Dex Charts Crypto

Dex Charts Crypto is a website that provides users with information on various cryptocurrencies. The site includes charts and graphs that show the prices of different cryptocurrencies over time, as well as other information such as the market capitalization of each currency.

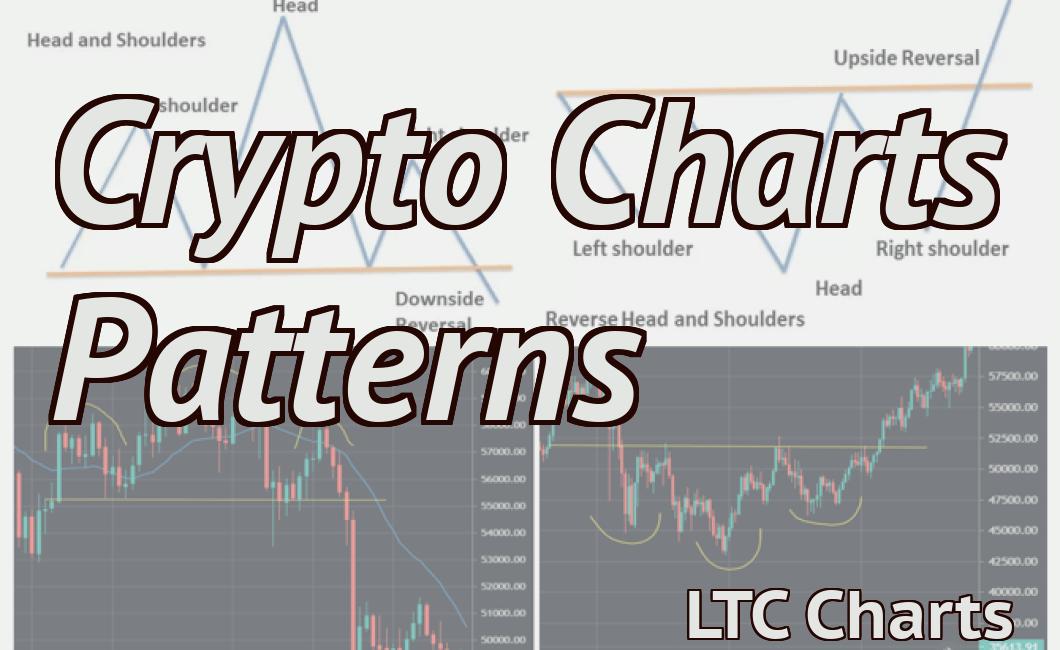

How to Use a DEX Chart to Trade Cryptocurrency

A DEX chart is a graphical representation of the order book for a cryptocurrency exchange. It allows you to see the current bid and ask prices for every order in the book, as well as the volume of trade that has taken place over the past few minutes.

To use a DEX chart, first find the exchange you want to examine. Next, open the order book for that exchange. (You can find the order book by clicking on the " Orders " tab at the top of the screen, then selecting " All Orders ".)

Once you have opened the order book, find the order you want to analyze. (You can find the order by either clicking on the " Bids " or "asks" column header, or by using the search bar at the top of the order book.)

Next, find the price at which that order is being traded. This is shown in the "Bid" column.

Next, find the price at which the order has been filled. This is shown in the "Ask" column.

Finally, find the volume of trade that has taken place over the past few minutes. This is shown in the "Volume" column.

The Benefits of Trading Cryptocurrency on a DEX

There are many benefits to trading cryptocurrency on a decentralized exchange (DEX). These include:

1. Security: A decentralized exchange is more secure than a centralized exchange because it does not rely on a single party to maintain custody of the user’s assets.

2. Speed: DEXs are much faster than centralized exchanges because they do not rely on a third party to process the order.

3. Privacy: With a DEX, users are not exposed to the same level of security risks that are associated with centralized exchanges.

4. Liquidity: A DEX allows for greater liquidity than a centralized exchange because it allows for the trading of a wider range of cryptocurrencies.

5. Fees: DEXs charge lower fees than centralized exchanges, making them more affordable for smaller traders.

The Risks of Trading Cryptocurrency on a DEX

One of the risks of trading cryptocurrency on a decentralized exchange (DEX) is that the trader may not be able to get their money back if the exchange goes bankrupt.

There is no central authority or clearing house to guarantee the safety and security of cryptocurrency trades on a DEX, so traders need to be very careful about trusting such exchanges. If the DEX goes bankrupt, the trader's funds may not be safe.

Another risk of trading on a DEX is that the trader may not be able to get their money out if they want to. This is because most DEXs do not have any traditional banking relationships, so traders must trust that the DEX will honor their trades. If the DEX goes out of business, the trader may not be able to get their money out.

It is also important to be aware of the risks associated with using a DEX for trading. For example, a hacker could gain access to a trader's account and steal their cryptocurrencies. A DEX also exposes traders to greater risk of market volatility, as there is no centralized body to help stabilize prices.

The Top 5 DEX Charts for Trading Cryptocurrency

1. CoinMarketCap

2. CoinDesk

3. CoinMarketCap

4. Coincap

5. Cryptocompare

How to Read a DEX Chart for Trading Cryptocurrency

A DEX chart is a graphical representation of the order book for a cryptocurrency exchange. It shows the current price and volume of each cryptocurrency and how those prices are changing.

To read a DEX chart, you first need to identify the currency pair that you're interested in. For example, if you want to know the current price of Bitcoin against Ethereum, you would look at the Bitcoin/Ethereum chart.

Next, you need to find the " candles " on the chart. Candles are the small, upright markers on a DEX chart that indicate the current price and volume of a given cryptocurrency.

To determine the volume of a given cryptocurrency, you first need to find the "high" and "low" values for that currency. The "high" value is the highest price that the cryptocurrency has ever traded at, and the "low" value is the lowest price that the cryptocurrency has ever traded at.

Then, you need to find the "volume" value for that cryptocurrency. Volume is the amount of money that has been exchanged for that cryptocurrency over the course of the last 24 hours.

The Different Types of DEX Charts for Trading Cryptocurrency

There are three types of DEX charts:

1. Volume- weighted

2. Price-weighted

3. Weighted average

Volume-Weighted DEX Charts

Volume-weighted DEX charts are based on the total volume of trades that have occurred on the DEX over a given time period. This type of chart is most commonly used to track the performance of a cryptocurrency exchange.

Price-Weighted DEX Charts

Price-weighted DEX charts are based on the price of a given cryptocurrency at the time that the trade occurred. This type of chart is most commonly used to track the performance of an individual cryptocurrency.

Weighted Average DEX Charts

Weighted average DEX charts are a combination of the two previous types of charts. They are based on the total volume and price of all trades that have occurred on the DEX over a given time period, but they also account for the percentage of each currency that has been traded.

Using Technical Analysis on DEX Charts to Trade Cryptocurrency

Technical analysis is a popular tool used by traders and investors to analyze financial charts in order to determine whether a security or other asset is overvalued or undervalued.

One common use of technical analysis is to identify overvalued or undervalued stocks. When used to trade cryptocurrencies, technical analysis can be used to identify when a cryptocurrency is overvalued or undervalued based on its price on various exchanges.

For example, if a cryptocurrency is trading at a high price on one exchange, but is trading at a low price on another exchange, then that may be an indication that the cryptocurrency is overvalued. Conversely, if a cryptocurrency is trading at a low price on one exchange, but is trading at a high price on another exchange, then that may be an indication that the cryptocurrency is undervalued.

Technical analysis can also be used to identify patterns in price movements, which can help traders make better decisions about when to buy or sell a security.