Rsi Charts Crypto

The article discusses the use of RSi charts in cryptocurrency trading. It explains how to interpret the data on the chart and how to use it to make trading decisions.

How to Use RSI Charts to Trade Cryptocurrency

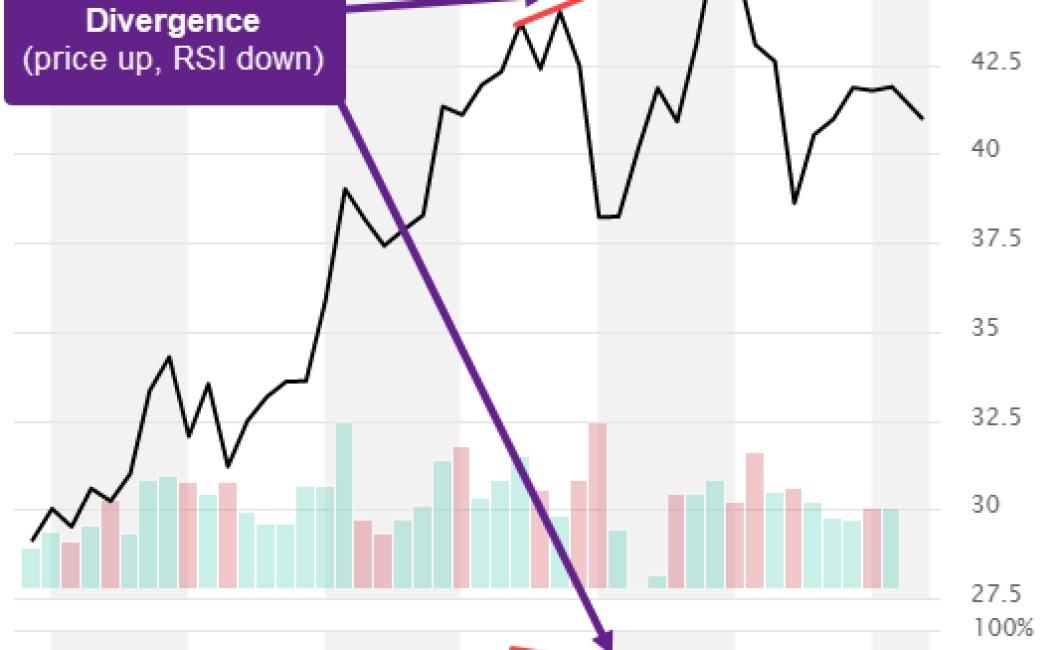

RSI (Relative Strength Index) charts are a popular way to trade cryptocurrency. RSI is a technical indicator that is used to identify oversold and overbought conditions in the market.

To use RSI charts, first find the appropriate time frame for your charts. For example, if you are trading bitcoin, you would use daily RSI charts.

Then, place a buy or sell order based on the RSI value that you believe is appropriate. For example, if the RSI value is over 80, you would place a buy order. If the RSI value is below 20, you would place a sell order.

Remember to watch the RSI value closely so that you can react quickly to changes in the market.

Trading Cryptocurrency with RSI Charts

There are a few different ways to trade cryptocurrency with RSI charts. You can use technical analysis to try and find in which direction the price is likely to move, or you can use market conditions to help guide your trading decisions.

1. Use Technical Analysis to Interpret RSI Charts

Technical analysis is a popular way to trade cryptocurrency using RSI charts. You can look at the RSI to see if the price is overbought or oversold, and then make trading decisions based on that information.

If the RSI is overbought, you might want to buy the cryptocurrency to help it increase in value. If the RSI is oversold, you might want to sell the cryptocurrency to help it decrease in value.

2. Use Market Conditions to Guide Your Trading Decisions

Market conditions can also help you guide your trading decisions when using RSI charts. You can look at the RSI to see if the price is nearing a specific level, and then make trading decisions based on that information.

If the RSI is near its maximum value, you might want to buy the cryptocurrency. If the RSI is near its minimum value, you might want to sell the cryptocurrency.

The Benefits of Using RSI Charts for Cryptocurrency Trading

RSI is a technical indicator used to measure the overbought and oversold positions in a security or commodity. When a security is overbought, it means that there is too much buying pressure and when a security is oversold, it means that there is too much selling pressure.

When used in conjunction with other technical indicators, RSI can help identify potential entry and exit points for a trade. By identifying overbought and oversold conditions, traders can better adjust their trading strategies in order to take advantage of price movements.

Additionally, RSI can be used to identify trends in the market. When used in conjunction with other indicators, RSI can help identify whether the market is heading in one direction or another.

How to Read an RSI Chart for Cryptocurrency Trading

The RSI indicator is useful in identifying oversold and overbought conditions in a market.

The RSI is plotted on a chart and shows the relative strength of a particular currency against the rest of the market.

When the RSI is above 50, it suggests that the currency is overbought and could fall in price.

When the RSI is below 30, it suggests that the currency is oversold and could rise in price.

What do RSI Charts Tell Us about Cryptocurrency Trading?

RSI charts are frequently used to assess the health of a cryptocurrency market. The Relative Strength Index (RSI) is a popular technical indicator that uses a 14-day moving average to detect overbought and oversold levels. When the RSI is above 70, it is considered to be in an overbought condition, and when the RSI is below 30, it is considered to be in an oversold condition.

RSI Charts: A Tool for Cryptocurrency Traders

The RSI ( Relative Strength Index ) is a tool used by cryptocurrency traders to determine if a cryptocurrency is oversold or overbought.

When the RSI is below 50 it is considered oversold, and when the RSI is above 70 it is considered overbought.

As a general rule, when the RSI is oversold, the price of the cryptocurrency will trend downwards, and when the RSI is overbought, the price of the cryptocurrency will trend upwards.

How to Use RSI Indicators in Cryptocurrency Trading

There are a few different ways to use RSI indicators in cryptocurrency trading.

RSI can be used as a general indicator of the health of a cryptocurrency market. When the RSI is overbought or oversold, this often indicates that the market is in a state of excessive speculation or irrationality, and may be an indication to sell or avoid the market.

RSI can also be used to identify oversold or overbought positions. When the RSI is low, this may indicate that the market is oversold and offers an opportunity to buy in at a lower price. Conversely, when the RSI is high, this may indicate that the market is overbought and offers an opportunity to sell at a higher price.

RSI can also be used to identify support and resistance levels. When the RSI crosses a support level, this may indicate that the market is strong enough to hold the position, and suggests that the buyer may be more likely to prevail. Conversely, when the RSI crosses a resistance level, this may indicate that the market is strong enough to resist the position, and suggests that the seller may be more likely to prevail.

Using RSI Analysis to Trade Cryptocurrencies

RSI is a technical indicator used to identify oversold and overbought conditions in securities markets. The RSI oscillates between 0 and 100 and can be used to identify changes in demand and supply for a security.

When the RSI is below the 30-day moving average, this indicates that the market is oversold and may be ready for a rally. When the RSI is above the 30-day moving average, this indicates that the market is overbought and may be ready for a correction.

To use RSI analysis to trade cryptocurrencies, you would first need to find the RSI of the cryptocurrency you are interested in trading. You can do this by accessing any cryptocurrency exchange and looking at the chart for that specific currency. The RSI will be located near the bottom of the chart.

Once you have found the RSI for your specific cryptocurrency, you can use it to help determine when the market is oversold or overbought. When the RSI is below the 30-day moving average, this indicates that the market is oversold and may be ready for a rally. When the RSI is above the 30-day moving average, this indicates that the market is overbought and may be ready for a correction.