Draw on crypto charts.

This article provides a basic overview of how to read and interpret cryptocurrency charts. It covers the different types of charts commonly used by traders, as well as the most important elements to look for when analyzing them. With this knowledge in hand, you will be better equipped to make informed trading decisions.

Use Crypto Charts to Make Better Trading Decisions

Crypto charts can be a powerful tool for better trading decisions. They can help you identify patterns and trends in the price of cryptocurrencies, and can help you make informed decisions about when to buy or sell.

Cryptocurrency charts can be divided into two main types: technical and fundamental.

Technical charts are focused on tracking the movement of prices and indicators, while fundamental charts focus on analyzing the underlying economics and technology of a cryptocurrency.

Technical charts are useful for tracking short-term movements, while fundamental charts can provide more long-term insights.

Cryptocurrencies are constantly changing, which means that technical charts may not always reflect the underlying fundamentals. Therefore, it is important to use both technical and fundamental charts to make an informed decision about your investments.

How to Read and Analyze Crypto Charts

Crypto charts are used to display the price of cryptocurrencies over time. The data is sourced from several different exchanges and can be confusing to read.

To make things easier, we have included a few tips on how to read and analyze crypto charts.

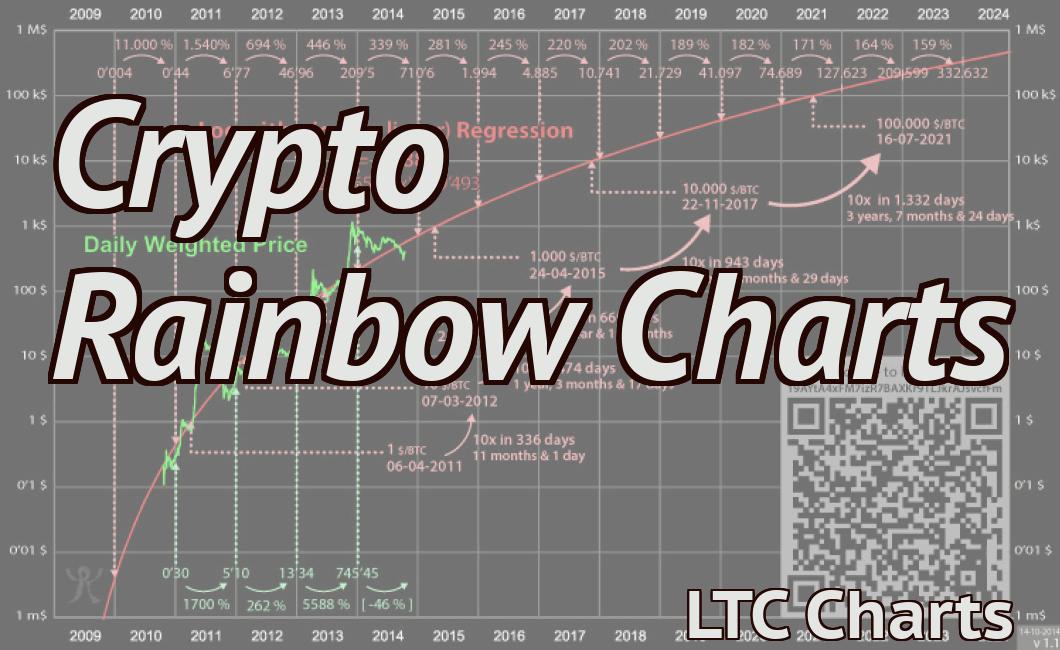

1. Look at the Long-Term Trends

The first thing you need to look at when analyzing crypto charts is the long-term trends. This will help you understand how the market is performing over a longer period of time.

2. Check for Support and Resistance Levels

Next, you need to check for support and resistance levels. These are important indicators of where the market is likely to stay. If the market breaks through these levels, it is likely to continue moving upwards.

3. Compare Cryptocurrencies

Finally, you should compare cryptocurrencies to see which ones are performing best. This will help you decide which ones to invest in.

Tips for Using Crypto Charts to Maximize Profits

Cryptocurrency charts are an essential tool for anyone interested in trading cryptocurrencies. By understanding how to use these charts, you can maximize your profits while minimizing your risk.

1. Use a Tradingview Charting Platform

Tradingview is one of the most popular cryptocurrency charting platforms available. It offers a wide range of features, including support for multiple cryptocurrencies, real-time data analysis, and custom indicators.

2. Get Familiar with Crypto Candles

Cryptocurrencies are traded on a variety of exchanges around the world. To make the most informed decisions when trading, it is important to become familiar with different cryptocurrency candles.

A cryptocurrency candle is a graphical representation of all the orders that were placed for a given cryptocurrency over a given period of time. By understanding how these candles move, you can better anticipate where prices are likely to go.

3. Use Technical Analysis to Predict Prices

Technical analysis is a popular method for forecasting future prices in markets. By studying past trends and analyzing technical indicators, you can better predict where prices are likely to go.

4. Use Moving Averages to Smooth Out Volatility

Moving averages are a common technical analysis tool that helps to smooth out volatility in markets. By using moving averages, you can reduce the impact of sudden changes in prices.

5. Use Volume to Indicate Strength or Weakness in a Market

Volume is another important indicator that can be used to predict future prices in markets. Volume indicates how much money is being traded in a given market, and can provide clues about the strength or weakness of a market.

Using Crypto Charts to Find the Best Buying and Selling Opportunities

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. Many cryptocurrencies have began to experience significant price appreciation in recent months, presenting investors with potential buying and selling opportunities.

To find the best buying and selling opportunities for cryptocurrencies, CoinMarketCap offers a range of useful charts. These charts allow investors to track the prices of individual cryptocurrencies, as well as the overall market value of all cryptocurrencies.

CoinMarketCap's 24-hour cryptocurrency prices chart shows the average price of cryptocurrencies across a 24-hour period. This chart is useful for tracking the performance of individual cryptocurrencies and for gauging long-term trends.

CoinMarketCap's 7-day cryptocurrency prices chart shows the average price of cryptocurrencies over a 7-day period. This chart is useful for tracking the performance of individual cryptocurrencies and for gauging short-term trends.

CoinMarketCap's 1-month cryptocurrency prices chart shows the average price of cryptocurrencies over a 1-month period. This chart is useful for tracking the performance of individual cryptocurrencies and for gauging short-term trends.

CoinMarketCap's 3-month cryptocurrency prices chart shows the average price of cryptocurrencies over a 3-month period. This chart is useful for tracking the performance of individual cryptocurrencies and for gauging short-term trends.

CoinMarketCap's 6-month cryptocurrency prices chart shows the average price of cryptocurrencies over a 6-month period. This chart is useful for tracking the performance of individual cryptocurrencies and for gauging short-term trends.

CoinMarketCap's 1-year cryptocurrency prices chart shows the average price of cryptocurrencies over a 1-year period. This chart is useful for tracking the performance of individual cryptocurrencies and for gauging long-term trends.

Getting the Most Out of Crypto Charts

Cryptocurrencies are an interesting way to invest, but it can be difficult to understand what is happening with them. There are a number of tools available to help you track your investments, and CryptoCharts is one of the best.

CryptoCharts is a comprehensive cryptocurrency tracking platform that offers real-time data on the prices and movements of digital currencies. You can view charts for all of the major cryptocurrencies, as well as detailed analysis of each one.

You can also use CryptoCharts to find good investments. By comparing different currencies and tracking their prices over time, you can find ones that are worth investing in. This can help you make informed decisions about your investments, and get the most out of your crypto portfolio.

Making the Most of Crypto Charting Tools

Crypto charting tools can help traders make informed decisions about the market. They can provide insights into price action, market sentiment, and other key indicators.

Some of the best crypto charting tools include TradingView, Coinigy, and Kraken.

Leveraging Crypto Charts for Successful Trading

Crypto charts are an essential tool for anyone trading cryptocurrencies. They can provide a visual representation of the market conditions, helping traders make informed decisions.

Cryptocurrencies are highly volatile and can be unpredictable, so it’s important to use charts that reflect this. There are a number of different types of charts available, so it’s important to choose the one that best suits your needs.

Some popular types of charts include:

1. Candle Sticks

Candle sticks charts are used to show the movement of a cryptocurrency over time. They display the price over a period of time, along with the volume and open, high, low and close prices.

2. Line Charts

Line charts are used to display the price movement over a specific period of time. They show the price change over a given time interval, as well as the percentage change.

3. OHLC Charts

OHLC charts show the price movement over a given period of time, as well as the percentage change in each category. This is a popular type of chart for traders who are looking for detailed information.

4. Fibonacci Retracements

Fibonacci retracements are used to identify potential support and resistance levels. They are based on the Fibonacci sequence, which is a mathematical pattern that relates to the growth of financial markets.

5. TradingView Charts

TradingView is one of the most popular platforms for creating and viewing crypto charts. It offers a wide variety of options, including:

- OHLC Charts

- Line Charts

- Candlestick Charts

- Timeframes

- Order Books

- Alerts

- Social Trading Features

- and more!

Using these charts can help you make informed decisions while trading cryptocurrencies. By using charts that reflect the market conditions, you can avoid costly mistakes.