spectrum crypto charts

The article "spectrum crypto charts" provides an overview of the different types of cryptocurrencies and their prices.

Crypto Market Charts You Should be Tracking

Bitcoin

Bitcoin is the world’s first and most popular cryptocurrency. Created in 2009 by an unknown person or group of people under the name Satoshi Nakamoto, Bitcoin is a decentralized digital currency without a central bank or single administrator. Transactions are verified by network nodes through cryptography and recorded in a public dispersed ledger called a blockchain. Bitcoin is often considered to be the first cryptocurrency, although there are numerous other digital currencies and cryptocurrencies.

Bitcoin has seen wild swings in value over the years, reaching as high as $19,783.56 on Dec. 17, 2017, before dropping to around $11,000 by early January 2018. As of Feb. 9, 2019, Bitcoin was trading at $8,811.72.

Ethereum

Ethereum is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of fraud or third party interference. Ethereum provides a new way to create and use smart contracts, which could make it a major disruptor in the tech industry.

Ethereum saw its initial launch in 2015 and has since seen a surge in popularity. As of Feb. 9, 2019, Ethereum was trading at $1,326.92.

Bitcoin Cash

Bitcoin Cash (BCH) is a spin-off cryptocurrency of Bitcoin that was created on Aug. 1, 2017. Bitcoin Cash is similar to Bitcoin in that it is decentralized, secure, and has no central bank or single administrator. However, BCH has an increased block size from 8 megabytes to 32 megabytes, making it faster and more scalable.

As of Feb. 9, 2019, Bitcoin Cash was trading at $2,726.54.

Litecoin

Litecoin is a decentralized cryptocurrency that was created in October 2011 by Charlie Lee. Litecoin is similar to Bitcoin in that it is decentralized, secure, and has no central bank or single administrator. However, Litecoin has a faster block generation time than Bitcoin and is also more efficient at processing transactions.

As of Feb. 9, 2019, Litecoin was trading at $113.02.

The Best Crypto Charts for 2018

Cryptocurrencies have been on a tear in 2018. Bitcoin, Ethereum, and other major cryptocurrencies have seen astronomical gains in value.

This has created a lot of interest in cryptocurrencies and blockchain technology. Cryptocurrency charts are popular tools for tracking the progress of these trends.

Here are the best crypto charts for 2018:

1. CoinMarketCap

CoinMarketCap is the most popular cryptocurrency charting platform. It provides real-time data on the price of cryptocurrencies across a variety of exchanges.

2. Coindesk

Coindesk is another popular cryptocurrency charting platform. It provides real-time data on the price of cryptocurrencies across a variety of exchanges.

3. TradingView

TradingView is a popular platform for trading cryptocurrency derivatives. It provides real-time data on the price of cryptocurrencies across a variety of exchanges.

4. Coincodex

Coincodex is a platform for tracking the latest news and information on cryptocurrencies. It provides real-time data on the price of cryptocurrencies across a variety of exchanges.

Spectrum: A Comprehensive Guide to Crypto Charts

Cryptocurrency charts are essential for understanding the movement of digital assets. They can provide insights into the market sentiment, price action, and overall health of a given cryptocurrency.

This guide provides a comprehensive overview of the most popular cryptocurrency charts and their associated terminology. We also provide tips on how to use them to your advantage.

Cryptocurrency Charts

Cryptocurrency charts are widely used to track the movement of digital assets. They are often displayed as candlesticks (or bar charts), with each candle representing a transaction or trading activity.

There are a variety of different types of cryptocurrency charts, each designed for different purposes. Here are the most popular types:

1. Candle Sticks

Candlestick charts are perhaps the most common type of cryptocurrency chart. They display the movement of a cryptocurrency over time using candles. Each candle represents a transaction or trading activity.

The width of the candle indicates the magnitude of that activity, while the color indicates the sentiment of the market at that point in time. For example, a green candle indicates that the market is bullish (positive), while a red candle indicates that the market is bearish (negative).

2. Line Charts

Line charts are similar to candle charts, but they display the movement of a cryptocurrency over time using lines. Lines indicate whether the price is increasing, decreasing, or staying the same.

3. Area Charts

Area charts are similar to line charts, but they display the movement of a cryptocurrency over time in terms of volume or value. Volume measures how many coins are being traded, while value measures the worth of those coins.

4. Graphed Price data

Graphed price data is displayed as a series of lines, curves, or bars. It can be used to display the price history, market sentiment, and other important data.

Cryptocurrency Charts Terminology

Before we dive into how to use cryptocurrency charts, it's important to understand the terminology associated with them. Here are some key terms you'll want to be familiar with:

Breadth : The number of transactions or trading activities represented by a given candle or chart.

: The number of transactions or trading activities represented by a given candle or chart. Depth : The number of transactions or trading activities represented by the nearest preceding candle or chart.

: The number of transactions or trading activities represented by the nearest preceding candle or chart. Open : The current price at which transactions or trading activities are taking place.

: The current price at which transactions or trading activities are taking place. High : The highest price recorded during the current candle or chart.

: The highest price recorded during the current candle or chart. Low: The lowest price recorded during the current candle or chart.

How to Use Cryptocurrency Charts

Now that you know what cryptocurrency charts are and their terminology, let's learn how to use them to your advantage.

1. Use Candlestick Charts to Interpret Market Sentiment

Candlestick charts offer an easy way to interpret market sentiment. They can be used to determine whether the market is bullish (positive) or bearish (negative). For example, a green candle might indicate that the market is bullish, while a red candle might indicate that the market is bearish.

2. Use Line Charts to Track Price Action

Line charts can be used to track the movement of a cryptocurrency over time. They can help you identify patterns such as support and resistance levels, as well as price trends.

3. Use Area Charts to Analyze Volume and Value

Area charts can help you visualise the volume and value of a cryptocurrency over time. This information can help you identify which coins are worth investing in.

How to Use Crypto Charts to Make Better Trading Decisions

Crypto charts can be a great way to make better trading decisions. By understanding the technical indicators and how they are related to price action, you can improve your chances of making profitable trades.

Some of the most important technical indicators to look at when trading cryptocurrencies are the:

1. MACD

2. RSI

3. SMA

4. Stochastic

5. Fibonacci Retracement Levels

Each of these indicators can provide valuable insight into the health of a cryptocurrency market. By understanding how they work and how they relate to price action, you can make better trading decisions.

For example, if you see that the MACD is beginning to trend upwards, this may be a sign that the market is about to experience a bullish trend. Similarly, if the RSI is trending downwards, this may be an indication that the market is about to experience a bearish trend.

By using crypto charts, you can improve your chances of making profitable trades. By understanding the technical indicators and how they relate to price action, you can make better trading decisions.

The Different Types of Crypto Charts and How to Interpret Them

Cryptocurrency charts are important tools for traders and investors. They can provide insights on the price of a cryptocurrency, market capitalization, and other important data.

There are three main types of cryptocurrency charts:

1. Price charts

Price charts show the price of a cryptocurrency over time. They can be used to show the overall trend of the price of a cryptocurrency, as well as how volatile the price is.

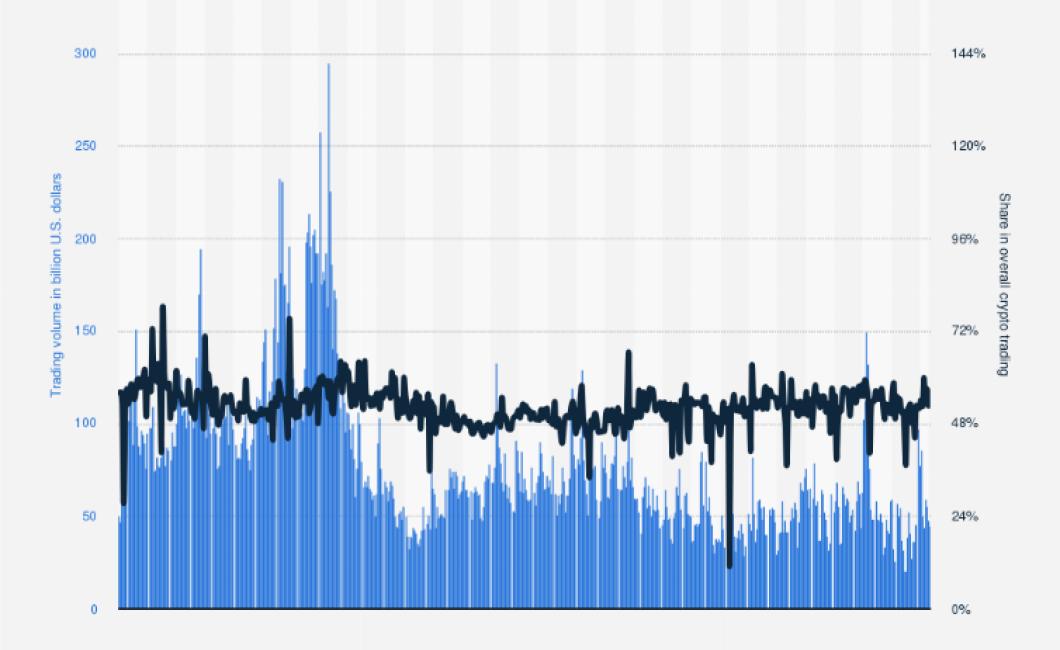

2. Volume charts

Volume charts show the amount of cryptocurrency traded over time. They can be used to show the strength of the demand for a cryptocurrency, as well as how active the market is.

3. Supply and demand charts

Supply and demand charts show the amount of cryptocurrency available on the market and the demand for it. They can be used to gauge the overall health of the cryptocurrency market.

Common Crypto Charting Mistakes and How to Avoid Them

There are a few things you should keep in mind when charting crypto prices.

1. Don’t overreact to short-term price movements.

It can be easy to get caught up in the day-to-day fluctuations of the crypto markets, and it’s important to remember that the prices of cryptocurrencies are highly volatile. If you’re investing in crypto for the long term, you should avoid getting too carried away by the latest price movements.

2. Don’t overvalue a cryptocurrency just because it’s popular.

Just because a cryptocurrency is popular on the market doesn’t mean that it’s worth investing in. There are a lot of scams and Ponzi schemes involving cryptocurrencies, so it’s important to do your research before investing in any new cryptocurrencies.

3. Don’t invest in cryptocurrencies if you don’t have enough money to lose.

Cryptocurrencies are highly volatile, and there’s a risk that you could lose all of your investment if the prices of cryptocurrencies decline. Before you invest in any new cryptocurrencies, it’s important to make sure that you have enough money to cover any potential losses.

4. Don’t invest in cryptocurrencies if you don’t have any experience with them.

It can be tough to know what to do when it comes to investing in cryptocurrencies, and if you don’t have any experience with them, it’s probably best to stay away from them. If you do decide to invest in cryptocurrencies, make sure that you do your research first.

Crypto Technical Analysis: Tips and Tricks for Beginners

Cryptocurrencies are a new and rapidly growing asset class. As with any new investment, there are a few things you need to know before diving in. In this article, we will cover some of the basics of crypto technical analysis, including how to analyze charts, identify indicators, and make informed decisions.

What is Crypto Technical Analysis?

Cryptocurrencies are unique assets because they are not bound by traditional financial regulations. This means that there is a lot of speculation and the prices of cryptocurrencies can be highly volatile.

The goal of crypto technical analysis is to help you understand how digital currencies are performing and to make informed decisions about whether or not to invest.

How Do I Analyze Charts?

The first step in crypto technical analysis is to understand how digital currencies are traded. To do this, you need to look at charts.

Charts are a visual representation of data. They show you how buyers and sellers are trading digital currencies, and can also help you spot trends.

Here are a few tips for analyzing charts:

1. Look at the Charts: The first thing you need to do is look at the charts. Try to get a sense of how the market is behaving overall and which digital currencies are doing well.

2. Identify Patterns: Once you have a general understanding of how the market is performing, you can start to identify patterns. For example, you might see a pattern where buyers are pushing the price up, and then sellers come in and push it down. This is called a “market cycle” and can be used to your advantage.

3. Use Indicators: There are a number of indicators that you can use to help you analyze the market. Some of the most popular include the MACD (Moving Average Convergence Divergence), RSI (Relative Strength Index), and the VIX (Volatility Index).

4. Make Decisions: After you have analyzed the charts, you need to make decisions about whether or not to invest. You can use your analysis to decide which digital currencies to buy or sell, and what kind of price you want to pay.

Crypto Technical Analysis: Tips for Beginners

In summary, crypto technical analysis is a way to help you understand how digital currencies are performing and to make informed decisions about whether or not to invest. Here are some tips for getting started:

1. Look at the Charts: The first step in crypto technical analysis is to look at the charts. Try to get a sense of how the market is behaving overall and which digital currencies are doing well.

2. Identify Patterns: Once you have a general understanding of how the market is performing, you can start to identify patterns. For example, you might see a pattern where buyers are pushing the price up, and then sellers come in and push it down. This is called a “market cycle” and can be used to your advantage.

3. Use Indicators: There are a number of indicators that you can use to help you analyze the market. Some of the most popular include the MACD (Moving Average Convergence Divergence), RSI (Relative Strength Index), and the VIX (Volatility Index).

4. Make Decisions: After you have analyzed the charts, you need to make decisions about whether or not to invest. You can use your analysis to decide which digital currencies to buy or sell, and what kind of price you want to pay.

What do the Top Crypto Traders Look at When Making Their Moves?

Crypto traders look at a variety of factors when making their moves, including price action, technical indicators, and news.