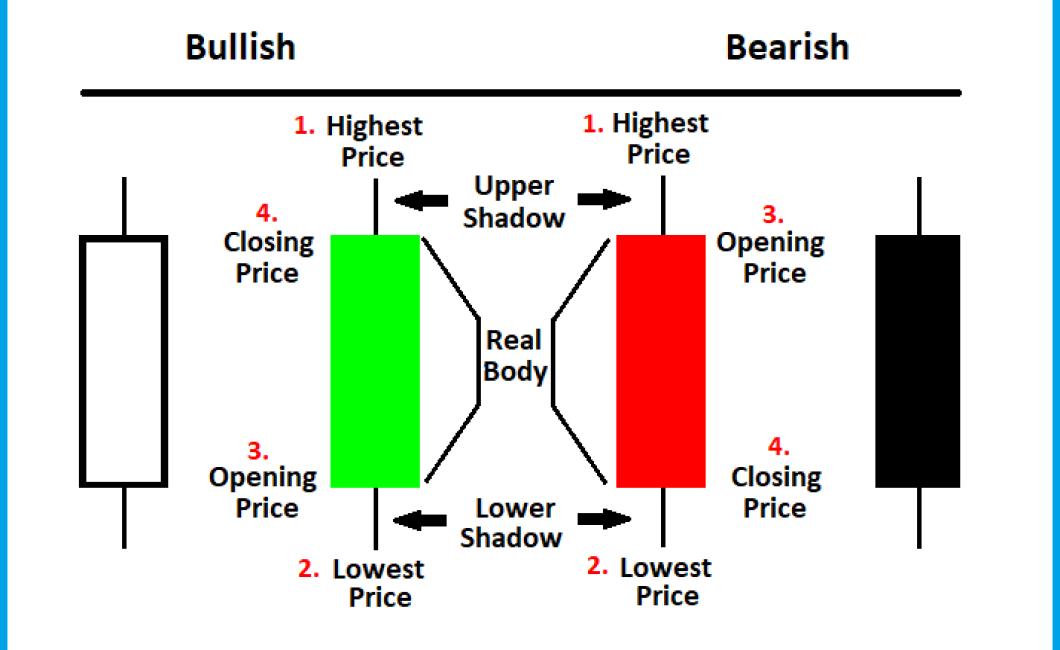

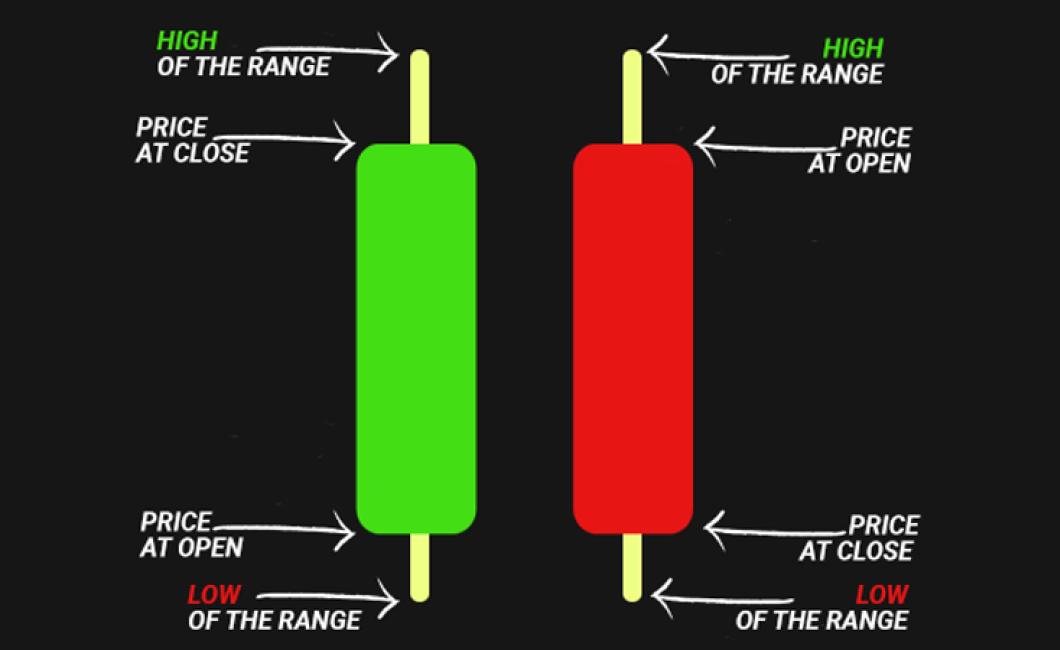

Now, you need to understand how to read candlestick charts. The first thing to look for is the opening and closing prices for the day. These are the prices at which the first and last candlesticks were created, respectively.

Next, look at the height of the candlestick. This indicates how much money was traded at that price point. The higher the candlestick, the more money was traded.

Finally, look at the color of the candle. This indicates the sentiment of the market at that point in time. The colors can be divided into three categories: green, blue, and red. Green candles indicate buying pressure, blue candles indicate selling pressure, and red candles indicate panic buying or selling.

How to Read Crypto Candlestick Charts Like a Pro

Reading crypto candlestick charts is an essential skill for anyone who wants to become a successful cryptocurrency trader. Crypto candlestick charts provide a visual representation of price movement over time and can help you identify patterns and trends.

To read a crypto candlestick chart, first identify the type of chart. There are three types of crypto candlestick charts:

1) Hourly Candlestick Chart

2) Daily Candlestick Chart

3) Weekly Candlestick Chart

Then, focus on the time period being displayed. For example, the daily chart displays prices for one day at a time. The weekly chart displays prices for seven days at a time. Finally, look for the candlestick indicators.

The three candlestick indicators are the open, high, low, and close. The open candlestick shows the price at the opening of the trading session. The high candlestick shows the highest price during the session, and the low candlestick shows the lowest price during the session. The close candlestick shows the price at the closing of the trading session.

To interpret a crypto candlestick chart, first look for patterns. Patterns can include peaks and valleys, bull and bear markets, and support and resistance levels. Once you have identified a pattern, study the accompanying chart to see how the pattern is affecting prices.

Finally, use your experience and intuition to make trading decisions.

3 Simple Steps to Reading Crypto Candlestick Charts

1. Open a crypto candlestick chart on your favorite cryptocurrency exchange and locate the currency pair you're interested in.

2. Click on the " candles " tab located at the top of the chart.

3. From the candle chart, select the date range you would like to view.

4. Right click on the candle you would like to view more details about and select " Get Info ".

5. In the " Info " window, you will find important information such as the candle's volume, open, high, low, and close prices as well as the percentage gain or loss for that candle.

The Basics of Reading Crypto Candlestick Charts

Candlestick charts are a widely used tool to monitor the performance of a cryptocurrency over time. They show the price of a cryptocurrency at specific points in time, and can be used to identify trends.

A candlestick chart is made up of a series of bars, each representing a specific day. The bars are usually spaced at one-minute intervals, and the width of the bars corresponds to the amount of change in the price of the cryptocurrency over that period.

The colors of the candlesticks represent different types of data. The top (green) candlestick is for the price of the cryptocurrency, the middle (yellow) candlestick is for the volume of trades, and the bottom (red) candlestick is for the market capitalization.

To use a candlestick chart, you first need to find the specific cryptocurrency you want to track. You can do this by entering its symbol into the search bar on CoinMarketCap.com, or by using the ticker symbol that appears on most news sources.

Once you have found the cryptocurrency, you can open its chart on CoinMarketCap.com. The first thing you will need to do is find the date range you want to study. To do this, click on the "Time Frame" button at the top of the chart.

Next, you will need to find the price bars for the cryptocurrency you want to study. To do this, click on the "Price" button next to each bar. This will display a list of all the price points for that day.

To analyze a candlestick chart, you first need to understand what it is telling you. The main thing to look for is the direction of the trend. This can be found by looking at the shape of the candlestick and the color of the candle.

If the candle is green, this means that the price of the cryptocurrency went up over that period. If the candle is red, this means that the price of the cryptocurrency went down over that period.

If the candle is yellow, this means that there was a moderate amount of change in price over that period. If the candle is blue, this means that there was a large amount of change in price over that period.

If you want to know how much money was spent on the cryptocurrency during that period, you can look at the volume bar. If you want to know how much money was brought in by the cryptocurrency during that period, you can look at the market capitalization bar.

How to Understand Crypto Candlestick Charts

Crypto candlestick charts are often used to visualize trends in cryptocurrency prices. The candlestick chart is a graphical representation of price action over time. It consists of a series of rectangles, each representing a 24-hour period.

The height of the rectangle corresponds to the price of the asset at that point in time. The width of the rectangle corresponds to the volume of trade that took place during that period. The color of the rectangle indicates the direction of the trend: red for up, green for down, and blue for sideways.

The most important thing to remember when interpreting crypto candlestick charts is to keep an eye on the direction of the trend. If the trend is up, look for candlesticks that are red or green. If the trend is down, look for candlesticks that are blue or black.

A Simple Guide to Interpreting Crypto Candlestick Charts

Crypto candlestick charts are a popular way to analyze cryptocurrency markets. They provide a visual representation of the market’s current state, and can help you identify trends and patterns.

To use a crypto candlestick chart, first identify the price bars that you want to analyze. You can do this by either visually identifying the bars, or by using a built-in order book indicator.

Next, identify the candlestick type that best represents the market’s current state. There are four main candlestick types:

Bullish: The candle is filled with color, which indicates that the price is rising.

The candle is filled with color, which indicates that the price is rising. Bearish: The candle is filled with color, which indicates that the price is falling.

The candle is filled with color, which indicates that the price is falling. Intermediate: The candle does not have a clear color, which indicates that the price is somewhere in between the two extremes.

The candle does not have a clear color, which indicates that the price is somewhere in between the two extremes. Open: The candle is not filled with color, which indicates that the market is open.

Once you have identified the type of candlestick, you can use it to identify the current market state. For example, a bullish candlestick would indicate that the market is currently in a bull market, while a bearish candlestick would indicate that the market is in a bear market.

How to Effectively Use Crypto Candlestick Charts

Crypto candlestick charts offer a more detailed look at the price movement of a digital asset over time. They are used to identify patterns and trends in price action, and can provide valuable insights into how a digital asset is performing.

To use crypto candlestick charts, first open a charting platform of your choice. Then, click on the "candlesticks" tab.

To create a crypto candlestick chart, first select the timeframe for which you wish to examine price action. For example, you can select 30, 60, or 120 minutes.

Next, select the asset you wish to view price action for.

Finally, choose the type of candlestick you would like to create. There are three types of candlesticks available: open, high, and low. You can also create a combination of these types of candlesticks.

To create a crypto candlestick chart, first select the timeframe for which you wish to examine price action. For example, you can select 30, 60, or 120 minutes.

Next, select the asset you wish to view price action for.

Finally, choose the type of candlestick you would like to create. There are three types of candlesticks available: open, high, and low. You can also create a combination of these types of candlesticks.

The Do's and Don'ts of Reading Crypto Candlestick Charts

There are a few key things to keep in mind when reading crypto candlestick charts:

1. Don't try to read too much into the chart at one time.

2. Always take a look at the previous and next candlesticks to get a sense of how the market is moving.

3. Try to keep an eye on the volume and price action to get a sense of how active the market is.

4. Be aware of potential market trends and be prepared to adjust your trading strategy accordingly.

10 Tips for Reading Crypto Candlestick Charts

1. Look for the patterns.

Crypto candlestick charts are a great way to see how the market is performing over time. By looking for patterns, you can quickly identify whether the market is trending up or down.

2. Compare the prices of similar cryptocurrencies.

When looking at crypto candlestick charts, it's important to compare the prices of similar cryptocurrencies. This will help you understand how the market is performing and which cryptocurrencies are performing the best.

3. Watch for buy and sell signals.

Watch for buy and sell signals on crypto candlestick charts. When these signals are triggered, it often indicates that the market is about to experience a significant change.

4. Keep an eye on the volume of the market.

Keep an eye on the volume of the market when looking at crypto candlestick charts. This will help you understand how active the market is and which cryptocurrencies are experiencing the most demand.

5. Compare the dates of the candlestick charts.

When comparing crypto candlestick charts, it's important to pay attention to the dates on the charts. This will help you understand how the market has been performing over time.

What You Need to Know About Reading Crypto Candlestick Charts

Crypto candlestick charts are a popular way for traders and investors to follow the latest movements in cryptocurrency prices.

Candlestick charts are a visual representation of price movements over time. They consist of a series of candlesticks, each representing a different period of time.

Each candlestick is represented by a particular color, and the height of the candlestick indicates the value of the cryptocurrency at that particular moment.

The following is a brief guide on how to read crypto candlestick charts:

1. Look for the open, high, and low prices for each period of time.

2. Compare the open, high, and low prices for each period of time to see whether the cryptocurrency price has increased, decreased, or remained the same.

3. If the cryptocurrency price has increased or decreased, look for clues in the color and height of the candlesticks to determine the direction of the trend.

How to Get the Most Out of Reading Crypto Candlestick Charts

Candlestick charts are a great way to see how the market is performing over time. By understanding how candlestick charts work, you can get the most out of them and increase your trading ability.

When looking at a candlestick chart, you first need to understand the four types of candles. These are open, high, low, and close.

Each candle represents a point in time where the market was performing. The size of the candle tells you how much volume was traded at that point.

The next thing you need to understand is the moving averages. Moving averages help you identify trends and help you predict future prices.

Finally, you need to understand the indicators. Indicators help you make better decisions when trading and can provide you with valuable information about the market.