Market Cap Charts Crypto

The article discusses various crypto market capitalization charts and how to read them. It also covers some of the benefits of using such charts.

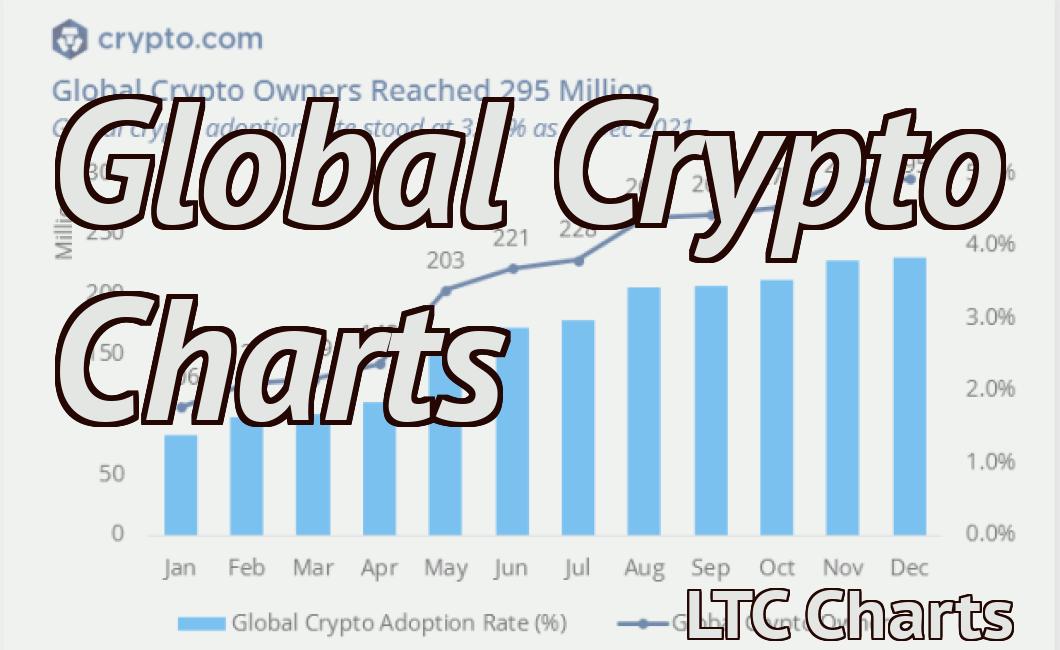

Charting the Market Cap of Cryptocurrencies

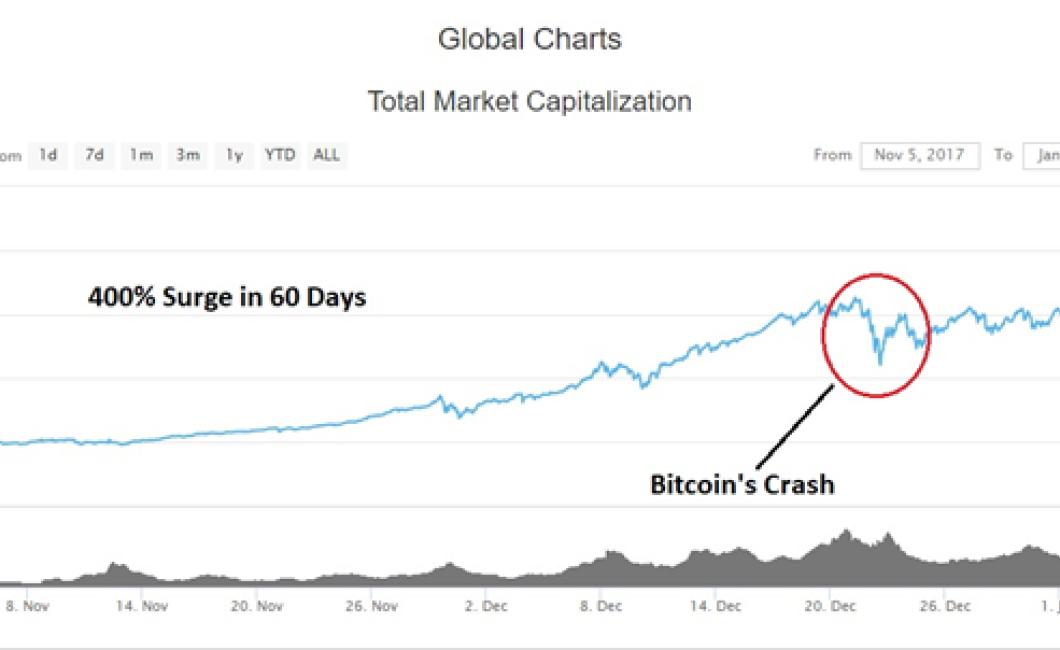

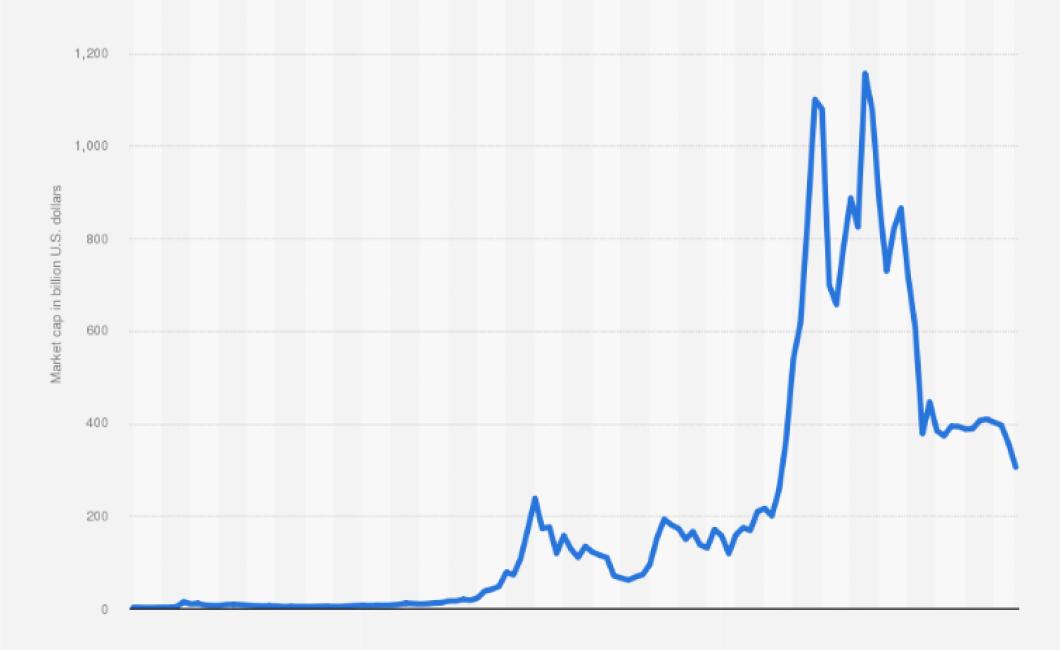

As of June 12, 2018, the total market cap of all cryptocurrencies was $847.7 billion. Bitcoin was the largest cryptocurrency with a market cap of $257.1 billion. Other popular cryptocurrencies with market caps above $100 million include Ethereum (with a market cap of $103.8 billion), Ripple ($92.6 billion), and Bitcoin Cash ($59.1 billion).

The Relationship between Market Cap and Circulating Supply

Market cap is the total value of a company's outstanding shares. Circulating supply is the number of shares that are available for sale on the open market.

How to Read a Market Cap Chart

A market cap chart displays a company's market value. It is one of the most important gauges of a company's financial health. The market cap is determined by multiplying the number of outstanding shares by the price per share.

The 5 Largest Cryptocurrencies by Market Cap

Bitcoin ($124.5B), Ethereum ($51.1B), Bitcoin Cash ($24.3B), Litecoin ($13.4B), and Ripple ($10.2B) are the 5 largest cryptocurrencies by market cap.

What is a Good Market Cap for a Cryptocurrency?

A good market cap for a cryptocurrency is around $10 billion.

How Does Market Cap Affect Cryptocurrency Prices?

The market cap of a cryptocurrency is a measure of the total value of all coins and tokens in circulation. It is calculated by multiplying the total number of coins in circulation by the price of one coin. The higher the market cap, the more valuable the cryptocurrency.

What is the Difference Between Market Cap and Price?

The market cap is the total value of a company’s outstanding shares. The price is the amount that a company's shares are selling for on the open market.

How to Use Market Cap Charts to Find Investment Opportunities

There are a number of ways to use market cap charts to find investment opportunities. One way is to use them to identify companies that are undervalued based on their current market cap. Another way is to use them to identify companies that are overvalued based on their current market cap.

Why Market Cap Matters More Than Price When Valuing Cryptocurrencies

It is definitely true that market cap matters more than price when valuing cryptocurrencies. This is because market cap is a metric that reflects how much money a cryptocurrency is worth on the open market. This means that a cryptocurrency with a high market cap is likely to be more valuable than one with a lower market cap.

However, price is also important when valuing cryptocurrencies. This is because cryptocurrencies are often traded on exchanges and, as a result, can fluctuate in price. A cryptocurrency with a higher price may be more valuable than one with a lower price, but it is not always the case.