How to read and understand crypto charts.

This article provides a basic guide on how to read and understand cryptocurrency charts. It covers the different types of charts and indicators, and explains how to use them to make informed trading decisions.

How to read and understand crypto charts

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are unique in that they are decentralized, meaning they are not subject to government or financial institution control.

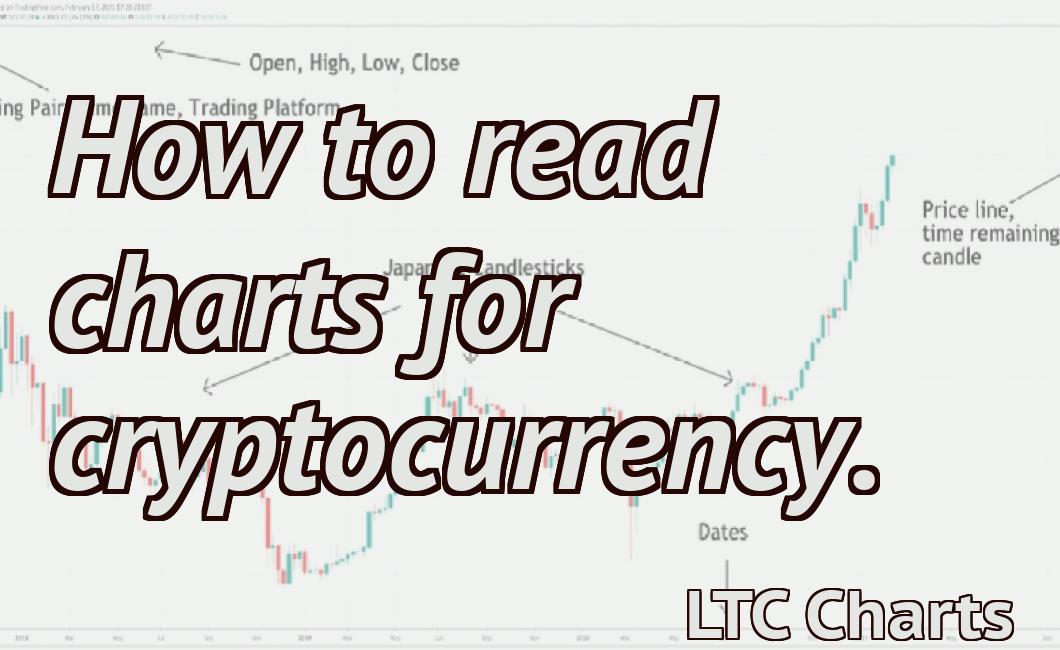

Cryptocurrency prices are displayed on various exchanges and can be accessed through various online tools. Cryptocurrency charts show the price of a cryptocurrency over time and can be used to track price movements, assess market sentiment, and predict future trends.

To read and understand a cryptocurrency chart, first identify the currency of interest. Next, look for the price data on the chart. This data will show you how much value the cryptocurrency has gained or lost over a given period of time. Finally, look for any indicators or patterns that may suggest future price movements.

The basics of reading crypto charts

Cryptocurrencies are often traded on exchanges, and their prices are displayed on charts. Crypto charts can be used to identify trends, spot price bubbles, and predict future prices.

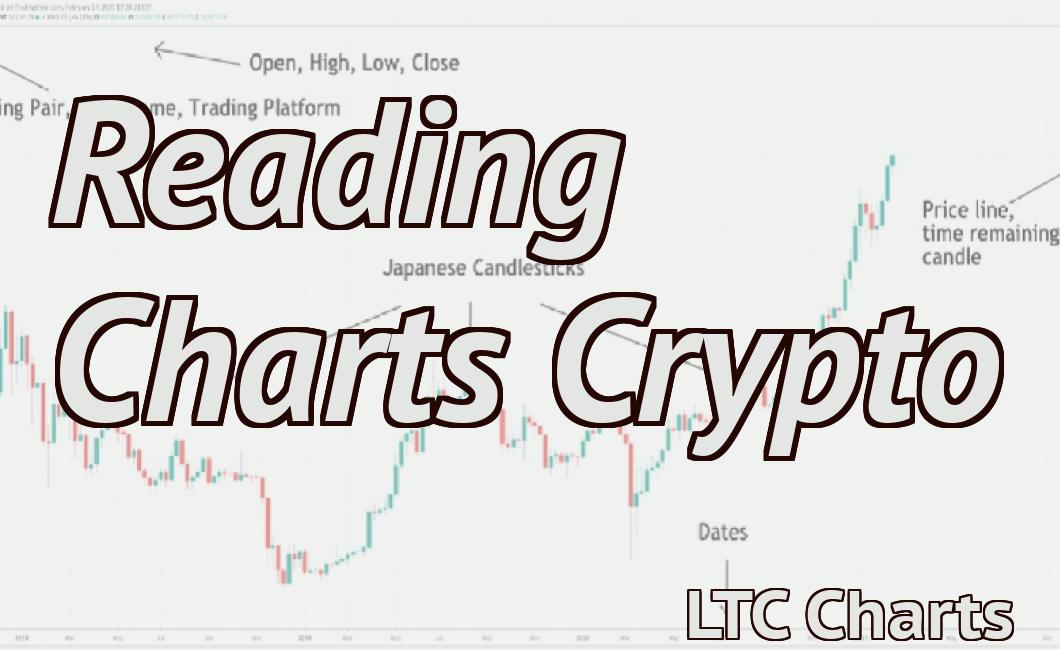

Cryptocurrency charts are usually divided into two types: technical analysis and fundamental analysis. Technical analysis focuses on the price movements of a cryptocurrency, while fundamental analysis looks at the underlying factors that influence prices.

Technical analysis

Technical analysis is the study of how prices move on a chart. Technical analysts look for patterns in price movements and use that information to predict future prices.

Cryptocurrencies are often traded on exchanges, and their prices are displayed on charts. Crypto charts can be used to identify trends, spot price bubbles, and predict future prices.

Crypto charts are usually divided into two types: technical analysis and fundamental analysis. Technical analysis focuses on the price movements of a cryptocurrency, while fundamental analysis looks at the underlying factors that influence prices.

Technical analysis is the study of how prices move on a chart. Technical analysts look for patterns in price movements and use that information to predict future prices.

Technical analysts look for clues in the price movements of a cryptocurrency to predict future prices. They look for patterns such as support and resistance levels, Fibonacci retracements, and trendlines.

If a cryptocurrency is in a strong uptrend, technical analysts may sell their holdings before the trend breaks down. They may also buy cryptocurrencies when the price is below their entry point to take advantage of the uptrend.

If a cryptocurrency is in a downtrend, technical analysts may buy cryptocurrencies when the price is below their entry point to take advantage of the downtrend. They may also sell their holdings when the trend breaks down.

Fundamental analysis

Fundamental analysis investigates the factors that influence a cryptocurrency’s price. These factors may include the supply and demand for the cryptocurrency, its technology, and the community behind it.

Cryptocurrencies are often bought and sold on exchanges based on their price movements. Fundamental analysts try to understand why these price movements happen and what they mean for the future of the cryptocurrency.

They may look at a cryptocurrency’s technical indicators, such as its volume and market cap, to see if there is evidence of an increase or decrease in demand for the cryptocurrency. They may also look at a cryptocurrency’s social media activity to see if there is a large community behind it.

How to interpret crypto charts

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services.

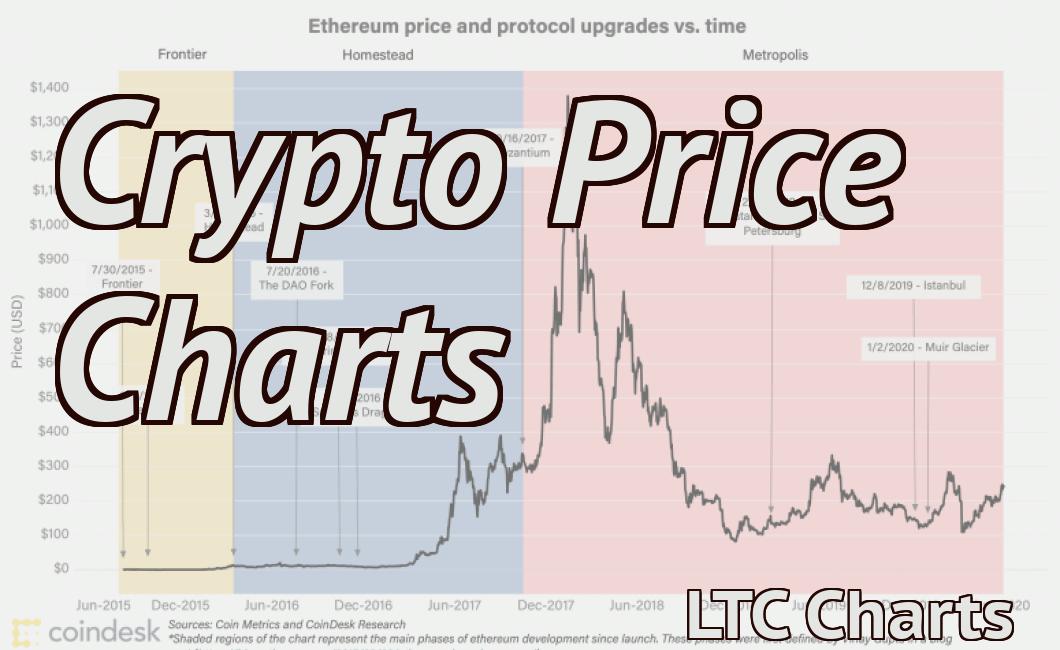

Cryptocurrencies are often associated with digital assets, such as Bitcoin, Ethereum, and Litecoin. Crypto charts show the price of cryptocurrencies over time. Crypto charts can show the price of a cryptocurrency over a period of days, weeks, or months. Crypto charts can also show the price of a cryptocurrency over a period of years.

How to make sense of crypto charts

Crypto charts can be difficult to understand and make sense of. While they might seem complex at first, once you learn how to read them, you can start to see patterns that help you make informed decisions about which coins to invest in.

When looking at crypto charts, the most important thing to remember is that they are a visual representation of price movements. As such, they are not always accurate or indicative of future performance. Instead, they are a tool for investors to use to get an idea of how a certain coin is performing over time.

Crypto charts typically display three main elements: the price of a coin, the volume of that coin's trading activity, and the 24-hour volatility of that coin's price.

The price of a coin on a crypto chart will generally move up or down in tandem with the price of that coin on exchanges where it is traded. The volume of a coin's trading activity on a crypto chart will generally be inversely proportional to the price of that coin on exchanges where it is traded. And the 24-hour volatility of a coin's price on a crypto chart will generally be higher than the 24-hour volatility of the price of that coin on exchanges where it is not traded.

While these three elements are important, it is also important to keep in mind that they are not always accurate indicators of future performance. For example, the volume of a coin's trading activity on a crypto chart might be high even though the price of that coin is low. And the 24-hour volatility of a coin's price on a crypto chart might be high even though the price of that coin is stable.

It is also important to remember that crypto charts are updated continuously, so they might not reflect the latest changes in a coin's price. For example, if a new update is released for a coin's blockchain, the price of that coin on exchanges where it is traded might change even though the volume of that coin's trading activity and the 24-hour volatility of that coin's price on crypto charts might not change.

How to use crypto charts to your advantage

Crypto charts can be used to make informed investment decisions. When looking at crypto charts, it is important to keep in mind the following:

1. Technical indicators

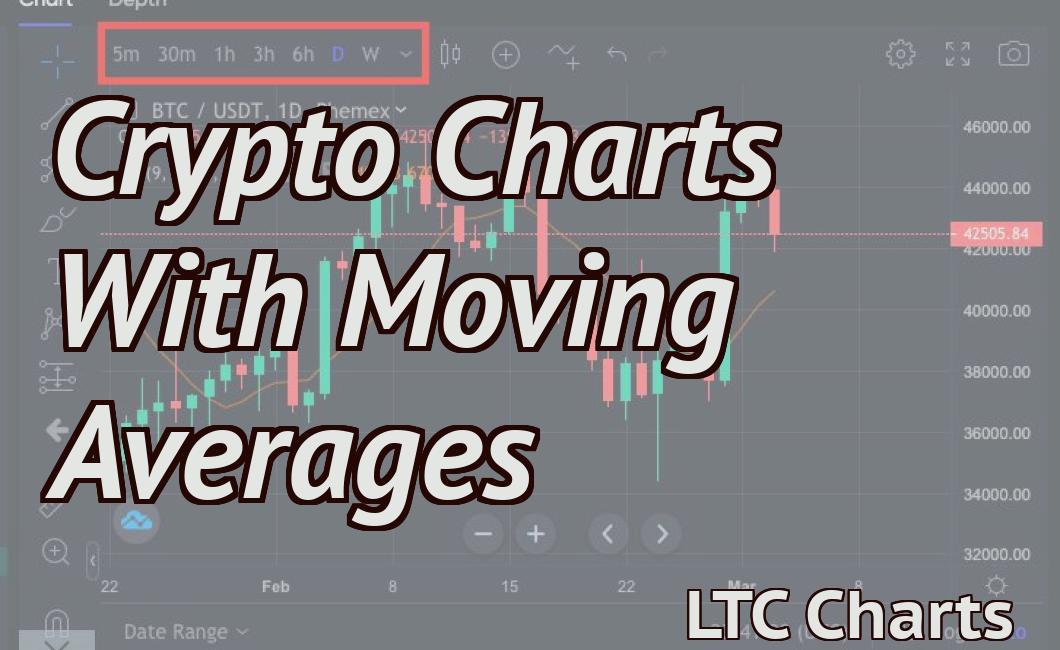

When examining a crypto chart, it is important to look at technical indicators such as the price of the asset, volume, and RSI. These indicators can help you determine if the market is headed in a positive or negative direction.

2. Supply and demand

It is also important to look at supply and demand to determine if there is a potential for a price increase or decrease. When the supply of an asset is low and demand is high, the price of the asset will tend to go up. Conversely, when the supply of an asset is high and demand is low, the price of the asset will tend to go down.

3. Political factors

Political factors can also affect the price of a cryptocurrency. For example, if a governmental body declares a cryptocurrency to be illegal, the price of the cryptocurrency could decrease.

How to get the most out of crypto charts

Crypto charts offer a way to track the movement of digital currencies over time. They can be a helpful tool for investors and traders, as they can help monitor the performance of various cryptocurrencies.

When using crypto charts, it is important to keep in mind the following tips:

1. Draw your own conclusions. Crypto charts are not a prediction tool and should not be used to make investment decisions.

2. Do your own research. Before making any investment decisions, be sure to do your own research. Cryptocurrencies are complex and volatile, and individual results may vary.

3. Only invest what you can afford to lose. Don't invest more money than you can afford to lose. Always remember that cryptocurrencies are highly volatile and can quickly lose value.

How to take your crypto chart knowledge to the next level

Cryptocurrency charts are a great way to stay up-to-date on the latest market movements. However, if you want to take your chart knowledge to the next level, you should become familiar with a few more tools and techniques.

One such tool is a trading platform. Trading platforms allow you to trade cryptocurrencies and other digital assets directly with other users. This can give you a greater understanding of the market and help you make better investment decisions.

Another tool that can help you understand the crypto market is a technical analysis tool. Technical analysis is the use of charts and indicators to identify price trends and forecast future movements. By using technical analysis, you can better understand how the market is performing and make informed investment decisions.

If you want to take your crypto chart knowledge to the next level, be sure to learn about these tools and techniques.

How to become a pro at reading crypto charts

There is no one-size-fits-all answer to this question, as the best way to become a pro at reading crypto charts varies depending on your experience and skill level. However, some tips to help you improve your skills include:

1. Pay attention to technical indicators

One of the most important skills you can develop when reading crypto charts is paying close attention to technical indicators. These indicators help you identify changes in the price of a cryptocurrency and can help you make informed investment decisions.

2. Understand market sentiment

Another key skill you need to become a pro at reading crypto charts is understanding market sentiment. This includes understanding whether investors are bullish or bearish on a particular coin, and gauging the level of excitement or fear that is currently surrounding it.

3. Use a charting tool

If you want to become a pro at reading crypto charts, it is recommended that you use a charting tool to help you visualize the data. This will help you make more informed investment decisions and track your progress over time.

How to master the art of reading crypto charts

If you want to be a successful crypto trader, you need to be able to read crypto charts like a pro. Here are some tips on how to do that:

1. Understand the basics

Before you can start reading crypto charts, you first need to understand the basics. This includes understanding what a crypto chart is, how it works, and what factors influence it.

2. Focus on the trend

When you're looking at a crypto chart, the most important thing to focus on is the trend. This means understanding which direction the price is heading in, and whether or not it's showing any signs of reversing.

3. Use technical indicators

If you want to improve your trading skills, you need to use technical indicators. These are graphs that show you how the market is behaving, and can help you make informed decisions about your trading strategy.

4. Pay attention to news events

Whenever there are news events that could affect the price of cryptocurrencies, pay attention to them. This includes things like regulatory changes, announcements from major players in the space, and anything that might impact sentiment.

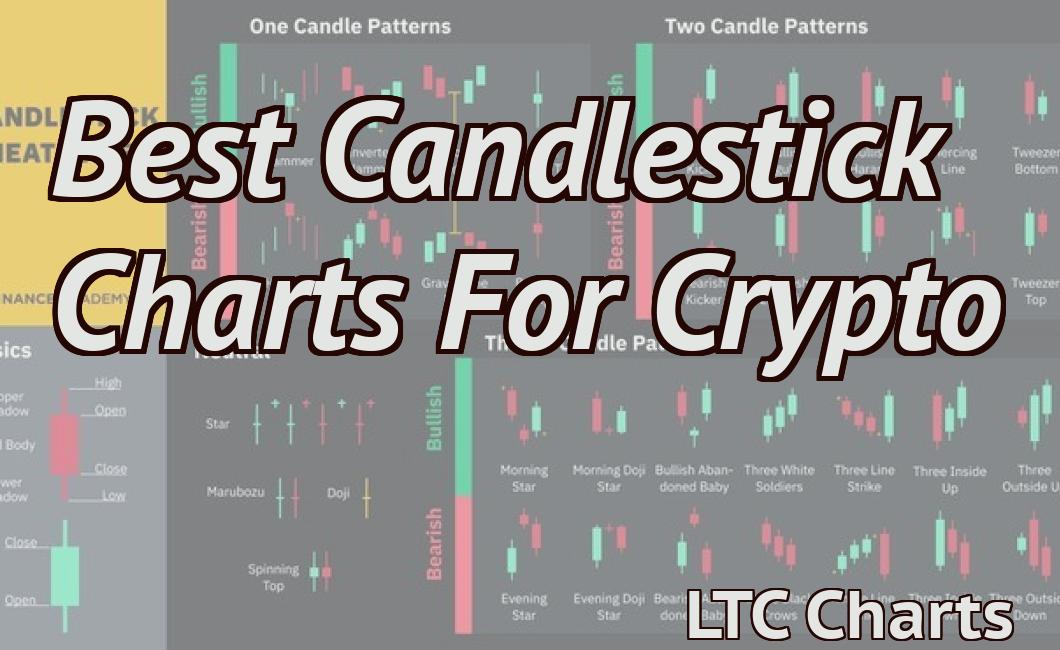

5. Use candlesticks

Candlesticks are another important tool for traders. They're used to visualise price movements over time, and can help you make more informed decisions about your trading strategy.