Token Charts Crypto

Token Charts is a website that provides users with information on various cryptocurrencies. The site offers charts and graphs for each currency, as well as a description of the currency and its purpose.

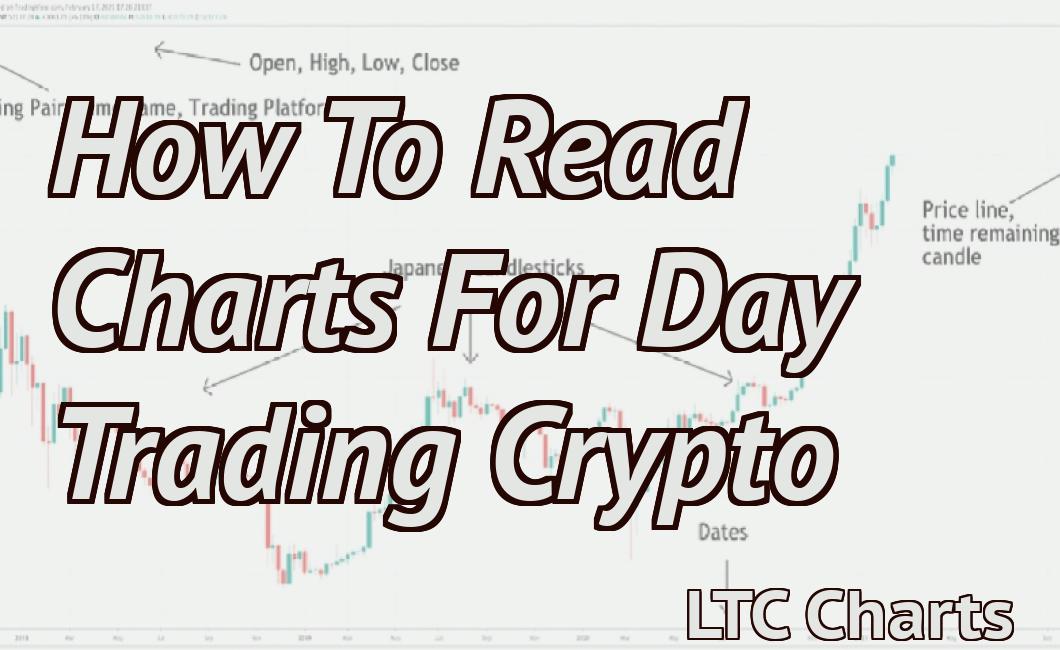

How to read token charts and identify trends in the crypto market

To read token charts and identify trends in the crypto market, it is important to understand what a token is. A token is a digital asset that represents an ownership stake in a particular project or company.

Token charts typically display the price of a token over time, and can also show the total number of tokens issued, the percentage of total supply held by the token’s developers, and the volume of trades conducted in the token.

Token trends can be identified by looking for patterns in the price and supply data. For example, if the price of a token is rising steadily, this may indicate that the demand for the token is growing, and that the developers behind the project are doing a good job of managing the supply of the token.

Similarly, if the price of a token is falling steadily, this may indicate that there is a lack of demand for the token, and that the developers behind the project may not be able to adequately manage the supply of the token.

Token charts can also be used to predict future trends in the crypto market. For example, if the price of a token is falling steadily, this may indicate that the market is bearish, and that the token may not be worth investing in.

3 important things to look for when analyzing token charts

There are a few things to look for when analyzing token charts. The first thing to look for is the total supply of a token. A high total supply can mean that the token is overvalued, and a low total supply can mean that the token is undervalued.

Another thing to look for is the circulating supply of a token. A high circulating supply can mean that the token is overvalued, and a low circulating supply can mean that the token is undervalued.

The third thing to look for is the market cap of a token. A high market cap can mean that the token is overvalued, and a low market cap can mean that the token is undervalued.

Tips for beginners: reading and understanding crypto token charts

1. First and foremost, always do your own research before investing in any type of cryptocurrency. There are a lot of scammy ICOs out there, and it’s important to do your due diligence before putting any money into a project.

2. Once you’ve done your research, it’s important to understand how to read a crypto token chart. A token chart will show you the price history of a cryptocurrency, as well as the current market value.

3. It’s also important to know how to use a trading platform like CoinMarketCap. This website will give you an overview of the current market value of all the different types of cryptocurrencies.

The difference between token charts and other types of cryptocurrency charts

There are many different types of cryptocurrency charts, each with its own strengths and weaknesses.

One of the most common types of cryptocurrency charts is the token chart. Token charts show the price of a cryptocurrency over time, typically on a monthly or weekly basis.

Token charts are useful for understanding the performance of a cryptocurrency over time, as well as for predicting future price movements.

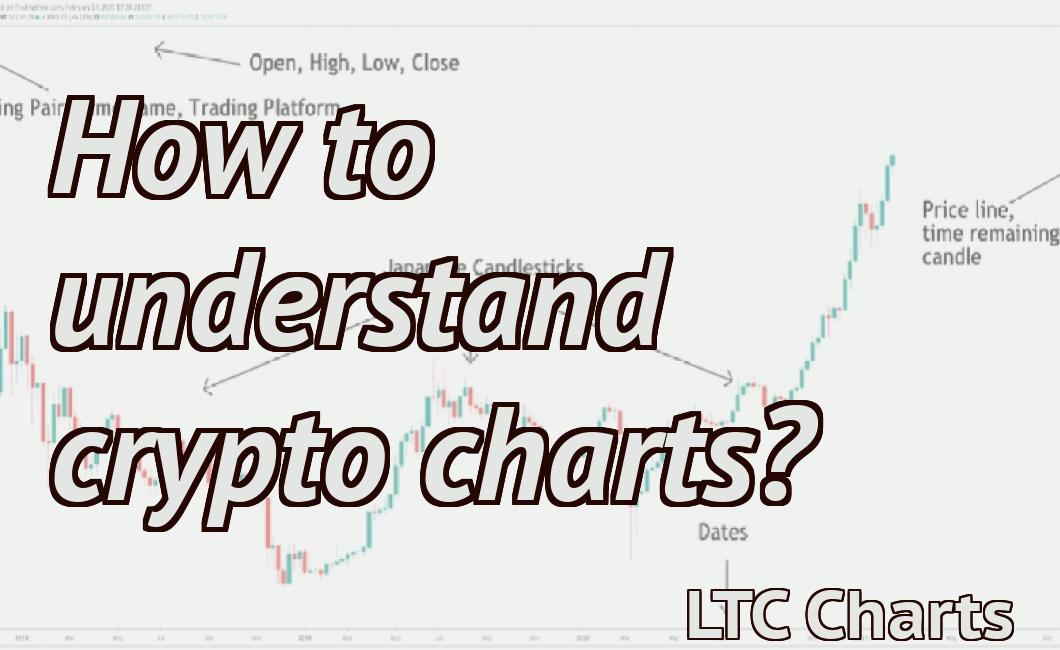

Another common type of cryptocurrency chart is the candlestick chart. Candlestick charts are used to display the performance of a cryptocurrency over time, typically on a daily or hourly basis.

Candlestick charts are useful for identifying short-term price fluctuations, as well as for predicting future price movements.

Other common types of cryptocurrency charts include the volume chart, the hashrate chart, and the block chain explorer.

How to use token charts to your advantage in the crypto market

Token charts are a great way to track the performance of cryptocurrency tokens. By using token charts, you can see how the value of a given token has fluctuated over time, and make informed investment decisions.

To use token charts effectively, you'll need to gather the following information:

The name of the cryptocurrency token you're interested in

The date of the data point you're interested in

The market value of the cryptocurrency at the time of the data point

You can then use this information to create a token chart. To do this, simply open a charting platform such as CoinMarketCap, and enter the name of the cryptocurrency, the date of the data point, and the market value of the cryptocurrency at that time.

Once you have the information necessary to create a token chart, you can use it to track the performance of your cryptocurrency investments. By looking at how the value of a given token has fluctuated over time, you can make informed investment decisions.

What do experts look for when analyzing token charts?

Some key factors that experts may look for when analyzing token charts are the following:

1. The number of tokens issued

2. The price of the tokens at the time of issuance

3. The market cap of the tokens

4. The circulating supply of the tokens

5. The percentage of the total supply of the tokens that are in circulation

6. The percentage of the total supply of the tokens that are available for purchase

7. The percentage of the total supply of the tokens that are held by the team

How to make sense of token charts and use them to predict future prices

Token charts are an easy way to see how a token is performing relative to its peers. By looking at the token chart, you can get a sense of the trend, the current price, and where the price is likely to go in the future.

In order to make sense of a token chart, you need to know a few things:

1. The token's name

2. The date of the chart

3. The token's price (in USD or ETH)

4. The percentage of change from the previous day's price

5. The percentage of change from the day before that

6. The total number of tokens issued

7. The total number of active tokens

8. The total number of tokens in circulation

9. The percentage of total tokens in circulation

10. The percentage of total tokens sold

11. The percentage of total tokens available for purchase

12. The market cap of the token

13. The number of days since the ICO

14. The number of days until the ICO end

15. The percentage of total tokens sold

16. The percentage of total tokens available for purchase

17. The market cap of the token

18. The number of days since the ICO

19. The number of days until the ICO end

20. The percentage of total tokens sold

21. The percentage of total tokens available for purchase

22. The market cap of the token

23. The number of days since the ICO

24. The number of days until the ICO end

25. The percentage of total tokens sold

26. The percentage of total tokens available for purchase

27. The market cap of the token

28. The number of days since the ICO

29. The number of days until the ICO end

30. The percentage of total tokens sold